- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Meta up the ante AI and hardware investment, is the growth in the coming years worth looking forward to?

Recently, Meta is increasing its investment in AI and wearable devices, which means it will further promote technological innovation and optimize User Experience. The company plans to invest $600- $65 billion in fiscal year 2025, which will mainly be used to enhance its computing power and promote the development of next-generation AI models. In this way, Meta can not only better support its ad platform and improve advertising effectiveness, but also take the lead in today’s increasingly popular AI technology.

We know that advertising revenue is one of Meta’s important sources of income. With the transformation of the advertising market towards AI-driven automated advertising, Meta is expected to usher in a strong growth period. By strengthening AI technology, Meta can not only improve the accuracy of advertising, but also bring users a more personalized experience. In other words, Meta not only wants to be a “social” platform, but also hopes to become a leader in future technological development.

How does Meta build future computing power with AI and custom hardware?

Meta’s future strategy not only relies on the upgrade of AI models, but also focuses on enhancing computing capabilities. In response to the growing demand, Meta has increased investment in computing infrastructure, especially in the development of custom hardware and AI systems. Meta is turning to its own custom ASIC chips - MTIA, which are optimized for Meta’s workloads, aiming to improve data processing efficiency and reduce long-term operating costs.

MTIA chips will help Meta improve the cost-effectiveness of computing resources, reduce reliance on third-party hardware, and achieve more accurate AI calculations in areas such as advertising and content recommendation. It is expected that Meta will deploy these custom chips on a large scale in the next few years to replace old GPU servers and ensure the stable expansion of the AI platform.

In addition to hardware, Meta has not relaxed in the development of AI models. Llama 4 is a representative of the next generation of AI models and is actively being developed. Llama 4 will support more complex MultiModal Machine Learning applications and have “intelligent agent” functions that can automate heavy tasks. It can not only execute simple instructions, but also make higher-level decisions and optimizations to improve work efficiency.

Meta’s AI goals are not limited to advertising and content recommendations, but are also exploring the integration of Llama 4 into wearable devices and other platforms. Future Meta hardware will seamlessly collaborate with AI, and even achieve personalized functions to help users handle daily tasks more efficiently.

In addition, Meta has collaborated with NVIDIA to develop the Andromeda system, a Machine Learning Platform aimed at improving advertising placement efficiency. By accurately pushing advertising content, Andromeda improves the relevance and effectiveness of advertisements. Meta’s deep integration in advertising technology and AI has brought unprecedented advertising benefits.

Meta accelerates the development of AI applications while strengthening computing capabilities, driving its growth in advertising and other business areas, further consolidating its leadership position in the global technology ecosystem.

If you are optimistic about Meta’s growth prospects and want to seize investment opportunities, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Meta product and platform innovation: the transition from threads to content creator tools

While continuously optimizing AI technology and computing power, Meta is also accelerating the innovation of its products and platforms to cope with user requests and market competition pressure. A notable example is Meta’s Threads platform. Threads quickly attracted a large number of users and became an important part of Meta’s reshaping of content creation and social ecology.

The success of Threads lies in its provision of more flexible and diverse interactive experiences. Meta transformed it from a simple social platform to a tool with powerful content creation capabilities. Meta has launched a series of creator tools that support various content editing and sharing functions such as video, LIVE, and images. These innovations have improved the user creation experience, attracted a large number of creators and brands to settle in, and made the platform’s content ecosystem more diverse.

At the same time, Meta has also made efforts to strengthen freedom of speech and community interaction. Through policy adjustments, Meta strives to create a more open, inclusive, and safe community environment, which has improved user engagement rates and platform stickiness. In particular, Meta ensures that users from different countries and regions can enjoy social experiences that comply with local laws and cultures through localization management and policy design.

In terms of advertising, Meta combines AI technology to improve advertising effectiveness, provide more accurate and personalized advertising services, help brands improve ROI, and further increase advertising revenue potential. Meta’s ad platform is gradually tilting towards video and short video advertising, drawing on the successful models of TikTok and YouTube, enhancing the platform’s attractiveness.

In the long run, Meta will solidify its existing user base and attract new users and creators through continuous product innovation and platform optimization. Especially in the context of the increasing demand for global social and content creation, Meta’s innovation will bring huge growth opportunities and put it in a favorable position in future competition.

Meta’s financial performance and operating conditions: advertising revenue growth and cost control

Meta’s financial performance in recent years has shown strong growth momentum, especially in advertising revenue. With the continuous upgrading of AI technology and optimization of ad platforms, Meta’s advertising revenue continues to rise in the North American and European markets. The growth of advertising revenue is due to Meta’s continuous improvement of advertising products and the increase in the number of users and creators on the platform. With Meta’s deep integration in social platforms, content creation, and advertising technology, advertisers can obtain higher returns on investment, which has driven brands to increase their advertising investment on the Meta platform.

In addition to steady growth in advertising revenue, Meta has also shown strong resilience in global expansion and diversified investments. With the increasing demand for Meta products in the global market, Meta has accelerated its internationalization pace. In the Asian, European, and Latin American markets, Meta has successfully expanded into multiple Emerging Markets through localization strategies and Refined Operations, further enhancing the diversity and stability of revenue sources.

However, despite Meta’s strong revenue growth, its operating costs are under considerable pressure. Continuous investment in AI technology and custom hardware development require significant capital expenditures, while global expansion faces regulatory and market risks in various countries, which brings uncertainty to its operations. To address these challenges, Meta has taken measures to optimize internal resource allocation and improve Operational Efficiency in cost management.

Meta is investing in hardware and AI to reduce long-term operating costs and improve computing efficiency through custom ASICs (MTIA) and data center upgrades. These Technology Investments not only support the growth of Meta’s future advertising business, but also provide strong infrastructure support for the company to enter new markets and fields. In addition, Meta is also exploring new profit models, such as launching subscription services and value-added products deeply integrated with AI, bringing stable revenue sources and enhancing profitability.

Looking to the future, Meta’s financial performance will be influenced by multiple factors, including changes in the global advertising market, AI technology applications, and hardware investment returns. While strengthening advertising revenue, Meta also needs to effectively control costs and flexibly adjust investment strategies to achieve sustainable growth.

Future Outlook and Risk Analysis: Challenges and Opportunities in AI and hardware investment

Meta is investing heavily in AI and hardware technology, especially in the fields of wearable devices and data centers. These investments bring huge opportunities to the company, but there are also many challenges. In the long run, the integration of AI and hardware may become Meta’s competitive advantage, especially in advertising efficiency and user interaction. However, this also comes with significant risks.

Firstly, innovation and hardware investment in AI require significant capital expenditures. Although Meta’s current investments are advancing the development of its next-generation AI models, especially the development of Llama 4 and the application of ASIC hardware, the actual benefits of these technologies may take several years to manifest. Therefore, in the short term, Meta’s financial performance may not immediately reflect the value of these Technology Investments.

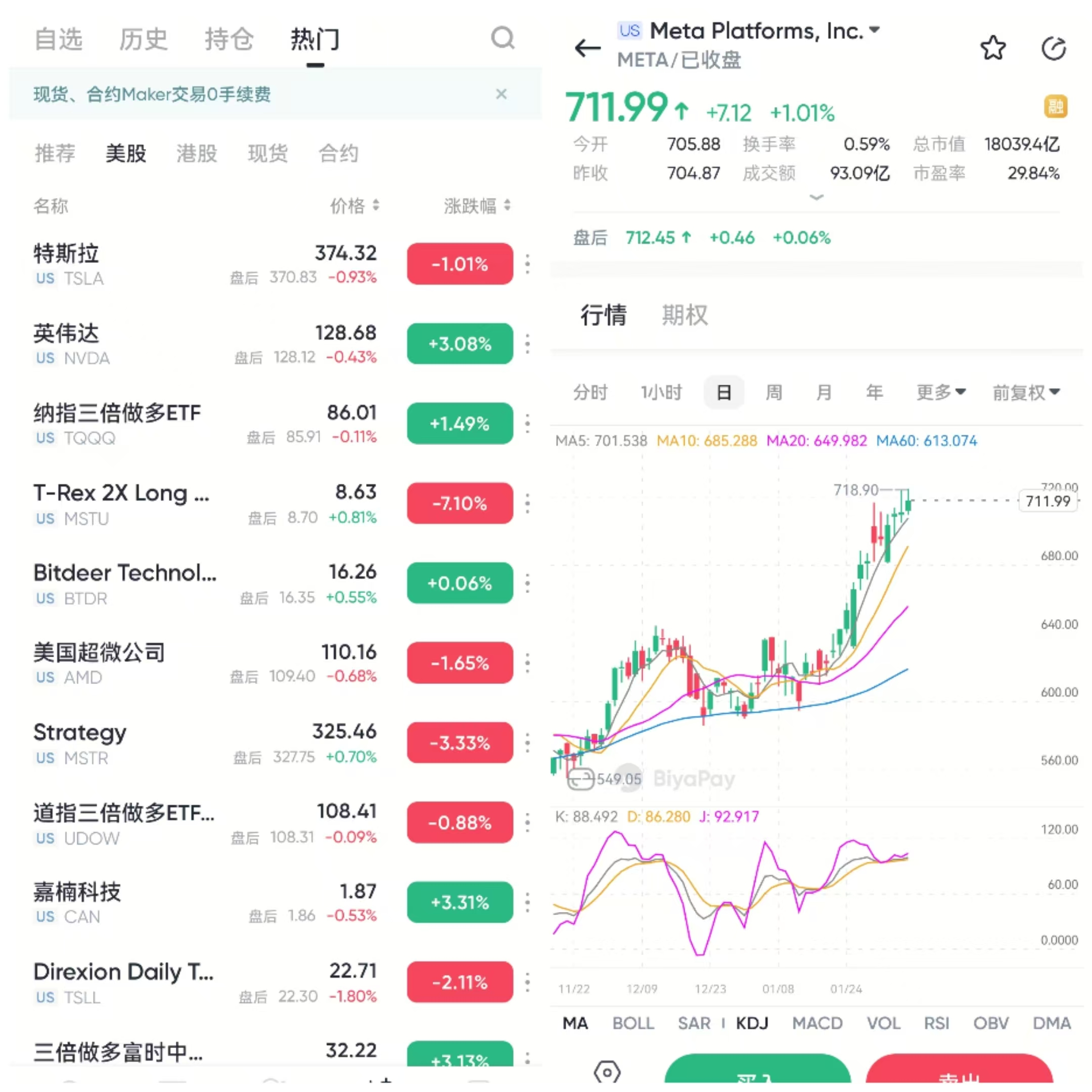

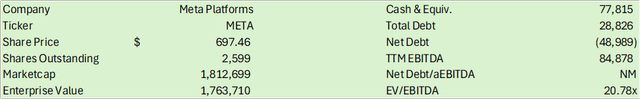

On the other hand, Meta’s performance in terms of shareowner value is closely related to its technological innovation. Although Meta’s current stock price is significantly discounted compared to its peers’ large-scale enterprises, using a valuation model based on EBITDA forecasts, Meta’s stock price is relatively low and may have room for recovery. The EV/EBITDA ratio in the past 12 months was 20.78 times, and the internal valuation calculated based on Meta’s EBITDA forecast and historical transaction premiums shows that Meta’s stock price should be priced at $729 per share, which means that the company may experience certain stock price growth in the next few years.

Looking ahead to the 2027 fiscal year, as Meta’s investment in AI and wearable devices gradually realizes expectations, we can expect the stock price to rise more significantly. It is expected that with the gradual implementation of the investment plan, Meta’s stock price may break through the target price of $872, which brings potential returns to shareholders. Although facing uncertainties in technology research and development progress and market demand in the short term, Meta still has the ability to achieve shareholder returns through technological innovation, advertising revenue growth, and hardware application expansion.

However, the biggest risk facing Meta is still the Sustainability of investments and the realization of returns. If these AI and hardware investments fail to turn into profits as expected, the company’s stock price may be affected. In addition, global economic fluctuations, intensified competition, and regulatory pressure may also affect Meta’s long-term development. Therefore, while investing in AI and hardware, Meta also needs to accurately control its cost structure and Operational Efficiency to ensure that these investments can ultimately translate into considerable financial returns.

Overall, Meta’s shareowner returns and future valuation largely depend on the successful transformation of its AI and hardware investments. Despite uncertainties, Meta’s continued investment in this field will bring long-term development potential and provide good return prospects for shareowners. However, investors also need to pay attention to possible risks and uncertainties and do corresponding risk management.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.