- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Oracle only has a 3% market share in Cloud Service business. What is the potential for future growth?

In the tide of the technology industry, there are always some companies that can stand firm in the wind and rain, and even continuously evolve to become the backbone of the industry. Oracle is such an existence.

Performance continues to improve, Cloud Service becomes the core driving force

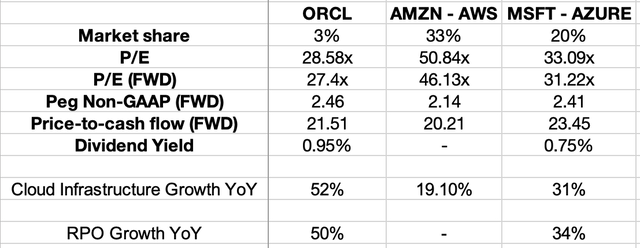

In today’s increasingly fierce competition in Cloud Services, Oracle is gradually demonstrating its unique competitive advantages. Although it currently accounts for only 3% of the global cloud infrastructure market, its Cloud Service business is growing rapidly and has become a key engine driving the company’s overall performance. The latest financial report shows that Oracle’s Cloud Infrastructure Business (OCI) has grown by 52% year-on-year, and its remaining performance obligations (RPO) have increased by 50%, indicating that future revenue growth has high visibility.

The overall revenue growth rate of the company is gradually increasing. In the 2024 fiscal year, Q1 increased by 7% YoY, Q2 increased by 9%, and it is expected to exceed 11% in Q3. Among them, Cloud as a Service and license support business revenue has accounted for 77% of the company’s total revenue, becoming an absolute core business. Especially in the two major cloud business areas of IaaS and SaaS, Oracle’s performance is particularly eye-catching, with the database Cloud as a Service growing by 28% and OCI growing by 52%.

Correspondingly, the company is actively strengthening its layout in the AI field. The strategic cooperation between Meta and Oracle will make OCI an important platform for training Llama AI models. In addition, Oracle has also participated in the “Stargate” project jointly promoted with OpenAI, SoftBank, etc., with an expected investment scale of up to $500 billion in the next four years. Such a huge market potential is gradually opening up greater growth space for Oracle.

Low market share but high growth, how big is the opportunity for Oracle’s Cloud Service?

The competition landscape of the Cloud Service market has basically taken shape. AWS, Azure, and Google Cloud occupy the top three positions, with AWS leading with a market share of 33%, followed closely by Azure, and Google Cloud ranking third. In contrast, Oracle’s Cloud Service market share is only 3%, but this may be the key to its future growth potential.

Oracle’s cloud business has grown significantly faster than its main competitors. AWS’s growth rate in the latest quarter was 13%, Azure was 31%, and OCI was as high as 52%. In other words, although the current market share is small, if Oracle can steadily increase its market share, even if it only grows from 3% to 4%, its cloud business revenue growth rate may reach more than 30%.

In addition, Oracle’s positioning in the Cloud Service market is different from AWS and Azure. Compared to its comprehensive Public Cloud business, Oracle focuses more on enterprise-level database Cloud as a Service and has stronger multi-cloud compatibility. Its products can run on platforms such as AWS and Azure at the same time, but AWS and Azure are not compatible with each other, which enables Oracle to penetrate more enterprise-level markets and provides a unique competitive advantage for expanding its market share.

Financial stability, reasonable valuation, and promising long-term growth

From the financial data perspective, Oracle’s current valuation is still attractive. Although the debt level is relatively high, with a total debt of $100 billion, the company still maintains good cash flow management capabilities. In the past 12 months, nearly 1 million shares of stock have been repurchased and dividends of $4.40 billion have been paid. Compared with AWS and Azure, Oracle’s valuation level is lower, and RPO growth is strong. The market still has confidence in its future performance.

If you are optimistic about Oracle’s growth prospects and want to seize investment opportunities, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

However, the company’s capital expenditures for fiscal year 2025 are expected to increase significantly, which may put some pressure on free cash flow in the short term. But considering the surge in AI computing demand and Oracle’s leading position in AI infrastructure, these investments are expected to bring higher returns in the future. The market expects that by fiscal year 2027, Oracle’s annual revenue from the Stargate project may exceed $10 billion, equivalent to 18% of its total revenue in fiscal year 2024.

AI layout accelerates, multiple collaborations enhance growth potential

AI is undoubtedly one of the most important growth engines in the current technology industry, and Oracle is actively promoting this field. Its launch of the world’s largest and most powerful AI supercomputer can be scaled to 65,000 NVIDIA H200 GPUs and supports multi-cloud architecture, making it highly attractive in the AI training market.

Meta’s Llama AI model will run on OCI, while Oracle is exploring more cooperation possibilities with Microsoft, OpenAI, and others. If the cooperation with Microsoft is further deepened in the future, and even the rumored TikTok acquisition can be implemented, Oracle’s market position will be further enhanced.

In addition, Oracle’s AI infrastructure is deeply integrated with Autonomous Database, which can provide enterprises with more efficient and low-cost AI solutions. This product combination makes it more competitive compared to AWS and Azure, especially in large enterprise customer groups, where Oracle’s advantages are more obvious.

Future challenges and latent risks

Of course, Oracle’s growth path is not without challenges.

Firstly, high capital expenditures will put pressure on short-term free cash flow. With the surge in AI computing demand, the company expects to significantly increase CapEx in the 2025 fiscal year. Although it will help enhance competitiveness in the long term, it may affect profit performance in the short term.

Secondly, the rapid changes in the AI market bring uncertainty. For example, DeepSeek AI launched its own large model for only $6 million, and despite being accused of technology theft by OpenAI, the rise of such emerging competitors may still challenge Oracle’s market growth expectations.

Finally, although Oracle’s multi-cloud strategy has reduced market dependence to some extent, it still needs the support of competitors such as AWS and Azure. If these cloud giants adjust their strategies and limit Oracle’s integration capabilities, it may affect its future growth. However, considering the openness of the Cloud Service market, the probability of this happening in the short term is low.

Overall, Oracle is gradually establishing its competitive position in the Cloud Service market. Despite its current market share of only 3%, the company has significant market expansion potential with strong growth momentum, good financial management, multi-cloud compatibility, and leading advantages in AI infrastructure.

It is expected that in the next few years, with the continuous growth of AI computing demand and the deepening of cooperation between Oracle and enterprises such as Meta and OpenAI, the company is expected to occupy a larger share of the Cloud Service market. If it can steadily increase its market share, the future revenue growth space will be very considerable.

While investors are concerned about the growth potential of Oracle, they also need to pay attention to the impact of capital expenditures on free cash flow and the uncertainty of the AI market. However, overall, as a “dark horse” in the Cloud Service market, Oracle’s future performance is worth looking forward to.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.