- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use Remittance Apps to Send Money to Colombia: A Guide to Quick, Secure, and Transparent Fees

Image Source: pexels

You can easily send money from mainland China to Colombia through remittance apps. The process is simple, highly secure, and offers clear, transparent fee information. Different methods have varying delivery times, for example, debit or credit card transfers typically arrive within minutes, while bank transfers take an average of 3 to 5 business days. The table below shows specific transaction times:

| Transaction Method | Average Transaction Time |

|---|---|

| Debit Card/Credit Card | Usually completed within minutes |

| Bank Transfer | Usually takes 3 to 5 business days |

You can choose the most suitable remittance method based on your needs to ensure funds arrive safely and quickly to the recipient.

Key Points

- Using remittance apps, you can quickly send funds from China to Colombia, with debit and credit card transfers typically arriving within minutes.

- Remittance apps provide multiple security measures, such as biometric authentication and encryption technology, to ensure the safety of funds and personal information.

- When choosing a remittance app, always compare fees and exchange rates across platforms to avoid hidden costs and ensure transparency for every transaction.

- Before sending money, ensure the recipient’s information is accurately filled to avoid transfer failures or delays due to errors.

- Understand the legal and platform restrictions for remittances, and select an appropriate transfer amount to ensure smooth transactions.

Advantages of Remittance Apps

Image Source: pexels

Fast Delivery

When you use remittance apps, you can experience very fast delivery times. Most platforms support multiple delivery methods, with transfers typically completed within minutes. You can choose bank deposits, mobile wallets, cash pickups, or direct debits. The table below shows the delivery speeds for different methods:

| Delivery Method | Speed |

|---|---|

| Bank Deposit | Usually available within minutes |

| Mobile Wallet | Usually available within minutes |

| Cash Pickup | Usually available within minutes |

| Direct Debit | Usually available within minutes |

| Home Delivery | Usually available within 24 hours, with 80% of transfers completed same-day |

You can select the most suitable method based on the recipient’s needs. Many remittance apps also support cash pickups at multiple locations in Colombia, with direct deposits arriving as quickly as 15 minutes. This way, you don’t have to wait long, and funds can reach family or friends promptly.

Security Assurance

When using remittance apps, platforms employ multiple security measures to protect your funds and personal information. Common security technologies include:

- Biometric Authentication: Such as fingerprint or facial recognition, ensuring only you can operate the account.

- Encryption Technology: Platforms use SSL/TLS protocols to encrypt all data, securing information between you and the platform.

- Fraud Detection Technology: Systems monitor transactions in real-time, using machine learning algorithms to identify suspicious behavior and prevent risks promptly.

These measures allow you to confidently conduct international remittances, protecting your privacy and funds.

Transparent Fees

When choosing a remittance app, you can clearly see the fees and exchange rates for each transaction. Platforms display all fees upfront based on factors like transfer amount, payment method, delivery method, and pickup location. You can compare transfer fees and currency exchange rates across platforms to select the most cost-effective service. Note that exchange rates and transfer fees may fluctuate, and platforms will display the latest information before you confirm. This helps you avoid hidden fees, ensuring every remittance is clear and transparent.

Tip: Before sending money, compare fees and exchange rates across multiple platforms to choose the service that best suits your needs.

Remittance Process

Image Source: unsplash

Account Creation and Identity Verification

When using a remittance app, you first need to create a personal account. The registration process is typically simple, requiring you to fill in basic information and set a password. After registration, the platform will require identity verification to ensure fund security and compliance. For identity verification, you can choose to upload one of the following documents:

| Document Type | Requirements |

|---|---|

| National ID | Must be issued in mainland China, with both front and back uploaded, ensuring the number is clearly visible. |

| Passport | Must show all four corners, including photo, full name, and date of birth. |

| Driver’s License | Must display expiration date, issuing location, and complete machine-readable zone. |

| Address Verification | Provide a high-quality proof of address showing full name, address, issuance date, and issuer’s logo. |

After completing identity verification, the platform will review your documents. Once approved, you can start the remittance process.

Enter Amount and Select Receiving Method

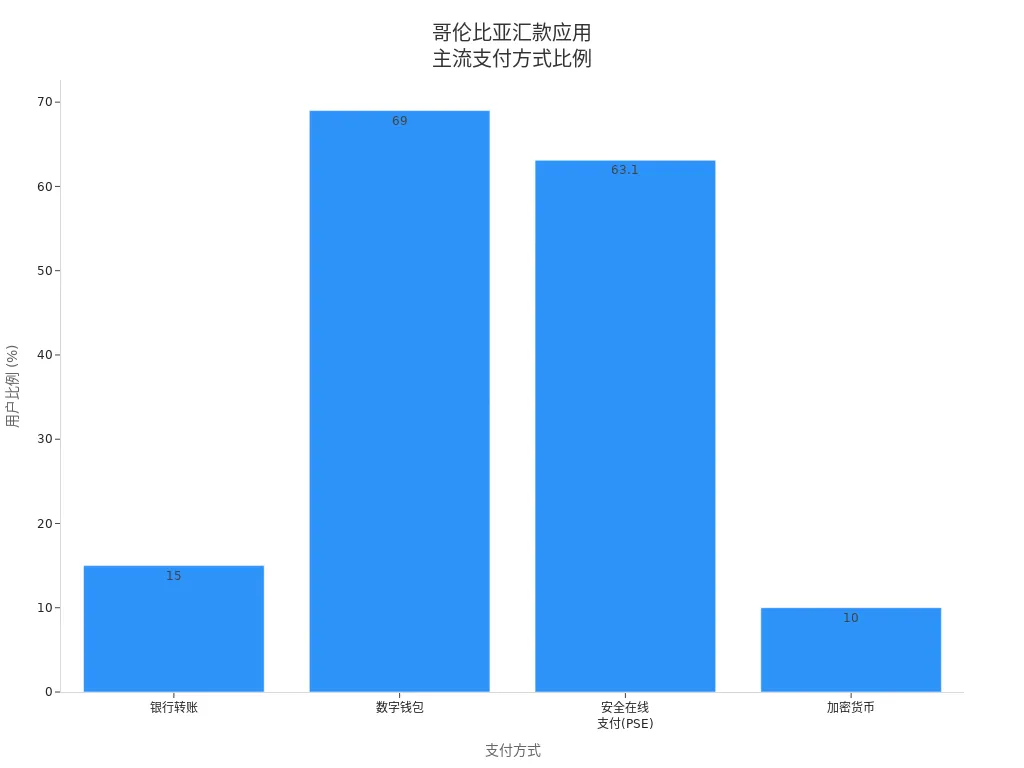

After your account is verified, you can access the remittance page. You need to enter the amount you wish to send, and the platform will automatically display the equivalent USD amount. Next, you can choose the receiving method, including bank account deposits, cash pickups, digital wallets, and more. In mainland China, many Hong Kong-licensed banks support international remittance services, allowing you to transfer funds through these banks. The table below shows mainstream payment methods and their usage percentages:

| Payment Method | Description |

|---|---|

| Bank Transfer | Suitable for users with bank accounts, chosen by about 15% of users. |

| Digital Wallet | Such as Nequi or Daviplata, preferred by 69% of users. |

| Secure Online Payment (PSE) | Most popular in Q1 2025, with a 63.1% market share. |

| Cryptocurrency | Approximately 10% of users tried crypto transactions in 2024. |

You can select the most suitable receiving method based on the recipient’s situation. Some platforms also support email transfers, enabling recipients to receive funds quickly.

Enter Recipient Information

You need to accurately fill in the recipient’s details, including name, address, contact information, and receiving account information. If choosing cash pickup, ensure you provide the recipient’s ID number and pickup location. Carefully verify the information to avoid transfer failures or delays due to errors.

Tip: Before filling in recipient information, confirm all details with the recipient to ensure accuracy.

Confirm Fees and Exchange Rates

Before submitting the remittance, the platform will clearly display all fees and exchange rates. The table below lists the information platforms typically disclose:

| Disclosure Content | Description |

|---|---|

| Applicable Exchange Rate | The platform displays the exchange rate for this transfer, accurate to four decimal places. |

| Transfer Amount | Shows the remittance amount and the actual amount received in USD. |

| Transfer Fees and Taxes | The platform informs you of all handling fees and taxes in advance. |

| Total Amount | Displays the total cost of this transaction, including all fees. |

You can compare fees and exchange rates across different remittance apps based on the displayed information to choose the most cost-effective service. Platforms update the latest exchange rates and fees before you confirm, ensuring you understand every expense.

Complete Remittance and Track

After verifying all information, you can select a payment method to complete the remittance. Common payment methods include debit cards, credit cards, bank transfers, and secure online payments. After completing the payment, the platform will send a confirmation message and provide a tracking number (e.g., MTCN) for you and the recipient to check the transfer progress in real-time. The table below shows the average delivery times for different remittance methods:

| Remittance Method | Average Time |

|---|---|

| Traditional Remittance Operators | 1 to 5 business days |

| Blockchain-Based Remittance (USDC) | Completed within minutes |

You can check the transaction status anytime in the remittance app. Some platforms offer an activity list function to help you manage all historical transactions. For example, the WorldRemit app supports real-time transfer tracking, allowing you to stay updated on fund movements. You can also share the tracking number with the recipient for them to collect cash or confirm receipt promptly.

Reminder: After completing the remittance, save the transaction record and tracking number for future reference or inquiries.

Choosing a Remittance App

Fee and Exchange Rate Comparison

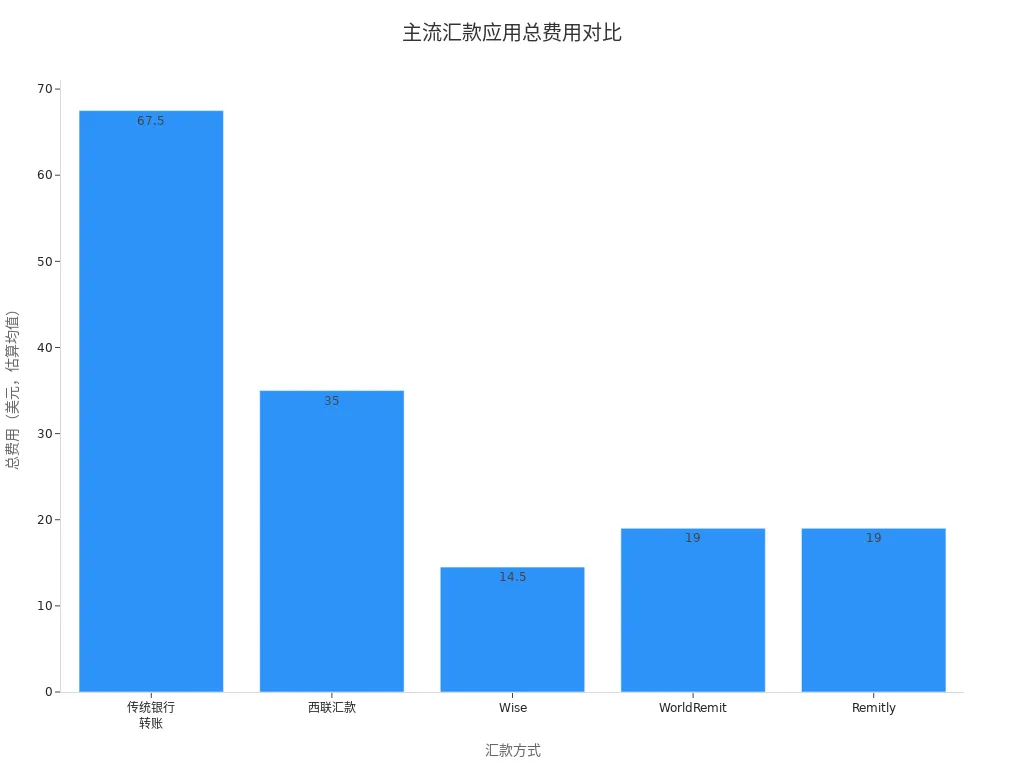

When choosing a remittance app, you should focus on transfer fees and exchange rates. Different platforms have varying fee structures and exchange rate margins. The table below shows the fee and exchange rate details for mainstream platforms:

| Method | Transfer Fee (USD) | Exchange Rate Markup | Total Cost (USD) | Speed |

|---|---|---|---|---|

| Traditional Bank Transfer | $25-$50 | 2-4% | $45-$90 | 2-5 business days |

| Western Union | $5-$25 | 1-3% | $15-$55 | Minutes to 1-2 business days |

| Wise | $7.42 | 0.5-1% | $12-$17 | 1-2 business days |

| WorldRemit | $3.99 | 1-2% | $14-$24 | 1-2 business days |

| Remitly | $3.99 | 1-2% | $14-$24 | As fast as same-day |

You can visually compare the average total costs of five mainstream methods in the chart below:

Wise, WorldRemit, and Remitly typically offer lower fees and better exchange rates, making them ideal for cost-conscious users.

Amount Limits

When sending money, you should also note each platform’s amount limits. Different providers have specific rules for single and monthly transfer amounts. The table below lists the limits for common platforms:

| Provider | Sending Limit (USD) | Receiving Limit |

|---|---|---|

| Bank Transfer | Up to $3,000 per transaction, $7,000 per month | No other restrictions |

| Mobile Payment | Up to $3,000 per month, $10,000 per year | No other restrictions |

| Cash Pickup | Up to $3,000 per transaction, max 5 transactions daily, 15 monthly | No other restrictions |

You can choose a platform with suitable limits based on your remittance needs to avoid transaction failures due to exceeding limits.

User Experience and Security

When selecting a remittance app, user experience and security are equally important. Many users find OneSafe to have a user-friendly interface, low fees, and good customer support. Wise is highly rated for its transparency and simplicity, scoring 4.7/5. Some users report that Remitly has higher fees and limited local language support, which affects the user experience.

It’s recommended to prioritize platforms with simple interfaces, transparent fees, and high security. Mainstream apps support multiple receiving methods like bank accounts and cash pickup points, allowing you to choose flexibly based on the recipient’s situation.

Common Issues and Precautions

Account Security

When using remittance apps, account security is critical. You can take the following measures to protect your funds and personal information:

- Identify suspicious behavior to avoid financial losses.

- Ensure all recipient information is correct to prevent misdirected funds.

- Avoid transferring money over public networks; use a secure home network instead.

- Set a strong password with letters, numbers, and symbols, and enable two-factor authentication.

Platforms typically employ multiple security measures to prevent fraud and unauthorized access. The table below shows common protection measures and their purposes:

| Protection Measure | Purpose |

|---|---|

| Monitoring Suspicious Transactions | Detect and prevent fraudulent activities promptly |

| Verifying Party Identities | Ensure the legitimacy of all transaction parties |

| Implementing Security Measures | Prevent unauthorized access or transaction manipulation |

You can also learn to identify common fraud tactics like phishing and social engineering to protect personal information, increase vigilance, and reduce risks.

Reminder: Before sending money, check if the platform uses HTTPS protocols and secure server connections to ensure transaction safety.

Exchange Rate Fluctuations

When sending money, you’ll notice exchange rates change daily. The table below shows recent USD to Colombian Peso fluctuations:

| Date | Highest Rate | Lowest Rate | 24-Hour Maximum Change |

|---|---|---|---|

| 2025-09-19 | 3908.22 | N/A | -0.594% |

| 2025-09-23 | N/A | 3836.76 | N/A |

You can reduce the impact of exchange rate fluctuations by:

- Using forward contracts to lock in exchange rates in advance.

- Employing currency hedging tools like option contracts and swaps.

- Opening multi-currency accounts to hold foreign currencies and avoid immediate conversions.

- Consolidating batch payments to reduce conversion frequency and fees.

Transaction Fees

When sending money, you should understand all fees, including upfront fees and hidden currency conversion costs. You can:

- Compare different transfer methods to review total costs.

- Note that some platforms may charge fees twice: once for transfer fees and once for currency conversion.

Tip: Before confirming the remittance, carefully review the fee breakdown to avoid increased costs due to hidden fees.

Information Accuracy

You must be extremely careful when filling in recipient information. The table below lists common errors and their consequences:

| Error Type | Result Description | Handling Process |

|---|---|---|

| Incorrect Beneficiary Name | Minor errors may trigger security checks; major errors may pause transfers | Bank requires additional documents to verify identity |

| Incorrect Account Number | Funds may be transferred to the wrong account, requiring the recipient’s consent to recover | Invalid numbers are refunded, with funds returned in 3-14 business days |

| SWIFT/IBAN Errors | Transaction delayed, bank requests additional information | Contact bank to update information |

| Legal Consequences | May trigger compliance issues, even legal reviews and fines | Recovering funds may require legal procedures |

Before confirming the transaction, verify all recipient information, including name, account number, and currency. Any errors may lead to delays or fund losses.

Remittance Limits

When sending money, pay attention to legal and platform-imposed limits. The table below shows Colombia’s related requirements:

| Requirement/Limit | Description |

|---|---|

| Recipient Eligibility | Legal age (18+), must hold a valid ID |

| Funding Channels | International transfers must go through authorized intermediaries |

| Nationality Restrictions | No nationality restrictions; Colombians and legal residents can receive |

| Foreign Exchange Declaration | Residents must submit a foreign exchange transaction declaration |

| Remittance Cap | No universal legal cap; financial institutions may set internal limits |

| Specific Caps | Colombians up to $5,000, foreigners up to $7,500 |

You can choose an appropriate remittance amount based on your needs to avoid transaction failures due to exceeding limits.

Using remittance apps, you can experience fast, secure, and transparent fee services. As digital solutions become more prevalent in Colombia’s economy, payments are becoming more convenient and cost-effective. When sending money, you can take the following steps to ensure smooth transactions:

- Choose reputable services to ensure fund safety.

- Compare fees and exchange rates across platforms to find the best option.

- Confirm recipient information accuracy to avoid delays.

- Understand remittance terms and Colombia’s regulations to ensure compliance.

It’s recommended to proactively compare multiple services, focusing on fees and security details to make every remittance efficient and worry-free.

FAQ

Are remittance apps safe?

When using mainstream remittance apps, platforms employ encryption technology and identity verification. You can set strong passwords and enable two-factor authentication to secure your account.

It’s recommended to choose platforms with international credentials in mainland China to ensure the safety of funds and information.

How long does it take for a remittance to arrive?

When using debit or credit cards, funds typically arrive within minutes. Bank transfers take an average of 3 to 5 business days. You can track progress in real-time within the app.

What should I do if a remittance fails?

If a remittance fails, first check if the recipient information is correct. Contact the platform’s customer service, provide transaction records and tracking numbers, and request a refund or resend.

How are exchange rates and fees calculated?

Before sending money, you can see the platform’s displayed USD exchange rate and fees. Compare different platforms to choose the service with the lowest total cost, avoiding hidden fees.

| Platform | Exchange Rate Markup | Transaction Fee (USD) |

|---|---|---|

| Wise | 0.5-1% | $7.42 |

| WorldRemit | 1-2% | $3.99 |

What are the remittance limits?

When sending money from mainland China to Colombia, platforms typically allow up to $3,000 per transaction and $7,000 per month. Choose an appropriate amount based on your needs to avoid failures due to exceeding limits.

While using remittance apps for transferring money to Colombia offers undeniable benefits—instant delivery, transparent fees, and operational convenience—these services fundamentally focus on fund transfers. They often fall short of meeting your broader needs for flexible global asset allocation, multi-currency trading, and low-cost investment funding.

If you’re looking for a comprehensive financial platform with robust investment capabilities that surpasses conventional remittance, BiyaPay is the superior choice. You can achieve zero-barrier global investment with our quick registration, completed in just 3 minutes without needing an overseas bank account. Regarding cost, we offer the significant advantage of remittance fees as low as 0.5%, providing savings of up to 90% versus traditional banks. Our platform also includes real-time exchange rate inquiry and fiat conversion, ensuring you constantly monitor rate dynamics and effectively avoid hidden losses.

A single BiyaPay account grants you access to both US and Hong Kong stocks trading, allowing for unified, quicker asset management without platform switching. Crucially, we support the conversion between fiat and digital currencies (like USDT), ensuring quick funding by bypassing complex channels. For both urgent transfers and investment deposits, we guarantee global remittance with same-day sending and arrival, meaning your funds arrive the same day, so you never miss a trading window. Furthermore, active traders benefit from zero commission for contract limit orders, a preferred method for low-cost position building. Start exploring today to streamline your cross-border capital flow and global asset allocation.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.