- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money from US Dollars to Mexican Pesos via Remitly?

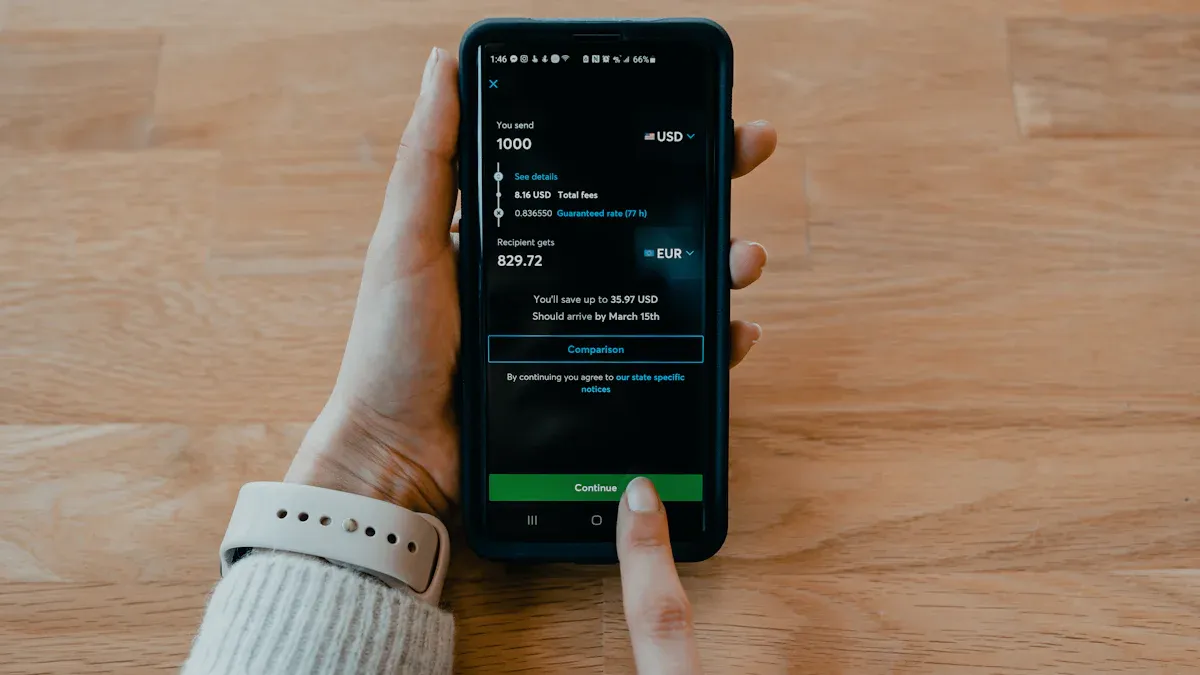

Image Source: pexels

You can transfer USD directly to MXN through Remitly. The process is very simple, and the platform prioritizes user experience. Remitly holds a significant position in the Mexican market, with many users choosing it for cross-border transfers. Other services like Azimo focus on affordability and ease of use, while Intermex offers an extensive agent network and cash pickup options. You only need to follow the platform’s instructions to complete registration, identity verification, and transfer setup to quickly finalize the transfer.

Key Points

- Transferring with Remitly is simple; users just need to follow the platform’s instructions to complete registration and transfer setup.

- When choosing payment and receiving methods, consider transfer fees and delivery times to ensure your needs are met.

- Before transferring, carefully verify recipient information, ensuring the name and contact details are accurate to avoid delays.

- Use Remitly’s real-time exchange rate and fee display to plan your transfer timing, securing the best exchange rate.

- If you encounter issues, promptly contact Remitly’s customer service to ensure the transfer is completed smoothly and funds are secure.

Remitly Transfer Process

Image Source: unsplash

Step Overview

You can complete a USD to MXN transfer with Remitly by following these steps:

- Visit the Remitly website or download the Remitly mobile app, create an account, or log in to an existing one.

- Click “Send Money” or select “Get Started” in the app.

- Enter the USD amount you wish to send.

- Choose the receiving method. You can opt for bank account deposits or cash pickup (if needed, select the nearest pickup location).

- Enter the recipient’s name and phone number.

- Follow the prompts to enter your personal information, including name, phone number, address, and date of birth. Information already provided during registration does not need to be re-entered.

- Select the payment method. You can pay using a bank account, credit card, or debit card. Licensed bank accounts in Hong Kong are also accepted for payment.

- Carefully review the transfer summary to confirm all details are correct.

- Click “Send Money,” and the system will begin processing your transfer request.

- Upon completion, you will see a confirmation page and receive an email receipt.

Tip: The entire process is designed to be intuitive, requiring no complex operations. You can complete a Remitly transfer in just a few minutes by following the on-screen instructions.

Key Considerations

- The Remitly transfer process is simple and suitable for individual users. You can easily operate it on your phone without needing specialized knowledge.

- The platform supports multiple payment methods, allowing you to choose the most suitable option based on your situation.

- Receiving methods are flexible, with both bank accounts and cash pickup options meeting various recipient needs.

- Users generally find Remitly’s transfer experience user-friendly, with responsive customer service providing timely assistance when issues arise.

- The mobile app interface is clear, with straightforward steps. You can initiate a transfer anytime, anywhere, without delay.

- Before transferring, carefully verify recipient information and the amount to ensure accuracy before submission.

Note: When entering recipient information, ensure the name and phone number are accurate. Incorrect information may lead to transfer delays or failures.

Account Registration and Verification

Registration Process

You can register an account on the Remitly transfer platform, and the process is very straightforward. First, you need to visit the Remitly website or download the mobile app. After clicking “Sign Up,” the system will guide you to enter basic information. You need to provide your name, date of birth, phone number, and home address. For business users, the platform also requires business address, website, customer type, transfer purpose, industry, number of employees, and Employer Identification Number (EIN). If you are an owner, you must provide your position, ownership percentage, and similar information for other owners. The table below shows common information requirements during registration:

| Information Category | Specific Requirements |

|---|---|

| About You | Name, date of birth, tax ID (SSN, ITIN, or valid ID), phone number, and home address. |

| About Your Business | Business address, website (if applicable), customer and transfer purpose, industry, number of employees, and EIN (if applicable). |

| Ownership Information | Position, ownership percentage, and similar information for other owners, including addresses and tax IDs. |

Required Materials

When registering an account, you need to prepare some materials to pass verification smoothly. The platform typically requires you to upload a government-issued ID, such as a passport or driver’s license. Sometimes, proof of address, like a utility bill or bank statement, is also needed. You can prepare these documents in advance to ensure a smooth registration process.

- Government-issued ID, such as a passport or driver’s license

- Proof of address (if required)

Tip: Uploading clear photos of your documents can speed up the verification process.

Identity Verification

Identity verification is a critical step in ensuring account security. When logging in for the first time or switching devices, the system may require additional information. The platform does this to comply with financial regulations, ensuring every transfer is secure and reliable. You need to follow the on-screen prompts to complete identity verification, typically involving uploading ID documents and entering personal information. Common issues include logging in from a new device, compliance requirements, and maintaining account security.

- Additional verification required for new device logins

- Compliance with financial regulations

- Periodic identity verification for account security maintenance

Note: If identity verification fails or information doesn’t match, it’s recommended to contact customer service promptly for assistance.

Transfer Operation Details

Adding a Recipient

When transferring with Remitly, you first need to add recipient information. The system requires you to enter the recipient’s full name and contact details, including their phone number. This ensures funds are accurately delivered to the designated recipient. You can save multiple recipients on the platform for convenient future transfers.

Tip: Carefully verify the recipient’s name and phone number to avoid delays due to incorrect information.

- Recipient’s full name

- Contact details (phone number)

If the recipient chooses cash pickup, ensure they can visit the designated pickup location to collect the funds. For bank account deposits, you need to provide the recipient’s bank account details.

Selecting Payment Method

You can choose a payment method based on your situation. Remitly supports multiple payment channels, meeting various user needs. Common payment methods include:

- Bank account transfer (available in specific countries and regions, such as licensed bank accounts in Hong Kong)

- Debit card, credit card, or prepaid card

- Mobile wallet (e.g., Apple Pay, Google Pay)

When selecting a payment method, consider delivery speed and fees. Debit and credit cards typically offer faster delivery, while bank account transfers are suitable for larger amounts. Mobile wallets are ideal for users accustomed to mobile payments.

Note: Ensure the selected payment method has sufficient funds to avoid delays due to payment failures.

Entering Amount and Currency

You need to enter the transfer amount and select the currency on the platform. Remitly supports USD to MXN transfers. The system automatically displays the real-time exchange rate and estimated delivery amount. You can adjust the transfer amount based on the recipient’s needs, and the platform will update the exchange results accordingly.

| Transfer Currency | Target Currency | Real-Time Rate Display | Estimated Delivery Amount |

|---|---|---|---|

| USD | MXN | √ | √ |

You can check exchange rate changes at any time to choose the optimal transfer timing. The platform will confirm the amount and currency again before submission to ensure accuracy.

Submitting the Transfer

After verifying all information, you can submit the transfer request. The platform will prompt you to confirm the recipient information, payment method, and transfer amount again. After submission, the system will begin processing your transfer. You can complete the payment through:

- Debit or credit card

- Bank account transfer

Remitly offers multiple receiving methods in Mexico, including cash pickup, bank deposits, and mobile payments. Cash pickup is suitable for recipients without bank accounts, while bank deposits are ideal for those preferring direct deposits. Ensure funds are sent only to bank accounts or cash pickup points registered under the recipient’s name.

Tip: Remitly uses advanced encryption and multi-layered security measures to protect your personal and financial data. The platform monitors transactions around the clock to prevent fraud.

You can track the transfer status in real time after submission. The platform sends email and SMS notifications, allowing you to stay updated on progress.

Exchange Rates and Fees

Image Source: pexels

Viewing Real-Time Exchange Rates

When transferring with Remitly, you can check the real-time USD to MXN exchange rate at any time. The platform updates rates multiple times per hour, helping you stay informed about market changes. Before confirming the transfer, you’ll see the final amount received, ensuring rate transparency.

- Rates updated multiple times per hour

- Real-time display of final delivery amount

- You can choose transfer timing based on market changes

Tip: Before submitting the transfer, verify the exchange rate and received amount to avoid impacts from rate fluctuations.

Fee Structure

Remitly’s fee structure is clear, with no hidden fees. You only pay the service and exchange rate fees displayed on the platform. The table below shows fees for different payment methods:

| Transfer Amount | Bank Account Payment | Debit Card Payment |

|---|---|---|

| $500 or more | $0 | $0 |

| Less than $500 | $3.99 | $3.99 |

You won’t encounter additional charges during transfers. The platform clearly displays all fees on the page. While there are no hidden fees, you should still note exchange rate costs. First-time transfers may benefit from promotional rates, while subsequent transfers follow standard rates.

- No hidden fees

- Exchange rate fees included in the conversion process

- First transfer enjoys promotional rates, subsequent ones follow standard rates

First-Time Promotional Rates

As a new customer, your first transfer with Remitly qualifies for a promotional exchange rate. The platform offers a higher exchange rate for the first $1,000 and waives the service fee. The table below details the promotion:

| Promotion Content | Details |

|---|---|

| Discount Code | 10-OFF-MX-AFF |

| First Transfer Offer | Promotional rate for the first $1,000 |

| Eligible Customers | New customers, one-time use |

| Validity Period | February 8, 2022, to March 4, 2022 |

| Additional Information | Transfers exceeding $1,000 will use non-promotional rates |

Note: Your first transfer can yield more MXN, with no service fee. Amounts exceeding the promotional limit will switch to standard rates.

Transfer Limits and Compliance

Transfer Limits

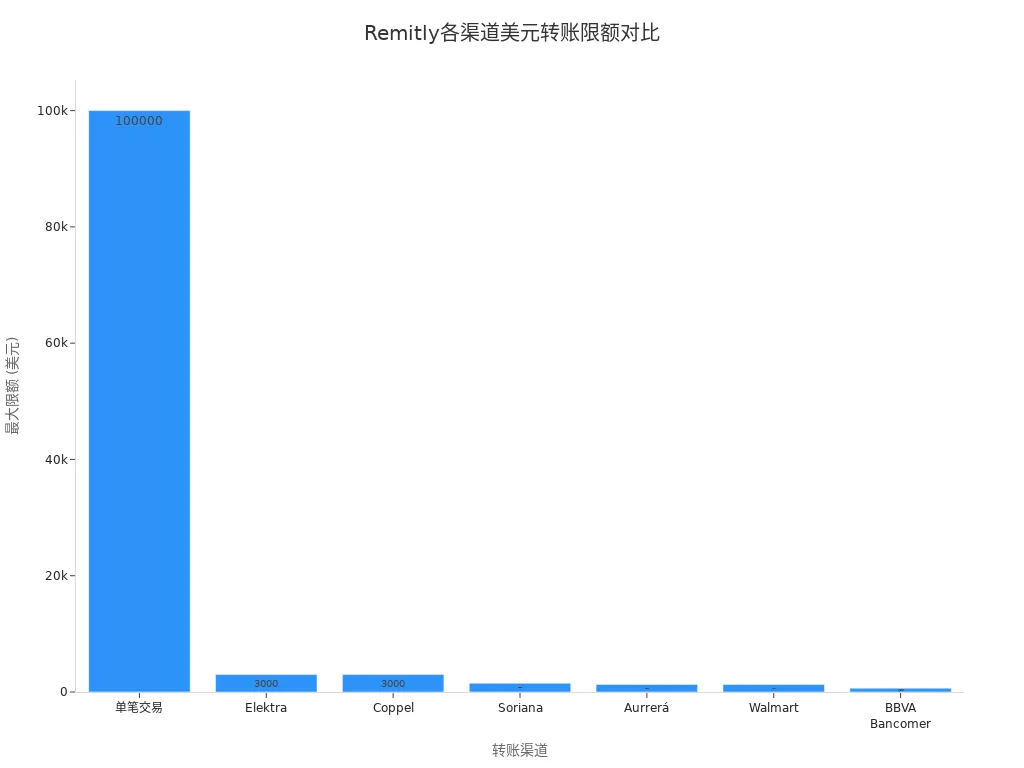

When transferring USD to MXN with Remitly, you need to understand the transfer limits for different channels. The platform sets maximum amount limits for each receiving method. Refer to the table below to choose the most suitable channel:

| Transaction Type | Maximum Limit (USD) |

|---|---|

| Single Transaction | 100,000 |

| Cash Transfer (Elektra) | 3,000 |

| Cash Transfer (Coppel) | 3,000 |

| Cash Transfer (Soriana) | 1,500 |

| Cash Transfer (Aurrerá) | 1,300 |

| Cash Transfer (Walmart) | 1,300 |

| Cash Transfer (BBVA Bancomer) | 650 |

| Cash Transfer (Farmacias Guadalajara) | Approx. 15,000 (MXN) |

| Cash Transfer (Oxxo) | Approx. 3,000 (MXN) |

You can visually compare the maximum transfer limits for different channels in the chart below:

Tip: For large transfers, choose bank account deposits. Cash pickup channels are suitable for smaller amounts with lower limits.

Regulatory Requirements

You must comply with relevant regulations during transfers. Remitly conducts compliance reviews for each transaction based on U.S. and Mexican financial regulations. You need to provide accurate personal information to pass identity verification. The platform monitors unusual transactions to prevent money laundering and fraud. For large transfers, the platform may request additional documents, such as proof of fund source or income.

- Compliance with U.S. and Mexican financial regulations

- Complete identity verification and compliance reviews

- Large transfers may require additional supporting documents

Note: If a compliance review is triggered, cooperate promptly to avoid transfer delays.

Recipient Information

When entering recipient information, ensure all details are accurate. The platform requires the recipient’s name to match their bank account or cash pickup ID exactly. You also need to provide the recipient’s contact details, and some channels may require their address. Inaccurate information may lead to transfer failure or return.

- Recipient’s name must match their ID

- Contact details and bank account information must be accurate

- Cash pickup requires valid ID

Tip: Confirm all details with the recipient in advance to ensure smooth delivery.

Delivery Time and Tracking

Express Service

You can choose Remitly’s Express service to speed up USD to MXN transfers. Express service typically completes transfers in minutes, ideal for urgent fund needs. The platform sets minimum transfer amount requirements for Express service, as detailed below:

| Transfer Method | Minimum Transfer Amount | Fee |

|---|---|---|

| Remitly Express | $500 | $0 |

| Remitly Economy | < $500 | $3.99 |

| Xoom | $18.79 | N/A |

When choosing Express service, ensure the transfer amount meets the minimum requirement. Express service is not only fast but also waives fees for amounts of $500 or more. You can flexibly choose the appropriate service type based on your needs.

Tip: Express service is ideal for scenarios requiring fast delivery, but note the amount restrictions.

Real-Time Monitoring

After completing the transfer, you can track the fund status in real time through multiple methods. The platform sends a confirmation email containing a reference number. You can enter the reference number on the Remitly website or app to check transfer progress at any time. The platform also notifies you at each stage via email or SMS, ensuring you’re always informed about the transfer process.

- You will receive a confirmation email with a reference number.

- You can check real-time status on the Remitly website or app using the reference number.

- The platform provides timely notifications via email or SMS for each step.

This real-time monitoring mechanism allows you to stay updated on fund movements, enhancing transfer security.

Error Handling

If you encounter issues or errors during the transfer process, contact Remitly customer service immediately. You can report issues via phone, email, or mail. Contact within 180 days of the promised fund availability date and prepare the following information:

- Your name and email address

- Specific reason for the transfer error or issue

- Recipient’s name and contact details (if known)

- Transfer amount

- Original transaction reference number

Contact details:

- Phone: 1-888-736-4859

- Email: us-complaints@remitly.com

- Mailing Address: Remitly, Inc., attn.: Error Resolution 401 Union Street, Suite 1000, Seattle, WA 98101

Note: Promptly reporting issues helps the platform resolve errors quickly, ensuring fund security.

Customer Support and FAQs

Common Questions

When transferring USD to MXN with Remitly, you may encounter common questions. Understanding these can help you prepare in advance and improve your transfer experience.

- How much does Remitly charge? You can clearly see all service and exchange rate fees on the transfer page, with no hidden fees.

- How long does it take to send money online with Remitly? Express service typically delivers in minutes, while Economy service may take 1-3 business days.

- What is the maximum amount I can transfer with Remitly? The maximum per transaction is 100,000 USD, with different limits for various receiving channels.

- What is the minimum amount I can transfer with Remitly? Some services have minimum requirements, such as 500 USD for Express service.

- What payment methods does Remitly support? You can choose bank accounts, debit cards, credit cards, or mobile wallets for payment.

- What receiving methods does Remitly support? Recipients can choose bank accounts, cash pickup points, or digital wallets.

Before transferring, you can review the platform’s help center to understand relevant policies and processes, avoiding operational errors.

Customer Service Channels

If you encounter issues, you can contact Remitly customer service through multiple channels. The platform provides 24/7 support for USD to MXN users, ensuring timely assistance. The table below shows main customer service channels and their details:

| Channel | Language | Availability |

|---|---|---|

| Online Chat | Spanish | 24/7 |

| Phone Support | English and Spanish | 24/7 |

| U.S. Customer Service Phone | English and Spanish | 24/7 |

You can choose the contact method based on your language preferences and needs. Online chat is suitable for quick inquiries, while phone support is ideal for complex issues. The U.S. customer service phone also provides convenience for users in China/Mainland China, helping resolve transfer-related questions promptly.

It’s recommended to have your account information and transaction reference number ready when contacting customer service to expedite issue resolution.

When transferring USD to MXN with Remitly, you need to focus on the following points:

- When choosing payment and receiving methods, consider transfer fees, delivery time, maximum and minimum amounts, and available channels.

- You can check real-time exchange rates and fees at any time to plan transfer timing effectively.

- Using the platform’s real-time tracking feature, you can stay updated on fund movements, enhancing security.

Users generally find Remitly’s transfer service fast and reliable. The table below shows user ratings from different sources:

| Source | Rating |

|---|---|

| Remitly Review | 2.6/5 |

| TrustPilot | 4.6/5 |

| Customer Service Reviews | 4.5/5 |

You can operate flexibly based on your needs and contact customer support promptly if issues arise to ensure a smooth transfer.

FAQ

How long does it take for a Remitly transfer to arrive?

When you choose Express service, funds typically arrive in minutes. Economy service generally takes 1-3 business days. Delivery time depends on the payment method and receiving channel.

Can I cancel a transfer order?

You can cancel an order on the account page before it’s processed. Funds will be refunded to the original payment method. Orders cannot be canceled after processing, so confirm details in advance.

What are the transfer limits?

You can transfer up to 100,000 USD per transaction. Different receiving channels have specific limits, with cash pickup points having lower limits. Refer to the platform’s limit table.

What should I do if a transfer fails?

If a transfer fails, contact Remitly customer service. Prepare the transaction reference number and recipient information. Customer service will assist in identifying and resolving the issue.

Are there discounts for first-time transfers?

Your first transfer enjoys a promotional rate, with the first 1,000 USD exempt from service fees. The platform automatically applies the discount, with no additional action needed. Amounts exceeding this use standard rates.

Using Remitly for USD to MXN remittances, you may value its intuitive interface, Express service’s minutes-fast delivery, and first $1,000 fee-free offer, yet encounter drawbacks: $3.99 fees for small transfers, 0.4%-1.4% rate markups, low cash pickup limits (e.g., Oxxo at ~3,000 MXN), and verification delays impacting frequent or urgent transfers. Despite 256-bit encryption and compliance checks, hidden rate costs and fraud risks require caution, particularly with the US remittance market’s ongoing 2025 growth amplifying cost and convenience concerns.

BiyaPay offers a refined cross-border financial solution. Our real-time exchange rate query provides instant mid-market rates to maximize remittance value. With fees as low as 0.5%, it supports conversions across 30+ fiat currencies and 200+ digital assets, covering multiple countries globally with same-day delivery. Uniquely, BiyaPay’s unified platform enables US and Hong Kong stocks trading without overseas accounts, with zero fees on contract orders, transforming remittances into investment opportunities. Licensed under US MSB and more, fortified by 256-bit encryption and real-time fraud detection for robust compliance and security.

Sign up at BiyaPay today for low-cost, rapid transfers and integrated investing, making your USD-to-MXN remittances more efficient and secure!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.