- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Does Western Union Conduct International Money Transfers? Analysis of Remittance Limits, Fees, and Security

Image Source: unsplash

Western Union remittance provides an efficient solution for international fund transfers. Its service network spans the globe, covering over 200 countries and territories with 550,000 agent locations. Data shows that Western Union’s digital footprint reaches over 95% of countries involved in cross-border remittances. Users can achieve secure fund circulation through a simple process, enjoying multiple security measures and compliance support.

Key Points

- Western Union covers over 200 countries, offering convenient international fund transfer services.

- After registering an account, users must accurately provide personal and recipient information to improve transfer efficiency.

- Choosing the right payment method can reduce fees, with bank transfers typically incurring lower costs.

- Users should pay attention to transfer amount limits and regional policies to avoid failures due to exceeding limits.

- Western Union employs multiple security measures to ensure the safety of users’ funds and information.

International Fund Transfer Process

Image Source: unsplash

Registration and Account Creation

Before conducting international fund transfers, users must complete registration and account creation with Western Union. The process is straightforward and efficient, typically involving the following steps:

- Online Registration: Users need to fill out an online registration form, providing basic personal information.

- Email Verification: After registration, users must visit a nearby designated agent location and present identification documents matching the registered information.

- Account Activation: Upon receiving the account verification email, users can start international fund transfer operations on Western Union’s website or app.

This process ensures the authenticity of user identities, effectively preventing illegal fund flows. For users in China/mainland China, registration must comply with local regulatory requirements, ensuring all information is accurate and valid.

Information Entry

When initiating an international fund transfer, users must accurately provide relevant information. Western Union requires detailed personal and recipient information, as follows:

| Information Type | Details |

|---|---|

| Name | Full name as shown on government-issued ID |

| Bank Name | Name of the receiving bank |

| Bank Branch | Branch information of the bank |

| Bank Account Number | Bank account number (if applicable) |

| Tax Registration Number | Local tax registration number if in Hong Kong or other regions |

| Valid Identification | Government-issued ID with ID number and expiration date |

| Country of Birth | Country of birth |

| Date of Birth | Date of birth |

| Phone Number | Home or mobile phone number |

| Home Address | Street, city, town, or parish address |

| Occupation | Occupation information |

| Email Address | Email address |

| Proof of Bank Account Ownership | Bank statement, canceled check, account passbook, etc. |

| Additional Requirements | Front and back photos of ID, tax registration card photo, selfie with ID, proof of address, bank portal screenshot |

When entering recipient information, users must also provide the following:

| Required Information | Description |

|---|---|

| Recipient Name | Name on the recipient’s bank account, which can be an individual or company name |

| Account Number or IBAN | Recipient’s account number or International Bank Account Number (IBAN) |

| BIC or SWIFT Code | Used to identify the bank account and destination country for international payments |

| National Clearing Code | Required if no IBAN is provided; optional with IBAN |

| Bank Name | Name of the receiving bank |

| Bank Address | Full address of the receiving bank’s branch |

| Message to Recipient | Optional, to include a note on the purpose of the payment |

Accurately providing the above information helps improve the efficiency of international fund transfers and reduces delays due to errors.

Payment and Receiving Methods

Western Union offers diverse payment and receiving methods for international fund transfers to meet various user needs. Common methods include:

- Bank Transfer: Users can transfer funds directly from their bank account to the recipient’s account, suitable for large or regular transfers.

- Cash Pickup: Recipients can collect cash at local designated agent locations with a transaction number and valid ID, ideal for those without bank accounts or needing quick cash access.

- eWallet: Some countries and regions support receiving funds via digital or mobile wallets, offering convenience and efficiency.

- Money Orders and Checks: Users can opt for traditional money orders or checks, suitable for specific compliance-required transfers.

Different payment methods significantly impact the process. For example, credit card payments enable fast delivery, ideal for urgent transfer needs; debit card payments typically offer better exchange rates, suitable for cost-conscious users; debit cards also allow higher transfer limits, ideal for large international transfers. Users can choose the most appropriate method based on their needs and the recipient’s regional policies.

Agent Location Operations and Documents

Some users prefer handling international fund transfers at Western Union agent locations. The process is as follows:

- Online Transfer: Users log into their account, select “Send Now”, enter the destination and amount, choose bank account payment, provide recipient bank details, confirm, and complete the payment, with the system generating a tracking number.

- Cash Transfer: Users visit a nearby agent location, present valid ID and recipient bank details, pay in cash, and receive a receipt and tracking number.

- Bank Account Transfer: Through the Western Union app, users enter relevant information, complete the payment, and obtain a tracking number.

When handling transactions at agent locations, users must bring the following identification documents:

| Required Identification Documents |

|---|

| Passport |

| EU/EEA ID Card |

| Permanent Residence Card |

| Emergency Travel Document |

| Alternative ID |

| Foreigner Travel Document |

| Swiss ID Card |

Users in China/mainland China must provide identification documents as required by local laws when conducting international fund transfers. Some regions may require additional compliance materials. Users should prepare all documents in advance to ensure a smooth process.

Professional Advice: When choosing payment and receiving methods, users should consider fund delivery speed, fees, exchange rates, and compliance requirements to plan their international fund transfer strategy effectively.

Transfer Limits

Amount Caps

Western Union sets clear amount caps for international fund transfers. The user’s account verification status directly affects single and cumulative transfer limits. The table below shows the maximum transfer amounts under different verification statuses:

| Verification Status | Maximum Single Transfer Amount |

|---|---|

| Unverified | €1,000 |

| Verified | €5,000 |

| Note | Limits vary by country |

For example, unverified accounts can transfer up to 3,000 USD per month, while verified accounts can increase to 50,000 USD. Some countries or regions may further adjust limits based on local regulations. Users should thoroughly understand the policies of both sending and receiving regions to avoid transfer failures due to exceeding limits.

Regional Policies

The laws and regulations of different countries and regions significantly impact Western Union’s international fund transfer processes and limits. This is reflected in the following aspects:

- International transfers must comply with the laws of both sending and receiving regions, with some countries imposing specific requirements on amounts, frequency, and purpose.

- Local tax policies may affect transfer amounts and required documentation.

- Western Union adjusts its service processes based on regional policies to assist users in compliant operations.

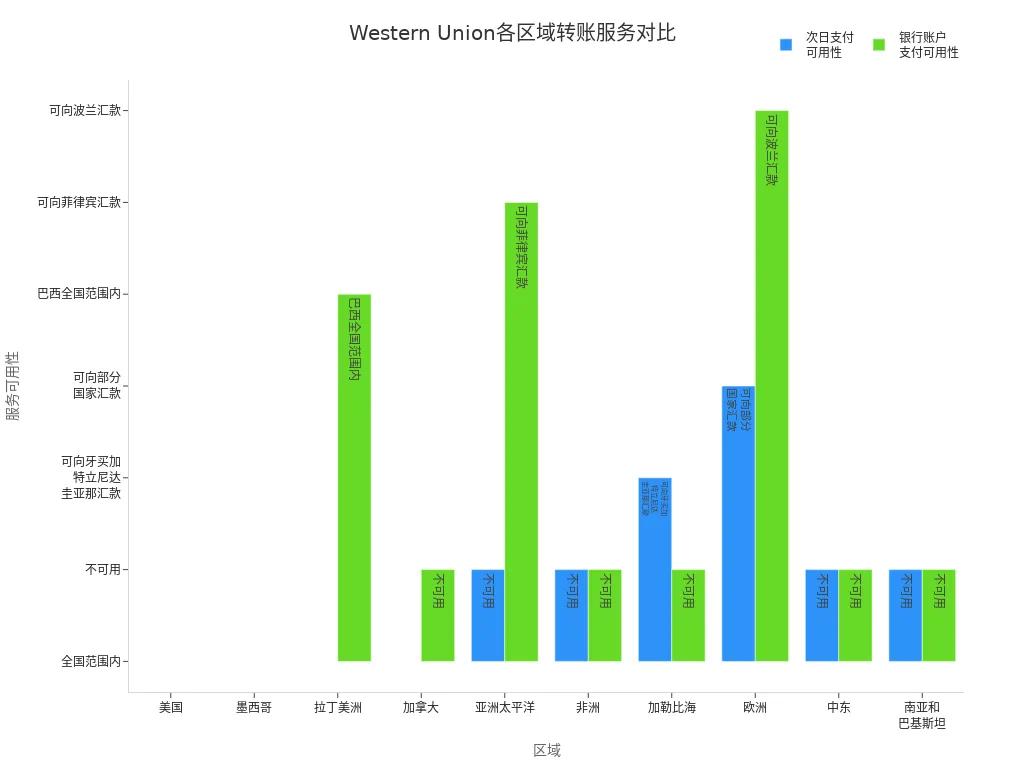

The table below compares service availability in major regions:

| Region | Next-Day Payment Availability | Bank Account Payment Availability |

|---|---|---|

| United States | Nationwide | Nationwide |

| Canada | Nationwide | Unavailable |

| Asia-Pacific | Unavailable | Available to the Philippines |

| Europe | Select countries | Available to Poland |

| Africa | Unavailable | Unavailable |

Users in China/mainland China should pay special attention to local compliance requirements and policy changes when conducting international fund transfers.

Identity Verification

Identity verification is a critical step in preventing money laundering and ensuring fund security. Western Union requires users to provide varying levels of identity documentation based on transfer amounts and regional policies:

- Large transfers require additional proof of occupation and fund source.

- Banks may request government-issued ID, proof of address, and other documents.

- Identity verification helps prevent fraud and illegal activities, ensuring compliant international fund transfers.

Western Union has a dedicated Financial Intelligence Unit (FIU), responsible for identifying and investigating suspicious transactions. Over 20% of the company’s staff focus on compliance, ensuring the safety and compliance of every international fund transfer.

Fee Analysis

Image Source: unsplash

Transaction Fees

Western Union’s fee structure varies based on the destination country, payment method, and transfer amount. Fees differ significantly depending on the payment method (e.g., cash, debit card, credit card, or bank account). For example, international fund transfers via bank accounts typically incur lower fees, while credit card payments may result in higher costs. The following are common fee ranges (in USD):

| Destination/Payment Method | Fee Range (USD) |

|---|---|

| SEPA Transfer (Standard) | Usually free |

| SEPA Transfer (Foreign Currency) | Up to 30 |

| Non-SEPA Transfer | 15 to 50 (per 1,000) |

When initiating international fund transfers from China/mainland China or Hong Kong-licensed banks, transfers to EU or EEA countries may enjoy free or low-fee policies. Transfers to non-European countries incur significantly higher fees. Western Union’s fees can sometimes reach up to 10% of the transfer amount. In comparison, some online transfer services (e.g., Wise, OFX) typically offer lower fees and better exchange rates.

Tip: Before initiating a transfer, users can use Western Union’s website or app fee calculator to understand specific fees and avoid budget discrepancies due to unclear costs.

Exchange Rate Margin

For international fund transfers, Western Union typically adds a margin to the mid-market exchange rate, which is a key profit source. For example, if the mid-market rate is 1:0.92, Western Union may offer only 1:0.88. For large transfers, this difference accumulates quickly, reducing the amount received by the recipient. The size of the exchange rate margin depends on factors such as currency pairs, transfer amounts, and destination countries. Smaller amounts or less common currency pairs typically face less favorable rates. Compared to other services, Western Union’s exchange rate margins are relatively high, while providers like Wise offer rates closer to the mid-market rate, resulting in lower overall costs.

Hidden Fees

In addition to explicit transaction fees and exchange rate margins, users should be aware of hidden fees, including:

- Larger transfer amounts incur tiered fees. For example, sending 500-600 USD incurs a 35 USD fee; 1,000-1,100 USD incurs 52 USD; 2,500-3,000 USD incurs up to 119 USD.

- Credit card payments may incur additional fees, with some issuing banks charging cash advance fees.

- Recipient banks in certain countries or regions may charge incoming transfer fees.

- Exchange rate margins are an implicit cost, directly affecting the received amount.

For instance, sending 1,000 USD to Mexico via Western Union may incur a 40 USD transfer fee plus approximately 45 USD in exchange rate margin. If using a credit card, additional issuing bank fees may apply.

Advice: Users should carefully review fee disclosures before transferring to fully understand all potential costs and avoid receiving less than expected due to hidden fees.

Cost-Saving Tips

Users can reduce the total cost of international fund transfers through several methods:

- Compare Providers: Different providers vary in fees and exchange rates. Users can use online tools to compare and choose the best option.

- Prioritize Bank Account Payments: Bank account payments typically have lower fees and better rates than credit card payments.

- Use Online Transfer Services: Online operations are often cheaper and more transparent than agent locations.

- Avoid Foreign Currency Settlement: If possible, settle in local currency to reduce currency exchange losses.

- Exchange Currency in Advance: Convert currency when rates are favorable to lower costs.

- Leverage Promotions and Discounts: Some providers offer periodic fee waivers or exchange rate discounts, which can save costs.

- Use Fee Calculators: Before initiating a transfer, use Western Union or bank calculators to accurately estimate total fees and received amounts.

- Read User Reviews and Terms: Understand potential fees and service reliability through user feedback and official terms.

By adopting these measures, users can minimize the overall cost of international fund transfers while ensuring fund security.

Security Assurance

Data Encryption

Western Union places high importance on customer data security. During international fund transfers, the platform employs multiple encryption technologies to protect user information. The table below outlines key encryption measures:

| Encryption Technology | Description |

|---|---|

| TLS (Transport Layer Security) | Encrypts sensitive information like user IDs, passwords, and credit card numbers, ensuring secure data transmission over the internet. |

Additionally, Western Union uses SSL (Secure Sockets Layer) technology to further enhance data transmission security. The platform strictly adheres to PCI DSS (Payment Card Industry Data Security Standard), ensuring the safety of every fund transfer.

Verification Process

Western Union ensures compliance and security for every international fund transfer through multiple identity verification and risk prevention measures, including:

- The platform requires users to register and complete identity verification to prevent fraud and money laundering.

- Each transfer requires multi-factor authentication via PIN, password, or biometric verification.

- Transfers exceeding 1,000 USD require additional identity verification, which can be completed via video or official documents.

- End-to-end encryption protects transfer information from being intercepted.

- The system automatically detects and alerts for potential fraudulent activities.

- Users can track transfer status in real-time using a 10-digit Money Transfer Control Number (MTCN).

- The platform provides anti-fraud education resources to help customers identify risks.

These measures align with international financial industry standards, effectively reducing fund risks.

Customer Service

Western Union offers multi-channel support to help users resolve issues during international fund transfers. Common service channels are as follows:

| Channel | Contact Method |

|---|---|

| Online Chat | Communicate directly with customer service representatives for real-time assistance |

| Phone Contact | 0800 297 579 (Austria); +4314240528 (International) |

| Austria.customer@westernunion.com | |

| Find a Location | Locate nearby Western Union agent locations for in-person consultations via the website |

Customers can choose the most suitable service channel based on their needs to receive professional support and risk prevention advice.

Western Union demonstrates efficient processes, strict limits, transparent fees, and robust security measures in the field of international fund transfers. Users should pay attention to transfer amount caps, regional policies, fees, and exchange rate margins. Choosing the right payment and receiving methods can enhance fund delivery efficiency. By tailoring cross-border transfer plans to specific needs, users can effectively reduce costs and ensure fund security.

- The process is straightforward with clear document requirements.

- The fee structure is transparent, and security measures are comprehensive.

FAQ

What payment methods can be used with Western Union in China/mainland China?

Users can choose bank accounts, debit cards, credit cards, or cash for payments. Some Hong Kong-licensed banks support international fund transfers, with specific methods subject to local policies.

Professional Tip: Bank account payments typically have lower fees and faster delivery.

How long does it take for a transfer to arrive?

Western Union typically completes fund transfers within minutes to 1 business day. Delivery time depends on the destination country, payment method, and compliance reviews.

| Payment Method | Estimated Delivery Time |

|---|---|

| Cash | Minutes |

| Bank Account | 1 business day |

How can I track the transfer status?

Users can enter the 10-digit Money Transfer Control Number (MTCN) on Western Union’s website or app to track transfer progress in real-time. The system displays the fund status and estimated delivery time.

What happens to funds if a transfer fails?

If a transfer fails, Western Union automatically refunds the funds to the original payment account. Users can contact customer service for detailed refund process instructions.

Note: Refund times vary by payment method, typically taking 3 to 7 business days.

What should I do if I encounter identity verification issues during a transfer?

Users should prepare valid identification documents, such as a passport or proof of a Hong Kong-licensed bank account. For verification issues, contact online customer service or phone support for professional assistance.

When selecting cash withdrawal services or other remittance methods, you may value their convenience and broad coverage (e.g., ATMs handling 6400 transactions monthly), but face challenges: theft risks at remote ATMs, 3-5 day delays and high intermediary fees for cross-border wire transfers, elevated third-party platform fees with poor integration, and crypto volatility, especially as mobile transfers hit 40% globally in 2025 and cash regulations tighten, amplifying hidden costs and security concerns.

BiyaPay offers a streamlined cross-border financial solution to enhance your remittance experience. Our real-time exchange rate query delivers instant mid-market rates, minimizing conversion losses. With fees as low as 0.5%, it supports conversions across 30+ fiat currencies and 200+ digital assets, covering multiple global destinations with same-day delivery. Uniquely, BiyaPay’s single platform supports direct US and Hong Kong stock trading without separate overseas accounts, with zero fees on contract orders, transforming remittances into investment opportunities. Licensed under US MSB and more, fortified by 256-bit encryption and real-time fraud detection, it ensures robust compliance and security.

Sign up at BiyaPay today for low-cost, rapid transfers and integrated investing, making your global fund flows more efficient and secure!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.