- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to Sending Money to Canada: Choosing the Right Platform, Understanding Fees, Restrictions, and Security

Image Source: unsplash

When choosing a remittance platform for Canada, you need to consider the purpose of the transfer, the amount, the speed of delivery, service fees, and the platform’s security. Each channel has distinct features suited to different needs. You can refer to this guide to sending money to Canada and make an informed choice based on your situation. Platform security and fee transparency are crucial, so it’s recommended to prioritize reputable service providers.

Key Points

- Clarify the purpose of the remittance and choose the appropriate channel. Different reasons for sending money will influence your platform choice.

- Focus on the platform’s security and user reviews. Select a reputable provider to ensure the safety of your funds.

- Understand the fee structure of each platform to avoid hidden costs. Review the terms of service carefully to ensure fee transparency.

- Pay attention to exchange rate fluctuations and choose the right timing for your transfer. Compare exchange rates across platforms to maximize the received amount.

- Comply with regulatory requirements to ensure legal fund transfers. Understand tax reporting obligations to avoid legal risks.

Guide to Sending Money to Canada: Platform Selection

Image Source: pexels

Purpose and Needs of the Remittance

Before choosing a remittance channel, you must first clarify the purpose of your transfer and your specific needs. Different reasons for sending money will affect your choice of channel and service. Common remittance purposes include:

- Family support, such as providing living expenses for relatives in Canada.

- Gift transfers to express care or holiday wishes.

- Convenience for both you and the recipient is also a key factor. Data shows that 30% of senders and 32% of recipients prioritize ease of operation.

You can choose the most suitable channel based on your actual needs and this guide to sending money to Canada. For example, if you need fast delivery, you might prioritize online platforms or apps. If cost is your main concern, banks or money changers might be more suitable.

Channel Types

Currently, the main channels for sending money to Canada include banks, wire transfers, remittance operators, online platforms (such as digital wallets), and money changers. Each channel has its own advantages and disadvantages. You can refer to the table below for an overview of common channel types:

| Remittance Channel | Market Share |

|---|---|

| Banks | N/A |

| Remittance Operators | N/A |

| Online Platforms (Wallets) | N/A |

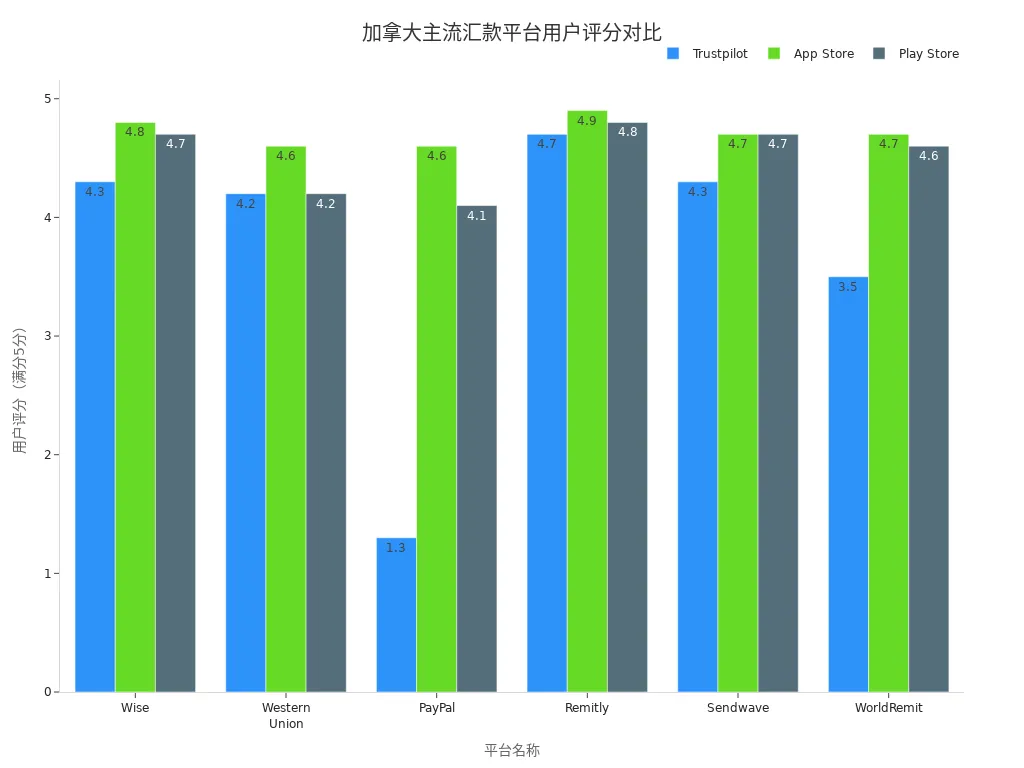

When choosing a channel, it’s recommended to focus on the platform’s security and user reviews. Mainstream platforms like Wise, Western Union, PayPal, Remitly, Sendwave, and WorldRemit have the following user ratings:

| Platform | Rating |

|---|---|

| Wise | Trustpilot: 4.3/5 (241,772+ reviews), App Store: 4.8/5 (24,700+ reviews), Play Store: 4.7/5 (1.1M+ reviews) |

| Western Union | Trustpilot: 4.2/5 (102,600+ reviews), App Store: 4.6/5 (31,100+ ratings), Play Store: 4.2/5 (19,300+ reviews) |

| PayPal | Trustpilot: 1.3/5 (31,500+ ratings), App Store: 4.6/5 (158,000+ reviews), Play Store: 4.1/5 (3.33M+ reviews) |

| Remitly | Trustpilot: 4.7/5 (67,000+ reviews), App Store: 4.9/5 (494,000+ reviews), Play Store: 4.8/5 (947,000+ reviews) |

| Sendwave | Trustpilot: 4.3/5 (19,900+ reviews), App Store: 4.7/5 (7,700 reviews), Play Store: 4.7/5 (100,000+ reviews) |

| WorldRemit | Trustpilot: 3.5/5 (88,000+ user reviews), App Store: 4.7/5 (47,300+ user reviews), Play Store: 4.6/5 (213,000+ reviews) |

You can also refer to the reliability and transparency of different platforms:

| Platform | Reliability | Transparency |

|---|---|---|

| Remitly | Fast transfers, often completed in minutes | Competitive exchange rates and transparent fees |

| Western Union | Long-standing reputation, extensive network | May charge higher fees but offers reliable service |

| ACH | Cost-effective, suitable for non-urgent needs | Transparent fees |

| Wire Transfer | Offers speed and reliability | Relatively high fees |

Selection Criteria

When choosing a remittance platform, you need to consider the following criteria:

- Cost: Do you want the most cost-effective option, even if it means slower transfer times?

- Speed: Do you need the funds to arrive quickly, even if it involves higher fees?

- Security: Do you prioritize the platform’s regulation and reputation, even if fees are slightly higher?

- Convenience: Do you and the recipient prefer cash pickup or direct bank deposits?

- Availability: Is the service accessible in both mainland China and Canada?

In practice, you may encounter the following challenges:

- High fees and hidden charges

- Slow transaction processing

- Security risks and fraud

- Lack of transparency

- Limited accessibility

Tip: When choosing a platform, carefully review the terms of service to understand all potential fees. Some services charge extra for specific payment methods (e.g., credit cards), some offer uncompetitive exchange rates, and others may impose withdrawal fees or minimum transfer amounts. For example, Ria Money Transfer displays service fees before you submit the transfer, but final costs may still be affected by the Canadian government or financial institutions. Waverlite is not responsible for delays or errors caused by uncontrollable factors and has limited compensation amounts.

You can use this guide to sending money to Canada to prioritize platforms with strong reputations and transparent fees. It’s recommended to check user reviews and ratings to avoid unnecessary losses due to hidden fees or unclear services.

Fees and Exchange Rates

Transaction Fees

When selecting a remittance channel, you should first focus on transaction fees. Fee structures vary significantly across channels. Generally, banks, wire transfers, online platforms, and money changers each have distinct fee structures. You can refer to the table below for fee details of mainstream channels (in USD):

| Service/Bank | Sending Fee (USD) | Receiving Fee (USD) |

|---|---|---|

| Online Platform Remitbee | 0 (under specific conditions) | N/A |

When processing remittances through a bank counter, you typically face higher fees. Some online platforms waive fees under specific conditions. When choosing, consider the transfer amount, speed, and service convenience to balance costs.

Tip: When using money changers or third-party remittance services, fees may be lower, but you should pay close attention to the terms of service and ensure fund security.

Exchange Rate Impact

When sending money across borders, exchange rate fluctuations directly affect the received amount. Different platforms have varying exchange rate markups. You can refer to the table below for exchange rate differences among major providers:

| Provider | Exchange Rate Fluctuation Range | Stability |

|---|---|---|

| Wise | 2.35% - 3.34% | High volatility |

| Monito | 1.28% - 1.96% | Low volatility |

| Xoom | Dynamic fluctuations | High volatility |

| Western Union | Stable low rate | Low volatility |

| Remitly | Slightly below global average | Stable |

When choosing a platform, don’t just focus on explicit fees; pay attention to exchange rate markups. Some platforms advertise “zero fees” but profit through exchange rate differences. You can compare real-time exchange rates across platforms to select the most cost-effective option.

Recommendation: Before sending money, check the platform’s real-time exchange rate and compare it with the bank’s mid-market rate to avoid losses due to unfavorable rates.

Hidden Fees

When processing remittances, beyond explicit fees and exchange rate differences, you may encounter various hidden fees, including intermediary bank fees, account maintenance fees, or transaction withdrawal fees. Refer to the table below for common hidden fee types:

| Bank | Outbound Fee | Inbound Fee | Hidden Fee Details |

|---|---|---|---|

| Other Banks | N/A | $15 | Exchange rate markup, potentially adding $20-40 in costs |

| Intermediary Bank Fees | N/A | N/A | Each intermediary bank may charge fees, amounts vary |

| Receiving Bank Fees | N/A | $15-$17.50 | Fees for receiving international transfers, deducted from the transfer amount |

When sending money through banks, funds may pass through multiple intermediary banks, each potentially charging additional fees. Some platforms also impose account maintenance or withdrawal fees. Before proceeding, carefully review the terms of service to understand all possible costs.

You can use the table below to compare the total cost of sending $1,000 to Canada across different channels:

| Option | Transfer Fee | Exchange Rate Markup | Other Fees |

|---|---|---|---|

| Major Banks | $30.00 - $80.00 | 1%-3% | Intermediary bank fees $15-$50 |

| Airwallex | N/A | N/A | N/A |

| Money Changers | N/A | N/A | N/A |

When choosing a channel, prioritize platforms with transparent fee structures. You can use this guide to sending money to Canada to select a remittance method that suits your needs, avoiding losses due to hidden fees.

Note: When processing remittances, always keep all transaction receipts. If you encounter unclear fees or discrepancies in the received amount, contact the platform’s customer service or a professional institution promptly.

Limits and Frequency

Amount Limits

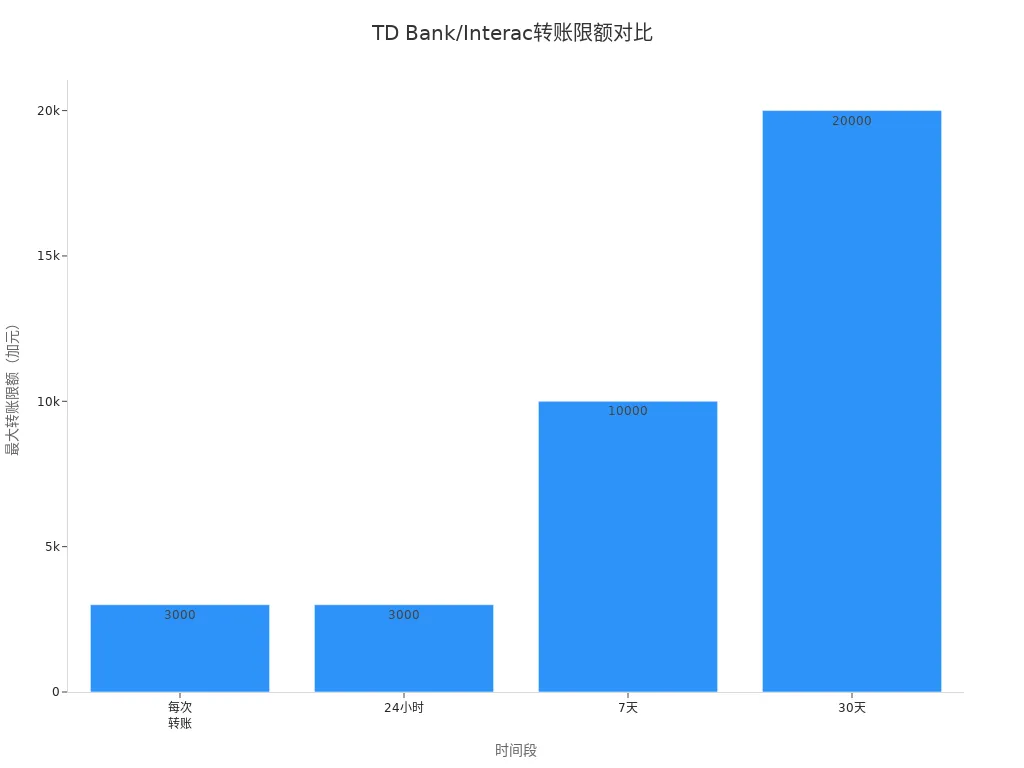

When sending money to Canada, you must understand each platform’s amount limits. Different channels have specific restrictions on single, daily, weekly, and monthly maximum transfer amounts. For example, TD Bank and Interac have the following limits:

| Time Period | Maximum Transfer Limit (USD) |

|---|---|

| Per Transfer | $3,000 |

| 24 Hours | $3,000 |

| 7 Days | $10,000 |

| 30 Days | $20,000 |

When using bank transfers, limits are typically higher but come with stricter reviews. Digital wallets or online platforms offer more flexible limits, suitable for small, frequent transfers. Choose a channel based on your transfer amount and frequency.

Frequency Requirements

You can set up recurring transfers through various remittance services, with common frequencies including weekly, biweekly, or monthly. Some platforms allow you to flexibly schedule transfer times to meet needs like family support or tuition payments. When sending amounts exceeding certain thresholds, platforms may require additional documentation for identity verification. In the U.S., single or cumulative transfers exceeding $10,000 must be reported to the Financial Crimes Enforcement Network (FinCEN). Check the platform’s frequency and amount limits in advance to avoid delays due to exceeding limits or frequent transfers.

Regulatory Compliance

When processing cross-border remittances, you must comply with Canadian and international regulations. Canada’s primary anti-money laundering law is the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), which aims to detect and deter money laundering and terrorist financing while providing investigative leads for law enforcement. New regulations effective in 2024 (SOR/2023-194 amendment) further expand compliance requirements to include virtual asset service providers and mortgage brokers. Platforms will enhance due diligence, especially for high-risk clients like politically exposed persons (PEPs). All suspicious transactions must be reported to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) in real time. When choosing a platform, prioritize those with strong compliance and transparent information to ensure the safety and legality of your funds.

Security

Image Source: pexels

Platform Security Standards

When choosing a remittance platform, security must be your top priority. Mainstream platforms typically implement multiple security measures to protect your funds and information:

- Platforms use robust security technologies to ensure every transaction is encrypted.

- Remittance providers strictly comply with international payment regulations, such as PCI DSS standards, to safeguard your payment data.

- All transaction processes meet the highest industry standards to minimize risks.

You should prioritize platforms with transparent security policies and strong user reviews to ensure your funds are secure.

Information Verification

When sending money, platforms require detailed information from both you and the recipient to prevent fraud and money laundering. Common verification methods include:

| Verification Type | Description |

|---|---|

| Identity Verification Document | You need to upload a valid government-issued photo ID, such as a passport, driver’s license, or permanent resident card. |

| Proof of Address | Platforms may require utility bills or bank statements to confirm your residential address. |

| Recipient Information | You must provide the recipient’s full name, address, and bank details (e.g., IBAN, SWIFT code) to ensure accurate delivery. |

| Proof of Fund Source | For large transfers, platforms may request income proof or fund source documents to meet anti-money laundering requirements. |

When providing this information, ensure it is accurate. Platforms use multiple verification and anti-money laundering checks to ensure the safety and legality of fund transfers.

Anti-Fraud Measures

During the remittance process, stay vigilant to prevent various fraud risks. Consider the following recommendations:

- Be skeptical of suspicious emails. Pause and think before responding to unusual requests.

- Avoid sending or confirming personal or financial information via email; always use official channels.

- Only send money to people you know and trust to avoid losses due to scams.

- Regularly check bank and credit card statements and report any unusual transactions promptly.

- Use strong passwords and avoid easily guessable answers for security questions.

- For transactions via online marketplaces or rental platforms, verify information in person and confirm the recipient’s identity before transferring funds.

Tip: Use authoritative resources like the Canadian Anti-Fraud Centre to stay informed about the latest scams. If you encounter suspicious activity, verify through different channels and report promptly to protect your funds.

Documentation and Process

Required Documents

When sending money to Canada, you need to prepare the necessary documents in advance. Requirements vary slightly across platforms and banks but typically include:

| Required Document/Information | Description |

|---|---|

| Government-Issued ID | Such as a passport or U.S. driver’s license, used for registering a remittance account |

| Recipient’s Name | Must match the name on the recipient’s ID |

| Phone Number | Some platforms may require the recipient’s address and contact details |

| International Bank Account Number (IBAN) | The recipient’s bank international account number |

| Bank Institution Number | Includes the receiving bank’s institution number, account number, and account type |

When preparing documents, double-check all information to ensure accuracy. Incomplete or incorrect information can delay the remittance process.

Operational Process

When sending money, you can choose online platforms or bank channels. The common steps are:

- Log into your online banking or remittance platform account and select add external account.

- Enter the recipient’s bank details, including account number and account type.

- Verify the account holder’s identity; some platforms may require you to approve small test transfers.

- Set up one-time or recurring transfers based on your needs.

- For licensed banks in Hong Kong, log into the bank’s mobile or online system, select global remittance or electronic transfer, enter the recipient’s details and amount, and submit the request.

During the process, carefully verify each step to avoid delays due to incorrect information.

Review Considerations

You may encounter common issues during the review process. Key points to note include:

- Platforms may lack clear communication requirements, leading to missing information.

- Paper-based remittance processes are less efficient; prioritize electronic channels.

- Inconsistent e-bill payment frameworks may affect user experience.

- Financial institutions may fail to disclose bill payment details promptly, impacting fund transfers.

- Bill payers may not respond to error correction requests in time, causing review delays.

- Banks may not clearly communicate bill payment processing deadlines, affecting delivery times.

If you encounter review issues, proactively contact platform customer service to provide additional documents or correct errors. This can improve remittance efficiency and ensure funds arrive safely.

Exchange Rates and Delivery

Exchange Rate Fluctuations

When sending money to Canada, exchange rate fluctuations directly impact the received amount. The Canadian dollar’s exchange rate is influenced by various factors. Refer to the table below for key factors affecting exchange rates:

| Influencing Factor | Description |

|---|---|

| Interest Rates | Higher rates attract foreign investors to buy Canadian assets, driving up the exchange rate. |

| Commodity Prices | When prices of Canada’s export commodities rise, the Canadian dollar’s exchange rate typically increases. |

| Inflation Rate | When Canada’s inflation rate is higher than other countries, the Canadian dollar may depreciate. |

| International Trade | A trade surplus boosts the exchange rate, while a trade deficit may cause it to fall. |

| Foreign Investment | Increased investment inflows raise demand for the Canadian dollar, boosting the exchange rate. |

| Productivity | Higher productivity enhances international competitiveness, supporting Canadian dollar appreciation. |

Before sending money, monitor these factors to choose a favorable exchange rate timing.

Delivery Time

When choosing a remittance channel, delivery time is a key consideration. Bank wire transfers typically take 1-3 business days, while some licensed Hong Kong banks can achieve same-day delivery. Online platforms and digital wallet services can sometimes complete transfers in minutes. During peak periods or holidays, delivery times may extend. Plan your transfer in advance to avoid delays affecting the recipient’s access to funds.

Tip: After submitting a remittance request, monitor platform notifications and promptly address any requests for additional documents or identity verification to shorten delivery times.

Optimization Strategies

You can adopt several strategies to optimize exchange rates and delivery speed, enhancing your remittance experience:

- Monitor exchange rates and choose favorable timing for transfers.

- Use competitive remittance services to secure better exchange rates.

- Plan future transfers in advance to avoid delays from last-minute operations.

- Consider cross-border banking solutions to improve fund delivery efficiency.

By combining these methods, you can effectively reduce remittance costs and improve delivery speed.

Tax Implications

Tax Reporting

When sending money to Canada, you need to understand tax reporting requirements. Service providers like banks or third-party payment platforms will report single or cumulative electronic transfers of CAD 10,000 (approximately USD) or more to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and the Canada Revenue Agency (CRA). If you carry CAD 10,000 or equivalent cash across the border, you must declare it to the Canada Border Services Agency (CBSA) at the airport or land border.

Tip: Before sending money, verify the amount to avoid legal risks from non-reporting. For large transfers, keep all related receipts and declaration records.

Canadian Tax Regulations

Personal remittances received from the U.S. or other countries are generally not taxed by the Canada Revenue Agency, especially for gifts or family support. However, payments for goods or services may require taxes, such as sales tax or income tax. Large transfers trigger financial crime prevention reporting requirements.

- Personal remittances and gifts are typically tax-exempt.

- Payments for goods or services may involve taxes.

- Large transfers must meet reporting requirements.

When processing, distinguish the purpose of the remittance and plan fund flows accordingly.

Compliance Recommendations

When handling cross-border remittances, follow these compliance measures to ensure fund safety and legality:

| Compliance Measure | Description |

|---|---|

| Anti-Money Laundering Policy | Develop and implement AML policies tailored to different business scenarios. |

| Customer Due Diligence | Verify the recipient’s identity to ensure information accuracy. |

| Regular Audits | Conduct periodic AML compliance audits to identify and address potential risks. |

| Suspicious Transaction Reporting | Report abnormal or suspicious transactions to relevant authorities promptly. |

| Risk Management | Adopt risk-based strategies, appoint compliance officers, and dynamically adjust processes. |

Stay in communication with compliance experts or lawyers to address policy changes promptly. This reduces legal risks and ensures fund safety.

When choosing a remittance method, focus on convenience, fees, exchange rates, and security. The table below summarizes the key features of bank transfers:

| Feature | Bank Transfer |

|---|---|

| Convenience | Online banking services, initiate transfers anytime, anywhere |

| Speed and Security | Typically instant or within hours, using secure networks and encryption |

| Fees | Lower compared to other transfer methods |

| Exchange Rates | Offer better rates, ensuring recipients receive more funds |

You should also note compliance requirements. Remittance taxes increase identity verification and reporting processes. Some may seek alternative methods. You can seek help through CARM customer service, online contact forms, or phone support. This guide to sending money to Canada recommends choosing a channel based on your needs to ensure fund safety. For questions, consult professional institutions or platform customer service.

FAQ

What basic documents are needed to send money to Canada?

You need to prepare a valid ID, the recipient’s name, bank account details, and contact information. Some platforms may also require proof of fund source. Preparing these documents in advance can speed up the review process.

How long does it take for a remittance to arrive?

Delivery times vary by channel. Licensed Hong Kong banks typically take 1-3 business days. Some online platforms complete transfers in minutes. Delays may occur during holidays or peak periods.

Are there limits on remittance amounts?

Most platforms impose limits on single and daily remittance amounts. For example, some banks allow a maximum of $3,000 per transfer and $20,000 per month. Check with platform customer service for specific limits.

How can I ensure the safety of my funds during a remittance?

Choose platforms with strong reputations. Platforms use encryption to protect information. Verify recipient details to avoid transferring to the wrong account. Contact customer service immediately if you encounter suspicious activity.

Do I need to pay taxes on remittances?

Personal remittances from mainland China are generally not taxed. Payments for goods or services may require tax declarations. Keep remittance receipts for future reference.

When sending funds to Canada, you must carefully weigh the cost, speed, and security of your chosen channel. While both traditional wire transfers and modern operators offer viable options, they often struggle to simultaneously deliver the low cost, high efficiency, and flexible asset management required by today’s global investor, especially when managing fluctuating exchange rates and compliance checks.

If you are looking for a global financial solution that extends beyond basic remittance, BiyaPay offers a compelling alternative. You can complete our quick registration in just 3 minutes with no overseas bank account required, providing a zero-barrier entry to global investment. We provide real-time exchange rate tool and fiat conversion services, enabling you to continuously monitor rate dynamics and avoid hidden losses. On the cost front, you benefit from remittance fees as low as 0.5%, which can save you up to 90% compared to conventional banks.

A single BiyaPay account allows you to trade both US and Hong Kong stocks , eliminating platform switching for unified, quicker asset management. Crucially, we support the conversion between fiat and digital currencies (like USDT), ensuring quick funding by bypassing complex channels. Whether for tuition, living expenses, or investment, our global remittance supports same-day sending and arrival, meaning your funds reach their destination the same day, so you never miss a critical trading window. Active traders will also appreciate the zero commission for contract limit orders, a preferred method for low-cost position building. Start exploring today to make your transfers to Canada and global investments more efficient and secure.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.