- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Choosing the Best Instant Transfer Apps: Comparing Zelle, Venmo, PayPal, Cash App, TransferWise, etc.

Image Source: pexels

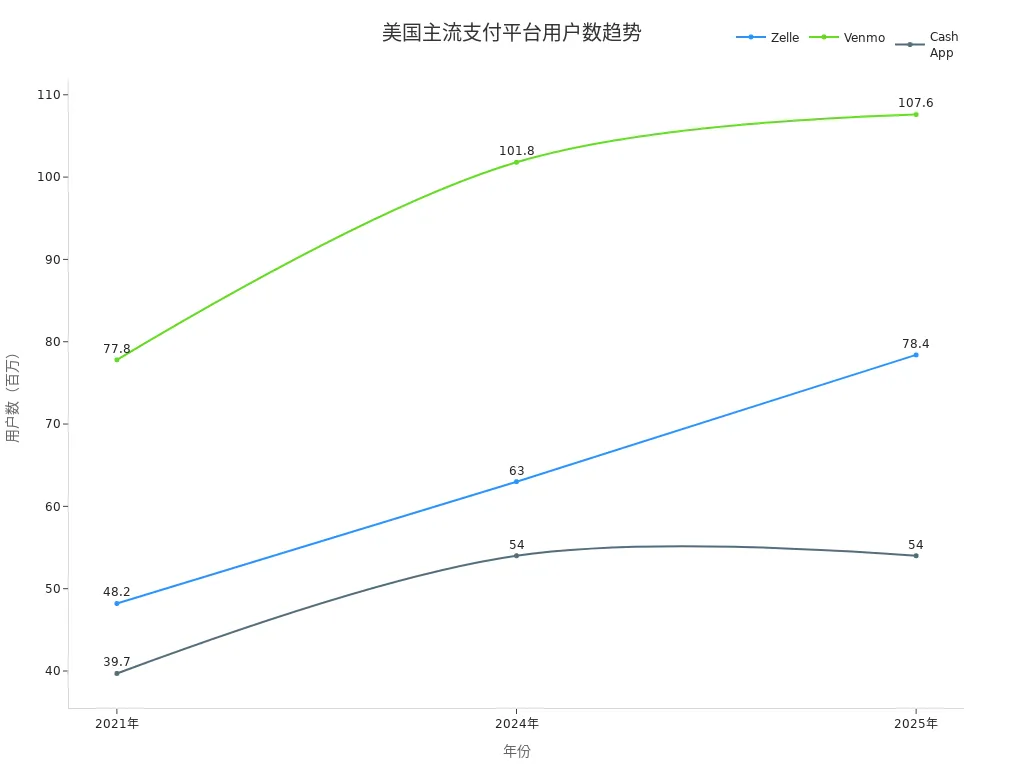

When choosing an instant money transfer app, you should focus on fees, transfer speed, security, and use cases. The user base of different platforms reflects their popularity in the U.S. market. The table below shows the latest user data for Zelle, Venmo, and Cash App:

| Platform | 2021 Users | 2024 Users | 2025 Users | 2025 Market Share |

|---|---|---|---|---|

| Zelle | 48.2M | 63M | 78.4M | 36.2% |

| Venmo | 77.8M | 101.8M | 107.6M | 61.8% |

| Cash App | 39.7M | 54M | 54M | 31% |

You can filter based on your needs to find the best instant money transfer app for you.

Key Points

- When choosing an instant money transfer app, focus on fees, transfer speed, and security to ensure it meets your personal needs.

- Zelle is ideal for fast domestic U.S. transfers, typically arriving within minutes with no transfer fees.

- Venmo and Cash App are suitable for social payments, supporting small transfers, usually free with debit cards.

- PayPal and TransferWise are ideal for international remittances, offering multi-currency support and transparent fee structures.

- When selecting an app, consider transfer speed and limits to ensure they meet daily and large payment needs.

App Overview

Image Source: unsplash

Zelle

Zelle is an app focused on instant transfers between U.S. banks. You can use Zelle’s transfer function directly within the apps of nearly all major U.S. banks. Zelle partners with over 2,200 banks, offering extremely fast transfers, typically arriving within minutes. You incur no transfer fees. Zelle is suitable for users needing fast remittances between U.S. bank accounts. If you have a USD account with a licensed Hong Kong bank, you cannot directly use Zelle, but you can refer to its bank partnership model.

Venmo

Venmo specializes in social payment features. You can send and receive money to friends or family on Venmo while sharing payment records. Venmo supports U.S. users, allowing free transfers via balance or debit card, while credit card transfers incur a 3% fee. You can choose standard transfers (free) or instant transfers (1% fee). Venmo is ideal for U.S.-based scenarios like group gatherings, bill splitting, or daily small payments.

Tip: Venmo uses encryption, supports PIN codes, and two-factor authentication to ensure your account security.

PayPal

PayPal is a globally recognized payment tool. You can use PayPal for cross-border transfers, supporting multiple currency conversions. PayPal is suitable for international trade, overseas shopping, or remittances to friends and family abroad. You can link bank accounts, debit cards, or credit cards for flexible payment options. PayPal is widely accepted by global online stores, catering to diverse needs for businesses and individuals.

| Platform | Technical Features | Partnerships |

|---|---|---|

| PayPal | Multiple payment options, linking bank accounts and cards | Widely accepted by global merchants |

Cash App

Cash App is known for its simplicity and ease of use. You can use Cash App for small instant transfers in the U.S. and explore Bitcoin and stock investment features. Cash App is suitable for daily U.S. spending, transfers between friends, or trying digital asset investments. You need to stay vigilant against fraud risks to ensure account safety. Cash App does not currently support direct registration for users in mainland China.

TransferWise

TransferWise (now Wise) specializes in international remittances. You can use TransferWise to send USD globally with low fees and transparent exchange rates. TransferWise is ideal for cross-border remittance needs, such as transfers to U.S., European, or Hong Kong bank accounts. You can view exchange rates and fees in real time, avoiding hidden costs. TransferWise is not tied to specific banks, making it suitable for individuals and businesses needing flexible international transfers.

Fees

Transfer Fees

When choosing an instant money transfer app, you should first focus on each platform’s transfer fees. Fee structures vary significantly. The table below compares the main transfer fees for Zelle, Venmo, PayPal, Cash App, and TransferWise:

| App | Fee Description |

|---|---|

| Zelle | Free, no transfer fees. |

| Venmo | Free for bank account or debit card transfers, 3% for credit card transfers, 1.75% for instant transfers. |

| PayPal | 2.90% + $0.30 for credit or debit card transfers, 1.75% for instant transfers. |

| Cash App | Free for cash balance or debit card transfers, 3% for credit card transfers. |

| TransferWise | Low international transfer fees, transparent rates, calculated based on currency and amount. |

If you only transfer between U.S. bank accounts, Zelle is the most cost-effective. Venmo and Cash App are free for debit card or balance transfers but charge 3% for credit cards. PayPal fees are relatively high, especially for credit card or instant transfers. TransferWise is ideal for international remittances, with lower fees and better rates than traditional banks.

Hidden Fees

In addition to explicit transfer fees, you should also be aware of hidden fees. These fees may arise when choosing specific payment or withdrawal methods. Common hidden fees include:

- PayPal and Cash App typically charge about 3% for peer-to-peer payments using credit cards.

- Banks may charge cash advance fees for credit card payments, typically $10 or more.

- Venmo incurs additional fees for credit card payments, cash check deposits, business account receipts, instant electronic withdrawals, or Venmo card withdrawals.

- Many users link apps to external payment sources (like debit cards or bank accounts), which are usually free in most cases. However, choosing credit cards or instant transfer services often incurs extra charges.

When choosing the best instant money transfer app, it’s recommended to carefully read each platform’s fee details and consider your actual needs to avoid increased costs due to hidden fees.

Speed and Limits

Transfer Speed

When choosing an instant money transfer app, transfer speed is a key consideration. The time for funds to become available varies significantly. Zelle’s strength lies in near-instant transfers, typically arriving within minutes. Venmo and PayPal are relatively fast, but you may need to wait 1 to 3 business days, with PayPal taking up to 5 days in some cases. Cash App and TransferWise transfer times vary depending on the operation and bank processing, generally fast, but some international transfers may take longer.

| Service | Average Availability Time |

|---|---|

| Zelle | Minutes |

| Venmo | 1 to 3 business days |

| PayPal | 1 to 2 days, up to 5 days |

| Cash App | Varies |

| TransferWise | Varies by country and amount |

If you want near-real-time transfers between U.S. bank accounts, Zelle is the best choice. Venmo and PayPal are suitable for scenarios where speed is less urgent but flexibility is needed. TransferWise is ideal for cross-border remittances, with arrival times depending on the recipient country and amount.

Transfer Limits

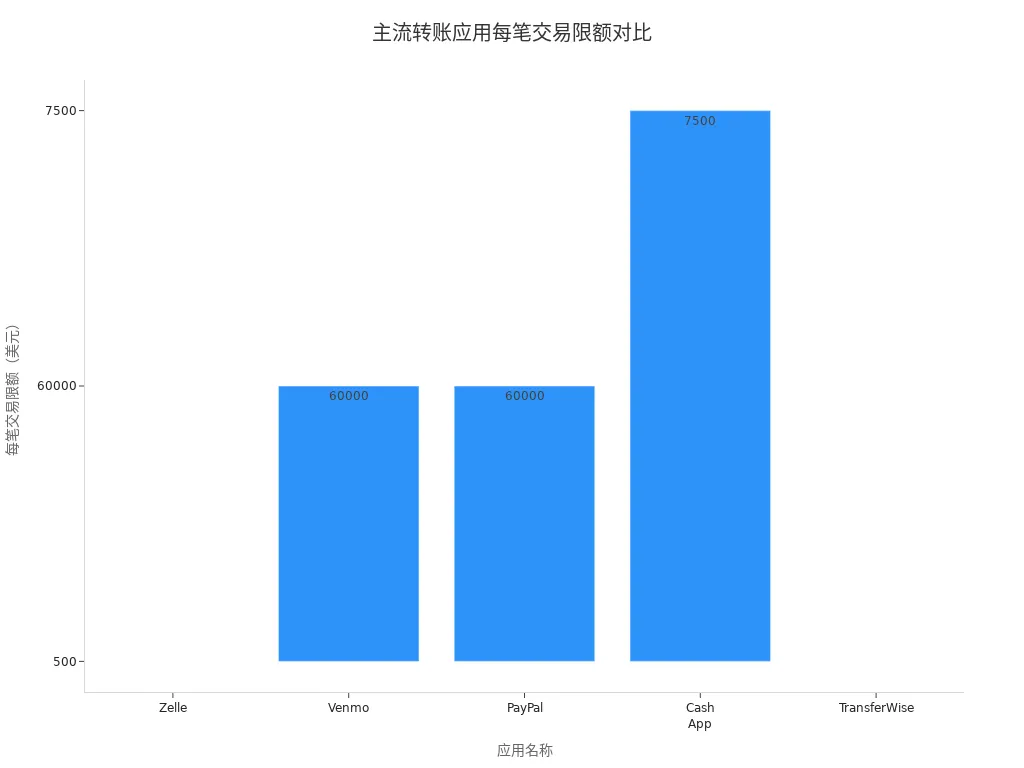

When using instant money transfer apps, you must pay attention to per-transaction and daily/periodic transfer limits. Different platforms have strict rules on single and periodic limits. Zelle’s per-transaction and daily limit is about $500, suitable for small, fast transfers. Venmo’s weekly limit is up to $60,000, and PayPal’s per-transaction limit is also $60,000, meeting large payment needs. Cash App’s weekly limit is $7,500, suitable for daily small payments. TransferWise’s limits adjust flexibly based on the recipient country and amount, allowing you to choose based on actual needs.

| App | Per-Transaction Limit | Daily/Periodic Limit |

|---|---|---|

| Zelle | $500 | $500 |

| Venmo | $60,000/week | N/A |

| PayPal | $60,000/transaction | N/A |

| Cash App | $7,500/week | N/A |

| TransferWise | Varies by country and amount | N/A |

If you only need transfers between U.S. bank accounts, Zelle’s limits are sufficient for daily needs. For large payments, choose Venmo or PayPal. TransferWise is suitable for cross-border remittances with flexible limits. When selecting the best instant money transfer app, consider speed and limits to ensure they meet your actual needs.

Security

Image Source: pexels

Data Encryption

When choosing an instant money transfer app, you should prioritize data encryption and privacy protection. Major platforms use advanced encryption to ensure your account and transaction information are secure. The table below shows the data encryption standards and other security measures of major apps:

| Service | Encryption Standard | Other Security Measures |

|---|---|---|

| PayPal | Advanced encryption technology | Buyer protection, prevents unauthorized transactions |

| Venmo | Encryption, two-factor authentication | Reliable instant transfers |

| Zelle | Encryption, two-factor authentication | Reliable instant transfers |

PayPal uses advanced encryption to protect your personal and financial information. Venmo and Zelle employ two-factor authentication and encryption, ensuring every transfer is rigorously verified. When using these apps in the U.S. or through licensed Hong Kong banks, you can confidently conduct financial operations.

Tip: You can set strong passwords and enable two-factor authentication to further enhance security.

Fraud Prevention

When using instant money transfer apps, preventing fraud is equally important. Bank-integrated platforms like Zelle have a clear security advantage. Zelle integrates directly with bank security systems, and funds are typically protected by FDIC insurance. Banks monitor transactions in real time, helping you detect and stop fraudulent activities promptly. While Venmo lacks direct bank integration, it allows you to set PIN codes or biometric verification to enhance account security.

| Feature | Zelle | Venmo |

|---|---|---|

| Bank Integration | Directly integrated with bank security systems, offering extra protection | No direct bank integration |

| FDIC Insurance | Funds typically protected by FDIC insurance | Balances typically not FDIC-insured |

| Fraud Protection | Relies on banks’ existing fraud monitoring systems | Offers fraud monitoring, allows users to set additional security features |

If you transfer between U.S. bank accounts, Zelle provides higher security. When using international transfer apps in mainland China or licensed Hong Kong banks, check for bank partnerships and insurance mechanisms. You can regularly monitor account activity to detect anomalies and protect your funds.

Features and Use Cases

Personal Transfers

When making personal transfers in the U.S., you can choose from multiple instant money transfer apps. Zelle is ideal for near-instant fund flows between participating banks. Cash App also supports personal transfers, typically arriving in 1-3 business days. PayPal and Venmo support personal transfers with similar speeds. The table below compares the personal transfer speeds and features of major apps:

| App Name | Speed | Notes |

|---|---|---|

| Zelle | Near-instant | Fast transfers between participating banks |

| Cash App | 1-3 business days | Suitable for personal transfers |

| PayPal | 1-3 business days | Suitable for international transfers |

| Venmo | 1-3 business days | Social transfer platform |

If you have a USD account with a licensed Hong Kong bank or in mainland China, prioritize apps supporting international transfers, like PayPal or Wise, for flexible cross-border fund flows.

Family and Friends

When splitting bills or transferring money with family and friends, Venmo stands out. Venmo Groups allows you to split bills in a group, with all members able to add expenses, eliminating the need for one person to track costs. Real-time notifications keep you updated on transactions among friends, enhancing the interactive experience. Venmo’s social elements make payments fun, ideal for gatherings, travel, or daily spending.

| Feature | Description |

|---|---|

| Venmo Groups | Allows users to split bills in a group, with all members able to add expenses, eliminating the need for one person to track costs. |

| Real-Time Notifications | Users can see transactions among friends in real time, enhancing the interactive experience. |

| Interactivity | Social elements make the payment process more engaging, improving user experience. |

When using Venmo in the U.S., you can easily handle social payments with friends and family. In mainland China or licensed Hong Kong bank scenarios, choose international apps with group-splitting and real-time notification features.

Businesses and Merchants

As a business or merchant, when choosing an instant money transfer app, focus on security, fees, user interface, and currency support. Security is critical, requiring data encryption, multi-factor authentication, and real-time fraud monitoring. Transparent fees aid budget management. Intuitive interfaces reduce operational errors and improve efficiency. For U.S. operations, PayPal and Wise support multiple currencies and international transfers, ideal for cross-border businesses. App integration and scalability also impact long-term choices.

When choosing business transfer tools, prioritize security and fee transparency to ensure efficient and reliable fund flows.

International Transfers

For international remittance needs, PayPal and Wise are ideal choices. PayPal supports multiple currencies, allowing global transfers, but may incur currency conversion and transfer fees. Wise uses a peer-to-peer system with transparent fees, offering lower international transfer costs and mid-market exchange rates. Both use top-tier security protocols to ensure transaction safety. In mainland China or licensed Hong Kong bank scenarios, you can use these apps for flexible USD-to-other-currency conversions and transfers.

| App | Features | Fees | Security |

|---|---|---|---|

| PayPal | Supports cross-border transfers, multiple currencies | May include currency conversion and transfer fees | Strong encryption and fraud protection |

| Wise | Transparent fee structure, peer-to-peer system | Lower international transfer fees, mid-market rates | Top-tier security protocols ensure transaction safety |

If you need international transfers between mainland China or licensed Hong Kong banks and the U.S., prioritize apps with transparent fees and high security for safe and cost-effective fund flows.

Selection Advice and Best Instant Money Transfer Apps

Choices for Different Groups

When choosing the best instant money transfer app, consider your identity and needs. Different groups suit different apps. The table below summarizes recommended choices, fees, and transfer speeds for common groups to help you quickly find the right tool:

| Group Type | Recommended Apps | Main Advantages | Fee Description | Transfer Speed |

|---|---|---|---|---|

| Students | Venmo, Cash App, Zelle | Low fees, simple operation, ideal for bill splitting and small daily payments | Regular transfers free, instant transfers within 1.75% | Zelle: minutes, others: 1-3 days |

| Professionals | Zelle, PayPal | Bank integration, supports large and multi-scenario payments | Zelle free, PayPal charges for some scenarios | Zelle: minutes, PayPal: as fast as 30 minutes |

| International Travelers | Wise, PayPal, Remitly | Low international fees, multi-currency support, fast delivery | Wise and Remitly transparent fees, PayPal has rate differences | Wise and Remitly: 1-2 days, PayPal: as fast as 30 minutes |

| Businesses/Merchants | PayPal, Wise | Multi-currency support, transparent fees, easy reconciliation | PayPal merchants: 1.9%-3.49%, Wise low rates | PayPal: as fast as 30 minutes, Wise: 1-2 days |

If you’re a student, prioritize Venmo, Cash App, or Zelle. You can transfer for free, with convenient bill-splitting and fast delivery. For transfers between U.S. bank accounts, Zelle is one of the best instant money transfer apps. For frequent international remittances, Wise and PayPal are more suitable, offering low fees and transparent rates, ideal for transfers between mainland China or licensed Hong Kong banks and U.S. accounts. As a business user, PayPal and Wise support multi-currency accounts and international operations with clear fee structures for financial management.

When choosing, prioritize fees, transfer speed, and security. Zelle integrates directly with bank apps, completing transfers in minutes without needing additional apps. You can use bank account funds directly without topping up digital wallets, greatly enhancing convenience.

Scenario-Based Recommendations

Your needs for the best instant money transfer app vary by life and work scenarios. Below are specific recommendations for common scenarios:

- Daily Friend Gatherings and Bill Splitting

You can choose Venmo or Cash App. Venmo supports social bill splitting and group features, ideal for splitting expenses after group gatherings. Cash App is simple to use, suitable for small instant transfers. - Fast Transfers Between U.S. Bank Accounts

If you prioritize speed and security, Zelle is the best instant money transfer app. You don’t need to download a new app, operating directly within your bank’s app, with funds arriving in minutes. - International Remittances or Cross-Border Payments

If you need to transfer from mainland China or licensed Hong Kong banks to the U.S. or other countries, Wise and PayPal are more suitable. Wise offers low fees and transparent rates with short delivery times. PayPal supports multiple currencies, ideal for international e-commerce and remittances to overseas friends or family. - Business Collections and Multi-Currency Settlements

As a business or merchant, PayPal and Wise support multi-currency accounts with clear fee structures, facilitating reconciliation and international business management. - Mobile Convenience Payments

If you’re a Google or Apple user, consider Google Pay or Apple Pay. You can enjoy platform ecosystem convenience for quick small payments.

When choosing the best instant money transfer app, refer to the table below to quickly compare the uses, fees, and transfer speeds of major apps:

| App Name | Best Use | Fee Description | Transfer Speed |

|---|---|---|---|

| PayPal | Nearly all money-related transactions | Free for consumers, merchants 1.9%-3.49% | Usually minutes, up to 30 minutes |

| Venmo | Transfers with friends and family | Regular transfers free, instant transfers 1.75% | Instant for instant transfers, 24-72 hours for regular |

| Cash App | Instant transfers and online shopping | Instant transfers 0.5%-1.75% | Instant for instant transfers, 1-3 days for regular |

| Google Pay | Google ecosystem users | 1.5% or $0.31 to debit cards | Usually minutes, up to 24 hours |

| Apple Pay | Apple ecosystem users | Regular transfers free, instant transfers 1.5% | Usually instant, up to 30 minutes |

| Zelle | Direct bank account transfers | No fees | Completed in minutes |

If you frequently travel abroad or have international remittance needs, consider apps like Remitly, Xe Money Transfer, and WorldRemit. Remitly supports multiple delivery methods with economical fees but lower limits. Xe Money Transfer is suitable for large transactions with competitive rates. WorldRemit covers many countries with transparent fees, ideal for small international transfers.

When choosing the best instant money transfer app, consider your identity, use case, and fund flow needs, prioritizing fees, speed, and security. You can use the table above and real-world experience to quickly select the most suitable transfer tool.

Pros and Cons Summary

Main Advantages

When choosing the best instant money transfer app, you’ll find each platform has unique strengths. The table below summarizes the most frequently mentioned advantages in user reviews:

| Payment Platform | Advantage Description |

|---|---|

| PayPal | Offers a wide range of services, including online payments and international transactions, allowing users to complete payments quickly and securely. |

| Venmo | Focuses on peer-to-peer payments with a user-friendly experience, ideal for social payments. |

| Zelle | Transfers directly through bank accounts, fast and secure. |

If you need international remittances, PayPal and Wise support multi-currency and global transfers. Venmo is ideal for splitting bills with friends and daily small payments. Zelle integrates directly with U.S. bank systems, completing transfers in minutes with high security. Cash App is simple to use, suitable for small instant payments and investments. You can flexibly choose the best instant money transfer app based on your needs.

When transferring between the U.S. or mainland China and licensed Hong Kong banks, prioritize platforms with speed, security, and transparent fees to enhance fund flow efficiency.

Main Disadvantages

When using these apps, you may encounter some drawbacks. The table below compares common disadvantages:

| Advantages | Disadvantages |

|---|---|

| Fast communication | Productivity issues |

| More noticeable than email | Security concerns |

| Easily connects people in different locations | N/A |

| Easy to use | N/A |

When using Venmo and Cash App, you may worry about account security and privacy protection. PayPal and Wise, while supporting international transfers, may have higher fees in some scenarios. Zelle’s limits are low, unsuitable for large payments. In mainland China or licensed Hong Kong bank scenarios, some apps may not support direct registration or use. You need to weigh each platform’s pros and cons based on your needs to select the best instant money transfer app.

When choosing a transfer tool, refer to the table below to quickly understand each platform’s pros and cons:

| Payment Platform | Advantages | Disadvantages |

|---|---|---|

| Venmo | Free transfers from bank accounts or debit cards, easy to use, high limits | High credit card transfer fees, lacks protection measures |

| Zelle | Completely free, bank-level security, fast delivery | No credit card support, limited features |

| PayPal | Multiple payment methods, free for personal payments, flexible for international transfers | High credit card transfer fees, extra steps for withdrawals |

You can choose the right transfer app based on fees, speed, security, limits, and ease of use, considering mainland China or licensed Hong Kong bank scenarios. Matching your needs with app features will increase satisfaction. In the future, the mobile transfer market will continue to grow, with improved security and transparency.

FAQ

Can Zelle be used in mainland China or licensed Hong Kong banks?

You cannot use Zelle directly in mainland China. If you have a USD account with a licensed Hong Kong bank, you also cannot currently use Zelle for transfers.

Are there amount limits for Venmo and Cash App transfers?

When using Venmo, you can transfer up to USD 60,000 per week. With Cash App, the weekly limit is USD 7,500. You need to choose a platform based on your actual needs.

How are PayPal and Wise international transfer fees calculated?

When using PayPal, international transfers incur a 2.90% plus USD 0.30 fee. With Wise, fees are transparently displayed based on currency and amount, with rates better than traditional banks.

Which app has the fastest transfer speed?

When using Zelle, funds arrive in minutes. With Venmo, PayPal, or Cash App, transfer times are typically 1 to 3 business days. Wise international transfer times vary by country.

How to ensure account security?

You can set strong passwords and enable two-factor authentication. When using these apps with licensed Hong Kong banks or U.S. bank accounts, regularly check account activity to prevent fraud risks.

When comparing instant transfer apps like Zelle, Venmo, PayPal, Cash App, and Wise, you may appreciate Zelle’s minutes-fast free transfers but note its low limits (e.g., $500 daily) and US-bank-only integration, Venmo’s social splitting but 3% credit card fees and default public privacy, PayPal’s global support yet high 2.90%+$0.30 fees, Cash App’s simplicity but $7,500 weekly cap and crypto volatility risks, and Wise’s transparent rates but 1-2 day international arrivals—especially amid Venmo’s 107.6M users in 2025, where pain points like hidden costs, limits, and vulnerabilities inflate frequent transfers’ expenses and hassles.

BiyaPay emerges as a premier cross-border finance platform, addressing these issues comprehensively. Our real-time exchange rate query delivers instant mid-market rates to sidestep markups. With fees as low as 0.5%, it supports conversions across 30+ fiat currencies and 200+ digital assets, covering multiple global destinations with same-day delivery. Uniquely, BiyaPay’s single platform supports direct US and Hong Kong stock trading without separate overseas accounts, with zero fees on contract orders, seamlessly turning transfers into investment opportunities. Licensed under US MSB and equivalents, fortified by 256-bit encryption and real-time fraud detection for unmatched compliance and security.

Sign up at BiyaPay today for low-rate, rapid transfers and integrated investing, elevating your instant fund flows to greater efficiency and safety!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.