- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What are the ways to send money to the Dominican Republic?

Image Source: unsplash

You can choose from multiple remittance methods to send funds to the Dominican Republic. According to the latest statistics, cash pickup is the most common, followed by account deposits and digital wallet transfers. The table below shows the usage percentages of different methods:

| Remittance Method | Percentage |

|---|---|

| Cash Pickup | Nearly 50% |

| Account Deposit | 24% |

| Digital Wallet Transfer | Below 20% |

- Bank Transfer: High security, suitable for large transfers, higher fees, typically takes 1-3 days to arrive.

- International Money Transfer Services: Convenient, moderate fees, fast delivery, ideal for urgent situations.

- Cash Remittance: Convenient, no account required, higher fees, suitable when the recipient lacks a bank account.

- Prepaid Card Remittance: Simple to use, suitable for small transfers, relatively fast delivery.

Key Points

- When choosing a remittance method, consider fees and delivery speed. Bank transfers are suitable for large amounts, while international money transfer services are ideal for urgent needs.

- Cash remittances are convenient and fast, suitable for recipients without bank accounts. Ensure valid identification is prepared for smooth cash pickup.

- Prepaid card remittances are easy to operate and suitable for small amounts. Recipients can use the card for spending or withdrawals without a bank account.

- Before sending money, verify the service provider’s security and reliability. Choosing regulated platforms reduces financial risks.

- Save remittance receipts and check delivery status promptly to ensure the recipient receives the funds smoothly.

Main Remittance Methods

Image Source: unsplash

Bank Transfer

Bank transfer is a common remittance method, suitable for transferring funds between your bank account in China/Chinese Mainland or Hong Kong and a bank account in the Dominican Republic. You can process it via online banking, mobile banking apps, or at a bank counter.

Process is as follows:

- Log in or download the bank app, register an account, and complete your profile.

- Select the Dominican Republic as the recipient country and set the currency to Dominican Peso (DOP).

- Choose the delivery method, such as cash pickup or account deposit.

- Enter the recipient’s name (must match their ID), phone number (optional).

- Review transfer details, confirm the amount, and complete the transaction. The bank will notify you when the funds are ready.

Bank transfers typically arrive the next business day, with bank deposits expected within 1 day.

In terms of fees, bank transfers have higher fees, with specific amounts depending on the bank and transfer amount.

Advantages: High security, suitable for large transfers, ideal for stable and reliable fund transfers.

Disadvantages: Higher fees, delivery speed slower than some faster methods.

Use Case: Bank transfer is the preferred method when you need to send large amounts or when the recipient has a bank account.

International Money Transfer Services

International money transfer services like Western Union and MoneyGram offer convenient cross-border remittance options. You can process them online or offline.

Process is as follows:

- Visit the money transfer service’s website and click “Send Money.”

- Select the Dominican Republic as the recipient country.

- Choose the payment and delivery method (e.g., cash pickup, bank account, digital wallet).

- Enter recipient details, including full name, bank name, account number, ID number, phone, and address.

- Review all information, confirm accuracy, and complete the remittance.

- Receive a receipt and Money Transfer Control Number (MTCN) for online tracking.

| Feature | Details |

|---|---|

| Fees | Low fees for new users, some services like Paysend start at $1.99 USD. |

| Speed | Transfers typically arrive same-day, cash pickup as fast as 30 minutes. |

| Security | Uses encryption technology to ensure transaction safety and reduce fraud risks. |

Advantages: Fast delivery, convenient operation, supports multiple delivery methods, suitable for urgent remittances.

Disadvantages: Some services have high fees, exchange rates may be less favorable than banks, and some have transfer amount limits.

Use Case: Ideal when you need fast remittances or when the recipient lacks a bank account.

Cash Remittance

Cash remittances are suitable when you or the recipient lack a bank account or need direct cash pickup. You can complete them through offline locations or certain online platforms.

Process is as follows:

- Download a remittance app (e.g., Remitly), register an account, and select the Dominican Republic as the destination.

- Enter the remittance amount and choose delivery methods like cash pickup, home delivery, or bank deposit.

- Enter recipient information, including bank account number and phone number.

- Add a payment method (bank account, credit, or debit card).

- Submit the remittance, and the recipient can pick up cash at designated locations with valid ID.

You need to prepare valid identification and recipient details. For larger amounts, additional documents may be required.

Cash pickup transactions can complete in as fast as 30 minutes, home delivery in as fast as 6 hours, and bank deposits within 1 day.

| Send Amount | Sending Cost | Notes |

|---|---|---|

| $200 | 3.5% | Drops to 3% or lower when paying in USD |

Advantages: No bank account required, fast delivery, suitable for recipients without accounts.

Disadvantages: Relatively high fees, larger amounts require extra verification, limited locations in some areas.

Use Case: Suitable when you or the recipient lack a bank account or need quick cash pickup.

Prepaid Card Remittance

Prepaid card remittances offer a flexible remittance method. You can preload funds onto a prepaid debit card, which the recipient can use without a traditional bank account.

Process:

- You apply for a prepaid card on the platform, load funds, and provide the card number and details to the recipient.

- The recipient can withdraw cash or make purchases at ATMs or POS terminals in the Dominican Republic.

- You can transfer funds in real-time via online platforms, with funds arriving in minutes.

| Item | Details |

|---|---|

| Fees | First three transfers free, subsequent fees start at $0.00. |

| Transfer Time | Most online transfers complete in minutes. |

| Security Measures | Uses advanced security measures to protect transactions and personal data. |

Advantages: Simple operation, fast delivery, suitable for small transfers and immediate needs. No bank account required for recipients.

Disadvantages: Some prepaid cards lack rewards or cashback, and some have loading and spending limits.

Use Case: Convenient for providing flexible spending and withdrawal options for family or friends or avoiding traditional banking processes.

Remittance Method Comparison

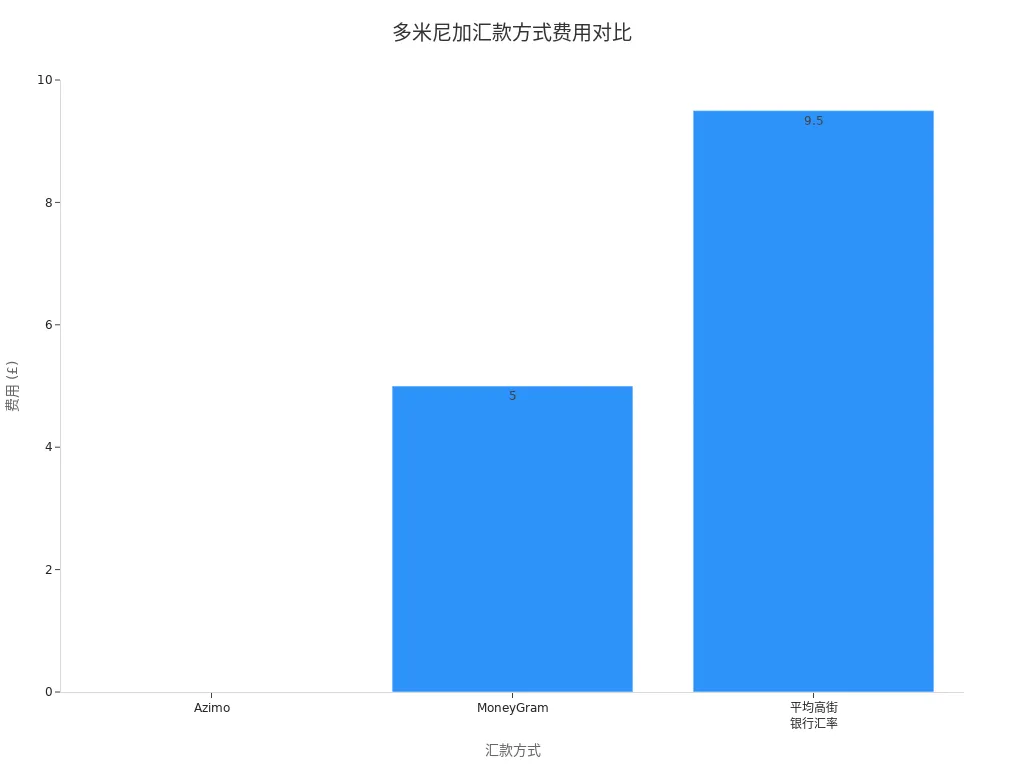

Fees

When choosing a remittance method, fees are a direct consideration. Fee structures vary significantly across providers. The table below shows fees and exchange rates for major remittance services (in USD):

| Provider | Amount Received (DOP) | Fees (USD) | Exchange Rate | Speed |

|---|---|---|---|---|

| Azimo | 16,456.17 | 0 | 82.2808 | 1-5 days |

| MoneyGram | 15,898.01 | 6.5 | 79.4901 | 1-5 days |

| High Street Bank Average | 15,419.63 | 12.3 | 77.0982 | 1-5 days |

Azimo has the lowest fees, while some banks charge higher fees. You can choose the most suitable service based on transfer amount and frequency.

Delivery Time

Delivery speed directly impacts the recipient’s experience. Through online remittance services, funds typically arrive in minutes. Bank transfers and some traditional services take 1-5 days. Cash pickup services like WorldRemit and Azimo can deliver funds in as fast as a few minutes. You can prioritize fast delivery methods for urgent situations.

Security

When remitting, you should focus on security measures. Major remittance companies use multi-layer encryption to protect information. Banks implement strict security policies to safeguard your personal and financial data. When using debit or credit cards, you should choose cards with two-factor authentication. PayPal offers encrypted payments and 24/7 fraud monitoring, while Sharemoney is regulated by federal and state authorities, using SSL encryption to protect financial information. You should prioritize regulated providers with strong reputations.

Convenience

You can easily complete remittances via mobile or computer. Remitly, in partnership with Caribe Express, is highly praised for convenience. You can complete transfers with just a few clicks. Multiple delivery options meet various recipient needs. Online platforms allow you to send money anytime, anywhere, without visiting physical locations.

Use Cases

You can choose different remittance methods based on the scenario:

| Remittance Method | Use Case | Features |

|---|---|---|

| Cash Pickup Service | Urgent transfers | Fast, secure, convenient |

| Online Transfer Service | Regular payments | Low fees, fast |

| Digital Payment System | Small transfers | Low fees, instant |

You can choose cash pickup services for urgent situations, online transfers for regular payments, and digital payment systems for small, instant remittances.

Other Remittance Methods

Credit/Debit Card

You can use a credit or debit card to send money to the Dominican Republic via international money transfer services. Many major platforms like Western Union, MoneyGram, and WorldRemit support this method. You simply link your credit or debit card on the platform, enter recipient details, and the transfer amount to complete the transaction.

- This method is simple and suitable for quick transfers.

- You can track transfer progress anytime via mobile apps, ensuring fund safety.

- When paying with a credit card, platforms charge a fee, depending on the provider and transfer amount.

You should carefully compare fee structures across platforms before sending to choose the most suitable service.

Electronic Payment Platforms

Electronic payment platforms are gaining popularity in the Dominican Republic. You can achieve more convenient fund transfers through these platforms. The Dominican Republic’s central bank is promoting payment system modernization, planning to implement an instant payment system. This will provide you with faster delivery and higher security.

Data shows that the proportion of mobile money account holders increased from 4% in 2017 to 8% in 2021. The rise of digital payments has improved security and speed while reducing costs for domestic payments and international remittances.

| Statistic | Description |

|---|---|

| Mobile Money Account Holders | 4% in 2017 → 8% in 2021 |

| Digital Payment Growth | Improves security, speed, and reduces payment and remittance costs |

- Remitting through digital platforms can promote savings and enhance fund security.

- Electronic payment platforms have lower fees, suitable for small and frequent remittances.

- This method supports financial inclusion, helping more families access funds.

Home Delivery Service

Home delivery services offer you great convenience. You can arrange for the provider to deliver cash directly to the recipient’s home, eliminating the need for them to visit a bank or pickup point.

The table below outlines options and features of some providers:

| Service Name | Options | Features |

|---|---|---|

| Caribe Express | Cash pickup, home delivery, bank deposit | High reliability, flexible, widely available |

| Paysend | Send to Caribe Express | Low fixed fees, fast transfers, secure transactions |

From China/Chinese Mainland or Hong Kong, you can order home delivery online through these providers. The recipient simply waits at home to receive the cash securely. This method is ideal for recipients with mobility issues or those in remote areas.

Remittance Process and Notes

Image Source: unsplash

Process

When sending money from China/Chinese Mainland or Hong Kong to the Dominican Republic, you can follow these steps:

- Create an account or log into an existing account. You can choose a bank, international money transfer service, or third-party platform.

- Add recipient information, including name, location, and phone number. For bank transfers, you also need to provide the recipient’s bank account details.

- Enter the amount to send and select a payment method. You can pay with a bank account, credit, or debit card.

- Confirm all information is correct and submit the remittance request. Some platforms may require identity verification or a verification code.

After completing these steps, the platform will process your remittance request and notify you of the progress.

Materials and Verification

When processing a remittance, you need to prepare materials for identity verification and compliance:

- Valid government-issued identification, such as a passport, driver’s license, or national ID.

- Proof of address, such as a recent utility bill or bank statement.

- Proof of income or funds, such as bank statements or pay stubs.

- Recipient details, including full name and bank account information.

- For high-value transfers, additional documents like invoices or property sale agreements may be required.

Per Dominican Republic regulations, banks must verify your identity and source of funds for transfers exceeding USD 15,000. This helps prevent illegal fund flows.

Compliance and Risks

You need to be aware of compliance requirements and potential risks during the remittance process. The table below summarizes key compliance requirements and risks:

| Compliance Requirement/Risk | Description |

|---|---|

| Anti-Money Laundering (AML) | Remittance providers must comply with local AML regulations. |

| Counter-Terrorism Financing (CTF) | You need to follow CTF regulations to reduce risks. |

| Foreign Investment Law | Foreign investors can repatriate profits and capital without prior central bank authorization. |

Many countries have strengthened oversight of remittance providers to meet Financial Action Task Force (FATF) requirements. You should choose regulated platforms to ensure fund safety.

Tip: When using mobile financial services, confirm that the service operates legally in the Dominican Republic to avoid remittance failures due to policy restrictions.

Tracking Delivery

You can track remittance delivery status through multiple methods:

- Log into the bank or third-party platform’s online account to check transfer status.

- Use mobile banking or apps to track fund progress in real-time.

- Contact customer support for detailed information.

- Visit a bank branch in person to inquire.

- Track international bank transfers via the SWIFT network.

- Use third-party provider tracking features by entering the Money Transfer Control Number.

You should promptly verify delivery status after sending to ensure the recipient receives the funds smoothly.

When choosing a remittance method to the Dominican Republic, consider these factors:

- Compare fees and exchange rates to select a cost-effective platform.

- Focus on the provider’s reliability and security, prioritizing regulated channels.

- Based on the recipient’s situation, bank deposits are suitable for regular or large transfers, cash pickup for recipients without accounts, and mobile wallets for small digital payments.

For example, using online services from licensed Hong Kong banks can avoid extra fees, while platforms like PayPal offer fast and secure transfer experiences.

| Common Risks | Description |

|---|---|

| Information Errors | Incorrect recipient name or account details may cause delays or losses. |

| Unchecked Exchange Rates | Rate differences across platforms may increase costs. |

| Using Unknown Platforms | Increases risks of fraud and fund loss. |

You should choose the appropriate method based on your needs and the recipient’s situation, and save receipts to ensure fund safety.

FAQ

How long does it take to send money to the Dominican Republic?

Delivery time depends on the method chosen. Bank transfers typically take 1-3 days, international money transfer services can deliver in as fast as 30 minutes. Cash remittances and prepaid cards are usually available same-day.

Can I use a bank card from China/Chinese Mainland to send money?

You can use a bank card from China/Chinese Mainland or Hong Kong to complete transfers via international money transfer services. Some platforms support credit or debit card payments.

What materials are required for remittances?

You need to prepare valid identification, recipient details, and bank account information. For large transfers, platforms may require proof of fund sources.

Are there limits on remittance amounts?

Most platforms have limits on single or daily transfer amounts. You can check specific limits on the platform’s website. Higher amounts require additional identity verification.

How can I track remittance progress?

You can log into the platform’s account or use a Money Transfer Control Number (e.g., MTCN) to track online. Some banks and providers also offer SMS notifications for delivery status.

When remitting to the Dominican Republic, you may value Remitly’s fast arrivals (Express in minutes) and diverse delivery (cash pickup/bank deposit), plus WorldRemit’s 70% instant transfers across 200+ countries, yet face challenges: Western Union/MoneyGram fees of $6.5 plus 1%-3% markups totaling $10-$40 losses, $3,000 per-transaction limits needing verification, cash pickups requiring ID causing delays, Paysend/Xoom limited to Visa/bank deposits, and 2025’s market where 50% rely on offline spots, heightening fraud/tracking risks amid $64.74B remittances for family support.

BiyaPay stands out as a premier cross-border finance platform, addressing these issues comprehensively. Our real-time exchange rate query delivers instant mid-market rates to eliminate markups. With fees as low as 0.5%, it supports conversions across 30+ fiat currencies and 200+ digital assets, covering multiple global destinations with same-day delivery. Uniquely, BiyaPay’s single platform supports direct US and Hong Kong stock trading without separate overseas accounts, with zero fees on contract orders, seamlessly turning remittances into investment opportunities. Licensed under US MSB and equivalents, fortified by 256-bit encryption and real-time fraud detection for unmatched compliance and security.

Sign up at BiyaPay today for low-rate, rapid transfers and integrated investing, elevating your Dominican Republic remittances to greater efficiency and safety!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.