- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What are the ways to remit money from Mexico to the United States?

Image Source: unsplash

Mexico sends a total of $64.74 billion in remittances to the USA annually. You will find that many Mexican families rely on remittances as economic support, especially during poor economic conditions or rising inflation rates. During the pandemic, financial difficulties for family members also led to increased remittance amounts. You can choose different remittance methods, such as bank wire transfers, international money transfer companies, or online platforms. Each method varies in process, fees, and delivery time.

Main reasons for remittances include:

- Deteriorating Mexican economy

- Family members needing economic support

- Inflation increasing living costs

| Year | Total Remittances (Billions USD) |

|---|---|

| 2024 | 64.74 |

Key Points

- Mexico sends up to $64.74 billion annually to the USA, with remittances being a vital economic support for many families.

- When choosing a remittance method, consider bank wire transfers, international money transfer companies, or online platforms, and make decisions based on fees, delivery time, and security.

- Online remittance platforms like PayPal and Wise offer convenient digital transfer services, suitable for users without bank accounts.

- Postal money orders are suitable for those unable to use digital tools, but delivery takes longer, typically 7 to 14 business days.

- Ensure you choose legitimate channels for remittances to protect personal information and avoid financial losses.

Common Remittance Methods

When sending money from Mexico to the USA, you can choose from multiple remittance methods. Each method suits different needs, and below is a brief overview of the main options:

Bank Wire Transfers

Bank wire transfers are a traditional remittance method. You can transfer funds directly to a U.S. recipient’s account through a bank counter or online banking. Many licensed Hong Kong banks also support international wire transfer services.

International Money Transfer Companies

You can use international money transfer companies like Western Union, MoneyGram, or Viamericas. These companies have locations in both Mexico and the USA, supporting cash remittances and withdrawals. Based on market share, Remitly holds 23%, Viamericas about 10%, and other companies collectively 47%.

Online Remittance Platforms

Online remittance platforms provide convenient digital transfer services. Common platforms include PayPal, Xoom, and others. You only need to register an account and complete the remittance using a debit or credit card, without requiring a bank account.

Tip: Digital payment platforms like PayPal support direct transfers without a bank account but may require a debit or credit card.

Paysend Transfers

Paysend is an emerging online remittance method. You can transfer funds from Mexico to the USA via a mobile app or website, with a simple process and relatively fast delivery.

Wise Remittances

Wise (formerly TransferWise) specializes in low-cost cross-border remittances. You can submit a remittance request online, enjoying transparent exchange rates and fees, suitable for users seeking cost-effectiveness.

Postal Money Orders

Postal money orders are a more traditional remittance method. You can purchase a money order at a post office and mail it to the U.S. recipient, who can convert it at a local bank or post office.

Cash Carrying and Third-Party Intermediaries

Some users choose to carry cash personally or entrust third-party intermediaries to deliver funds. This method carries higher risks and lower security, so caution is advised.

| Remittance Method | Description | Features |

|---|---|---|

| Money Transfer Companies | Use companies like Western Union, MoneyGram, or Xoom for cash remittances. | Fast, secure, requires ID for cash pickup. |

| Digital Payment Platforms | Transfer via platforms like PayPal without a bank account. | May require a debit or credit card. |

You can choose the most suitable remittance method based on your specific situation. The following sections will detail the processes and features of each method.

Bank Wire Transfer Method Details

Process

You can send funds from Mexico to the USA via bank wire transfers. The bank wire transfer process typically includes the following steps:

- Choose the destination for the funds. You need to specify the city, state, and receiving terminal in the USA.

- Verify recipient information. Ensure the recipient is willing to receive the funds and can access the designated terminal.

- Fill out the remittance application. You can complete the relevant forms at a licensed Hong Kong bank counter or via online banking.

- If using electronic services, ensure funds are sent in USD to the recipient’s bank account.

- The bank will verify the information and process the remittance. You can receive notifications about the remittance progress.

Tip: When filling out remittance information, double-check the recipient’s account and bank codes to avoid delays due to errors.

Required Documents

When processing a bank wire transfer, you need to prepare the following documents and information:

- Your personal information:

- Name

- Address

- Account number

- Recipient information:

- Name

- Address

- Account number

- Account type (e.g., checking, savings, brokerage)

- International Bank Account Number (IBAN) or standard bank code (CLABE)

- Transfer information:

- Transfer amount (in USD)

- Wire transfer type and purpose

- Whether transferring to a third party

- Remittance notes or description

- Currency type

- Receiving financial institution information:

- Bank name and address

- SWIFT/BIC code

- Intermediary bank name and routing number (if applicable)

You also need to confirm the remittance fees and limits, ensuring sufficient funds in your account to cover the transfer and related costs.

Fees and Delivery Time

Bank wire transfers have distinct characteristics in terms of fees and delivery times. You can refer to the table below for common scenarios:

| Type | Fee Range | Transfer Time |

|---|---|---|

| Domestic Transfer | Average $27 | A few hours |

| International Transfer | Average $44 | 1 to 5 business days |

| International Transfer (Other Sources) | Up to $75 (sending) | 2 to 4 business days |

When processing international wire transfers, fees can reach up to $75, and the recipient may also incur up to $16 in receiving fees. Typically, funds arrive within 2 to 4 business days. Delays may occur during holidays or bank reviews.

Note: Different banks and remittance methods may have varying fee structures and delivery speeds. You can consult the bank in advance to choose the most suitable option.

Pros and Cons

Bank wire transfers have the following advantages and disadvantages, which you can weigh based on your needs:

| Pros | Cons |

|---|---|

| High security, supported by official financial institutions | May incur high fees |

| Reliable, suitable for large transfers | Processing time may be longer, up to 5 business days |

| Uses SWIFT system, ensuring information security | Requires additional information, such as IBAN and SWIFT codes |

- Sending funds through banks or credit unions offers high security and reliability.

- Bank wire transfers are suitable for large fund transfers, with encrypted information and low risk.

- You need to prepare detailed recipient and bank information, making the process more cumbersome.

- Fees are higher, suitable for users prioritizing security and compliance.

Suggestion: If you need a secure, large-amount remittance, bank wire transfers are a good choice. However, if you prioritize speed and cost, consider other remittance methods.

International Money Transfer Company Methods

Image Source: unsplash

Process

You can send funds from Mexico to the USA through international money transfer companies. Common methods include bank transfers and counter services. The process is as follows:

- You can choose to process the remittance via bank transfer or at an agent counter.

- If using a bank transfer, you can handle it directly through a licensed Hong Kong bank or opt for intermediary services.

- For counter services, visit the nearest transfer agent, pay the amount, and specify the destination city.

- The recipient collects the funds at a U.S. agent location with proof of identity and a reference number.

You can also use digital platforms, such as downloading the Revolut app, adding funds after registration, selecting the transfer method, entering the destination country, currency, and amount, and filling in recipient details before sending.

Required Documents

When processing international remittances, you need to prepare the following documents:

- Valid government-issued photo ID, such as a passport or driver’s license.

- Secondary proof of identity, such as a utility bill or bank statement showing name and address.

- Recipient information, including full name, address, and sometimes proof of identity.

Fees and Delivery Time

Fees and delivery times vary by provider. You can refer to the table below:

| Provider | Transfer Time |

|---|---|

| WorldRemit | 1-2 business days |

| Western Union | Up to 5 days for initial transfers |

| Inpay | Average 30 minutes |

Bank transfers typically incur fees and exchange rate margins. Intermediary services may offer better rates and lower fees. Counter service fees are usually higher than bank transfers. When sending international transfers, pay attention to currency conversion and transfer fees.

Pros and Cons

When choosing international money transfer companies, you can refer to the following pros and cons:

| Key Point | Advantages | Disadvantages |

|---|---|---|

| Financial Inclusion | Foreign remittances promote financial inclusion, increasing demand for formal financial services. | Mexico has low financial inclusion, with only 49% of consumers using bank accounts. |

| Convenience | Digital solutions provide convenient transfer methods. | High fees and distrust in financial institutions lead many to prefer informal transfers. |

| Recipient Preferences | Many recipients prefer non-bank institutions for fund management. | Distrust in banks results in remittances often received through non-bank institutions. |

You can choose the most suitable remittance method based on your needs. If you prioritize speed and convenience, digital platforms and intermediary services may be more suitable. If you value security, prioritize bank transfers.

Online Remittance Platform Methods

Image Source: unsplash

Process

You can easily send money from Mexico to the USA through online remittance platforms. The typical process is as follows:

- Create an account: You need to register on the platform’s website or download the app and activate an international account.

- Verify identity: You must complete identity verification to enable bank payments and full platform features.

- Enter transfer details: You fill in the recipient’s information and specify the amount and currency.

- Choose funding source: Platforms support multiple payment methods, including bank accounts, debit cards, or credit cards.

- Send and track: You can track the remittance status in real time to ensure funds arrive safely.

Tip: When registering and transferring, double-check recipient information to avoid delays due to errors.

Required Documents

When using online remittance platforms, you need to prepare the following documents:

- Sender and recipient’s full name (must match ID)

- Recipient’s phone number and mailing address in Mexico

- Bank account information for bank transfers

- Transfer amount, including fees and current exchange rate

- Payment method: bank, debit card, credit card, or cash

- Withdrawal method: cash pickup, mobile wallet, bank deposit, or home delivery

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) may be required for account registration

Fees and Delivery Time

When choosing a remittance method, fees and delivery times are key considerations. The table below shows fees and processing times for common platforms:

| Remittance Amount | Cost Percentage | Processing Time |

|---|---|---|

| $200 | 4.5% | Instant or same-day transfer |

| $500 | 3.1% | Instant or same-day transfer |

| Digital Remittance | 4.8% | Instant or same-day transfer |

| Cash Remittance | 6.52% | Instant or same-day transfer |

You can typically complete transfers within minutes to hours. Digital platforms have lower fees, while cash remittances are slightly more expensive.

Pros and Cons

When using online remittance platforms, you can refer to the following pros and cons:

| Pros | Cons |

|---|---|

| Funds can be withdrawn at pharmacies, currency exchanges, grocery stores, etc. | Service fees and exchange rates may vary |

| Most platforms support mobile apps, making operations convenient | Transfer fees fluctuate with amount and exchange rate |

| Suitable for users without bank accounts, offering flexibility | Need to review platform-specific terms |

You can choose the most suitable remittance method based on your needs. If you prioritize speed and convenience, online platforms are a good choice.

Paysend and Wise Remittance Methods

Process

You can easily send money from Mexico to the USA using Paysend or Wise. Here are the specific steps for Paysend:

- Create a Paysend account.

- Set up the first remittance.

- Prepare the necessary documents.

- Download the Paysend app.

- Visit Paysend.com and register or log in.

- Click the “Send” button in the “Transfers/Activity” section.

- Select the recipient’s country and currency.

- Choose the receiving method.

- Enter the recipient’s details.

- Input the remittance amount.

- Select the payment method.

- Review all information and click “Confirm and Send.”

Wise’s process is also simple. You need to register an account, enter recipient information, select the remittance amount and currency, confirm fees, and submit the transfer. Wise converts funds at the real-time exchange rate, and funds typically go directly to the recipient’s U.S. bank account.

Tip: During operations, carefully verify recipient information to avoid delays due to errors.

Required Documents

When using Paysend or Wise for remittances, you need to prepare the following documents:

- Mexican citizenship identification

- Valid INE ID

Wise may also require you to upload a photo of your ID to ensure account security. During registration and remittance, the platform will guide you through document submission.

Fees and Delivery Time

When choosing a remittance method, Paysend and Wise have transparent fee structures. The table below shows fees for common payment methods:

| Payment Method | Fees (USD) |

|---|---|

| Direct Debit and Debit Card | $1.25 + 0.85% |

| Wire Transfer | $1.25 + 0.70% |

| Credit Card | $1.25 + 2.55% |

| USD to MXN Conversion | 0.70% |

| Withdrawal to Other Bank Accounts | $12.20 |

In terms of delivery time, Paysend and Wise typically complete transfers within 1-2 business days. In some cases, funds can arrive within hours, depending on the recipient bank’s processing speed.

Pros and Cons

When choosing Paysend or Wise as a remittance method, you can refer to the following pros and cons:

| Pros | Cons |

|---|---|

| Simple process, supports online and mobile operations | Requires valid identification |

| Transparent fees, with real-time display of rates and charges | Some payment methods have higher fees |

| Fast delivery, suitable for urgent transfers | Requires linking a bank card or credit card |

| Supports multiple receiving methods, offering flexibility | May be limited by some bank or regional policies |

You can choose the most suitable remittance method based on your needs. If you value fees and delivery speed, Paysend and Wise are both worth considering.

Postal Money Order Method

Process

You can choose postal money orders to send funds from Mexico to the USA. This method is suitable for users who cannot use banks or online platforms. You need to visit a local post office and inform staff of your remittance needs. After filling out the money order application form, pay the amount and fees. The post office will issue a money order. You need to mail this money order to the U.S. recipient, who can redeem it for cash or deposit it at a U.S. bank or post office.

Tip: When filling out recipient information, ensure the name and address are accurate to avoid issues with redemption.

Required Documents

When processing a postal money order, you need to prepare valid identification. Common identification for Mexican residents includes the Matricula Consular. This is an ID issued by the Mexican government through its consulates to Mexican nationals living abroad. You also need to fill out the money order application form, providing the recipient’s name and detailed address.

| Identification Type | Description |

|---|---|

| Matricula Consular (Mexico) | An ID issued by the Mexican government through its consulates to Mexican nationals living abroad. |

Fees and Delivery Time

Postal money order fees are relatively fixed. You typically need to pay the money order amount plus a handling fee, generally between $5-$10 USD. Mailing costs are calculated separately, depending on the mailing method and distance. Delivery times are longer, typically requiring 7 to 14 business days. Delays may occur due to weather or holidays.

Pros and Cons

When choosing postal money orders, you can refer to the following pros and cons:

- Pros:

- No bank account required, suitable for users without banking services.

- Simple process, ideal for older individuals or those unfamiliar with digital tools.

- Money orders serve as physical proof, facilitating tracking.

- Cons:

- Longer delivery times, unsuitable for urgent remittance needs.

- Lost or damaged money orders involve cumbersome replacement procedures.

- Requires in-person visits to the post office, less convenient.

Suggestion: If you have no urgent delivery needs and prefer physical proof, postal money orders are a viable option. For faster delivery or greater convenience, prioritize other remittance channels.

Cash Carrying and Third-Party Intermediaries

Process

You can choose to personally carry cash or entrust third-party intermediaries to deliver funds from Mexico to the USA. Cash carrying typically requires you to travel between the two countries and hand over USD directly to the recipient. Third-party intermediaries arrange for a designated person or channel to facilitate fund delivery. You need to communicate with the intermediary in advance, confirming the remittance amount and receiving method. Some intermediaries also offer electronic transfer services to send funds directly to a U.S. bank account.

Tip: Cash carrying is high-risk, so carefully consider safety. For third-party intermediaries, choose legitimate channels to avoid financial losses.

Required Documents

When carrying cash, you need to prepare valid identification, such as a passport or Mexican ID. Third-party intermediaries typically require your personal information and recipient details, including name, address, and contact information. Some intermediaries may also request a description of the fund source to ensure compliance. During the process, verify all information to avoid delays due to incomplete documents.

- Only 10% of Mexicans have bank accounts, and many distrust banks.

- Undocumented immigrants often cannot open bank accounts due to lacking a tax number or Social Security Number.

Fees and Delivery Time

Cash carrying typically incurs no handling fees, but you need to cover additional costs like travel and accommodation. Third-party intermediary fees vary by service type, with some offering lower electronic transfer costs due to market competition. You can inquire about specific fees in advance to ensure sufficient funds. In terms of delivery time, cash carrying enables instant delivery, while third-party intermediary electronic transfers generally complete within 1-2 business days.

- Only 0.7% of remittances are sent as cash or in-kind, with 99% completed via electronic transfers.

- Undocumented immigrants rarely send cash or in-kind remittances due to inability to travel between Mexico and the USA.

Pros and Cons

When choosing cash carrying or third-party intermediaries, you can refer to the following pros and cons:

| Advantages | Disadvantages |

|---|---|

| Electronic transfers via intermediaries have lower costs due to competition | Informal transfers carry higher risks |

| Can reach a wider audience | Undocumented immigrants face challenges accessing banking services |

- Cash carrying is suitable for users able to travel between countries, but it carries high safety risks.

- Third-party intermediaries provide convenience for those without bank accounts, but beware of financial risks from unregulated channels.

- When choosing, prioritize safety and compliance based on your situation.

Remittance Method Comparison and Selection

Fee Comparison

When choosing a remittance method, fees are a direct consideration. Fees vary significantly across channels. You can refer to the table below for fees and exchange rates of major remittance services:

| Remittance Provider | Fees (USD) | Received Amount (USD) | Exchange Rate | Wait Time |

|---|---|---|---|---|

| Xe | $1.99 | $1,753.92 | $18.14 | <1 day |

| Remitly | $1.99 | $1,729.88 | $17.65 | 0-3 days |

| Wells Fargo | $6.00 | $1,707.29 | $18.16 | 0-3 days |

| Bank of America | $45.00 | $956.52 | $17.39 | 1+ day |

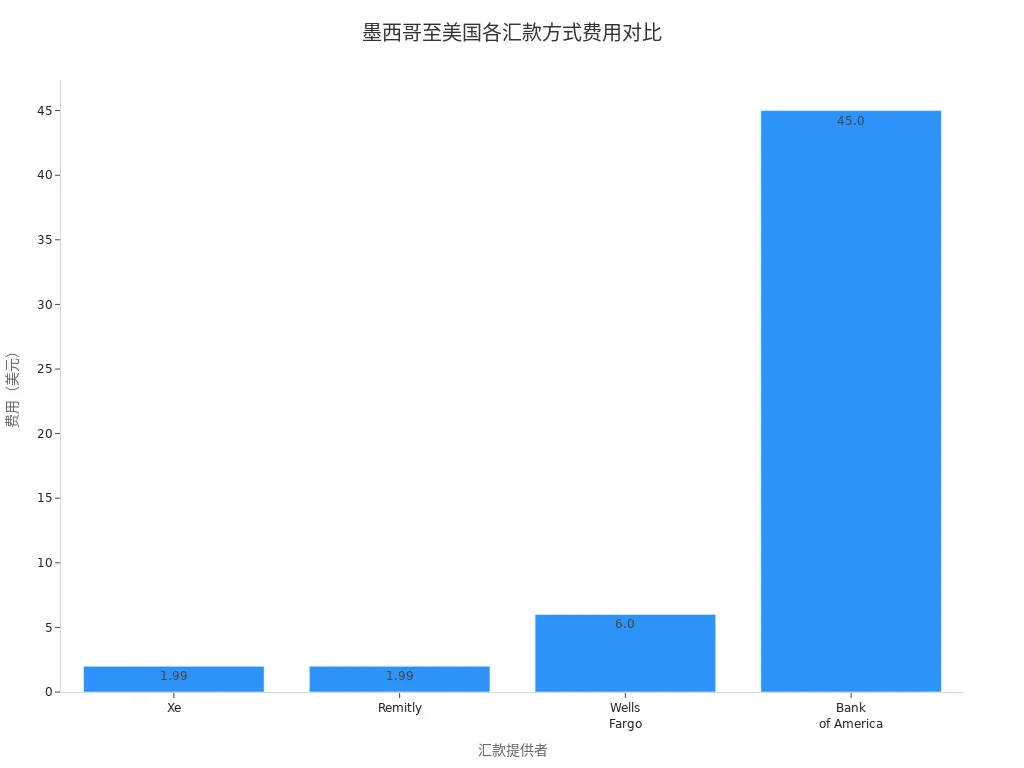

You can see that bank wire transfers have the highest fees, while online platforms and international money transfer companies are more cost-effective. The chart below provides a visual comparison of fees across channels:

Delivery Speed Comparison

Delivery speed directly affects your fund usage plans. Using online platforms and international money transfer companies, you can typically complete transfers within the same day or 1-2 business days. Bank wire transfers and postal money orders take longer, with bank transfers requiring 1-5 business days and money orders 7-14 business days. Cash carrying and third-party intermediaries can achieve instant delivery but have lower security.

Convenience and Security

When considering convenience, online platforms and international money transfer companies support mobile and web operations, making the process simple. Bank wire transfers require detailed information and are more cumbersome. Postal money orders and cash carrying require in-person handling. In terms of security, banks and legitimate money transfer companies are regulated, offering lower risks. Third-party intermediaries and cash carrying have higher risks, so prioritize legitimate channels.

Tip: When choosing a remittance channel, verify the provider’s credentials, protect personal information, and avoid financial losses.

Recommendations for Different Groups

You can choose the most suitable remittance method based on your needs:

- If you need fast delivery and low fees, opt for online remittance platforms or international money transfer companies.

- If you’re sending large amounts and prioritize security, consider bank wire transfers.

- If you lack a bank account or are unfamiliar with digital tools, postal money orders are suitable.

- If you cannot use legitimate channels and must resort to cash carrying or third-party intermediaries, exercise extreme caution to ensure fund safety.

You can make the best choice by considering fees, speed, convenience, and security.

You can select the most suitable remittance method based on your needs. Bank wire transfers offer high security, ideal for large transfers; international money transfer companies and online platforms have lower fees and faster delivery; postal money orders and cash carrying suit those without bank accounts. When remitting, prioritize safety and compliance, opting for legitimate channels. Consider fees, speed, and convenience to make informed choices and avoid impulsive decisions.

FAQ

What basic documents are needed to send money from Mexico to the USA?

You need to prepare valid identification, the recipient’s name, and address. For bank transfers, provide the recipient’s bank account information and SWIFT code.

How fast can a remittance to the USA arrive?

Using online platforms or international money transfer companies, funds can arrive in minutes. Bank wire transfers take 1-5 business days, and postal money orders require 7-14 business days.

Can I send money to the USA without a bank account?

You can use international money transfer companies, online platforms, or postal money orders. These methods don’t require a bank account, making them suitable for those without banking services.

Are there limits on remittance amounts?

Most channels impose limits on single and daily remittance amounts. You need to consult the provider in advance to ensure the amount complies with regulations.

How to ensure fund safety during remittances?

You should choose legitimate channels, such as licensed Hong Kong banks or well-known money transfer companies. Avoid using unclear intermediaries or carrying large amounts of cash to minimize financial risks.

When remitting from Mexico to the US, you may value Remitly’s fast arrivals (3-5 days economy, minutes Express) and broad delivery (cash pickup/bank deposit), plus Wise’s low rates (0.5%-2%) and transparent exchanges, yet face hurdles: bank wires cost $30-$50 plus $15-$30 intermediaries totaling up to 7%, 1-5 day delays, postal money orders taking 7-14 days, cash carry/third-party risks (only 0.7% cash in 99% electronic dominance prone to theft), and $10K limits needing verification—especially amid 2025’s $64.74B remittances, where economic woes and inflation heighten costs and risks for frequent family support.

BiyaPay stands out as a premier cross-border finance platform, addressing these challenges comprehensively. Our real-time exchange rate query delivers instant mid-market rates to eliminate markups. With fees as low as 0.5%, it supports conversions across 30+ fiat currencies and 200+ digital assets, covering multiple global destinations with same-day delivery. Uniquely, BiyaPay’s single platform supports direct US and Hong Kong stock trading without separate overseas accounts, with zero fees on contract orders, seamlessly turning remittances into investment opportunities. Licensed under US MSB and equivalents, fortified by 256-bit encryption and real-time fraud detection for unmatched compliance and security.

Sign up at BiyaPay today for low-rate, rapid transfers and integrated investing, elevating your Mexico-US remittances to greater efficiency and safety!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.