- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Transfer Money with Apple Pay: A Detailed Explanation of Steps, Security, and Fees

Image Source: unsplash

You can easily manage daily fund transfers with Apple Pay. Apple Pay is integrated into devices, supporting seamless integration and privacy protection. Each transfer uses dedicated encryption technology, and actual card numbers are neither stored nor shared, ensuring a secure and reliable transaction process.

Key Points

- Apple Pay transfers are simple to use, requiring only setup of Apple Pay and Apple Cash on compatible devices to transfer funds.

- Each transfer employs high-security encryption technology to ensure the safety of users’ personal information and funds.

- Using a debit card for transfers incurs a 1.5% fee, while bank account transfers are free of charge.

Apple Pay Transfer Overview

Apple Pay transfers allow you to easily manage fund flows across multiple devices. You only need a compatible device and an appropriate account to experience convenient transfer services.

Supported Devices and Accounts

You can use the Apple Pay transfer function on the following devices:

| Device Type | Compatible Models |

|---|---|

| iPhone | Models with Face ID, models with Touch ID (excluding iPhone 5s) |

| iPad | iPad Pro, iPad Air, iPad, and iPad mini with Touch ID or Face ID |

| Apple Watch | Apple Watch Series 1 and later |

| Mac | Mac models with Touch ID, 2012 or later Mac models (paired with an Apple Pay-supported iPhone or Apple Watch), Apple silicon Mac with Touch ID Magic Keyboard |

| Apple Vision Pro | Apple Vision Pro |

You can link the following account types:

| Account Type | Description |

|---|---|

| Apple Cash | Transfer via Apple Cash service, requiring age and residency conditions. |

| Visa/Mastercard Debit Card | US-issued Visa and Mastercard debit cards only, suitable for instant transfers. |

| Bank Account | Transfer funds from Apple Cash to a bank account with no fees. |

Use Cases

Apple Pay transfers are mainly suitable for fast peer-to-peer transfers within the US. You can use them in the following scenarios:

- Splitting daily expenses among family members

- Small payments or repayments between friends

- For international transfers, use third-party services like Wise for low-cost transfers

You need to be at least 18 years old and a US resident to use Apple Cash for transfers. Apple Pay transfers do not support international transfers and lack built-in currency conversion. Some banks or card issuers may impose transfer amount limits. If the recipient does not accept the transfer, the funds will remain in your account.

Apple Pay transfers rely on two core services: Apple Pay and Apple Cash. Apple Cash is suitable for sending and receiving payments, supporting split bills and repayment requests. Apple Pay is a global mobile payment solution, supporting contactless payments but not payment requests.

Transfer Steps

Image Source: pexels

Apple Pay transfers provide a convenient way to manage fund flows. You can follow the steps below to complete setup and transfer operations.

Setting Up Apple Pay

You need to complete the basic setup of Apple Pay on your device first. Please follow these steps:

- Open the “Settings” app on your iPhone, iPad, or Apple Vision Pro.

- Scroll down and tap “Wallet & Apple Pay.”

- Turn on Apple Cash.

- Under Payment Cards, tap “Apple Cash.”

- Tap “Continue” and follow the on-screen prompts to complete setup.

Tip: If you encounter issues like Apple Pay not appearing or being unable to add a card during setup, try restarting the device or signing out and back into your Apple ID. Ensure the device is updated to the latest system version to reduce common setup issues.

Adding a Bank Card

You need to add a bank card to Apple Pay to successfully perform transfers. When adding a card, the system will require verification. Common verification methods include:

- Receiving a verification code via SMS

- Receiving a verification code via email

- Verifying identity through a customer service call

- Using the verification method within the bank issuer’s app

You need to enter the verification code or complete the relevant steps as prompted. Some banks may have additional verification requirements. You should ensure the card information matches the bank statement details; otherwise, the addition may fail.

Note: If you receive a “Payment Not Completed” or “Contact Card Issuer” message, check the card status first and contact bank customer service if necessary.

Transferring via iMessage

You can send funds directly to others via iMessage, with a simple process and instant delivery. The steps are as follows:

- Open the Messages (iMessage) app and enter the conversation window with the recipient.

- Tap the “Apple Pay” icon and enter the transfer amount.

- After confirming the amount, use Face ID, Touch ID, or a passcode to complete identity verification.

- After sending, the recipient will receive a transfer notification and can accept the funds directly in the conversation.

The table below summarizes the main restrictions for Apple Pay transfers via iMessage:

| Type | Restriction Details |

|---|---|

| Apple Cash Balance Limit | Up to $20,000 (after identity verification); $4,000 for family members |

| Add Funds Limit | Minimum $10 per transaction, maximum $10,000; weekly maximum $10,000 |

| Send and Receive Limit | Minimum $1 per message, maximum $10,000; weekly maximum $10,000 |

| Apple Cash Family Member Limit | Minimum $1 per message, maximum $2,000; weekly maximum $2,000 |

| Usage Requirements | Must be a US resident, device must be in the US, under 18 requires family organizer to set up Apple Cash |

Reminder: When using iMessage for transfers, ensure your device and account meet the above requirements to avoid transfer failures.

Canceling or Reversing Transactions

If you need to cancel a transfer after sending, you can try to reverse it with these steps:

- Open the Messages app, go to the relevant conversation, and tap the payment record.

- The Wallet app will automatically open the Apple Cash card. Under “Latest Transactions,” tap the payment and tap again to view details.

- Tap the “Cancel Payment” button.

If the recipient has not yet accepted the transfer, the funds will automatically return to your account. If the recipient has accepted, the transfer cannot be reversed. You should check the transaction status promptly after transferring to avoid unnecessary losses.

Tip: If you encounter issues like inability to cancel or other anomalies, contact Apple Support or bank customer service immediately for professional assistance.

Security

Image Source: unsplash

Encryption and Privacy

When using Apple Pay for transfers, the system employs multiple security technologies to protect your funds and personal information. Apple designs dedicated encryption and tokenization mechanisms for each transaction. You can learn about the following key security measures:

- Encryption technology converts your payment data into new values, preventing unauthorized access.

- Tokenization replaces sensitive bank card information with a random token, so even if data is intercepted, it cannot be traced back to the actual card number.

- Network-side tokenization ensures sensitive payment data does not enter merchant systems, reducing the risk of merchant breaches.

Apple also protects your privacy through the following methods:

- Bank account details and routing numbers are securely stored in iCloud Keychain, inaccessible to Apple.

- Apple established Apple Payments Inc. to isolate and protect transfer amounts, recipient details, and balance information, which are not shared with other Apple services.

- For recurring payments via Apple Cash, the system requests and stores merchant tokens linked to Apple Pay debit cards for secure authorization, but Apple does not know the transaction recipient or memo details.

- Devices automatically evaluate your usage patterns to generate risk assessment reports, shared only with Apple Payments Inc., without linking to your identity.

- During transactions, Apple and partner banks use your device and bank account information to prevent fraud and comply with financial regulations.

Tip: When setting up and using Apple Pay transfers, enable Face ID or Touch ID on your device to further enhance account security.

The table below summarizes the main encryption and privacy protection measures for Apple Pay transfers:

| Security Technology | Function Description |

|---|---|

| Encryption | Prevents unauthorized access to data |

| Tokenization | Replaces sensitive card info with random tokens, enhancing security |

| Network-Side Tokenization | Sensitive data does not enter merchant systems, reducing fraud risk |

| Isolated Storage | Apple Payments Inc. isolates transfer-related information |

| Risk Assessment | Devices generate risk reports automatically to prevent fraud |

Risk Prevention

When using Apple Pay for transfers, despite multiple security measures, you should remain aware of common risks. You can refer to the following security details to enhance your vigilance:

- Jailbroken devices are vulnerable to cyberattacks, so avoid transferring on jailbroken iPhones.

- In public WiFi environments, hackers may intercept transaction data. You should perform transfers in secure network environments.

- Apple collects some personal information for compliance and fraud prevention, which may pose data breach risks. You can regularly review account privacy settings to minimize unnecessary data sharing.

- During payments, conflicts between payment methods may lead to duplicate payments. You should confirm the payment method before transferring to avoid errors.

- In Express Transit mode, hackers may bypass authorization limits for small transactions. You can disable this mode or use it only in trusted locations.

- When using third-party apps for Apple Pay transfers, some apps may have security vulnerabilities. You should choose officially certified apps and update software regularly.

- Although Touch ID enhances security, it has been cracked in experiments. You can combine Face ID or a passcode for added protection.

Apple also employs the following measures to prevent fraud:

- Each transaction generates a device-specific number and unique transaction code, with card numbers not stored on devices or Apple servers.

- Credit and debit card numbers are not shared with developers, reducing transaction risks.

- Apple identifies and bans numerous stolen credit cards and suspicious accounts annually, enhancing overall security.

Reminder: Before transferring, carefully verify recipient information to avoid sending to the wrong account. If you encounter unusual transactions, contact Apple or bank customer service immediately to address risks promptly.

Fees Explained

Transfer Fees

When using Apple Pay for transfers, the fee structure is very clear. Apple Pay transfers do not waive any transfer fees. When using a debit card for instant transfers, the system charges a 1.5% fee, with a minimum of USD 0.25 and a maximum of USD 15 per transaction. If you choose a bank account for transfers, no fees are charged. Credit card transfers incur about a 3% fee. You can refer to the table below for a quick overview of fees for different payment methods:

| Payment Method | Fee Description |

|---|---|

| Bank Account | Free |

| Debit Card | 1.5%, minimum USD 0.25, maximum USD 15 |

| Credit Card | Approx. 3% |

You can check the fee details for each transfer via the Wallet app or bank statements. Apple Pay transfers excel in fee transparency, making management and verification convenient.

Exchange Rates and Cross-Border Fees

When making international transfers, Apple Pay itself does not charge additional fees. MasterCard handles international transactions and determines exchange rates. When choosing to pay in local currency or USD, the exchange rate and fees vary. Foreign exchange fees are controlled by MasterCard, and merchants may opt for USD transactions. Some banks or card issuers may charge foreign transaction fees, typically around 3%. Actual fees depend on the bank’s charges. Compared to Alipay and WeChat Pay, Apple Pay’s international transfer fees are more transparent. The table below compares fees for three major payment methods:

| Service | Apple Pay | Alipay | WeChat Pay |

|---|---|---|---|

| Transfer Fees | Free | 0.1% fee after exceeding limit | 0.1% fee after exceeding limit |

| Withdrawal Fees | N/A | 0.1% fee for amounts exceeding USD 20,000 | 0.1% fee for amounts exceeding USD 1,000 |

You can view exchange rates and fee details for international transactions in the Wallet app, ensuring clarity for every cross-border transfer.

You can enjoy the following benefits with Apple Pay transfers:

- Convenient to use, payments made by holding the phone near NFC

- High security with device-specific account numbers

- Supports offline payments

- Transparent transactions with no additional fees

- Privacy protection, as Apple does not track purchase records

- Widely accepted, with increasing store support

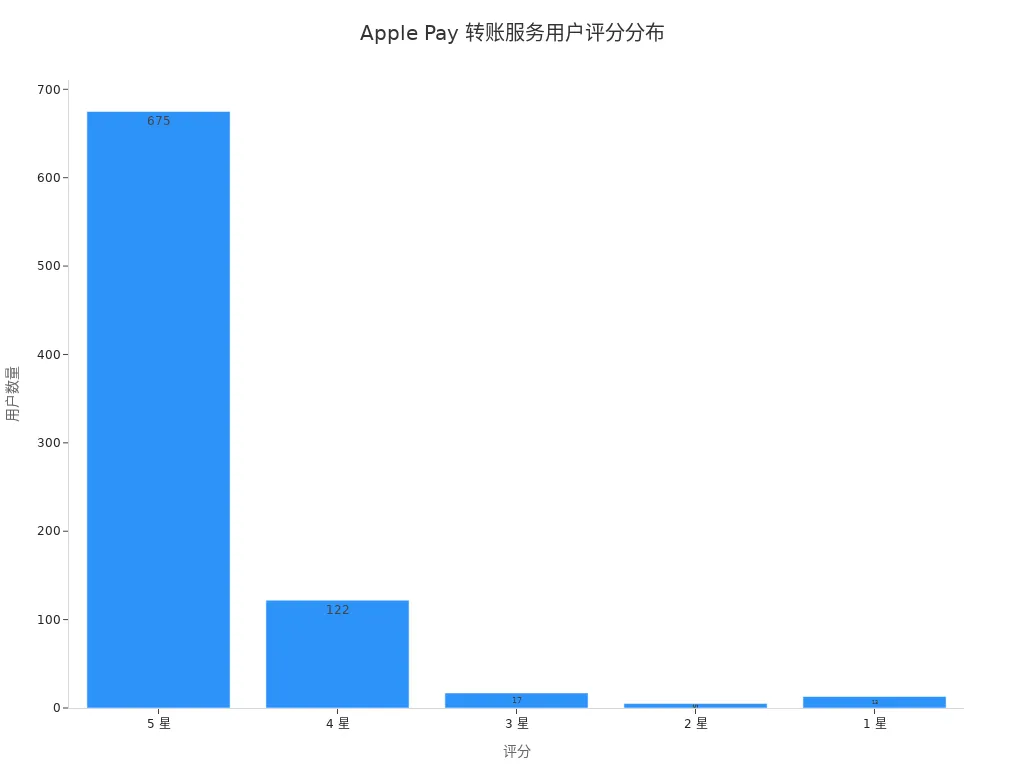

User ratings are as follows:

| Rating | Count |

|---|---|

| 5 | 675 |

| 4 | 122 |

| 3 | 17 |

| 2 | 5 |

| 1 | 13 |

You should prioritize account security, enable complex passwords and two-factor authentication, avoid operating on insecure networks, verify recipient information, and regularly monitor transactions. Use the service based on your needs and stay updated with official policies.

FAQ

What bank account types does Apple Pay transfer support?

You can link USD accounts from licensed Hong Kong banks or use US-issued debit or credit cards for transfers.

Reminder: Ensure account information is accurate and valid to avoid transfer failures.

What are the transfer limits? How can I increase them?

You can transfer up to USD 10,000 weekly. You can increase the limit through identity verification; follow the Wallet app’s prompts for details.

| Type | Weekly Limit (USD) |

|---|---|

| Unverified Account | 4,000 |

| Verified Account | 10,000 |

What should I do if a transfer fails?

You can check the network connection and account status. You can also contact Apple or bank customer service for professional assistance.

Tip: Regularly update your device system to reduce the likelihood of issues.

When using Apple Pay for transfers, you may value its instant delivery (iMessage in seconds), seamless device integration (iPhone/Apple Watch), and robust encryption (tokenization/device-specific numbers), yet face challenges: 1.5% debit card fees ($0.25-$15), no direct international transfers (requiring Wise), $10K weekly limits needing verification, 3% forex fees inflating cross-border costs, US-only residency, and 2025’s digital payment surge increasing risks from jailbroken devices/public WiFi hacks.

BiyaPay stands out as a premier cross-border finance platform, addressing these issues comprehensively. Our real-time exchange rate query delivers instant mid-market rates to eliminate markups. With fees as low as 0.5%, it supports conversions across 30+ fiat currencies and 200+ digital assets, covering multiple global destinations with same-day delivery. Uniquely, BiyaPay’s single platform supports direct US and Hong Kong stock trading without separate accounts, with zero fees on contract orders, seamlessly turning funds into investment opportunities. Licensed under US MSB and equivalents, fortified by 256-bit encryption and real-time fraud detection for unmatched compliance and security.

Sign up at BiyaPay today for low-rate, rapid transfers and integrated investing, elevating your cross-border financial management to greater efficiency and safety!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.