- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Fastest Way to Remit Money to India: From Banks to Online Platforms

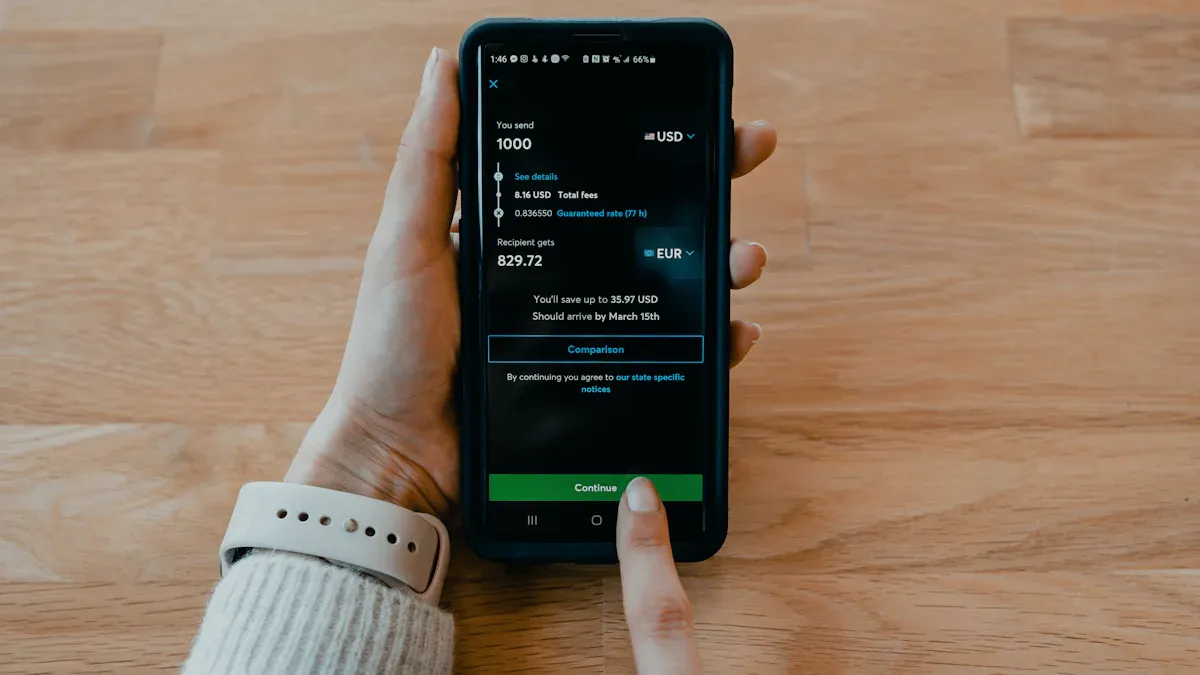

Image Source: unsplash

When you want to quickly send money to India, online platforms and popular apps usually allow the recipient to receive USD within minutes. Bank channels, such as licensed Hong Kong banks, take longer to deliver but are more robust for large transactions and security. You can focus on delivery speed, fees, exchange rates, and security measures to flexibly choose a remittance method that meets your and the recipient’s needs.

Key Points

- When choosing a remittance method, focus on delivery speed, fees, exchange rates, and security to ensure your needs are met.

- Online platforms like Wise and Remitly offer fast delivery and low fees, suitable for small and frequent transfers.

- Bank transfers are ideal for large funds, with high security but longer delivery times, typically 1-3 business days.

- Cash remittance services like Western Union are suitable for recipients needing funds urgently, without requiring a bank account, and offer fast delivery.

- Ensure recipient information is accurate and choose reputable service providers to effectively improve delivery speed and avoid delays.

Overview of Remittance Methods

Image Source: unsplash

You can transfer funds from mainland China to India through various channels. Different methods suit different needs, with distinct features in delivery speed, security, and convenience. The table below summarizes main remittance types and their use cases:

| Remittance Type | Description | Examples |

|---|---|---|

| Inward Remittance | Funds transferred from overseas to India. | Children receiving funds from parents abroad. |

| Outward Remittance | Funds transferred from India to overseas. | Supporting children studying abroad. |

| Wire Transfer | Transfer from one bank account to another via the SWIFT network. | Handled by banks or remittance agencies. |

| Bank Transfer | Transfers between bank accounts, requiring account details and routing numbers. | Viable for international and domestic transfers. |

| Peer-to-Peer Apps | Transfers using credit or debit cards via websites or mobile apps. | Fast remittance method supported by modern technology. |

Bank Transfers

You can choose to make international remittances through licensed Hong Kong banks. Bank channels are suitable for large fund transfers, offering high security and transparent fund flows. Banks typically use SWIFT or wire transfers, requiring detailed recipient account information. Bank transfers take longer, usually 1-3 business days. When choosing a remittance method, if you prioritize security and compliance, bank channels are a reliable option.

Online Platforms

You can use various online platforms and apps for remittances. These platforms support instant delivery, are easy to operate, and are suitable for frequent small transfers. Common platforms include Jupiter, BHIM, UltraCash, PhonePe, Paytm, Google Pay, and PayPal. You only need to enter recipient information, and funds can reach Indian accounts within minutes. Online platforms typically offer lower fees and real-time exchange rates, making it convenient to manage funds flexibly.

Tip: Online platforms are ideal for scenarios requiring fast delivery and ease of operation, especially for daily life and small payments.

Cash Remittance Services

You can also choose cash remittance services like Western Union, MoneyGram, and Xoom. These services support global cash transfers, allowing recipients to collect USD at local Indian branches. Cash remittance services offer fast delivery, with some completing in minutes. You don’t need a bank account; simply provide the recipient’s identity information to complete the transfer. Cash remittances are suitable for recipients without bank accounts or those needing funds urgently.

Note: Cash remittance services have higher fees and are best used in emergencies or when recipients cannot use bank accounts.

Delivery Speed Comparison

Delivery speed is one of the key factors you consider when choosing a remittance method. Different channels have significant differences in delivery time, affecting your and the recipient’s fund arrangements. You can learn about the delivery speeds of mainstream methods and key factors affecting them below.

Bank Channels

When you make international remittances through licensed Hong Kong banks, delivery speed is typically slower. Bank channels are suitable for large fund transfers but require longer wait times. The table below shows the average delivery times for bank transfers to India:

| Transfer Direction | Average Transfer Time |

|---|---|

| Receiving in India | 1-3 business days |

| Sending from India | 2-4 business days |

Bank channels are heavily influenced by business days, holidays, and transfer initiation time. If you initiate a transfer on non-business days or after business hours, delivery time may be extended. The accuracy of recipient information is also critical, as errors can cause delays.

Online Platforms and Apps

When you choose online platforms and apps, delivery speed is generally faster. Most platforms support delivery within minutes, especially suitable for small and daily remittances. You can refer to the following delivery times:

| Transfer Method | Delivery Time |

|---|---|

| Cash Pickup | Usually within minutes |

| Bank Deposit | Under 50,000: Within minutes |

| Over 50,000: Up to 2 hours |

When using online platforms, you only need to enter recipient account information, and the system will automatically process the transfer. Choosing reputable platforms ensures a faster delivery experience. You can also track remittance progress in real-time, reducing uncertainty during waiting.

Cash Remittance Services

When using cash remittance services, recipients can collect USD at local Indian branches within minutes. Cash remittance services are ideal for recipients without bank accounts or those needing funds urgently. You only need to provide recipient identity information, and the transfer speed is very fast. However, note that some services may experience brief delays during peak times or special holidays.

Tip: When choosing a remittance method, ensure recipient information is accurate, including bank account numbers and IFSC codes. Selecting reputable service providers can effectively improve delivery speed and avoid unnecessary delays.

Key factors affecting delivery speed include:

- Choosing reputable remittance services with a proven track record of fast transfers.

- Accuracy of recipient information, especially bank account and related codes.

- Transfer timing, as business days and holidays affect delivery progress.

- Exchange rate fluctuations, where timely operations can reduce losses due to delays.

You can flexibly choose a remittance method based on your needs and the recipient’s situation, balancing delivery speed and fund security.

Fees and Security

Image Source: unsplash

Fees and Exchange Rates

When choosing a remittance method, fees and exchange rates directly affect the actual amount received. Different channels have distinct fee structures. The table below shows the fee details for common banks and platforms (in USD):

| Bank/Transfer Company | Transfer Fees (USD) | Fee Determinants |

|---|---|---|

| Licensed Hong Kong Banks | $7.5-$15 | Transfer amount |

| Wise | $5-$7 (fixed) + 1.16% | Currency transfer amount |

| Western Union | $0 | None |

| ExTravelMoney | $4-$7 | Transfer purpose |

You need to note that actual exchange rates are typically lower than the mid-market rate shown on Google. Banks and platforms add a profit margin to the exchange rate, which reduces the actual amount received. Additionally, some services charge an 18% GST fee. For large transfers (e.g., over $12,500), a 20% TCS tax may apply, though exemptions exist for education and medical purposes. When choosing a remittance method, pay close attention to all potential hidden fees to ensure funds arrive safely.

Security Measures

When transferring money, security is equally important. Banks and mainstream online platforms implement multiple measures to ensure your funds’ safety:

- Choose trusted financial partners, ensuring they are regulated by the Reserve Bank of India.

- Thoroughly verify recipient information to avoid delays or additional fees due to errors.

- Understand exchange rates and fees, comparing the fee structures of different providers.

- Prioritize official platforms and avoid operations on public Wi-Fi networks.

- Understand regulatory requirements and prepare necessary documents to ensure compliance.

Mainstream platforms also use multi-factor authentication and encryption technology to prevent data breaches. When operating, always verify recipient account information to avoid losses due to errors.

Convenience

Different remittance methods vary in convenience. When processing international remittances through licensed Hong Kong banks, the process is more complex, requiring detailed information and document submission, suitable for large and compliance-driven needs. Online platforms and apps are user-friendly, allowing transfers in just a few steps, ideal for frequent small remittances. Cash remittance services don’t require bank accounts, enabling recipients to collect USD directly at local Indian branches, perfect for those without accounts or needing funds urgently.

When choosing a remittance method, weigh delivery speed, fees, security, and convenience based on your needs and the recipient’s preferences to find the most suitable channel.

Recommendations for Choosing a Remittance Method

When choosing a remittance method, you need to adjust the channel flexibly based on your actual needs and the recipient’s preferences. The best option varies by scenario. Below is a detailed analysis of four common needs to help you make quick decisions.

Fast Delivery

If you need the recipient to receive funds quickly, prioritize virtual wallets, online transfer services, or cross-border UPI. These channels typically complete transfers within minutes to hours, ideal for emergencies or when recipients need funds urgently. Refer to the table below for delivery speeds and features of each channel:

| Transfer Method | Speed | Notes |

|---|---|---|

| Virtual Wallet | Minutes to hours | Convenient and supports multi-currency transactions |

| Online Transfer Service | Minutes to hours | Competitive exchange rates, user-friendly |

| Cross-Border UPI | Minutes to hours | Suitable for NRIs, integrated with UPI features |

When choosing a remittance method, prioritize whether the recipient has a virtual wallet account or a bank supporting UPI. You also need to confirm whether the recipient prefers cash or bank account deposits. This ensures funds arrive quickly and securely.

Tip: For urgent remittances, communicate with the recipient in advance to confirm the most convenient receiving channel and account information.

Low-Cost Priority

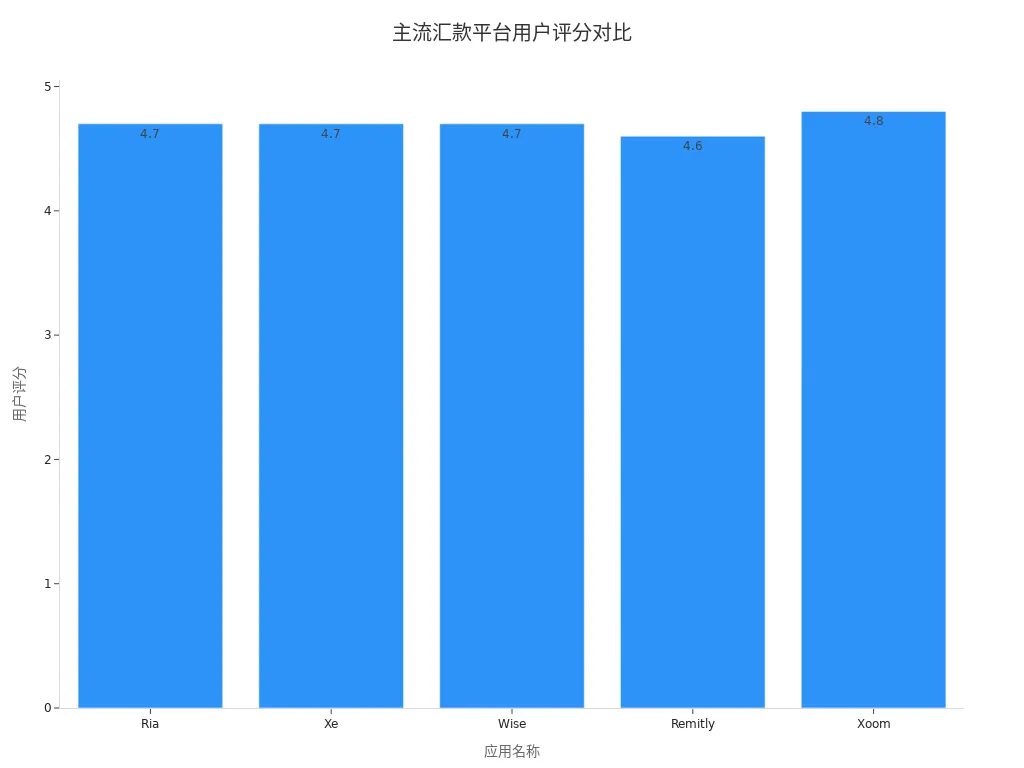

If you prioritize remittance costs, choose platforms like Wise or Remitly. These platforms are known for low, transparent fees and mid-market exchange rates, effectively reducing expenses. Refer to the table below for a comparison of platform fee advantages:

| Platform | Features |

|---|---|

| Wise | Uses mid-market exchange rates, transparent and low fees. |

| Remitly | Supports personal payments from 30 countries to India, with cash pickup options. |

When choosing a remittance method, consider the following platforms:

- Wise: Offers low, transparent fees and mid-market exchange rates, suitable for frequent small or large transfers.

- Remitly: Supports remittances from multiple countries with cash pickup options, ideal for recipients without bank accounts.

Before transferring, compare real-time exchange rates and fees across platforms to select the most cost-effective channel. You can also adjust the remittance method based on the recipient’s needs.

Note: In low-cost scenarios, pay attention to hidden fees and exchange rate changes to maximize the actual amount received.

Security and Compliance

If you need to ensure fund security and compliance, choose licensed Hong Kong banks or regulated international banks for remittances. These banks typically have robust security measures and compliance processes, suitable for large fund transfers. Refer to the table below for the security advantages of different banks and platforms:

| Option | Advantages |

|---|---|

| Licensed Hong Kong Banks | Reliable international remittance services, transparent fund flows, strong compliance. |

| Axis Bank | Reliable international remittance services, fast and convenient transfers, competitive fees and forex rates. |

| Kotak Mahindra Bank | Robust online platform, fast remittances, flexible high-value transfer options. |

| Karbon | Lowest transaction fees in the market, transparent pricing, best forex rates, compliance document management support. |

When choosing a remittance method, prioritize the bank’s exchange rates, transfer fees, processing times, and customer support. You can also focus on the bank’s global forex agent network to ensure funds arrive safely. For large remittances, prepare necessary compliance documents in advance to avoid delays due to incomplete information.

Tip: In security and compliance scenarios, prioritize regulated banks or platforms to ensure the safety of funds and personal information.

Frequent Small Transfers

If you need to make frequent small transfers, choose platforms like Wise, Remitly, or Revolut. These platforms support multi-currency transactions, transparent pricing, and easy operations, suitable for daily life and small payments. Refer to the table below for platform features:

| Platform Name | Features |

|---|---|

| Wise | Transparent pricing, easy to use, ideal for small transfers. |

| Remitly | Fast cross-border payment services, offering instant and economy transfer options. |

| Revolut | Multi-currency support, real-time exchange rates, suitable for global business. |

When choosing a remittance method, prioritize the platform’s ease of operation and real-time exchange rates. You can also select the channel most suitable for both parties based on the recipient’s needs. For frequent small transfers, prioritize platforms supporting automation and bulk operations to improve efficiency.

Note: In frequent small transfer scenarios, regularly compare platform fees and exchange rates to choose the most cost-effective channel long-term.

When choosing a remittance method, consider the recipient’s actual preferences. Communicate in advance to confirm which channel the recipient prefers, whether bank account or cash pickup. You can also adjust the remittance plan based on the urgency, fees, exchange rates, and payment methods required by the platform. This ensures funds reach the recipient securely and quickly.

Tip: Before transferring, communicate with the recipient to prioritize channels convenient for both parties, avoiding delays or extra fees due to mismatched information.

When choosing a method to send money to India, focus on delivery speed, fees, exchange rates, and security. Mainstream platforms like Wise, Remitly, and Xoom offer fast delivery and low fees, while licensed Hong Kong banks are suitable for large amounts and high security needs. The table below compares major channels:

| Remittance Method | Speed | Fees | Exchange Rate | Security |

|---|---|---|---|---|

| Wise | Minutes | Low | Highly competitive | High |

| Remitly | Minutes | Low | Highly competitive | High |

| Xoom | Minutes | Low | Highly competitive | High |

| Bank Transfer | Slower | Higher | Average | High |

You should note the following points:

- Starting October 2023, TCS tax rates under India’s Liberalised Remittance Scheme may increase, and budgets should account for a 1% federal remittance tax.

- Traditional bank international transfers have high fees and average exchange rates, reducing the actual amount received.

- Compare fees and exchange rates across platforms, watch for promotions and hidden fees, and choose the optimal channel.

- Avoid informal channels to prevent fund losses and legal risks.

You can flexibly choose based on transfer amount, delivery urgency, and recipient needs, regularly monitoring platform policies and fee changes to ensure funds arrive safely and efficiently.

FAQ

1. Can I send money to India directly using a mainland China bank card?

You cannot send money to India directly using a mainland China bank card. You can complete transfers through licensed Hong Kong banks or international remittance platforms.

2. What recipient information is needed to send money to India?

You need the recipient’s name, bank account number, IFSC code, and contact information. Accurate information prevents delays.

3. Are online platform remittances secure?

Choosing regulated mainstream platforms ensures fund security. Platforms use encryption technology and multi-factor authentication to protect your account.

4. Are there limits on remittance amounts?

When using legitimate channels, transfer amounts typically have caps. Large transfers require relevant documentation, subject to platform or bank regulations.

5. How do I choose the most suitable remittance method?

You can compare delivery speed, fees, exchange rates, and security. Communicate with the recipient to select a channel convenient for both parties.

Navigating fast remittance options to India often means grappling with steep fees, 1-3 business day bank delays, and exchange rate discrepancies—especially from mainland China, where urgent needs clash with slow traditional channels. BiyaPay delivers a seamless global finance solution to overcome these hurdles. With remittance fees as low as 0.5%, it undercuts Hong Kong licensed banks’ $7.5-15 charges, offering instant conversions across 30+ fiat currencies and 200+ cryptos. Our transparent real-time rates ensure recipients get more, sidestepping the hidden exchange costs some platforms apply.

Sign up in minutes, and BiyaPay enables same-day remittances to India and most global destinations, landing in UPI wallets or bank accounts swiftly—perfect for small daily transfers or significant overseas support. Backed by end-to-end encryption and multi-factor authentication compliant with Reserve Bank of India standards, your funds stay secure. Uniquely, BiyaPay lets you trade US and Hong Kong stocks without an offshore account, with zero-fee contract orders to diversify your portfolio effortlessly.

Take control today with BiyaPay! Check the Real-Time Exchange Rate Query for accurate INR delivery estimates and optimize every transfer. Explore Stocks to kickstart your investment journey. Join BiyaPay now for fast, secure, and cost-effective remittances—make every dollar count!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.