- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Send Money via GCash? A Comprehensive Analysis of Fees, Arrival Time, and Security

Image Source: unsplash

GCash operations are simple, allowing you to securely send funds to Philippine accounts via a mobile app or bank channels. GCash has 81 million active users and 2.5 million merchants, supporting international remittances with low fees and fast delivery. You only need to choose the appropriate remittance method, enter recipient details, and confirm the amount to complete the transfer. Most international remittance services are regulated, ensuring fund safety. You can focus on remittance fees, transfer times, and security, with detailed explanations of each aspect provided below.

Type Number Active Users 81 million Merchants and Sellers 2.5 million

Key Points

- GCash operations are straightforward, allowing users to send international remittances via the app, banks, or third-party platforms, choosing the method that suits them best.

- When transferring via the GCash app, ensure your account is verified and follow the steps to enter information to complete the transfer.

- Pay attention to remittance fees and transfer times, as choosing banks or platforms partnered with GCash can improve delivery efficiency.

- GCash provides multiple security measures; users should set strong passwords and enable two-factor authentication to protect account safety.

- By comparing fees and exchange rates across different channels, you can plan transfer timing and amounts to maximize cost savings.

GCash Operation Process

GCash offers multiple convenient ways to send funds. You can transfer directly via the GCash app, or use bank transfers or third-party platforms for international remittances. The “Cash In” feature on the GCash homepage integrates multiple international remittance partners, making it easy to send funds to Philippine accounts. Below are detailed explanations of three common GCash operation processes.

App Transfer

Using the GCash app for transfers is the most direct method. You need to ensure you have a fully verified GCash account. The verification process involves uploading a government-issued ID (e.g., passport), a selfie, and personal information. The specific steps are as follows:

- Log into the GCash app and go to the profile page.

- Select “Verify Now” and click “Get Started.”

- Read the verification requirements and click “Next.”

- Enter the received identity verification code.

- Provide your birthdate and confirm Philippine citizenship.

- Upload a photo of your ID and take a selfie.

- Review and submit the information.

After completing account verification, you can transfer funds with these steps:

- Open the GCash app and click “Cash In” on the homepage.

- Select an international remittance partner (e.g., Western Union, Moneygram, Wise).

- Enter the recipient’s GCash phone number and transfer amount (in USD).

- Confirm the information is correct and submit the transfer request.

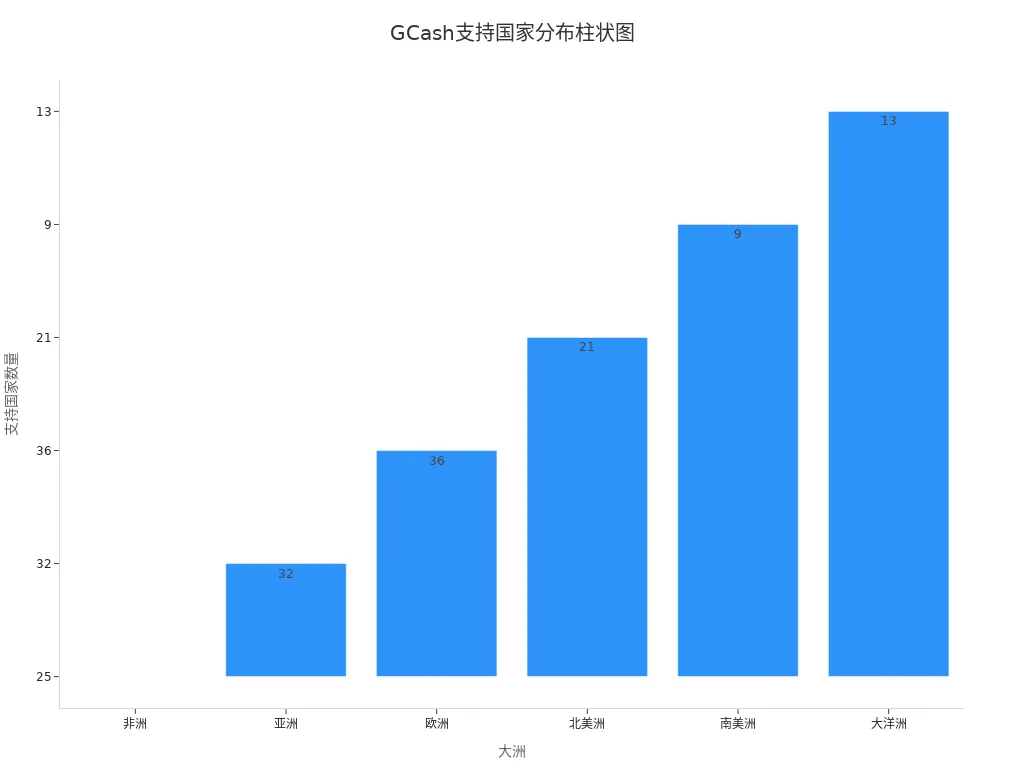

GCash supports remittances from multiple countries and regions globally. The table below shows some supported countries by continent:

| Continent | Example Supported Countries |

|---|---|

| Asia | China, Japan, Singapore, South Korea, Thailand, etc. |

| Europe | UK, Germany, France, Italy, Spain, etc. |

| North America | USA, Canada, Bahamas, etc. |

| Oceania | Australia, New Zealand, Fiji, etc. |

Tip: When transferring via the GCash app, if you encounter issues like insufficient balance, unstable network, or system maintenance, check your balance, restart the app, or try again later. For technical issues, contact GCash customer support for assistance.

Bank Transfer

You can also send funds to a GCash wallet via a bank account. For example, using a licensed Hong Kong bank, the process is as follows:

- Log into your bank account and select the “Transfer” function.

- Choose “Transfer to Other Banks” or “International Remittance.”

- Enter the recipient’s GCash account information (typically the phone number).

- Enter the transfer amount (in USD).

- Review and confirm the transfer.

- Download or save the electronic receipt upon completion.

Some banks also allow linking a bank account directly within the GCash app (e.g., BPI) via the “My Linked Accounts” feature for quick transfers after verification.

Note: Bank transfer delivery times may vary due to bank processing speeds and international clearing processes. Prioritize banks or platforms partnered with GCash to enhance delivery efficiency.

Third-Party Platforms

GCash collaborates with multiple international third-party remittance platforms, facilitating transfers to GCash wallets from around the world. Common partners include Western Union, Moneygram, and Wise. These are typically accessible via the “Cash In” feature on the GCash homepage. You select a partner, enter recipient details and the amount, and complete the transaction.

| Partner Service | Features |

|---|---|

| Western Union | Sends funds directly to GCash wallets |

| Moneygram | Offers competitive fees and exchange rates |

| Wise | No GCash cash-in fees |

Third-party platforms have limits on single and monthly transactions:

| Transaction Type | Limit |

|---|---|

| Maximum Per Transaction | 50,000 PHP per recipient daily (30,000 PHP for first-time transfers) |

| Recipient Monthly Income Limit | 100,000 PHP per recipient monthly |

| Recipient Wallet Limit | 100,000–500,000 PHP per GCash account |

Tip: When using third-party platforms, ensure your international phone number is active to receive one-time passwords (OTPs). Some platforms may charge data fees.

Through these three methods, you can flexibly choose the GCash operation process based on your needs. Whether via app transfers, bank transfers, or third-party platforms, GCash provides a secure and convenient international remittance experience.

Fee Analysis

Image Source: unsplash

Fee Comparison

When operating with GCash, you can choose from multiple remittance channels. Many international remittance providers allow direct transfers to GCash. Fees vary across channels. Some partners offer competitive or zero transfer fees for GCash transactions, while others may charge a small processing fee. GCash itself does not charge recipients for receiving funds, and the full amount sent is credited to their account. You can check specific fees on the GCash app or partner platforms.

- International remittance providers have varying fees

- Some platforms offer zero-fee promotions

- GCash receiving incurs no additional fees

Exchange Rates and Hidden Fees

When sending international remittances, you need to focus on exchange rates and potential hidden fees. GCash uses variable exchange rates, with fees influenced by multiple factors. Platforms like Wise use mid-market exchange rates with more transparent fee structures. The table below compares exchange rate types across providers:

| Remittance Provider | Exchange Rate Type | Notes |

|---|---|---|

| GCash | Variable exchange rate | Fees depend on multiple factors, compare with Wise |

| Wise | Mid-market exchange rate | Transparent fee structure, avoids hidden costs |

GCash wallets and GCash cards incur no foreign exchange fees for international transactions. You only need to focus on the exchange rate at the time of the transaction, and GCash automatically applies the best rate. You can check current forex rates in the GCash app. Some banks charge convenience fees for linked account top-ups, ranging from USD 0.1 to USD 0.5, depending on bank terms.

- Top-up convenience fees vary by bank

- Exchange rates fluctuate with markets, check in advance

Cost-Saving Tips

You can reduce GCash international remittance costs through various methods. Financial experts suggest using stablecoin technology, which can lower transaction costs from 6.5% to 1.95%. Combining blockchain solutions and local market segmentation can reduce settlement times. You can also choose platforms that work with regulators to ensure compliance while lowering fees.

- Use stablecoin technology to reduce fees

- Choose transparent exchange rate platforms to avoid hidden costs

- Prioritize GCash partners for discounts

Before operating with GCash, compare fees and exchange rates across channels, plan transfer timing and amounts, and maximize cost savings.

Transfer Time

Image Source: unsplash

Channel Speeds

When operating with GCash, your primary concern is the speed of fund delivery. GCash domestic transfers in the Philippines are nearly instant, with funds arriving in seconds if both you and the recipient have active GCash wallets. For remittances from Chinese Mainland or other countries to a GCash account, delivery typically takes minutes to hours. The exact speed depends on the chosen remittance service and the sender’s location. Compared to traditional international remittances, which may take days or weeks, GCash offers a highly efficient option.

Tip: You can track remittance progress in real-time via the GCash app or partner platforms to avoid anxiety from long wait times.

Influencing Factors

When using GCash for international remittances, transfer speed is affected by several factors:

- Advances in fintech solutions can accelerate fund processing.

- Blockchain technology adoption enhances real-time transfer capabilities.

- Demand for secure and real-time fund transfers drives platforms to optimize processes.

- High transaction fees may extend processing times for some channels.

- Regulatory compliance requirements can affect cross-border fund flow efficiency.

Your chosen remittance partner, payment method, and transfer amount also impact delivery time. Some platforms may slow down during peak periods, so you should avoid busy times for operations.

Tips for Fast Delivery

To ensure funds arrive quickly, consider these tips:

- Prioritize international remittance platforms partnered with GCash, as they integrate more closely with the GCash system for faster processing.

- Use the GCash app directly to minimize intermediaries and improve delivery efficiency.

- Avoid remitting during international holidays or peak times, opting for business days.

- Ensure the recipient’s GCash account is fully verified to avoid delays due to account issues.

- Check estimated delivery times and fees for each channel in advance to plan transfer amounts effectively.

By choosing the right channel and timing, you can make GCash operations more efficient, ensuring funds arrive quickly and securely.

GCash Operation Security

GCash operations are highly secure. When using GCash, the system employs multiple measures to protect your account and funds. You can enhance security by setting strong passwords, enabling two-factor authentication, and understanding official certifications and encryption technologies. Below is a detailed breakdown of GCash’s account protection, information encryption, and user safeguards.

Account Protection

When registering and using a GCash account, the system automatically activates multiple security measures to prevent unauthorized access. GCash enforces a “1 device, 1 account” policy, allowing only the registered device to access the account, preventing theft by others. The app cannot run on modified, jailbroken, or rooted devices, further reducing risks. You can also use the DoubleSafe feature, a facial recognition-based authentication that ensures only you can access the account, even if your MPIN or one-time password (OTP) is compromised. GCash also uses AI-driven security tools to analyze account activity in real-time, proactively detecting anomalies.

| Security Measure | Description |

|---|---|

| Device Security | GCash app cannot run on modified, jailbroken, or rooted devices. |

| 1 Device, 1 Account Policy | Only the registered device can access the account, preventing unauthorized use. |

| DoubleSafe | Uses facial recognition to enhance identity verification security. |

| AI Security Tools | Real-time analysis of account behavior to detect risks and anomalies. |

You can further enhance account security with these steps:

- Open the GCash app, go to the profile or settings page, and find the “Security” option.

- Enable biometric login (e.g., fingerprint or facial recognition).

- Verify your phone number to ensure SMS OTP receipt.

- Complete a small test transaction to confirm the OTP process works correctly.

GCash recommends setting a strong password with letters, numbers, and symbols, and configuring security questions. You can store passwords in an encrypted password manager to avoid leaks.

Tip: You can combine three authentication methods to protect account security: passwords or PINs (something you know), SMS OTP or authentication apps (something you have), and biometrics (something you are).

Information Encryption

During GCash operations, all personal and transaction data are protected by advanced encryption technology. GCash uses end-to-end encryption, ensuring data remains secure during transmission and storage, even on public networks. GCash also employs the latest security protocols and technologies to prevent fraud and unauthorized transactions. You can ensure every transaction is secure with two-factor authentication and end-to-end encryption.

All GCash transactions are protected by end-to-end encryption, ensuring secure and reliable fund transfers between you and the recipient.

GCash has obtained multiple international security certifications to safeguard your data privacy:

| Certification Name | Description |

|---|---|

| ISO/IEC 27001 | Globally recognized information security management standard, GCash systematically manages sensitive data. |

| ISO/IEC 27701 | Focuses on personal data protection, compliant with Philippine Data Privacy Act and EU GDPR. |

GCash is the first fintech company in the Philippines to receive dual ISO certifications for information security and privacy management. These certifications reflect GCash’s commitment to security, transparency, and trust, serving over 94 million users. GCash continues to pursue global best security practices to enhance user experience.

User Safeguards

When operating with GCash, if you encounter fraud or unauthorized transactions, GCash provides multiple safeguards. GCash’s Send Money Protect service protects users from social engineering, account takeovers, and online shopping fraud, offering up to USD 270 (approximately PHP 15,000) in transaction protection per user for 30 days, covering fund transfers and payments made via GCash.

| Protection Policy | Coverage |

|---|---|

| Send Money Protect | Protects against social engineering, account takeovers, and online shopping fraud. |

| Insurance Amount | Up to USD 270 (PHP 15,000), valid for 30 days. |

| Scope | Applies to GCash fund transfers and payments. |

You should remain vigilant against common scam types, such as fake websites and phishing links. GCash’s official recommendations include:

- Check that URLs start with “HTTPS” to ensure you’re visiting secure websites.

- Keep browsers and apps updated for the latest security protections.

- Be cautious of links received via SMS or email, and avoid clicking them.

- Use mainstream search engines to check website reviews and avoid scam traps.

Reminder: GCash will never request your password, OTP, or sensitive personal information via phone, SMS, or email. Contact official GCash customer support immediately if you encounter suspicious activity.

By adopting these measures, you can significantly enhance the security of GCash operations. With good security habits and official protection tools, you can confidently enjoy the convenience and efficiency GCash offers.

You can experience efficient, low-cost, and secure international remittance services with GCash. Many users praise GCash’s simple interface, convenient process, and high security. You can choose bank transfers, third-party platforms, or app operations based on your needs to flexibly address various scenarios.

GCash supports real-time international remittances, allowing you to quickly complete fund transfers from Chinese Mainland or other countries. By linking valid payment methods, you can convert USD to PHP with competitive exchange rates and low fees.

| Service Type | Fee Comparison |

|---|---|

| GCash | More cost-effective |

| Traditional Remittance Services | Higher fees |

Over the next five years, the digital remittance market will continue to grow, and platforms like GCash will keep optimizing services. By planning remittance channels and timing wisely, focusing on fees and delivery speed, you can save money and securely complete international remittances. As an international remittance tool, GCash helps you connect globally, enhancing fund transfer efficiency.

FAQ

How long does a GCash international remittance take to arrive?

When remitting through GCash partner platforms, funds typically arrive in minutes. Some bank channels may take hours. You can track progress in real-time via the GCash app.

Tip: Peak periods or holidays may delay delivery.

How much are GCash international remittance fees?

When using GCash partner platforms, fees are generally below USD 5. Some platforms offer zero-fee promotions. You can check specific fees before sending.

| Channel Type | Fee Range |

|---|---|

| Partner Platforms | USD 0-5 |

| Bank Transfers | USD 1-10 |

How to ensure GCash account security?

You can set a strong password and enable two-factor authentication. GCash uses end-to-end encryption and AI security tools to protect your account and funds. Contact official customer support if you encounter suspicious information.

Does a GCash account require real-name verification?

You need to complete real-name verification to send and receive funds. Upload ID documents and a selfie, and the system will activate full features after review.

Which countries does GCash support for remittances?

You can send money to GCash from Chinese Mainland, the USA, UK, Japan, and many other countries. GCash partners with international platforms, covering Asia, Europe, North America, and Oceania.

When navigating GCash for international remittances, you might encounter frustrations like fluctuating fees, opaque exchange rates, and delays in fund arrival—challenges that often make cross-border transfers cumbersome and costly. What if a platform offered a total fee as low as 0.5% (covering the entire remittance process), enabling seamless swaps between 30+ fiat currencies and 200+ digital assets, while supporting same-day delivery to most countries worldwide? This could transform your experience entirely.

BiyaPay was created precisely for this purpose. As a leading digital financial services platform, we offer real-time exchange rate checking and currency conversion features to help you lock in the best rates and avoid hidden costs. Whether you’re sending money to a GCash account in the Philippines or handling other global transfers, simply complete a quick registration in minutes to enjoy an efficient and secure experience. Our system supports multi-layer encryption and operates under strict compliance regulations, ensuring every transaction is reliable and secure.

Take the first step now! Check out our real-time exchange rates to plan your next transfer. Sign up for a BiyaPay account today and unlock low-cost, instant-arrival remittances that make global money movement effortless.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.