- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to Wise International Remittance: Amount Limits, Fee Structure, and Transaction Cancellation Process

Image Source: pexels

When using Wise for international remittance, you typically focus on three main concerns. Regarding amount limits, you can refer to the table below to understand the maximum limits for different currencies (priced in USD):

| Currency | Minimum Transfer Limit | Maximum Transfer Limit (USD) |

|---|---|---|

| CNY | N/A | 13,800 |

| USD | N/A | N/A |

| EUR | N/A | N/A |

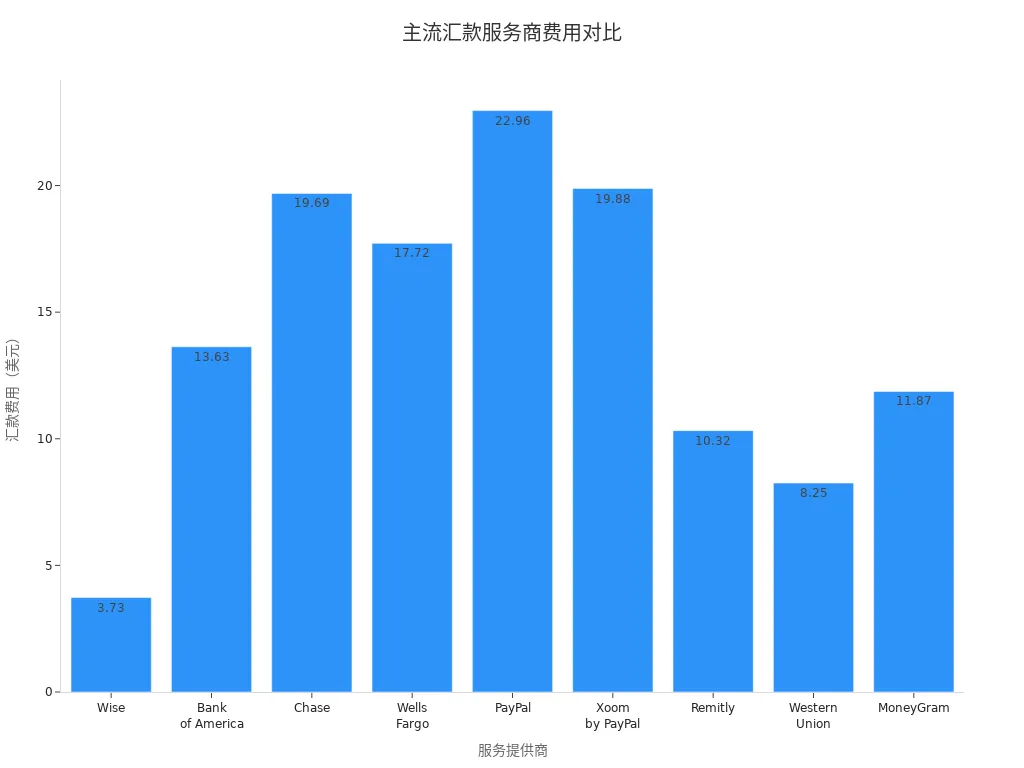

In terms of fee structure, Wise’s transaction fees are significantly lower than other mainstream providers. The chart below shows a fee comparison for sending USD 500:

The transaction cancellation process is also very clear. You can receive a refund within different timeframes depending on the payment method:

| Payment Method | Refund Time (Business Days) |

|---|---|

| Credit or Debit Card | Up to 10 |

| Bank Transfer | 0-3 |

| Wise Balance | Instant |

| Other Payment Methods | Varies by currency |

You can use this international remittance guide to quickly make transfer decisions, saving time and costs.

Key Points

- Wise’s single transaction limit can reach up to USD 1,000,000, suitable for large transfer needs.

- Wise’s fees are transparent, typically ranging from 0.35% to 1%, and you can estimate costs using the fee calculator.

- When canceling a transaction, as long as the status is “processing,” you can cancel directly in the app or website, with refund times depending on the payment method.

- Wise uses the mid-market exchange rate, ensuring no hidden fees and accurate received amounts.

- For large transfers, prepare proof of fund source in advance to ensure compliance and smooth processing.

International Remittance Guide: Amount Limits

Image Source: pexels

Single Transaction Limits

When using Wise for international remittances, you first need to focus on single transaction limits. Different payment methods have different default and maximum limits. The table below shows the limits for common payment methods (in USD):

| Payment Type | Default Limit | Maximum Limit |

|---|---|---|

| Chip and PIN | 1,000 | 2,000 |

| Magnetic Stripe | 1,000 | 1,500 |

| Apple/Samsung/Google Pay | 200 | 400 |

| Online Payment | 1,000 | 2,000 |

| ATM Withdrawal | 250 | 1,000 |

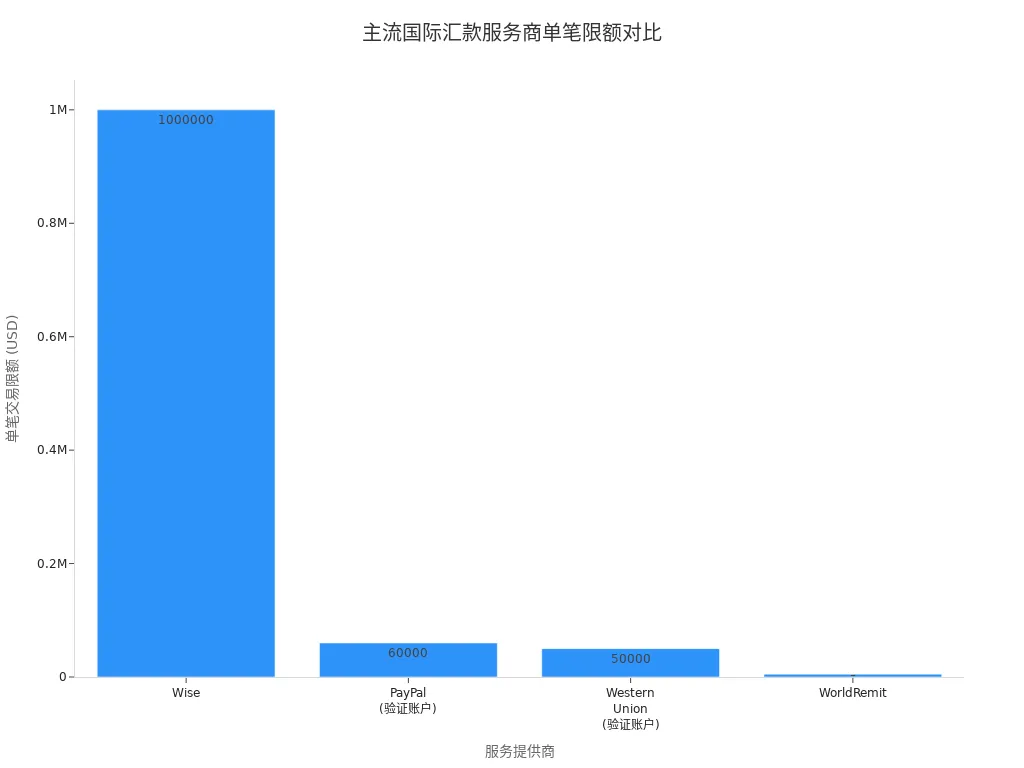

You can use a licensed Hong Kong bank account for Wise international remittances, which typically allows higher single transaction limits. The Wise platform’s overall single transaction limit can reach USD 1,000,000, far exceeding other major international remittance providers. The table below compares single transaction limits across different providers:

| Service Provider | Single Transaction Limit |

|---|---|

| Wise | 1,000,000 USD |

| PayPal | 60,000 USD |

| Western Union | 50,000 USD |

| WorldRemit | 5,000 USD |

When processing large transfers, you can prioritize the Wise platform to benefit from higher single transaction limits. This international remittance guide recommends confirming the recipient bank’s receiving capacity before transferring to avoid rejections due to excessive amounts.

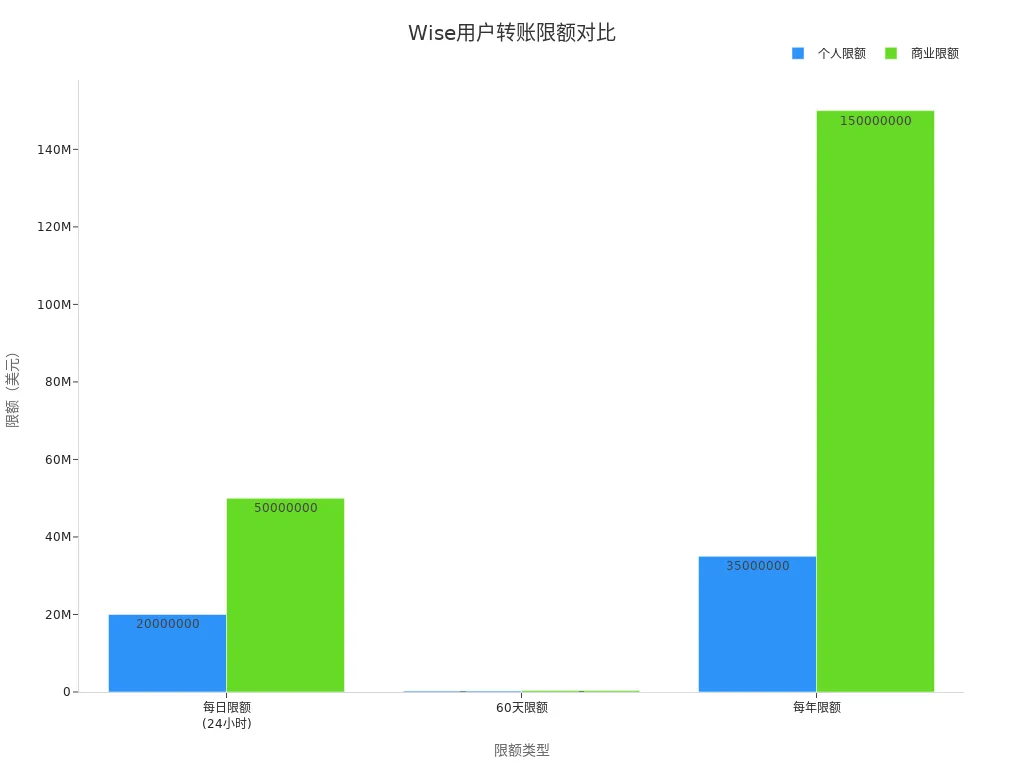

Daily/Annual Limits

Wise also has clear regulations on daily and annual remittance totals. You can refer to the table below to understand limits for personal and business users (in USD):

| Type | Per Transaction/Daily Limit | 60-Day Limit | Annual Limit |

|---|---|---|---|

| Personal Users | 20,000,000 | 250,000 | 35,000,000 |

| Business Users | 50,000,000 | 400,000 | 150,000,000 |

When using a licensed bank account in mainland China or Hong Kong for international remittances, you should plan your annual fund flows in advance. If you have large transfer needs, you can split transfers to avoid exceeding limits at once. This international remittance guide reminds you that Wise automatically detects and restricts daily and annual remittance totals based on different countries’ regulatory requirements.

Special Cases

When you need to transfer funds exceeding the limits, Wise will require you to provide proof of fund source. You can prepare relevant documents based on the type of fund source. Common cases include:

- Property Sales: Final sales contract excerpts, lawyer or auditor letters, bank statements, etc.

- Salary Income: Recent pay stubs, contract salary sections, employer letters, three months of bank statements, etc.

- Investment Income: Investment certificates or contract details, confirmation letters from investment companies or banks, bank statements, etc.

- Inheritance: Will copies, court documents, lawyer letters, bank statements, etc.

- Loan Funds: Loan agreement excerpts, loan statements, bank statements, etc.

- Other Sources: Letters signed by lawyers or accountants, written confirmations from payers, bank statements, etc.

This international remittance guide recommends preparing relevant proof documents in advance when submitting large transfer applications. Wise will review your materials to ensure compliance and security based on regulatory requirements. When processing international remittances through licensed Hong Kong banks, you must also comply with local financial regulations.

As a globally compliant international remittance platform, Wise is regulated by the UK Financial Conduct Authority (FCA) and the U.S. Financial Crimes Enforcement Network (FinCEN). When using Wise, the platform will periodically require you to update proof of fund source to ensure transaction security.

Fee Structure

Image Source: unsplash

Transaction Fees

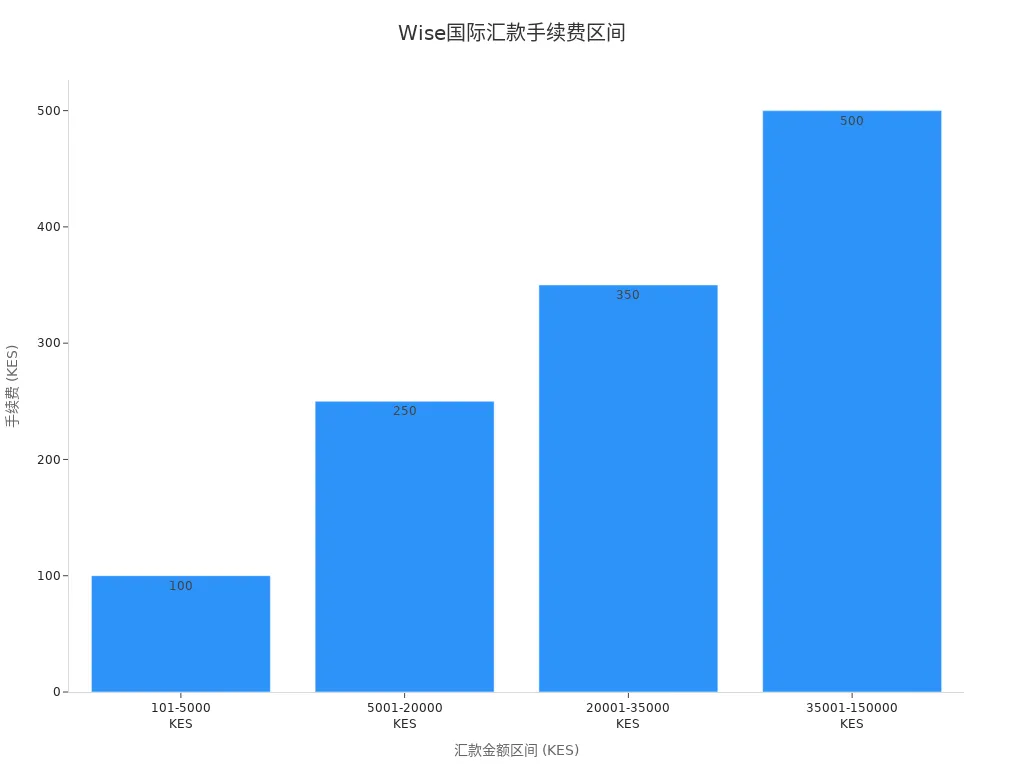

When using Wise for international remittances, transaction fees are one of your primary cost concerns. Wise charges fees based on a percentage of the transfer amount, typically ranging from 0.35% to 1%. Fees vary depending on the transfer amount, payment method, and destination country. You can refer to the table below to understand fees for different transfer amount ranges (in USD):

| Minimum Payment Amount (USD) | Maximum Payment Amount (USD) | Fee (USD) |

|---|---|---|

| 0.7 | 35 | 0.7 |

| 35.01 | 140 | 1.75 |

| 140.01 | 245 | 2.45 |

| 245.01 | 1,050 | 3.5 |

When using a licensed Hong Kong bank account for Wise international remittances, fees vary depending on the payment method. Paying with a Wise account is typically the cheapest option. If you choose a credit or debit card, fees will be slightly higher. You can use Wise’s fee calculator before transferring to estimate fees and avoid unexpected costs.

When processing, the fee structure is highly transparent. Wise does not charge hidden fees. You can clearly see the specific costs for each international remittance.

This international remittance guide recommends comparing fees for different payment methods before transferring to choose the most cost-effective option.

Exchange Rates

When making international remittances, exchange rates directly affect the received amount. Wise uses the mid-market exchange rate, which is the midpoint between the buy and sell prices in the global currency market. This rate is considered the “true” exchange rate. Wise does not add any hidden fees to the exchange rate. You can rest assured that the exchange rate is completely open and transparent.

- Wise uses the mid-market exchange rate for international remittances.

- This rate is the midpoint between the buy and sell prices in the global currency market.

- Wise does not add any additional fees to this rate.

You can check the exchange rate in real-time before transferring to ensure the received amount is accurate. This international remittance guide reminds you that some banks may charge additional fees during the receiving process, but Wise itself does not add markups to the exchange rate.

Fee Transparency

Wise places a high emphasis on fee transparency. Before confirming a transfer, you can use the real-time pricing and fee calculator to clearly understand all fees. The table below shows Wise’s fee transparency measures:

| Measure | Description |

|---|---|

| Real-Time Pricing | Wise provides real-time pricing information, ensuring you know the fees before transferring. |

| Fee Calculator | You can use the fee calculator to estimate transfer costs, increasing transparency. |

| Fees Aligned with Service Costs | Wise’s pricing model aligns with actual service delivery costs, ensuring reasonable fees. |

When using Wise for international remittances, every step includes detailed fee explanations. You don’t need to worry about hidden costs. This international remittance guide recommends fully utilizing Wise’s fee calculation tools before transferring to ensure every fund flow is clear and manageable.

When operating with a licensed Hong Kong bank account, you can also benefit from Wise’s fee transparency. You can choose the optimal remittance plan based on your needs, avoiding additional expenses due to unclear information.

Transaction Cancellation Process

Cancellation Conditions

When using Wise for international remittances, you may need to cancel a transaction. As long as your transfer status shows “Your money is being processed,” you can usually cancel the transfer directly. If you see the “Cancel Transfer” button on the Wise website or app, it means you can proceed with cancellation. If the button is not visible, you need to contact Wise customer service for assistance with cancellation.

Tip: In some cases, if the transfer has entered the bank’s processing flow, Wise cannot cancel it directly. You will need to provide relevant information for Wise to assist with further processing.

Operational Steps

You can easily cancel an international remittance through the Wise website or mobile app. The specific steps are as follows:

- Log into your Wise account and go to the homepage.

- Find the transfer you want to cancel in the activity list.

- Click on the transfer and select the “Cancel Transfer” button.

- Follow the on-screen prompts to confirm the cancellation.

If you are using a licensed Hong Kong bank account for Wise remittances, the cancellation process follows the same steps. Wise will process your cancellation request promptly based on your actions.

It’s recommended to double-check recipient information and amounts before transferring to avoid cancellations due to errors.

Refund Details

After completing the cancellation, Wise will refund the paid funds to your original payment account. Refund times depend on your payment method:

- Wise Balance Payment: Refunds are typically instant.

- Bank Transfer: Generally arrives within 2-5 business days.

- Credit or Debit Card Payment: May take up to 10 business days.

- Other Payment Methods: Specific arrival times vary by currency and bank.

If you haven’t received your refund after 10 business days, it’s recommended to contact Wise customer service promptly to check the refund progress.

Wise arranges refunds based on different banks’ processing speeds. When operating with a licensed bank account in mainland China or Hong Kong, actual refund times may vary slightly. Please be patient and keep relevant transaction records for reference.

Advantages and Considerations

Main Advantages

When choosing Wise for international remittances, you can experience several significant advantages. Wise is known for its speed, low fees, and high transparency, earning high praise from global users.

- Wise focuses on improving transfer efficiency. Many users report that international remittances arrive much faster than with traditional banks.

- Wise’s fee structure is simple and clear. You can see all fees before transferring, avoiding hidden costs.

- Wise uses the mid-market exchange rate, ensuring you get the true rate. Users generally find Wise highly transparent in fees and exchange rates.

- Wise processes over GBP 145 billion in international transfers annually for more than 15 million customers. Many users appreciate its speed and cost savings.

- Wise’s product interface is simple and user-friendly. You can easily complete account setup, payments, and inquiries, making the process efficient and convenient.

- Wise saved users approximately GBP 2 billion in fees in the 2025 fiscal year. Many users recognize its low-cost advantage.

If you need frequent international remittances, Wise can help you save significant time and costs. Both individual and business users can enjoy an efficient and transparent service experience.

Considerations

When using Wise for international remittances, you should also be aware of some practical issues:

- When collaborating with international clients, you may encounter language barriers and cultural differences. These factors can sometimes affect communication efficiency and project progress.

- Business practices and working styles vary across countries. You need to adapt to these differences to ensure smooth collaboration.

- International payments involve multiple currencies and payment methods. You may face some operational complexity and potential transaction fees when managing funds.

- Wise is more suitable for small businesses, international contractors, and global teams. If you need batch payments or to manage multiple international invoices, Wise’s batch transfer feature can significantly improve efficiency.

- When operating with a licensed bank account in China/mainland China or Hong Kong, you should understand local regulatory requirements in advance to ensure compliance.

It’s recommended to fully understand Wise’s fee structure and limit policies before transferring. You can choose the most suitable remittance plan based on your needs to improve fund management efficiency.

Wise offers high limits, low fees, and flexible cancellation processes. You can manage international remittances securely. Wise employs industry-standard security measures to protect your account and data:

| Evidence Type | Details |

|---|---|

| Compliance | Wise is registered with FinCEN in the U.S. and holds multi-state money transmission licenses. |

| Data Protection | All information inputs are protected, strictly complying with legal requirements. |

| Privacy Policy | Information is shared only when necessary, safeguarding your privacy. |

| Secure Storage | Financial and customer data are securely stored, and payment information is not shared with recipients. |

| Industry-Standard Security | Uses industry-grade security measures to ensure customer information safety. |

Common questions when using Wise include:

- Why was my transfer canceled?

- Does canceling a transfer incur additional fees?

- How long does a refund take?

- Which currencies can I send and receive?

- What documents are needed for large transfers?

You can make quick remittance decisions based on your needs, enjoying a safe, transparent, and efficient international remittance experience.

FAQ

Which currencies does Wise support for international remittances?

You can send and receive multiple mainstream currencies through Wise, including USD, EUR, GBP, AUD, and more. You can check the full currency list on Wise’s official website before transferring.

Does canceling a transfer incur additional fees?

When you cancel a transfer, Wise does not charge extra fees. The refunded amount equals the original amount paid. You don’t need to worry about hidden costs.

What proof is needed for large transfers?

For large transfers, Wise requires proof of fund source. You can prepare documents like pay stubs, bank statements, or contracts to ensure compliance.

How long does a Wise international remittance typically take?

When using Wise, remittances typically arrive within 1-2 business days. Delivery times vary by payment method. You can check the estimated time on the transfer page.

What should I do if recipient information is entered incorrectly?

If you notice incorrect recipient information, you can cancel the transaction before it’s completed. You need to reinitiate the transfer with correct information to ensure fund safety.

When using Wise for international remittances, you may value its high limits (up to $1M per transaction), low fees (0.35%-1%), mid-market rates without markups, and clear refund processes (instant for balance payments), yet face challenges: large transfers require source-of-funds proof, adding complexity; some banks charge extra fees; refunds can take up to 10 days; and 60-day limits ($250,000 for individuals) may constrain frequent transfers—especially amid Wise’s 2025 handling of £145B in transactions, amplifying costs and delays for active cross-border users.

BiyaPay stands out as a premier cross-border finance platform, addressing these issues comprehensively. Our real-time exchange rate query delivers instant mid-market rates to eliminate markups. With fees as low as 0.5%, it supports conversions across 30+ fiat currencies and 200+ digital assets, covering multiple global destinations with same-day delivery. Uniquely, BiyaPay’s single platform supports direct US and Hong Kong stock trading without separate overseas accounts, with zero fees on contract orders, seamlessly turning remittances into investment opportunities. Licensed under US MSB and equivalents, fortified by 256-bit encryption and real-time fraud detection for unmatched compliance and security.

Sign up at BiyaPay today for low-rate, rapid transfers and integrated investing, elevating your international remittances to greater efficiency and safety!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.