- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Long Does Zelle Transfer Take? Analysis of Fund Arrival Time, Fees, and Security

Image Source: unsplash

You may be wondering how long a Zelle transfer takes. Zelle’s biggest advantage is its speed. After you initiate a transfer, the recipient typically receives the funds within minutes. Compared to other mainstream transfer services, Zelle’s speed is noticeably faster:

| Service | Transfer Speed |

|---|---|

| Zelle | Arrives within minutes |

| Venmo | 1-3 business days (standard transfer) |

You also need to pay attention to fees and fund security to ensure every operation is worry-free.

Key Points

- Zelle transfers typically arrive within minutes, ideal for scenarios requiring fast transfers.

- Using Zelle for personal transfers generally incurs no fees, helping you save on fund management costs.

- Ensure the recipient is registered with Zelle and uses the correct contact information to avoid transfer delays.

- Zelle provides multiple security measures, but users should be cautious and avoid transferring to strangers.

- Understand each bank’s transfer limits and choose a bank account that suits your needs.

How Long Does a Transfer Take?

Image Source: pexels

One of the main concerns when using Zelle is how long a transfer takes. Zelle is known for its fast delivery, especially suitable for scenarios requiring instant transfers. You can learn about delivery speeds in different situations and potential reasons for delays below.

Instant Delivery

If the recipient is already registered with Zelle, funds typically arrive within minutes after you initiate the transfer. You don’t need to wait for bank processing cycles or worry about delays from interbank transfers. Many licensed Hong Kong banks operating in the U.S. market also support Zelle, making it convenient for quick transfers between family or friends.

You can refer to the table below to understand delivery times based on the recipient’s status:

| Recipient Status | Transfer Time |

|---|---|

| Registered Zelle User | Usually completes within minutes |

| Unregistered Zelle User | May take up to 2 business days after registration |

As long as you ensure the recipient has registered with Zelle using the correct email address or phone number, funds will arrive quickly. In most daily scenarios, you’ll experience the convenience of transfers arriving in minutes. You’ll find that Zelle performs exceptionally well in terms of how long a transfer takes.

Delivery Delays

Although Zelle transfers are typically fast, delays may occur in specific situations. You might encounter the following scenarios:

- Bank holds

- Incorrect recipient information

- Verification checks

- Recipient registration status

If the recipient hasn’t registered with Zelle, your transfer will be held until they complete registration. You also need to note that the recipient must register with the email address or phone number you provided; otherwise, the transfer may be delayed or blocked. When operating, always double-check recipient information to avoid delays due to errors.

In practice, you’ll find that how long a transfer takes depends not only on system speed but also on the recipient’s registration status and information accuracy. By communicating in advance to ensure the recipient is registered with correct details, you can improve delivery efficiency.

When choosing Zelle, you should understand these delivery time details to plan your fund movements effectively. With this knowledge, you can better handle various transfer scenarios and enjoy Zelle’s efficient experience.

Fees

Is It Free?

One of your main concerns when using Zelle is whether fees are required. One of Zelle’s biggest advantages is that it doesn’t charge transfer fees for personal or business users. You can refer to the table below to understand different banks’ fee policies:

| Bank | Fee Policy |

|---|---|

| Licensed Hong Kong Banks | Free for sending, requesting, and receiving funds |

| U.S. Mainstream Banks | Sending and receiving funds usually free |

When using Zelle in the U.S. market, whether through licensed Hong Kong banks or U.S. local banks, you can generally enjoy free transfer services. You don’t need to pay extra fees for each fund movement, significantly reducing your fund management costs. In contrast, PayPal typically charges 2.9% plus $0.30 for personal transactions in the U.S. market, and Cash App’s instant transfers incur 0.5% to 1.75% fees. By choosing Zelle, you can effectively save on fee expenses.

Other Potential Fees

Although Zelle itself doesn’t charge fees, you should note that some banks may have their own fee policies. Before using, it’s best to review your bank’s specific terms to ensure no hidden fees. Zelle doesn’t support international transfers; it’s limited to transactions between U.S. bank accounts. If you attempt an international remittance via Zelle, the system will automatically block the operation.

Tip: When using Zelle, always check your bank’s terms to avoid unexpected fees due to special services or account types.

In daily life, choosing Zelle for transfers typically avoids fee issues. However, if you need higher limits or special services, consult your bank’s customer service in advance to ensure smooth fund movements without additional costs. By understanding these details, you can better plan your fund management.

Security

Image Source: pexels

Platform Protections

When using Zelle, you can feel the platform’s multiple layers of security. Zelle is owned and operated by several major U.S. banks with advanced security systems. Each time you initiate a transfer, the system performs identity verification and monitors account activity in real-time. If anomalies are detected, the platform automatically flags them and takes action to reduce risks.

- Zelle uses two-factor authentication (2FA), requiring secondary verification during login or operations to effectively prevent unauthorized account use.

- Banks regularly monitor your account and transaction history to help you detect suspicious activity promptly.

- Zelle’s payment process involves direct bank-to-bank transfers, with funds not passing through third-party accounts, reducing the risk of interception or tampering.

When using Zelle, the platform reminds you to carefully verify the recipient’s email or phone number to ensure accuracy and avoid transfer errors.

You need to note that Zelle transfers are irreversible once completed. The platform doesn’t offer purchase protection, so it’s best to transfer only between trusted individuals. This maximizes your fund security.

User Precautions

While enjoying Zelle’s convenience, you should actively take steps to protect your account and funds. You can enhance security in the following ways:

- Transfer only to people you know and trust. If you wouldn’t give someone cash in person, don’t transfer via Zelle.

- Enable two-factor authentication to add an extra layer of account security.

- Regularly check bank statements and Zelle transaction records, contacting your bank or Zelle support promptly if anomalies are found.

- Verify recipient information before transferring to prevent losses due to errors.

You should also be wary of common scams. For example, someone may impersonate a friend or family member, claiming an emergency need for funds. Others may exploit emotional relationships to gain your trust and induce transfers. Some scammers even pose as bank staff, sending fake emails or texts to trick you into clicking malicious links.

- Zelle payments are instant and irreversible, and scammers may exploit this feature.

- If your phone is lost, criminals may attempt to initiate transfers through your account.

- Common risks include impersonation scams, romance scams, and bank fraud.

When using Zelle, always protect your account information and avoid sharing verification codes or passwords. If you encounter suspicious activity, pause operations immediately and contact your bank.

By understanding platform protections and taking user precautions, you can significantly enhance Zelle transfer security. This allows you to enjoy a fast and convenient transfer experience with greater peace of mind.

Limits

When using Zelle for transfers, you must understand per-transaction and daily limits. Different banks have varying Zelle limit policies, directly affecting the amount you can transfer each time. If you plan large transfers, check your bank’s specific policies in advance.

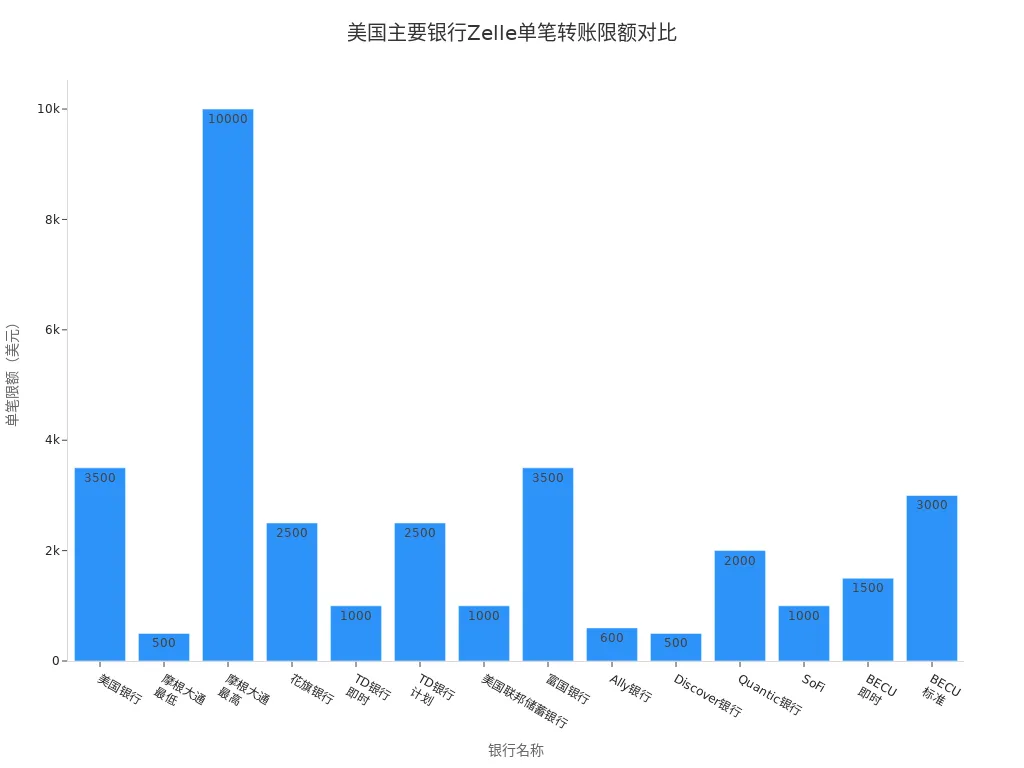

Per-Transaction Limits

Each Zelle transfer is subject to the bank’s per-transaction limit. Most U.S. mainstream banks and licensed Hong Kong banks operating in the U.S. set per-transaction limits between $500 and $3,500. Some banks adjust limits dynamically based on your account type or transaction history. You can refer to the table below for per-transaction transfer limits of major banks:

| Bank Name | Per-Transaction Limit |

|---|---|

| Bank of America | $3,500/day |

| JPMorgan Chase | $500–$10,000/day |

| Citibank | $2,500 |

| TD Bank | $1,000–$2,500 |

| U.S. Bank | $1,000/day |

| Wells Fargo | $3,500/day |

| Ally Bank | $600/day |

| Discover Bank | $500/transaction |

| Quantic Bank | $2,000/day |

| SoFi | $1,000/day |

You can see significant variations in limits across banks. Some banks also adjust limits based on account age, such as Citibank imposing lower limits for new accounts.

When operating, always choose a bank account that matches your needs. If you need higher per-transaction limits, consider contacting your bank’s customer service to explore options for increasing limits.

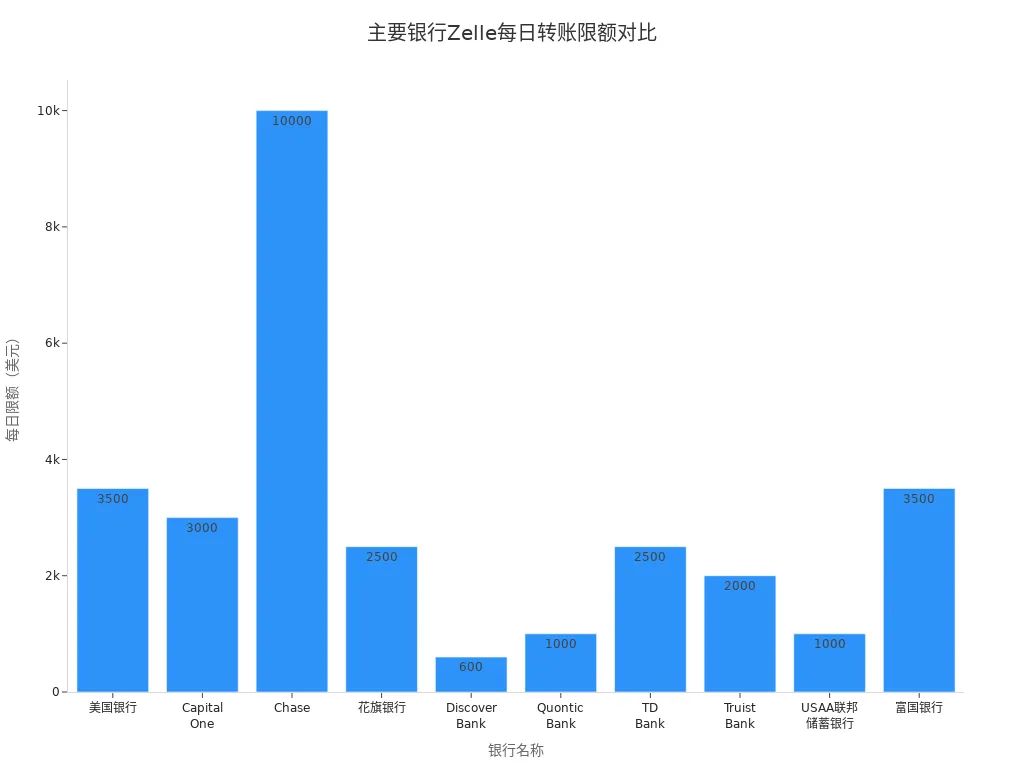

Daily Limits

In addition to per-transaction limits, your total daily Zelle transfers are also capped. Most banks set daily limits between $1,000 and $3,500. Some banks dynamically adjust daily limits based on account tier or transaction history. You can refer to the table below for daily and monthly limits of major banks:

| Bank | Daily Zelle Transfer Limit | Monthly Zelle Transfer Limit |

|---|---|---|

| Bank of America | $3,500 | $20,000 |

| Capital One | $3,000 | Not disclosed |

| Chase | $500–$10,000 | Not disclosed |

| Citibank | $2,500 | $15,000 |

| Discover Bank | $600 | Not disclosed |

| Quontic Bank | $1,000 | Not disclosed |

| TD Bank | $1,000–$2,500 | $5,000–$10,000 |

| Wells Fargo | $3,500 | $20,000 |

You can view a visual comparison of daily limits for major U.S. banks in the chart below:

When choosing a bank and account, consider your funding needs and transfer frequency. If you require frequent large transfers, opt for a bank account with higher daily limits. You can also communicate with your bank to explore possibilities for increasing limits.

Tip: Zelle’s limits are typically lower than platforms like Venmo, which allows per-transaction limits up to $25,000, while most Zelle banks have much lower caps. When planning fund movements, consider platform limit differences and choose the most suitable transfer method.

Registration Process

Steps

When you want to use Zelle for transfers, you first need to complete registration. The process is very simple. You can follow these steps:

- Confirm whether your bank supports Zelle services. Many licensed Hong Kong banks in the U.S. market have integrated Zelle. You can find the Zelle option in your bank’s mobile app or website.

- Open your bank’s mobile app and select the Zelle feature. You need to register with a U.S. phone number or email address. The system will require you to agree to relevant terms.

- After registration, you can add recipients directly through the bank app. Enter the recipient’s U.S. phone number or email address.

- Enter the dollar amount you want to transfer and double-check the information. Once confirmed, initiate the transfer. If the recipient is registered with Zelle, funds will arrive within minutes.

During registration, you can only link U.S.-based checking or savings accounts. Some banks also support Zelle registration through online banking websites. The entire process requires no complex documents and can be completed in minutes.

Linking Accounts

After registering with Zelle, you need to link your bank account to Zelle to send and receive funds smoothly. Most banks automatically link your primary account to Zelle. If you have multiple accounts, you can select which account to link within the app.

If you transfer to an unregistered Zelle recipient, the system will automatically send an SMS or email notifying them. The notification will inform the recipient that you’ve sent funds and include simple registration instructions. The recipient just needs to follow the prompts to complete registration to receive your transfer. If the recipient doesn’t register within 14 days, the funds will automatically return to your account.

When operating, communicate with the recipient in advance to ensure they’ve completed Zelle registration. This avoids delays in delivery due to registration issues. By understanding the registration and linking process, you can use Zelle more efficiently for fund management.

Usage Methods

Transfer Operations

When using Zelle for transfers, the process is very straightforward. Whether through licensed Hong Kong banks or U.S. local bank mobile apps, you can complete operations quickly. Just follow these steps:

- Log in to your bank’s mobile app and find the “Pay & Transfer” or similar feature.

- Select the Zelle® service.

- Click “Send” to enter the transfer page.

- Select or add a recipient, entering their email address or U.S. phone number.

- Enter the dollar amount you want to transfer.

- Click “Review” to verify all information.

- Once confirmed, click “Send” to complete the transfer.

During the process, the system will prompt you to verify recipient information. Many banks also perform account verification when adding a recipient for the first time to ensure fund security. In just a few steps, you can achieve a fast delivery experience within minutes.

Tip: When adding a recipient, always use the email or U.S. phone number they registered with Zelle to avoid delivery delays due to mismatched information.

Information Entry

When filling out transfer information, pay special attention to details. Many users make common mistakes during the process, which can affect delivery speed or cause transaction failures. You can refer to the following precautions:

- Ensure your Zelle account is verified. An unverified account may affect bank account linking and automatic payment functions.

- Check your account balance to ensure sufficient funds for the transfer. Insufficient funds can lead to transaction failure, and some banks may charge additional fees.

- Regularly update your account information. If you change banks or debit cards, update the details in Zelle promptly.

- Carefully verify payment details, including amount and frequency. Incorrect amounts or frequencies may cause unnecessary losses.

- Understand Zelle’s daily and weekly limits. Exceeding limits can result in transaction failure or delays.

- Choose reasonable payment frequencies to avoid financial strain from overly frequent automatic transfers.

- Regularly review your Zelle transaction history to promptly detect anomalies or unauthorized transactions.

By staying careful and cautious when entering information, you can effectively avoid common errors. This ensures smooth Zelle transfers and a secure, fast fund movement experience.

Precautions

Risk Alerts

When using Zelle for fund transfers, you need to be aware of common risks. Financial regulators highlight the following key vulnerabilities with the Zelle platform:

- Consumers have limited protection in cases of fraud.

- If unauthorized transactions occur, it’s difficult to obtain compensation.

- Some participating banks may violate anti-money laundering laws.

When operating, stay vigilant. Don’t agree to transfer requests from strangers. Note that Zelle transfers are irreversible once completed. The platform doesn’t offer purchase protection, so it’s best to transfer only between trusted individuals. If you notice suspicious transactions, contact your bank or Zelle support immediately to address risks.

Tip: When using Zelle in the U.S. market or through licensed Hong Kong banks, pay close attention to account security to avoid losses due to negligence.

Information Protection

You can adopt the following best practices to protect your personal information:

- Send funds only to people you trust, avoiding transactions with strangers.

- Before transferring, carefully verify the recipient’s name, phone number, and email address to ensure accuracy.

- Enable two-factor authentication to add extra security to your account.

- Regularly monitor your account activity to promptly detect suspicious transactions.

- Stay vigilant for unsolicited payment requests and verify the requester’s identity.

By building good information protection habits during daily Zelle use, you can significantly reduce risks. If you suspect account information has been compromised or notice unusual activity, change your password immediately and contact your bank. These measures allow you to enjoy Zelle’s efficient transfer experience more securely.

When using Zelle, you can experience delivery within minutes for efficient transfers. According to user surveys, Zelle transfers are typically instant, with zero fees and multiple security measures. The table below summarizes key features:

| Feature | Description |

|---|---|

| Transfer Speed | Usually arrives within minutes |

| Fees | No fees charged |

| Security | Uses encryption and multi-factor authentication, but beware of scams |

When operating, it’s recommended to transfer only to trusted individuals, carefully verify recipient information, and use strong passwords to protect your account. Financial experts also remind you to treat Zelle like cash and stay cautious of unfamiliar requests. By focusing on delivery speed, fees, and security, Zelle is a worthwhile tool.

FAQ

Can Zelle be used in mainland China?

You can only use Zelle between U.S. bank accounts. Mainland China bank accounts cannot support Zelle transfer services.

What happens to funds if the recipient isn’t registered with Zelle?

After initiating a transfer, the system notifies the recipient to register with Zelle. If they don’t register within 14 days, the funds automatically return to your account.

Are there fees for Zelle transfers through licensed Hong Kong banks?

Using Zelle through licensed Hong Kong banks in the U.S. market typically incurs no fees. Check your bank’s specific policy for confirmation.

What are Zelle’s transfer limits?

Your daily and per-transaction limits depend on the bank. Most banks set per-transaction limits between $500 and $3,500, with daily limits from $1,000 to $3,500.

Is Zelle safe for transfers?

When using Zelle, banks employ encryption and multi-factor authentication. Transfer only to trusted individuals and avoid sharing account information.

When using Zelle for transfers, its US-only restriction, $3,500 single-transaction cap, and irreversible instant payments can feel limiting, especially for cross-border needs or higher amounts, with fraud risks demanding extra vigilance. BiyaPay, a global financial platform, addresses these gaps with a versatile, cost-effective solution. Our remittance fees start at just 0.5%, undercutting platforms like PayPal’s 2.9%+$0.30, spanning 150+ countries with seamless conversions across 30+ fiat currencies and 200+ cryptos, all backed by transparent real-time rates to ensure no hidden losses, delivering maximum value worldwide.

Sign up in minutes, and BiyaPay enables same-day transfers from the US to Asia and beyond, surpassing Zelle’s geographic constraints. With end-to-end encryption and multi-factor authentication meeting global compliance standards, we proactively block anomalies, sidestepping Zelle’s risks like impersonation or romance scams. Uniquely, trade US and Hong Kong stocks on the same platform—no offshore account needed—with zero-fee contract orders, blending payments with wealth growth. Start now with BiyaPay! Use Real-Time Exchange Rate Query to forecast exact delivery amounts, streamlining global budgeting. Explore Stocks for integrated financial growth. Join BiyaPay today, breaking Zelle’s barriers for secure, low-cost, and borderless transfers that empower your funds to flow freely!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.