- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Zelle Transfers: Analysis of International Remittance Process, Amount Limits, and Security

Image Source: unsplash

You may want to use Zelle for international transfer processes, but Zelle currently only supports transfers between bank accounts within the United States. Both you and the recipient need to have US bank accounts and be registered with Zelle. The table below helps you quickly understand Zelle’s service scope:

| Service Scope | Description |

|---|---|

| Country | Limited to the United States |

| International Transfers | Does not support sending or receiving funds abroad |

| Bank Support | Integrated with over 2,200 US banks and credit unions |

Key Points

- Zelle only supports transfers between bank accounts within the United States and cannot be used for international transfers.

- When using Zelle for transfers, ensure both parties are registered with Zelle and have US bank accounts.

- Zelle’s transfer limits are $2,500 per transaction, up to 10 transactions daily, with a total not exceeding $3,500.

- Zelle uses bank-grade encryption technology but does not offer purchase protection, so users should be cautious of fraud risks.

- When choosing an international transfer platform, prioritize fees, delivery speed, and security.

Zelle International Transfer Process

Image Source: unsplash

Service Scope

When using Zelle, you must understand its service scope. Zelle only supports transfers between bank accounts within the United States. Both you and the recipient need to have US bank accounts and be registered with Zelle using a US phone number or email address. The table below helps you quickly understand the basic requirements for both parties:

| Sender and Recipient Requirements | Description |

|---|---|

| Bank Account | Both sender and recipient must have bank accounts in the United States. |

| Registration Information | Both sender and recipient must register with Zelle using an email address or US phone number. |

You also need to ensure the recipient has entered basic contact information, including an email address and a US phone number, and has linked a Visa or Mastercard debit card associated with a US account. Zelle is integrated with over 2,200 US banks and credit unions but does not support bank accounts in China/Mainland China, Hong Kong, or other countries and regions.

Note: Zelle cannot be used for international transfer processes. You cannot send funds to friends or family abroad via Zelle.

Process Description

If you want to complete a transfer within the United States using Zelle, the process is very simple. You can follow these steps:

- Register for Zelle service, ensuring your account meets eligibility requirements.

- In your profile, confirm that the Zelle logo appears next to your registered US phone number or email address.

- Enter the recipient’s US phone number or email address to send funds.

The entire process does not involve international transfer processes. You cannot use Zelle for currency exchange or transfer funds to bank accounts in China/Mainland China or Hong Kong. If you need to perform international transfer processes, you must choose other dedicated international transfer platforms.

Reasons for Not Supporting International Transfers

You may wonder why Zelle cannot be used for international transfer processes. The main reasons are as follows:

- Zelle is only available to customers with US bank accounts and US-registered phone numbers.

- You cannot send international payments to friends or family abroad.

- Zelle cannot be used in Canada, China/Mainland China, Hong Kong, or other regions, and is limited to payments between US local banks.

- Zelle requires registration through US banks’ online banking, all of which are US-based banks.

- You must have a US phone number or email address.

- Zelle is not a remittance or international payment platform and cannot perform currency conversion or deposit into international banks.

- Zelle does not comply with regulations of financial institutions in other countries, such as Mexico’s Banxico and CNVB.

Many users mistakenly believe Zelle can be used for international transfer processes. In reality, both the sender’s and recipient’s bank accounts must be in the United States. You cannot use Zelle for cross-border fund transfers. The table below compares Zelle with other mainstream platforms’ international transfer support:

| Platform | International Transfer Support | Notes |

|---|---|---|

| Zelle | No | Limited to US bank accounts |

| Western Union | Yes | Supports international transactions |

| PayPal | Yes | Supports international transactions |

When choosing an international transfer process, you should prioritize platforms that support cross-border transfers. Zelle is suitable for fast transfers between US local bank accounts but not for international transfer processes.

Alternative International Transfer Methods

Mainstream International Transfer Platforms

When performing international transfers, you can choose from several mainstream platforms. Common methods include SWIFT, Wise, and PayPal. These platforms have distinct features suited to different needs. The table below compares their fees and delivery times:

| Service | Transfer Fees | Delivery Time |

|---|---|---|

| Wise | Starting at 0.43% | Minutes to 4 business days |

| PayPal | Exchange rate markup up to 5% | Instant for existing accounts, varies otherwise |

Wise is known for transparent fees and mid-market exchange rates, ideal for users seeking low costs and fast delivery. PayPal supports instant global transfers with free account registration but has higher international fees. SWIFT covers the globe, allowing transfers to nearly any country with a mature and reliable process, but it may incur higher or unpredictable fees and slower delivery.

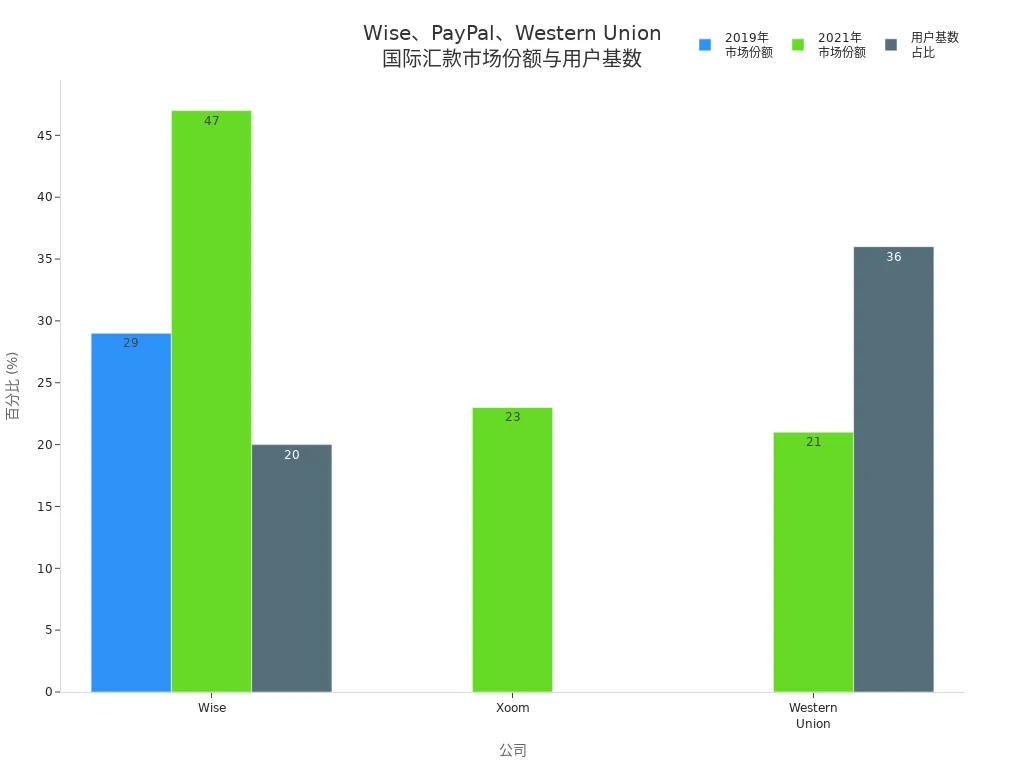

You can also refer to the market share and user base of each platform. The chart below shows the performance of Wise, PayPal (Xoom), and Western Union in the international transfer market:

Wise has seen rapid user growth in the US market, reaching a 47% market share in 2021. PayPal and its Xoom service have a vast global user base, while Western Union relies on traditional transfer channels with a similarly large user base.

Selection Advice

When choosing an international transfer platform, you need to consider fees, delivery speed, exchange rate differences, and service coverage. The table below summarizes the main advantages and disadvantages of the three platforms:

| Service | Advantages | Disadvantages |

|---|---|---|

| Wise | Mid-market rate, transparent fees, fast delivery | Not supported in all countries, no cash or check options |

| SWIFT | Global coverage, mature and reliable process | High fees, slow delivery, possible hidden fees |

| PayPal | Free registration, fast transfers, no bank info needed | High international fees, rate markup, recipient needs account |

Wise is suitable when you need low-cost, transparent fees and relatively fast delivery. SWIFT is ideal for transfers to global destinations, large amounts, or when the recipient only accepts bank accounts. PayPal is suitable when both you and the recipient have PayPal accounts and prioritize convenience and speed.

Tip: When choosing a platform, compare the actual amount received and total fees. Some platforms’ exchange rate differences may affect the final amount received. For example, Wise’s rate differences typically range from 2.35% to 3.34%, while PayPal and Western Union have larger rate fluctuations. You can flexibly choose the most suitable method based on the recipient’s country, amount, and delivery needs.

Zelle Amount Limits

Platform Limits

When using Zelle for transfers, you must understand the platform’s basic limits. Zelle has clear regulations on per-transaction, daily, and monthly transfer amounts. In most cases, you can transfer up to $2,500 per transaction, with a maximum of 10 transactions daily, totaling no more than $3,500. Limits also vary by account type. The table below shows Zelle transfer limits for some major US banks:

| Bank Name | Per-Transaction Limit | Daily Limit | Monthly Limit |

|---|---|---|---|

| Bank of America | $3,500/day (personal) | $20,000/30 days (personal) | $60,000/30 days (business) |

| Ally | $500/day | $10,000/30 days | - |

| Capital One | $2,500/day | $10,000/month | - |

| Chase | $5,000/day (personal) | N/A | - |

You can see that limits vary significantly across banks and account types. For new recipients, some banks set lower initial limits, such as $1,000 daily for personal accounts and $4,000 for business accounts. When operating, you should confirm your account limits in advance to avoid transfer failures due to exceeding limits.

Bank Variations

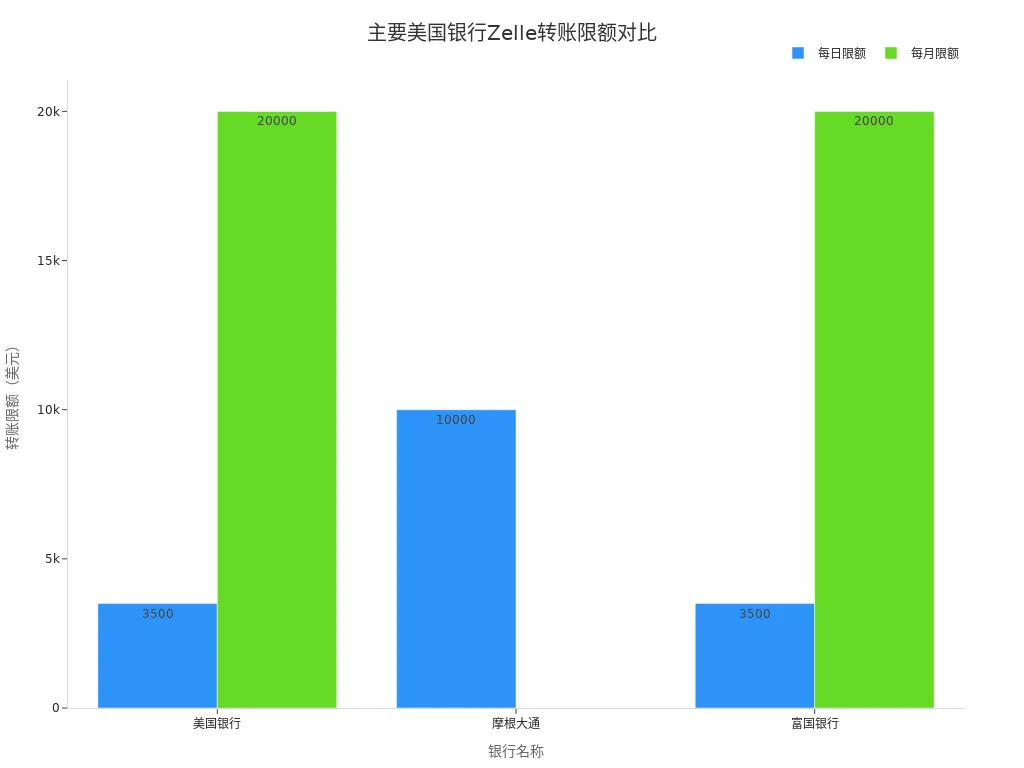

Zelle’s amount limits are not standardized. Each bank sets different transfer limits based on its policies. When using Zelle with Bank of America, JPMorgan Chase, or Wells Fargo, limits vary. The table below compares daily and monthly limits for three major banks:

| Bank | Daily Zelle Transfer Limit | Monthly Zelle Transfer Limit |

|---|---|---|

| Bank of America | $3,500 | $20,000 |

| JPMorgan Chase | $500-$10,000 | Not disclosed |

| Wells Fargo | $3,500 | $20,000 |

When choosing a bank, you can prioritize those with higher limits based on your funding needs and transfer frequency. Some banks set higher limits for small business accounts, such as up to $15,000 daily and $60,000 monthly. If you need frequent large transfers, consider upgrading to a business or premium account.

Checking and Increasing Limits

If you want to check your Zelle limits, you can do so easily through online banking or the mobile app. Common methods include:

- Check Zelle limits using online banking:

- Select your deposit account.

- Go to the account services page.

- View transaction limits; Zelle limits are displayed in the dedicated “Zelle Limits” section.

- Check Zelle limits using the U.S. Bank mobile app:

- Open the main menu and select Help & Services.

- Find “Know Your Transaction Limits” in the list; if not visible, tap “Show All.”

- View specific amounts in the Zelle Limits and Send Money section.

If you find the current limits insufficient, you can try the following methods to increase them:

- Contact the bank: You can directly contact bank customer service to request a Zelle limit increase. The bank will evaluate based on your account type and usage.

- Upgrade account: Some banks offer higher limits for premium or business accounts. You can consider upgrading your account type for a higher transfer limit.

- Verify identity: Banks may increase your Zelle limit after verifying your identity. You need to submit relevant documents as required by the bank.

For international transfer processes, if you need to transfer large amounts, prioritize banks with higher limits or upgrade your account. You can also combine other international transfer platforms to flexibly manage fund flows, ensuring security and delivery efficiency.

Tip: Zelle limit policies may change at any time. Before operating, check the bank’s official website or contact customer service for the latest limit information. Planning transfer amounts wisely can effectively avoid delays due to limit restrictions.

Zelle Security

Image Source: unsplash

Official Measures

When using Zelle, the platform employs multiple official security measures to protect your funds and personal information:

- Zelle uses bank-grade encryption technology to ensure the security of your financial data and transactions.

- In 2023, 95% of Zelle payments reported no issues related to fraud or scams.

- Over 99.9% of Zelle transactions were free of fraud, with an extremely low proportion reported as fraudulent or disputed.

- Zelle does not provide fraud protection for authorized payments, so you should only transfer to trusted individuals.

Tip: Zelle transfers are irreversible, and funds are delivered instantly. You must carefully verify recipient information before operating to avoid losses due to errors.

Risk Types

When using Zelle, you may encounter various fraud and security risks. The table below summarizes common risk types and their descriptions:

| Fraud Type | Description |

|---|---|

| Impersonation Fraud | Scammers pose as bank representatives or trusted contacts to trick you into sending money. |

| Fake Sales | You may be induced to pay for nonexistent goods or services, often seen on social media or ads. |

| Rental Fraud | Scammers pose as landlords, collecting deposits and then disappearing. |

| Bank Fraud | Scammers impersonate bank staff, tricking you into transferring money to fake accounts. |

| Account Upgrade Fraud | Scammers ask for personal information, claiming it’s needed to upgrade your Zelle account. |

| Account Takeover | Scammers steal login credentials, take over your Zelle account, and transfer funds. |

| Online Marketplace Fraud | Scammers pose as buyers, inducing you to send money before completing a transaction. |

| Refund and Recovery Fraud | Scammers pretend to be Zelle representatives, claiming to help recover funds while stealing information or fees. |

Protection Tips

You can take the following measures to enhance Zelle usage security and prevent fraud risks:

- Set a strong password and enable two-factor authentication to protect your account security.

- Regularly monitor your account and transactions, contacting the bank promptly if anomalies are detected.

- Only transfer to people you know and trust, avoiding sending money to strangers.

- Before each transfer, verify the recipient’s phone number and email address to ensure accuracy.

- Be cautious of urgent requests, as scammers often exploit a sense of urgency to make you act rashly.

- Do not respond to unsolicited contacts, and contact the bank immediately if you receive an “unexpected” transfer.

- Understand that Zelle transactions are irreversible, ensuring every fund transfer is under your control.

When choosing an international transfer process, you should also prioritize the platform’s security and protective measures to ensure fund safety.

When using Zelle, keep the following points in mind:

- Zelle only supports transfers between US bank accounts and cannot transfer to bank accounts in China/Mainland China or Hong Kong.

- Per-transaction and daily transfer limits are $500, with weekly limits at $1,500 and monthly limits at $6,000.

- Zelle uses encryption and authentication technology but does not offer purchase protection or dispute resolution, posing fraud risks.

- You should regularly learn about payment security, prioritize layered security measures, and contact bank support promptly if issues arise.

| Latest Policy | Details |

|---|---|

| End of Standalone App | Zelle will discontinue its standalone app on March 31, 2025 |

| Security Warning | Users must be cautious of scams, as Zelle does not provide dispute resolution |

When choosing a transfer method, consider your needs and bank policies, prioritizing security and fund flow efficiency.

FAQ

Can Zelle transfer to bank accounts in China/Mainland China or Hong Kong?

You cannot use Zelle to transfer funds to bank accounts in China/Mainland China or Hong Kong. Zelle only supports transfers between US bank accounts.

Are there minimum or maximum amount limits for Zelle transfers?

You can transfer up to $2,500 per transaction, with a maximum of 10 transactions daily, totaling no more than $3,500. Different banks may have varying limits, so check in advance.

Can funds be recovered if transfer information is entered incorrectly?

You cannot reverse completed Zelle transfers. Funds are delivered instantly. You must carefully verify recipient information before operating.

Is Zelle transfer secure? How can I prevent scams?

You can enhance security by setting a strong password and enabling two-factor authentication. Only transfer to trusted individuals and contact the bank promptly for suspicious requests.

How do I choose a platform suitable for international transfers?

You can compare fees and delivery speeds of platforms like SWIFT and Wise. Choose the most suitable method based on the recipient’s country, amount, and delivery needs.

When exploring Zelle for international remittances, its US-only scope, $2,500 single-transaction and $3,500 daily caps, and irreversible transfers heighten fraud risks, leaving you stranded for cross-border needs like sending to mainland China, Hong Kong, or beyond. BiyaPay, a dynamic global finance hub, shatters these constraints with a robust cross-border solution. Our remittance fees start at just 0.5%, undercutting PayPal’s up to 5% exchange rate markups, offering instant conversions across 30+ fiat currencies and 200+ cryptos with transparent real-time rates to ensure zero hidden costs, maximizing your funds’ global reach.

A quick signup unlocks same-day transfers to 150+ countries, from the US to Asia, effortlessly handling small or large sums, far surpassing Zelle’s domestic limits. With bank-grade encryption and multi-factor authentication meeting international compliance, BiyaPay proactively counters scams like impersonation or account takeovers, outpacing Zelle’s protections. Plus, trade US and Hong Kong stocks on the same platform—no offshore account needed—with zero-fee contract orders, merging payments with wealth growth. Start with BiyaPay today! Use Real-Time Exchange Rate Query to pinpoint cross-border delivery amounts, streamlining your planning. Explore Stocks for integrated financial growth. Join BiyaPay now, bypassing Zelle’s borders and caps for secure, swift, and cost-effective global transfers that empower your finances!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.