- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Cash App Currency Conversion: How to Remit Money from Canada to the US? Analysis of Fees, Limits, and Security

Image Source: unsplash

You can use Cash App to send money from Canada to the USA through remittances. The platform allows you to convert Canadian dollars to U.S. dollars, a process known as Cash App currency exchange. You can make payments using a debit card, credit card, or bank account. You may be concerned about the process, fees, amount limits, and security. Please continue reading for detailed steps and precautions.

Key Points

- When using Cash App to send money from Canada to the USA, you need to complete identity verification and link a valid bank account.

- For remittances, you can choose a debit card, credit card, or bank account, noting the different fees and delivery times for each method.

- The maximum limit per remittance is $1,500, with a total of $3,000 allowed within 15 days, suitable for small transfers.

- Pay attention to real-time exchange rates and fees, choosing the right timing for currency conversion to minimize losses.

- Ensure recipient information is accurate to avoid transfer failures or delays due to errors.

Remittance Feasibility

Supported Countries and Accounts

You can use Cash App for remittances between Canada and the USA. The platform currently supports account registration for users in Canada and the USA. You need a valid phone number and email address from Canada or the USA. Cash App requires you to complete identity verification, including uploading identification documents and providing personal information. You must be at least 18 years old to register and use the remittance function.

Note: Cash App does not currently support direct registration or remittances for users in mainland China. If you are in mainland China, you need to choose other international remittance channels.

You can link a local bank account in Canada or the USA. The platform also supports linking USD accounts from licensed Hong Kong banks, but you need to ensure the account information is accurate. You can select the receiving currency in the account settings, and the system will automatically convert the currency based on the recipient’s location.

Payment Methods

You can choose multiple payment methods to complete remittances. Cash App supports the following methods:

- Debit Card: You can link a debit card issued in Canada or the USA for direct deductions.

- Credit Card: The platform allows payments via credit card, but an additional fee, typically 3% of the transaction amount, is charged.

- Bank Account: You can transfer funds via a bank account, with funds arriving in 1-3 business days.

When choosing a payment method, you need to consider fees and delivery times. Debit cards and bank accounts typically have lower fees and faster delivery. Credit cards are convenient but have higher fees.

Tip: All remittance amounts and fees are settled in USD. You can review real-time exchange rates and fee details before sending to ensure transparency and fund safety.

Remittance Process

Image Source: unsplash

Account Setup

You need to complete the basic setup of your Cash App account to smoothly conduct cross-border remittances. The table below outlines the specific requirements for each step:

| Step Requirement | Description |

|---|---|

| Have a U.S. phone number | You can also use an email to verify your identity. |

| Reside in the U.S. or UK | Cash App is only available in the U.S. and UK, with the app and information provided only in English. |

| Have a bank account | To access all app features, it’s recommended to have a bank account. |

| Identity verification | This enables sending or receiving over $1,000 and applying for a Cash Card. |

| Information needed for verification | Requires full name, date of birth, and Social Security Number (SSN). |

When registering, you need to enter accurate personal information. Cash App will require you to upload identification documents and provide your full name and date of birth. You also need to link a bank account, preferably a USD account from a licensed Hong Kong bank or a U.S. local bank account. After completing identity verification, you can unlock higher remittance limits and additional features.

Tip: If you are in China/mainland China, you cannot directly register a Cash App account. You can consider other international remittance methods.

Cash App Currency Exchange Operation

When conducting cross-border remittances, the most critical step is Cash App currency exchange. You need to convert Canadian dollars to U.S. dollars to successfully send money to the USA. The process is as follows:

- Open Cash App and go to the main interface.

- Select the “Pay” or “Transfer” function.

- Enter the amount in Canadian dollars you wish to send, and the system will automatically display the equivalent USD amount.

- Cash App will convert Canadian dollars to U.S. dollars based on real-time exchange rates. You can view the current rate and estimated received amount on the interface.

- After confirming accuracy, click “Next” to enter the recipient information page.

When using Cash App for currency exchange, you need to pay special attention to exchange rate fluctuations. The platform adjusts the conversion rate based on market conditions. You can compare rates multiple times before proceeding to select a more favorable rate. The Cash App currency exchange process is simple and intuitive, but you must ensure the entered amount is accurate to avoid delays or losses due to manual errors.

Note: If you’ve linked a USD account from a licensed Hong Kong bank, the system will skip the currency conversion step and settle directly in USD.

Filling Out Recipient Information

You need to accurately fill out the recipient’s information to ensure funds arrive smoothly. Cash App requires you to provide the following recipient details:

- Recipient’s name

- Recipient’s email address

- Recipient’s phone number

When filling out the information, you must carefully verify each item. Any errors may lead to transfer failures or delays. It’s recommended to confirm all details with the recipient in advance, especially the email and phone number. Cash App will automatically identify the recipient’s account based on the provided information and proceed with the operation.

Tip: If you send money to the same recipient multiple times, you can save their information as a frequent contact for quicker operations in the future.

Initiating the Transfer

After completing all information, you can formally initiate the transfer. You need to confirm the remittance amount, recipient information, and exchange rate again. Cash App will display all fee details on the page, including handling fees and the estimated received amount. After clicking “Confirm,” the system will immediately process your remittance request.

When initiating a transfer, you may encounter the following common issues:

- Slow transfer speed: Transfers may be delayed due to weekends, holidays, or additional reviews.

- High fees: The platform may charge hidden fees or unfavorable exchange rates, reducing the actual received amount.

- Security issues: You need to stay vigilant about account security to prevent information leaks or hacker attacks.

- Poor customer support: When issues arise, the platform’s customer service response may not be timely.

- Connection issues: Unstable networks or outdated app versions can lead to transaction failures.

You can reduce the risk of transfer failures or delays by:

- Ensuring you use the latest version of Cash App.

- Maintaining a stable network connection.

- Avoiding large transfers on weekends or holidays.

- Carefully verifying bank account and routing numbers to avoid manual errors.

- Preparing all necessary identity and account documents for platform reviews.

Reminder: While Cash App currency exchange is convenient, you should always monitor exchange rate and fee changes, plan remittance timing wisely, and ensure fund safety.

Fees and Exchange Rates

Image Source: unsplash

Handling Fees

When using Cash App for remittances from Canada to the USA, the platform charges a handling fee. Generally, the fee ranges between 2.0%-2.5%. You can see the specific fee on the remittance page in advance. In some cases, Cash App offers promotional rates to help you save on transfer costs. If you frequently use Cash App for international remittances, the platform may provide discounts, allowing you to enjoy lower fees.

You also need to note withdrawal fees. If you withdraw received USD to a bank account, Cash App typically charges a $2 per transaction withdrawal fee. You can refer to the table below for a quick overview of common fees:

| Fee Type | Amount or Percentage | Description |

|---|---|---|

| Remittance Handling Fee | 2.0%-2.5% | Charged based on the transfer amount |

| Credit Card Payment Fee | 3% | Applies only to credit card payments |

| Withdrawal Fee | $2 per transaction | Charged when withdrawing to a bank account |

Tip: You can review all fee details before sending to avoid reductions in the actual received amount due to fees.

Cash App Currency Exchange Rates

When performing Cash App currency exchange, the platform converts Canadian dollars to U.S. dollars based on real-time market exchange rates. Rates fluctuate daily, and Cash App displays the current rate on the transfer page. You can choose the optimal remittance timing based on rate changes to minimize losses.

The platform may charge a currency conversion fee during the exchange process. You need to monitor rate differences, as the actual received amount may decrease due to fluctuations. Cash App’s exchange rates are typically slightly lower than the bank’s mid-market rate, and the platform transparently displays the conversion ratio on the page.

Note: If you use a USD account from a licensed Hong Kong bank, the system will settle directly in USD, bypassing currency conversion.

Hidden Costs

When making international remittances, in addition to handling fees and exchange rate losses, you should be aware of hidden costs. The following are potential additional expenses:

- International remittances may involve currency conversion fees, affecting the actual received amount.

- The platform may charge foreign transaction fees, especially when using a Cash App card for international transactions, typically 2%.

- If you deposit $300 or more in wages directly each month, this foreign transaction fee can be waived.

- Some banks may charge additional incoming transfer fees, so it’s advisable to check with your bank’s customer service in advance.

Before sending money, you should carefully read the platform’s fee disclosures to understand all potential costs. This helps you avoid unexpected expenses and plan funds wisely.

Reminder: Understanding the full fee structure and hidden costs helps you make more informed remittance decisions and ensures fund safety.

Limits Explanation

Amount Limits

When using Cash App for remittances from Canada to the USA, you need to understand the platform’s strict amount limits. The minimum transfer amount per transaction is $0.01. The maximum amount per transaction is typically $1,500. You can send up to $3,000 within 15 days. The platform does not support recurring automatic transfers.

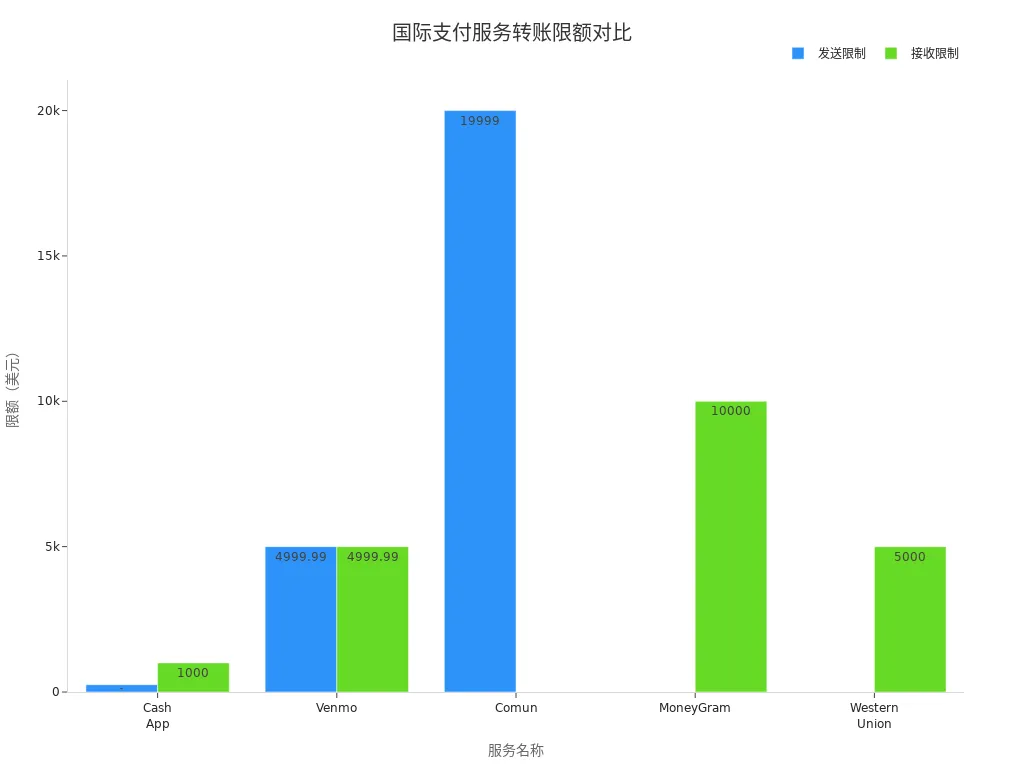

You can refer to the table below to compare Cash App’s amount limits with other international payment services:

| Service | Sending Limit | Receiving Limit |

|---|---|---|

| Cash App | $250 per 7 days | $1,000 per 30 days |

| Venmo | $4,999.99 per transaction | $4,999.99 per week |

| Comun | $19,999 cumulative over 90 days | N/A |

| MoneyGram | N/A | $10,000 per transaction |

| Western Union | N/A | $5,000 per transaction |

You can see that Cash App’s amount limits are relatively low, primarily suitable for small remittances. If you need large transfers, consider services like Comun, MoneyGram, or Western Union.

Tip: If you plan to send a large amount at once, Cash App may require proof of fund source, such as bank statements or pay stubs. You also need to provide detailed recipient information, including name, address, and bank account details.

Frequency Limits

When using Cash App, you also need to note transfer frequency limits. The platform sets a maximum of $1,500 per transaction. You can transfer up to $3,000 within 15 days. Cash App does not support scheduled or recurring payments.

For frequent or large remittances, the platform requires compliance with regulations from the U.S. Treasury Department’s Office of Foreign Assets Control. Cash App prohibits remittances to sanctioned countries, entities, or individuals. If your account is suspected of illegal activities, the platform may share your information with law enforcement.

For large or frequent transfers, you may need to submit:

- Proof of fund source, such as bank statements or pay stubs.

- Detailed recipient information, including name, address, phone number, and bank details.

- Account verification documents showing your full name, transfer amount, and date funds were received.

Reminder: Before sending money, prepare all necessary documents to ensure smooth platform reviews. This avoids delays or failures due to compliance issues.

Security

Platform Protections

When using Cash App for remittances from Canada to the USA, the platform provides multiple protections for your funds and information. Cash App uses unique PIN code protection, supporting Touch ID and Face ID biometric technologies to prevent unauthorized access. The platform also requires identity verification to ensure each user’s authenticity.

Cash App employs encryption and fraud detection systems to safeguard your data and funds. When sending money to users not in your contact list, the system requires secondary confirmation to reduce errors and fraud risks. If suspicious activity is detected, Cash App will notify you promptly, reminding you to take steps to secure your funds.

You can refer to the table below for Cash App’s main security measures:

| Security Measure | Description |

|---|---|

| PIN and Biometrics | Prevents account theft |

| Encryption and Fraud Detection | Protects data and funds, identifies unusual transactions |

| Identity Verification | Ensures user authenticity, enhances security level |

| Transaction Confirmation | Prevents errors and fraud with secondary confirmation |

| Risk Notifications | Alerts for account anomalies to ensure fund safety |

Tip: When setting up your account, enable all security features and regularly update your PIN to enhance protection.

User Risk Prevention

When making cross-border remittances, in addition to relying on the platform’s security technologies, you need to actively identify and prevent risks. Although Cash App offers multiple security features, you may still encounter fraud or data breaches. You need to stay vigilant, protect personal information, and avoid sharing account details with strangers.

Common risks include: the platform not supporting certain international remittances, leading to undelivered funds; encountering fake customer service or scammers inducing transfers or password leaks. You should learn to recognize fraud signals, such as strangers requesting verification codes or transfers to unknown accounts.

You can adopt the following best practices to reduce risks:

- Choose compliant and transparent payment platforms, focusing on fee and rate information.

- Optimize payment processes using Cash App’s automation and management tools.

- Monitor exchange rate changes and plan remittance timing to avoid rate losses.

- Comply with regulations, keep transaction records, and ensure legitimate fund sources.

- Use mobile apps and real-time tracking to monitor remittance progress.

Reminder: You cannot directly register a Cash App account in China/mainland China. For cross-border remittances, choose compliant international payment channels and review all fees and security policies in advance.

When using Cash App to send money from Canada to the USA, follow these key steps:

- Open your Cash App account and navigate to the “Contacts” tab.

- Add a new contact, entering the international contact’s name and details.

- Enter the amount, select the currency type, and send after verification.

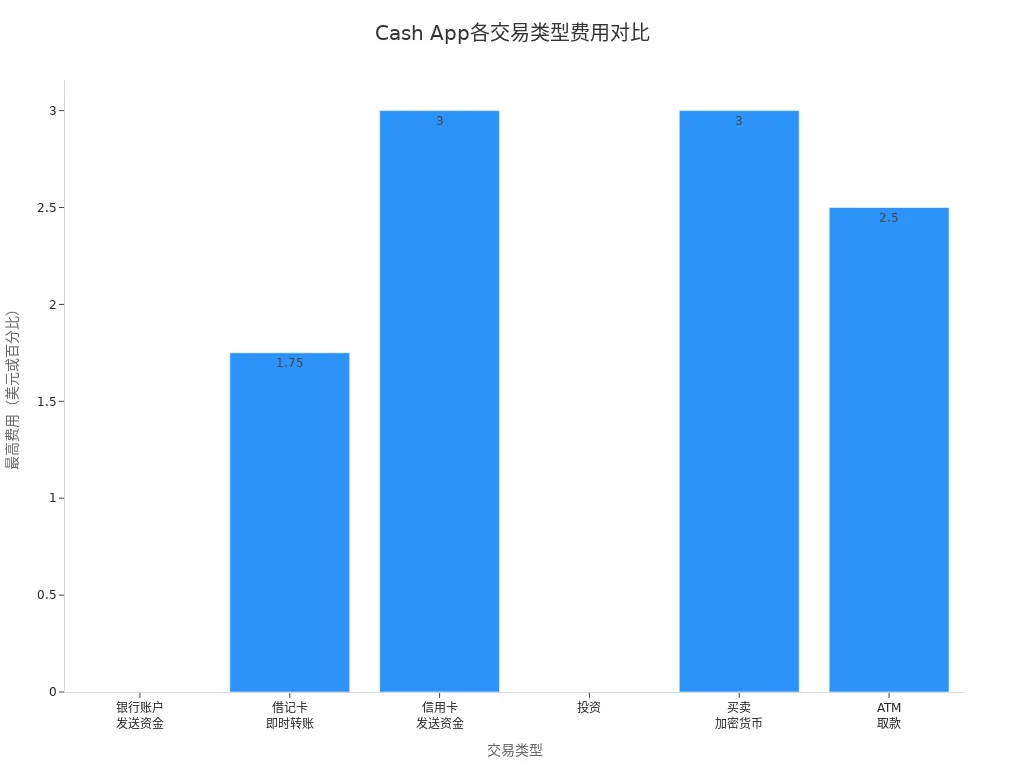

It’s recommended to carefully check the latest policies and fee standards before proceeding. The table below shows fees for different transaction types:

| Transaction Type | Fee |

|---|---|

| Sending funds via bank account | $0 |

| Instant transfers via debit card | 0.5%-1.75% (minimum $0.25) |

| Sending funds via credit card | 3% |

| ATM withdrawals | $2.50 per transaction (without direct deposit) |

When choosing a remittance service, you typically focus on fees, security, exchange rates, and user experience. Be sure to:

- Only send money to people you know and trust.

- Verify recipient information for accuracy.

- Enable two-factor authentication and payment notifications to enhance account security.

You should choose the most suitable remittance method based on your needs, plan funds wisely, and ensure every cross-border transfer is safe and compliant.

FAQ

Can Cash App be directly registered and used for remittances from China/mainland China?

You cannot directly register a Cash App account in China/mainland China. You need a Canadian or U.S. phone number and email to complete registration.

Which bank accounts can be linked for remittances?

You can link USD accounts from licensed Hong Kong banks or U.S. local bank accounts. You need to ensure account information is accurate.

How are remittance fees and exchange rates calculated?

You pay a handling fee typically ranging from 2.0%-2.5%. The platform automatically converts Canadian dollars to U.S. dollars based on real-time market rates.

Are there limits on single and monthly remittance amounts?

You can send up to $1,500 per transaction. The cumulative limit is $3,000 within 15 days. The platform does not support recurring automatic transfers.

How does Cash App ensure your fund safety?

You can enable PIN and biometric functions. The platform uses encryption and identity verification to prevent account theft.

When using Cash App for remittances from Canada to the US, you might encounter frustrations like its tight limits (just $1,500 per transaction and $3,000 over 15 days), 2%-2.5% fees, and barriers such as no direct signup from mainland China, compounded by an extra 3% on credit cards and potential hidden charges that erode your funds. BiyaPay, a versatile global finance platform, is engineered to resolve these issues with broader, more affordable options. Our remittance fees start at a mere 0.5%, well below Cash App’s 2%-2.5%, and facilitate instant swaps between 30+ fiat currencies and 200+ cryptos via transparent real-time rates, guaranteeing CAD-to-USD conversions without added erosion for fuller recipient amounts.

A swift signup in minutes grants access to same-day transfers to Canada, the US, and most worldwide destinations—tailored for small family aids or large business flows, arriving directly in bank accounts or digital wallets. With end-to-end encryption and multi-factor authentication meeting global regulatory benchmarks, BiyaPay surpasses Cash App’s PIN protections to eliminate fraud and data breaches. What’s more, on this unified platform—no offshore account needed—you can engage in US and Hong Kong stock trading, with zero-fee contract orders for seamless wealth building alongside remittances.

Unlock the future with BiyaPay today! Leverage the Real-Time Exchange Rate Query to forecast precise USD deliveries from CAD, dodging rate swings. Dive into Stocks to broaden your portfolio. Sign up for BiyaPay now, leaving Cash App’s constraints behind for low-cost, secure, and borderless transfers that make cross-border finance effortless!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.