- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Obtain a US Bank Routing Number for International Remittances and Simplify the Transfer Process

Image Source: unsplash

When conducting international transfers, you need to accurately provide the U.S. bank routing number. Common methods to find it include:

- Logging into your online banking account, checking the account information page

- Reviewing a bank-issued check or statement

- Visiting the Federal Reserve Fedwire website to search

You should verify the information to ensure accuracy. This helps effectively avoid transfer delays or failures.

Key Takeaways

- Obtain a U.S. bank routing number through checks, online banking, or customer service. Ensure accuracy to avoid transfer delays.

- When filling out international transfer information, always verify the recipient bank’s routing number, SWIFT code, and recipient details to ensure correctness.

- Use official channels to obtain the routing number, avoiding unofficial sources to ensure accuracy and fund security.

- Before each transfer, it’s recommended to double-check all information to reduce risks caused by human error, ensuring funds reach the target bank securely.

- Understand the differences between routing numbers, SWIFT codes, and IBAN to ensure correct information is provided during international transfers, avoiding transfer failures.

Obtaining a U.S. Bank Routing Number

Image Source: pexels

When making international transfers, you need to accurately obtain the U.S. bank routing number. You can use multiple methods to find and verify it to ensure accuracy and avoid transfer failures. Below are three commonly used methods in detail.

Check Lookup

You can directly obtain the U.S. bank routing number from a check. The steps are as follows:

- Look at the first set of numbers at the bottom left of the check.

- Identify the first nine digits, which represent the bank’s routing number.

- The bottom of the check typically has three sets of numbers, from left to right: routing number, account number, and check number.

Tip: The U.S. bank routing number on a check is usually very accurate, but you should still verify it to avoid transfer delays due to number changes.

You can follow the same method to find the routing number on checks for USD accounts issued by licensed Hong Kong banks. Even if the check comes from a different bank, the number format is generally consistent.

Online Banking Inquiry

If you don’t have a check, you can obtain the U.S. bank routing number through online banking. The process is as follows:

- Log into your online banking account.

- Select the account you need to transfer from.

- On the account information page, the routing number, account name, and last four digits of the account number are typically displayed.

U.S. banks regularly update routing number information in their online banking systems to ensure data accuracy. Large banks may update multiple times a week to ensure smooth ACH payments and international transfers. When using online banking services from licensed Hong Kong banks in China/Mainland China, you can find the routing number for USD accounts in a similar way.

Note: Even if you find the routing number through online banking, it’s recommended to verify it again before an international transfer to avoid discrepancies due to system updates.

Customer Service Inquiry

If you have doubts about the check or online banking information, you can directly contact bank customer service. You can inquire via phone, online customer service, or by visiting a bank branch. Customer service representatives will provide the latest U.S. bank routing number based on your account information.

The table below summarizes common official verification channels:

| Source | Description |

|---|---|

| Moneycorp | Provides FAQs on ABA routing numbers, recommending verification through bank websites or customer service for the latest information. |

| Wise | Emphasizes verifying routing numbers before international transfers to ensure secure and fast processing. |

| Western Union | Offers methods to find ABA numbers, including asking the recipient, contacting the bank, or checking the bank’s website. |

When conducting international transfers through licensed Hong Kong banks in China/Mainland China, you can also call the bank’s customer service hotline to obtain the most authoritative U.S. bank routing number information.

Reminder: U.S. bank routing numbers may change due to bank mergers or system upgrades. You should regularly check bank announcements or proactively inquire to ensure you have the latest information.

Using these three methods, you can efficiently and accurately obtain the U.S. bank routing number. Before an international transfer, always verify all information to avoid delays or losses due to incorrect numbers.

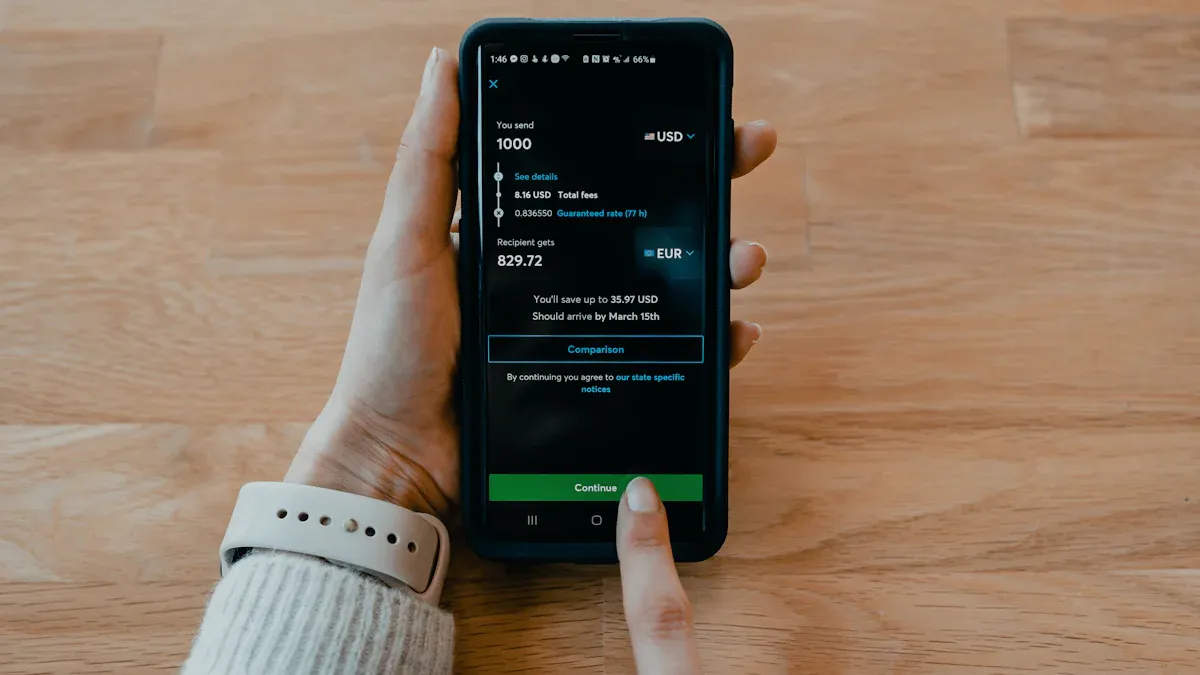

Filling Out International Transfer Information

Image Source: unsplash

Routing Number Entry Method

When conducting international transfers through licensed Hong Kong banks in China/Mainland China, entering the U.S. bank routing number is a critical step. The U.S. bank routing number (ABA number) is used to identify U.S. banks, ensuring funds are accurately transferred to the target bank. You need to provide the U.S. bank routing number in the following scenarios:

- When transferring from the U.S. to another country, banks typically require both the ABA number and SWIFT code to ensure smooth cross-border transfers.

- When handling international transfers in China/Mainland China, the bank will require the U.S. bank’s ABA number to help the system identify the recipient bank.

- Some South American countries may also require the ABA number when involving U.S. banks or USD clearing.

When filling out international transfer information, it’s recommended to follow the bank’s provided form or online page and enter each item carefully. You typically need to input the recipient bank’s routing number, SWIFT code, recipient’s name, account number, and recipient bank address. You should carefully verify each item to ensure accuracy.

Tip: If you’re unsure about the U.S. bank routing number, verify it through online banking, checks, or bank customer service to avoid transfer delays due to incorrect numbers.

SWIFT Code vs. IBAN

When making international transfers, in addition to the U.S. bank routing number, you’ll encounter SWIFT codes and IBAN. The three differ significantly in purpose and entry methods. The table below helps you quickly understand:

| Type | Purpose | Description |

|---|---|---|

| Routing Number | Domestic Transfers | Used for U.S. domestic transfers, a nine-digit identifier. |

| SWIFT Code | International Transfers | Identifies the receiving bank to ensure accurate international payments. |

| IBAN | International Transfers | Identifies specific bank accounts, with formats varying by country. |

When filling out international transfer forms, you typically need to provide the SWIFT code and IBAN. The SWIFT code consists of 8 to 11 characters, identifying a specific bank and branch. The IBAN can include up to 34 characters, comprising the country code, check digits, bank code, and account number. The SWIFT code ensures funds reach the correct bank, while the IBAN ensures funds go to the correct account. If the recipient bank is in the U.S., you usually only need the routing number and SWIFT code; if it’s in Europe or other regions, you may need to provide the IBAN.

- The SWIFT code identifies the bank, while the IBAN identifies the specific bank account and routing information.

- The routing number is used for payments when no IBAN is available, helping determine the funds’ destination.

You should choose the correct entry method based on the recipient bank’s country and requirements.

Information Verification

Before submitting an international transfer request, you must verify all information. Banks recommend focusing on the following:

- Recipient bank information, including SWIFT code, bank name, and address.

- Recipient information, including name, account number, and address.

- Accuracy of the U.S. bank routing number.

If the submitted information is incomplete or incorrect, the bank may reject the transfer. Common reasons include errors in beneficiary information, such as misspellings in the account number or SWIFT code. For large transfer amounts or incomplete information, banks may reject the transfer due to compliance issues. Technical issues or SWIFT network problems may also cause transfer failures.

Reminder: When handling international transfers through licensed Hong Kong banks in China/Mainland China, it’s recommended to prepare all necessary information in advance and verify it through official bank channels to ensure smooth completion.

Common Issues and Solutions

Routing Number Errors

When entering the U.S. bank routing number, it’s easy to make mistakes with digits or their order. The bank system may fail to identify the recipient bank due to an incorrect routing number, leading to the transfer being returned or delayed. You can take the following steps:

- Carefully verify the routing number from checks, online banking, or customer service.

- Before submitting a transfer request, confirm again using the bank’s website or official customer service.

- If a transfer fails, contact the bank promptly to identify the reason.

Tip: Verify the routing number before each transfer to avoid changes due to bank mergers or system upgrades.

Incomplete Information

When handling international transfers in China/Mainland China, incomplete information may lead to the bank rejecting the transfer. Common missing information includes the recipient’s name, account number, SWIFT code, or recipient bank address. You can refer to the table below to prepare all necessary information in advance:

| Required Field | Description |

|---|---|

| Routing Number | U.S. bank identifier |

| SWIFT Code | International bank identifier |

| Recipient Name | Must match the account |

| Recipient Account Number | Complete and accurate |

| Recipient Bank Address | Includes city and state |

You should follow the bank’s requirements, fill out and verify each item to ensure a smooth transfer.

Bank Differences

Different U.S. banks have varying routing numbers and transfer requirements. When handling international transfers in China/Mainland China, you may encounter the following:

- Some banks only accept routing numbers in specific formats.

- Some banks require both the SWIFT code and ABA number.

- Routing numbers may differ by region or branch.

You can verify specific requirements through the bank’s website, customer service, or checks. When in doubt, consult official bank channels to ensure accurate information. This helps avoid transfer failures or delays due to bank differences.

Optimizing the Transfer Process

Information Preparation

When handling international transfers through licensed Hong Kong banks in China/Mainland China, preparing all necessary information in advance can significantly improve transfer efficiency. You can refer to the following checklist to ensure everything is complete:

- Recipient details, including name, address, and bank name.

- Verify international transfer fees and limits, understanding the USD fee standard per transfer.

- Choose an appropriate global payment method, considering speed, cost, and convenience.

- Confirm sufficient funds in the account to cover the transfer amount and related fees.

Tip: Before sending a wire transfer, carefully verify the recipient’s name, address, and bank information. You can contact the recipient’s bank, especially for first-time transfers, to obtain written confirmation to ensure accuracy.

Preparing all information in advance reduces the risk of errors and speeds up the transfer process. Having the recipient bank’s details and transfer purpose helps comply with regulations and enhances transaction speed. The required information includes the recipient’s name and address, transfer amount (USD), recipient bank name and address, bank account number, account type, and SWIFT/BIC code.

Official Channels

When obtaining the U.S. bank routing number and transfer information, prioritize official channels. This ensures accuracy and fund security. Common official channels include:

- Check a paper check; the first set of numbers at the bottom left is the routing number.

- Log into your online banking account and find the routing number on the account details page.

- Review monthly bank statements, which typically list the routing number.

- Use the Federal Reserve Fedwire service to search the official routing number directory.

- Visit the financial institution’s official website, where most banks and credit unions publish routing numbers.

When handling international transfers through licensed Hong Kong banks in China/Mainland China, you can also consult bank customer service or visit a branch to obtain the latest routing numbers and transfer requirements. Avoid obtaining information from unofficial channels to prevent delays or losses due to incorrect information.

Reminder: Verify all information through official channels before each transfer to ensure smooth and secure completion.

When handling international transfers in China/Mainland China, accurately obtaining and entering the U.S. bank routing number is critical. This ensures funds reach the target bank securely, reduces errors and delays, and prevents unauthorized transactions. You should avoid entering incorrect bank information and carefully verify the recipient’s name and account number. Before each transfer, it’s recommended to double-check all details to minimize risks caused by human error.

FAQ

Can routing numbers and SWIFT codes be used interchangeably?

You cannot use routing numbers and SWIFT codes interchangeably. Routing numbers are used for U.S. domestic transfers. SWIFT codes are used for international transfers. You need to provide the appropriate information based on bank requirements.

Will funds be lost if the routing number is incorrect?

If you enter an incorrect routing number, the bank will typically return the funds. You need to contact bank customer service and provide the correct information. The bank will assist in recovering the funds.

Is an IBAN required for international transfers from China/Mainland China?

When transferring to a U.S. bank account, an IBAN is usually not required. U.S. banks primarily use routing numbers and SWIFT codes. You should provide information based on the recipient bank’s requirements.

Do routing numbers vary by bank branch?

When opening accounts at different branches, routing numbers may vary. You should verify the specific routing number for the recipient account’s branch. You can check through checks, online banking, or customer service.

Can I obtain a U.S. bank routing number through third-party platforms?

You can find information on third-party platforms, but it’s recommended to prioritize obtaining it through the bank’s website, online banking, or customer service. This ensures accuracy and fund security.

Navigating international remittances to the US can be daunting, with challenges like tracking down routing numbers, unclear fee structures, intricate form requirements, and potential transfer delays. What if a platform offered a total fee as low as 0.5%, real-time exchange rate checks, seamless conversion between 30+ fiat currencies and 200+ digital assets, and same-day delivery to most countries worldwide?

BiyaPay is your go-to solution. As a premier digital finance platform, we streamline mobile-based transfers, making it easy to input routing numbers, SWIFT codes, and more for swift, secure remittances. With our real-time exchange rates, you can lock in optimal rates and sidestep hidden costs. Backed by multi-layer encryption and global compliance, BiyaPay ensures your funds are safe and arrive instantly. Sign up in minutes to experience hassle-free transfers.

Take control of your remittances now! Visit BiyaPay to check real-time rates and plan your transfer. Sign up for a BiyaPay account today and unlock low-cost, instant, and secure transfers to the US, making global payments effortless and reliable.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.