- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Minimum Amount, Remittance Methods, and Tracking Methods for Remittances via MoneyGram

Image Source: unsplash

When using MoneyGram for remittance, you often focus on the minimum transfer amount. In fact, different countries and regions have different regulations for the minimum amount. For example, the minimum amount may vary in China/Chinese Mainland and the United States. You need to consult the local agent in advance to obtain the exact amount requirements. This ensures your remittance proceeds smoothly, avoiding unnecessary trouble.

Key Points

- MoneyGram’s minimum transfer amount is typically $1,000, with a maximum of $10,000, though specific amounts vary by country.

- Transfer methods are diverse, including bank transfers, credit cards, agent cash payments, and online apps, allowing you to choose the most suitable method.

- Using the transaction number, you can track transfer progress on the website, app, or by contacting customer service, ensuring fund safety.

- Ensure the information entered is accurate, and contact MoneyGram customer service promptly for assistance if issues arise.

- Understand the remittance fees and delivery times, consulting in advance to avoid unnecessary trouble.

MoneyGram Transfer Amount Limits

Image Source: unsplash

Minimum Amount

When using MoneyGram for remittances, you first need to focus on the minimum transfer amount. The minimum amount is not uniform globally. Each country’s laws and regulations affect MoneyGram’s minimum transfer amount. Each country sets its own limits based on local laws. For example, when remitting from China/Chinese Mainland and the United States, the minimum amount may differ. You should contact the local MoneyGram agent in advance to confirm the specific minimum amount requirements. This helps avoid transfer failures due to non-compliant amounts.

Tip: MoneyGram’s minimum transfer amount is influenced by various factors, including the sending and receiving countries, payment method, and delivery speed. When choosing a remittance method, it’s recommended to consult the agent or check the official website for details.

Amount Variations

MoneyGram transfer amount variations are primarily determined by the following factors:

- Differences between sending and receiving countries

- Size of the transfer amount

- Payment method (e.g., debit card, credit card, or bank transfer)

- Delivery speed

When you choose different payment methods, the fees also vary. For example, using a credit or debit card typically incurs higher fees. Rush delivery options have higher fees than standard delivery. Fees and exchange rates in different countries also affect the total transaction cost. Before remitting, it’s best to understand all related fees and restrictions.

Additionally, MoneyGram’s amount limits are influenced by each country’s laws and regulations. MoneyGram’s transaction limits are designed to comply with anti-money laundering and counter-terrorism financing laws. Some countries may be unable to use MoneyGram services due to related legal restrictions. When remitting, you may encounter additional documentation requirements or approvals, which could delay fund receipt.

Maximum Limit

MoneyGram also has clear regulations on maximum transfer amounts. Maximum limits vary by country and region. Below is the main limit information for the United States and China/Chinese Mainland:

| Region | Transfer Limit | Frequency/Type |

|---|---|---|

| United States | $10,000 | Every 30 days |

| China/Chinese Mainland | $10,000 | Per transaction |

| China/Chinese Mainland | $10,000 | Daily limit |

When using MoneyGram in the United States, you can send up to $10,000 every 30 days. In China/Chinese Mainland, the per-transaction and daily limit is $10,000. You need to note that actual limits may be adjusted based on local laws, remittance purpose, and identity verification requirements. MoneyGram’s single transfer limit is typically $10,000, but the specific amount is also influenced by the destination country’s currency and regulations.

Note: When remitting, you must comply with local amount limits and related regulations. If you need to send large amounts, it’s recommended to prepare relevant identification documents in advance and communicate with the local agent or customer service to ensure a smooth transfer.

MoneyGram Transfer Methods

Image Source: unsplash

Bank Transfer

You can choose to send MoneyGram remittances through a bank account. This method is suitable for users needing to transfer larger amounts. You need to provide valid government-issued identification, such as a passport or driver’s license. Bank transfers typically require you to provide the recipient’s full name, address, and phone number, ensuring the information matches their ID. When using bank transfers from China/Chinese Mainland or the United States, funds typically arrive within a few hours to one day. For large remittances, bank accounts are safer and suitable for scenarios requiring compliance and fund tracking.

Credit/Debit Card

You can also use a credit or debit card for MoneyGram remittances. You need to link the card to the MoneyGram platform. Credit card transfer fees are usually higher than debit card or bank transfer fees, and most credit card companies treat such transactions as cash advances, potentially incurring additional fees and higher interest. Debit card transfers have lower fees and faster delivery, suitable for urgent remittances. The per-transaction or monthly limit is generally $10,000. When operating, ensure the card is valid and recipient information is accurate.

Agent Cash Payment

You can visit a MoneyGram agent location in person to complete a remittance with cash. You need to bring valid identification (e.g., passport, driver’s license, or national ID) and recipient information. The process is as follows:

- Find a nearby MoneyGram agent location.

- Provide identification and recipient details.

- Deliver cash and remittance fees.

- Receive a receipt and an 8-digit reference number to notify the recipient for pickup.

Cash remittances are suitable for users without bank cards or those needing quick cash pickup, with funds typically arriving in minutes.

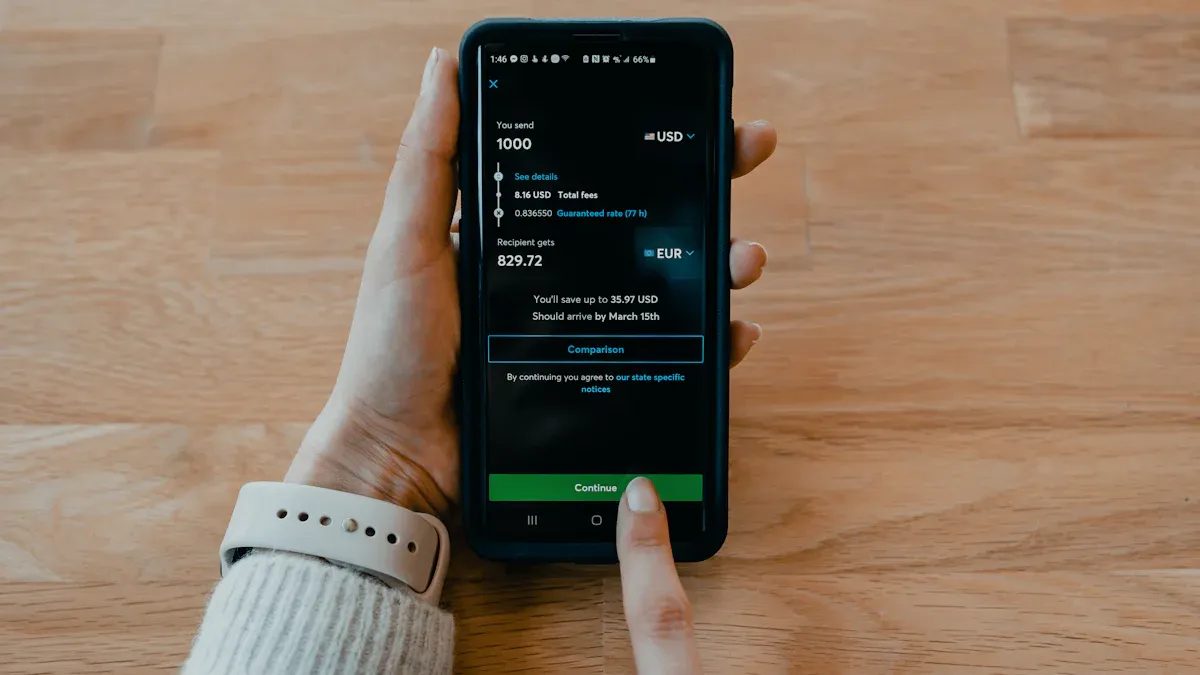

Online and App

You can also send remittances via the MoneyGram website or mobile app. You simply log into your account, enter the amount, select payment and delivery methods, fill in recipient information, and confirm the transfer. Online and app methods support multiple payment options, including bank cards, credit cards, and mobile wallets. MoneyGram uses encryption technology and two-factor authentication to secure your account and funds. You can track transfer status anytime within the app, making it convenient for users who frequently need international remittances.

Use Cases

Different methods suit different needs:

| Feature | Use Case |

|---|---|

| Cash Pickup | Funds available in minutes, suitable for urgent needs |

| Bank Account Transfer | Suitable for large remittances, arriving in hours to a day |

| Online and App | Suitable for frequent international remittances, flexible and secure |

You can choose the most suitable MoneyGram remittance method based on your actual needs. Whether in China/Chinese Mainland or the United States, MoneyGram offers diverse remittance options.

MoneyGram Transfer Tracking

After completing a MoneyGram remittance, you often need to check the fund’s delivery status promptly. Whether in China/Chinese Mainland or the United States, MoneyGram provides multiple tracking methods. You only need to prepare the reference number and identification to easily check transfer progress.

Website Tracking

You can track remittance status in real-time through the MoneyGram website. The process is as follows:

- Visit the MoneyGram official website.

- Enter the reference number (MTCN) from your transfer receipt.

- Enter your last name.

- Click the “Track” button to view the transfer status.

When tracking, it’s recommended to prepare the reference number, sender’s last name and date of birth, and recipient’s name in advance. This ensures accurate information and smooth tracking.

Tip: MoneyGram’s website offers a secure and convenient tracking tool, updating remittance status in real-time to help you stay informed about fund dynamics.

App Tracking

You can also download the MoneyGram mobile app to track remittance progress anytime, anywhere. The app supports the following features:

- View transfer status in real-time to stay updated on fund movements.

- Set transaction notifications to receive status updates instantly.

- Manage all sent and pending remittances after logging into your account.

When using the app, you only need to enter the reference number (MTCN) to access the latest transaction information. The app has a simple interface, making it convenient for users who frequently send international remittances.

Customer Service Inquiry

If you encounter special circumstances or cannot track information, you can contact MoneyGram customer service. You can reach out via chat or email (digitalsupport@moneygram.com). When contacting, it’s recommended to prepare the following information:

- Name

- Email address

- Phone number

- Wallet transaction ID (if applicable)

Customer service will assist in verifying the remittance status or resolving related issues based on the information you provide.

Common Issues

When tracking MoneyGram remittances, you may encounter the following common issues:

- Authorization errors or account verification failures

- Need for additional identification documents

- Mismatched recipient reference number or name

- App malfunctions, which can be resolved by restarting or redownloading

- Delayed remittance status updates, retry after a few minutes

During the remittance process, ensure the recipient has the correct reference number and valid photo identification. The name must match the information provided during sending. MoneyGram remittance status typically updates in real-time, and you can take prompt action or contact official customer service if delays occur.

- You need to remember that MoneyGram’s minimum transfer amount is typically $1,000, with a daily maximum of $10,000.

- You can choose from bank transfers, credit cards, agent cash payments, or online apps for remittances.

- You can track progress using the transaction number on the website, app, or customer service hotline.

MoneyGram uses encryption technology and identity verification processes to protect your information security. You should ensure the information entered is accurate and contact official customer service promptly if issues arise.

FAQ

How long does a MoneyGram transfer take to arrive?

After completing the remittance, funds typically arrive in minutes. Some bank account receipts may take a few hours. You can check progress in real-time via the app or website.

How much are the remittance fees?

The fees you pay vary based on the transfer amount, payment method, and receiving country. Fees generally start at $5. You can check specific fees on the website in advance.

What to do if the reference number is lost?

You can contact MoneyGram customer service, providing identification and remittance details. Customer service will help retrieve the reference number to ensure the recipient can pick up the funds.

What identification is required for remittances?

You need to provide valid government-issued identification, such as a passport or licensed Hong Kong bank account information. The recipient also needs to present photo identification, ensuring consistency with the provided details.

Navigating MoneyGram transfers can be daunting, with high fees, opaque exchange rates, restrictive amount limits, and complex tracking processes complicating cross-border remittances. Imagine a platform offering a total fee as low as 0.5% (covering the entire transfer), real-time rate queries for transparent mid-market pricing, seamless conversions between 30+ fiat currencies and 200+ digital assets, global coverage, and same-day delivery. How would that streamline your experience?

BiyaPay offers a superior alternative. As a top-tier digital finance platform, we simplify mobile-based remittances, enabling easy transfer management and real-time fund tracking. Access our real-time exchange rates to benefit from transparent mid-market pricing, avoiding hidden markups. With multi-layer encryption, FinCEN compliance, and two-factor authentication, BiyaPay ensures secure transactions. Sign up in minutes to handle urgent small transfers or large remittances effortlessly.

Simplify your remittances today! Visit BiyaPay to explore live rates and optimize your transfer strategy. Sign up for a BiyaPay account now and unlock low-cost, rapid, and secure global transfers, making cross-border support seamless and trustworthy.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.