- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Best Ways, Fees, and Security of Electronic Transfers from the US to Canada

Image Source: pexels

When choosing the best way for electronic transfers, you should focus on information accuracy, security measures, fees, processing time, and alternatives to traditional wire transfers. Common methods typically have processing times ranging from instant to four business days, with fees lower than wire transfers. You can flexibly choose the most suitable transfer method based on your actual needs and platform features, ensuring fund safety and reasonable costs.

- Information accuracy

- Security measures

- Fees (typically lower than wire transfers, priced in USD)

- Processing time (instant to 4 business days)

Key Points

- When selecting an electronic transfer method, focus on fees, processing time, and security to ensure fund safety and reasonable costs.

- Bank wire transfers are suitable for large transfers, offering high security but higher fees, with transfer times typically ranging from 1 to 5 business days.

- ACH transfers have low fees, suitable for routine fund flows, with processing times of 2 to 4 business days, ideal for non-urgent scenarios.

- Third-party platforms like Remitly and Wise offer low fees and fast delivery, suitable for individual and small business users.

- Before transferring, carefully verify recipient information and choose platforms with security certifications to protect funds and personal information.

Best Ways for Electronic Transfers

Image Source: pexels

When choosing the best way for electronic transfers, you need to balance transfer amount, speed, convenience, and security. Below, several mainstream methods are detailed to help you make the most suitable choice.

Bank Wire Transfer

Bank wire transfers are a traditional international transfer method. You can initiate a wire transfer through a licensed Hong Kong bank or a U.S. local bank, sending funds directly to the recipient’s bank account in Canada. Bank wire transfers are suitable for large fund transfers, offering high security and complete transaction records. You need to provide detailed recipient information, such as name and bank account details.

| Advantages | Disadvantages |

|---|---|

| Funds arrive quickly, especially for domestic transfers. | High fees ($15-$50 per transfer) |

| Safe and reliable. | Difficult to cancel or reverse once initiated. |

| No limit on transfer amount. | Requires extensive information (recipient name/bank account). |

| Suitable for international transfers. | Slower than most online payment platforms. |

| Easy transfers between your own accounts. | Susceptible to fraud and scams. |

| Provides transaction records as proof of payment. | Less convenient than online options. |

You typically need to wait 1 to 5 business days for funds to arrive. Bank wire transfers are suitable for scenarios requiring formal documentation or large funds, but fees are high, and the process is relatively complex.

- International wire transfers take an average of 1 to 5 business days to complete.

- Specific delivery times depend on the destination country, banks involved, and transfer method.

ACH Transfer

ACH transfers are an electronic automated clearing method, suitable for routine fund flows between the U.S. and Canada. You can initiate ACH transfers through your bank’s online portal, ideal for non-urgent scenarios like payroll or supplier payments. Processing fees are low, typically under $5, with no markup fees, allowing recipients to receive the full amount.

You need to follow these steps:

- Set up ACH or EFT access with your bank.

- Collect the recipient’s bank information.

- Initiate the payment through the online banking portal.

- Review and authorize the payment.

- Monitor the payment status.

- Record and reconcile the transaction.

Advantages of ACH transfers include:

- Low processing fees, especially for receiving funds.

- Electronic processing, eliminating the need for stamps or paper checks.

- Cost-saving for businesses.

However, you should note:

- Banks may set limits on transaction amounts.

- Accurate recipient information is required.

- Processing time can be longer, typically 2 to 4 business days.

Third-Party Platforms

Third-party platforms like Remitly, Xoom, Paysend, and Wise are increasingly popular choices for electronic transfers. These platforms are user-friendly, supporting mobile and web interfaces, making them suitable for individuals and small businesses conducting cross-border transfers. You only need to register an account and fill in recipient information to complete the transfer.

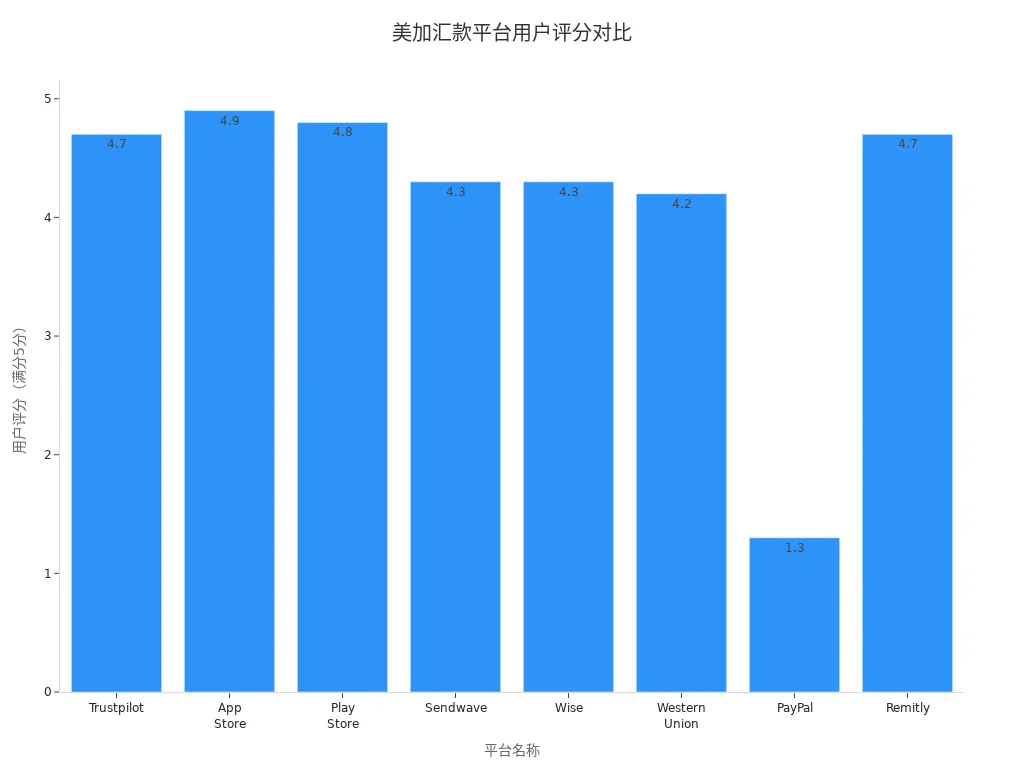

| Platform | Rating |

|---|---|

| Trustpilot | 4.7 stars (67,000+ reviews) |

| App Store | 4.9 stars (494,000+ reviews) |

| Play Store | 4.8 stars (947,000+ reviews) |

| Sendwave | 4.3 stars (19,900+ reviews) |

| Wise | 4.3 stars (241,772+ reviews) |

| Western Union | 4.2 stars (102,600+ reviews) |

| PayPal | 1.3 stars (31,500+ reviews) |

| Remitly | 4.7 stars (67,000+ reviews) |

Different platforms vary in speed and convenience:

| Service | Transfer Speed | Convenience |

|---|---|---|

| Paysend | Up to 3 business days | Depends on the recipient bank’s processing time |

| Remitly | Economy transfers take days, express transfers are faster | Depends on destination and delivery method |

You can choose the appropriate platform based on your needs. Remitly and Paysend are suitable for users seeking low fees and fast delivery. Wise is known for transparent fees, ideal for frequent international transfers.

Interac e-Transfer

Interac e-Transfer is a commonly used electronic transfer method within Canada. You can transfer funds between Canadian bank accounts within minutes. Interac e-Transfer does not support direct payments between the U.S. and Canada, as U.S. banks typically cannot initiate such transfers.

- Only applicable for transfers between Canadian bank accounts.

- Allows individuals and businesses to send or receive funds within minutes.

If you have a Canadian bank account, you can use Interac e-Transfer for small, fast transfers. In some international scenarios, recipients may need to provide valid identification or correct answers to security questions, and payments will be made in the destination country’s currency.

Other Methods

In addition to the mainstream methods above, you can also choose PayPal, Wise, Western Union, or MoneyGram for electronic transfers. Each method suits different scenarios:

| Transfer Method | Recommended Scenario |

|---|---|

| Interac e-Transfer | Suitable for small, fast transfers |

| PayPal | Online transactions and international transfers |

| Wire Transfers | Large transfers, traditional method |

| Mobile Banking Apps | Convenient transfers anytime, anywhere |

| Remitly | Fast and low-cost transfers |

- PayPal is suitable for online transactions, offering competitive exchange rates and low fees.

- Wise is ideal for international transfers with transparent fees.

- Western Union is suitable for traditional transfers but has higher fees.

- MoneyGram is reliable but has slower processing times.

You can flexibly choose the best electronic transfer method based on fund purpose, delivery speed, and fees. For large funds, bank wire transfers are safer and more reliable. For small or frequent transfers, third-party platforms and mobile banking apps are more convenient.

Fees and Costs

Image Source: unsplash

Fees

When choosing the best electronic transfer method, you must focus on the fees of different channels. Bank wire transfers typically have higher fees, especially for cross-border transfers. The table below shows average fees (USD) for major U.S. banks:

| Bank Type | Domestic Incoming | Domestic Outgoing | International Incoming | International Outgoing |

|---|---|---|---|---|

| Industry Average | $13 | $27 | $14 | $44 |

| Licensed Hong Kong Banks | $0-$15 | $30 | $15 | $0-$45 |

Third-party platforms like Paysend and Remitly are known for low fees:

| Service Provider | Fee Structure | Notes |

|---|---|---|

| Paysend | $2 per transfer | Applies to 70+ countries |

| Remitly | $3-$6 per transfer, free for transfers above $1000 | Economy and express options available |

You can choose the most suitable channel based on transfer amount and frequency to save costs.

Exchange Rates

Exchange rate differences directly affect the amount you ultimately receive. Traditional banks typically add a 1%-3% markup to exchange rates, with some banks charging as high as 3%-5%. Third-party platforms like OFX and Wise offer rates closer to the market rate, with lower transaction fees. You should monitor exchange rate fluctuations and plan transfer timing accordingly.

| Source | Exchange Rate Markup | Notes |

|---|---|---|

| Traditional Banks | 1%-3% | Common for international transfers |

| Certain Banks | 3%-5% | Higher markups for some banks |

| Third-Party Platforms | Close to market rates | Lower fees, high transparency |

Exchange rates fluctuate constantly due to market conditions. You can set alerts to transfer when the USD to CAD rate is favorable.

Processing Time and Rush Fees

Bank wire transfers typically take 1-5 business days, while third-party platforms like Remitly offer rush services with instant delivery. Rush services may incur additional fees of $5-$10. You should choose the appropriate service type based on the urgency of funds.

- Bank wire transfers: 1-5 business days

- ACH transfers: 2-4 business days

- Paysend/Remitly: Instant or up to 3 business days

- Rush fees: Some platforms charge $5-$10

Hidden Costs

When making cross-border transfers, you need to be cautious of hidden costs. In addition to explicit fees and exchange rate markups, international remittances often involve intermediary bank fees, which can add $15-$30 per transaction. Some banks also charge foreign currency conversion fees after funds arrive in Canada, affecting the final received amount.

| Fee Type | Description |

|---|---|

| Transaction Fees | Basic handling fees |

| Exchange Rate Markup | Additional costs due to rate differences |

| Intermediary Bank Fees | Fees charged by each intermediary bank during the transfer |

In international remittances, transfers may pass through multiple banks, with each intermediary bank potentially charging additional fees, increasing total costs.

When choosing the best electronic transfer method, you must consider both explicit and hidden costs to ensure fund safety and maximize the received amount.

Security

Platform Security Measures

When choosing the best electronic transfer method, you must focus on the platform’s security mechanisms. Mainstream platforms like Interac and Xoom employ multiple security measures to protect your funds and information. Interac collaborates with financial institutions, law enforcement, and industry partners to implement industry-wide anti-fraud strategies. In 2021, Interac prevented CAD 58.4 million in fraud losses, demonstrating its low fraud rate. The Interac e-Transfer service is regulated by Canadian banks, ensuring system safety and effectiveness. You should verify the recipient’s name and email address during transactions to avoid errors.

The table below outlines key security measures for Xoom and Interac e-Transfer:

| Security Measure | Description |

|---|---|

| Anti-Fraud Verification System | Xoom uses proprietary systems to review transactions and identify suspicious behavior. |

| Identity Verification | Recipients must provide valid identification to ensure authenticity. |

| Transaction Number | Transactions require a number for tracking and verification. |

User Information Protection

When conducting cross-border electronic transfers, platforms strictly comply with Canadian and U.S. data protection regulations. Canada has federal and provincial laws to safeguard your personal information. The table below lists key laws and their principles:

| Law Name | Main Principles | Scope |

|---|---|---|

| PIPEDA | Transparency and security | Federally regulated organizations |

| Act Respecting the Protection of Personal Information in the Private Sector | Data transfer assessment | Quebec |

| Personal Information Protection Act (PIPA) | Transparency and reasonable safeguards | British Columbia and Alberta |

Platforms use mechanisms like Standard Contractual Clauses (SCCs) and Binding Corporate Rules (BCRs) for compliant cross-border data transfers. Some regions require explicit user consent for data transfers or localized processing of sensitive data. In 2023, Meta was fined €1.2 billion for violating data transfer regulations, reminding you to focus on platform compliance.

Risk Prevention

When making cross-border electronic transfers, you need to be cautious of exchange rate fluctuations, high transfer fees, and security risks. Large transactions are prime targets for cybercriminals, but choosing platforms with robust encryption and compliance measures can reduce risks. Common risks include:

- Electronic transfer fraud: Scammers may impersonate senders or recipients to initiate fraudulent transfers.

- Social engineering: Scammers may pose as banks or companies to gain trust and funds.

- Insufficient security measures: Financial institutions failing to flag suspicious activity promptly, leading to fund losses.

You can adopt the following best practices to minimize risks and errors:

- Verify sender identity to ensure information accuracy.

- Set unique security questions for each recipient.

- Be cautious with urgent fund requests, especially those involving impersonation of government officials.

- Regularly change passwords and security questions, avoiding reuse across platforms.

When choosing the best electronic transfer method, prioritize security to protect your funds and information.

Process

Account Setup and Verification

Before using an electronic transfer platform, you first need to complete account setup and identity verification. Most platforms require a valid government-issued photo ID, such as a passport or driver’s license. Some platforms may verify through credit files or other simplified methods. The table below summarizes common identity verification methods:

| Identity Verification Method | Description |

|---|---|

| Government-Issued Photo ID | Requires a valid, current ID or equivalent foreign document issued by federal, provincial, or territorial governments. |

| Credit File | Verifies valid, current credit file information from a Canadian credit bureau. |

| Other Methods | Includes relying on verification from other registered entities or simplified identification for low-risk business entities. |

You should ensure the submitted information is accurate and valid, as errors may affect transfer progress.

Information Entry

When initiating a transfer, you need to accurately enter the recipient’s name, bank account number, bank details, and transfer amount. Some platforms may also require the recipient’s address or contact information. Inaccurate information can lead to transfer failures or delays. You should carefully verify all information before submission.

Delivery Time

Delivery times vary by transfer method. Bank wire transfers typically take 1 to 5 business days, while third-party platforms can achieve instant delivery. You should plan transfer timing based on the urgency of funds.

Currency Conversion

During cross-border transfers, platforms automatically convert USD to CAD. Exchange rates and fees vary across platforms. You can check real-time exchange rates before transferring to choose a cost-effective platform. Some platforms support locking exchange rates to mitigate fluctuation risks.

Notes

- Most banks close on weekends and holidays, so wire transfers initiated during these times are processed on the next business day.

- If you initiate a wire transfer on a weekend or holiday, the bank will process it on the next business day.

- You should monitor bank operating hours to avoid delays due to holidays.

- Save transfer receipts for future reference and reconciliation.

When choosing electronic transfer methods from the U.S. to Canada, consider the following:

- Traditional banks (e.g., licensed Hong Kong banks) have high fees and less competitive exchange rates, suitable for large transfers and scenarios requiring formal documentation.

- Online apps like Wise, Remitly, and Xoom offer low service fees, real-time exchange rates, and fast delivery, ideal for most individuals and small businesses.

- Prioritize security, verify recipient information carefully, and avoid risks from operational errors or information leaks.

You should choose a platform based on your needs, focusing on fees, delivery time, and security measures to ensure funds arrive safely and efficiently.

FAQ

How long does it take to transfer money from the U.S. to Canada?

When using third-party platforms, you can achieve instant delivery. Bank wire transfers typically take 1 to 5 business days. You should choose the appropriate method based on the urgency of funds.

What are common hidden fees in electronic transfers?

You may encounter intermediary bank fees, exchange rate markups, and rush service fees. You should carefully read the platform’s fee disclosures before transferring to avoid reduced received amounts.

Can I use a licensed Hong Kong bank to transfer directly to Canada?

You can initiate an international wire transfer through a licensed Hong Kong bank to send USD to a Canadian bank account. You need to provide detailed recipient information, and fees are higher.

How can I ensure information security during transfers?

You should choose platforms with security certifications and verify recipient information. You can also regularly change passwords and avoid operating on public networks to protect account security.

Will funds be refunded if a transfer fails?

If you enter incorrect information or the recipient account is abnormal, funds are typically refunded to the original account. You should promptly contact the platform’s customer service to verify the reason and provide additional information.

When transferring electronically from the US to Canada, you may value Wise’s low fees (0.45%-0.9%), mid-market rates (0% markup), and instant arrivals (60% of transfers), plus Remitly’s quick mode (minutes) and diverse delivery (cash pickup/Interac), yet face issues: bank wires cost $15-$50 plus $15-$30 intermediary fees, ACH takes 2-4 days, Remitly/Xoom’s 1%-2% rate markups cause ~$10-$35 losses, and $10,000 per-transaction limits require extra verification—especially in 2025’s 4.07% cross-border market growth, amplifying costs and delays for frequent transfers.

BiyaPay stands out as a premier cross-border finance platform, addressing these challenges comprehensively. Our real-time exchange rate query delivers instant mid-market rates to eliminate markups. With fees as low as 0.5%, it supports conversions across 30+ fiat currencies and 200+ digital assets, covering multiple global destinations with same-day delivery. Uniquely, BiyaPay’s single platform supports direct US and Hong Kong stock trading without separate overseas accounts, with zero fees on contract orders, seamlessly turning remittances into investment opportunities. Licensed under US MSB and equivalents, fortified by 256-bit encryption and real-time fraud detection for unmatched compliance and security.

Sign up at BiyaPay today for low-rate, rapid transfers and integrated investing, elevating your US-Canada remittances to greater efficiency and safety!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.