- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money via Remitly: A Safe, Fast, and Low - cost International Transfer Method

Image Source: pexels

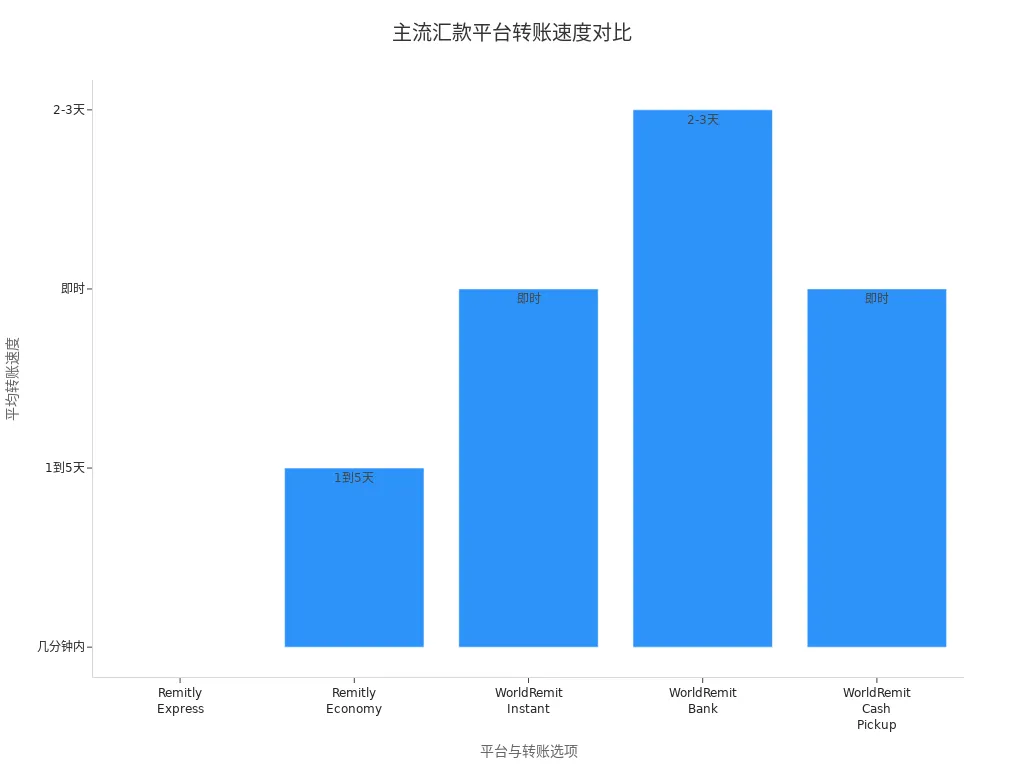

You care about whether international transfers are safe, fast, and low-cost. Remitly transfers offer you high security and flexible options. You can use the Express service to receive funds within minutes, or choose the Economy option to save on fees. The following comparison chart shows the transfer speeds of mainstream platforms:

When transferring money from licensed banks in Hong Kong, the average fees can often range from USD 15 to USD 30. Remitly’s fixed fees are lower, typically below the global average. You can flexibly choose the transfer method and delivery time based on your needs.

Key Points

- Remitly provides secure international transfer services, using multiple security measures to protect your funds and personal information.

- When choosing the Express service, funds typically arrive within minutes, ideal for urgent transfer needs.

- When using Remitly, fees are transparent and usually lower than traditional banks, helping you save more costs.

- Registering a Remitly account is simple, requiring only basic information to start transferring.

- You can flexibly choose transfer and receipt methods to meet different needs, making it convenient and fast.

Remitly Transfer Advantages

Security

When choosing an international transfer platform, security is one of the most important considerations. Remitly transfers use multiple advanced security measures to protect your funds and personal information. You can refer to the table below to understand the platform’s main security technologies:

| Security Measure | Description |

|---|---|

| Advanced Security Technology | Real-time monitoring and detection of suspicious activity, with immediate account freezing in case of theft to prevent unauthorized transactions. |

| Two-Factor Authentication | It’s recommended to enable two-factor authentication and regularly update passwords to enhance account security. |

| Encryption Technology | Ensures the safety of your sensitive data during transmission and storage. |

| 24/7 Transaction Monitoring | Monitors all transactions around the clock to promptly detect and prevent fraudulent activities. |

| Compliance | Adheres to global data protection regulations to ensure the safety of funds and personal information. |

| Cybersecurity | Uses intrusion detection systems and regular vulnerability assessments to prevent hacker attacks. |

| Partnerships | Collaborates with global payment networks and cybersecurity companies, adopting advanced encryption and data protection technologies. |

When using Remitly transfers, the platform also employs machine learning models and biometric technologies (such as facial recognition) to identify unusual account activity. Every transfer requires strict account verification to ensure only you can operate it. Remitly transfers are fully regulated by financial authorities in multiple jurisdictions, strictly adhering to anti-money laundering and anti-fraud standards. You can use Remitly transfers with confidence, without worrying about funds or information leaks.

Speed

Sometimes you need urgent transfers, and Remitly offers Express and Economy options. The Express service is ideal for urgent situations, with funds typically arriving within minutes. You can refer to the table below to understand the delivery speeds of different services:

| Service Type | Transfer Speed | Fees |

|---|---|---|

| Express | Usually arrives within minutes | Higher fees |

| Economy | Up to 3 business days | More affordable |

If you choose the Economy service, the transfer time can take up to 3 business days, suitable for scenarios where you’re less concerned about delivery time but want to save on fees. You can flexibly choose based on your actual needs, ensuring timely fund delivery while balancing costs.

Fees

When using Remitly transfers, you can enjoy a transparent and low-cost fee structure. The platform offers different fees and delivery times for various transfer options. The table below shows the main fee structures:

| Transfer Option | Fee Characteristics | Processing Time |

|---|---|---|

| Economy Transfer | Lower fees | Longer time |

| Express Transfer | Higher fees | Shorter time |

If you’re a new user making your first Remitly transfer, you can enjoy zero-fee transfers and exclusive discounts. As long as you register and complete your first qualified transfer during the promotional period, the system will automatically waive the handling fee. This offer is limited to one per new user, and existing customers are not eligible. You just need to ensure the funds are successfully deposited into the recipient’s bank account or mobile wallet to enjoy the discount.

Tip: Registering a Remitly transfer account during major promotional periods (e.g., June to September) usually offers higher initial savings.

When transferring from licensed banks in Hong Kong, you often need to pay fees of USD 15 to USD 30. Remitly’s Economy service fees are typically lower than this, helping you save more costs.

Platform Overview

Service Coverage

You can transfer money to multiple countries and regions worldwide through Remitly. The platform covers major markets in Asia, Africa, Europe, and the Americas. You can use Remitly services in mainland China, Hong Kong, the United States, and other locations. The platform supports multiple currency exchanges, allowing you to choose the appropriate currency based on the recipient’s location. When transferring from a licensed bank account in Hong Kong, Remitly will automatically display real-time exchange rates and estimated delivery times. You can operate anytime on your phone or computer without visiting a physical branch.

Tip: When using Remitly, you can check the transfer progress at any time, and the platform will notify you of each step via SMS or email.

Supported Methods

When transferring, you can choose from multiple payment methods. Remitly supports the following payment channels:

- Debit card

- Credit card

- Bank transfer

You can select the most suitable payment method based on your funding source and convenience. When choosing a receipt method, you also have multiple options. Remitly supports the following receipt methods:

- Cash delivery

- Bank deposit

- Mobile wallet

- Cash pickup

You can have the recipient receive funds directly in their bank account or choose to let them pick up cash at a designated location. Mobile wallets are suitable for recipients without bank accounts. Cash delivery services provide the convenience of doorstep cash delivery in some countries and regions. During the process, the platform clearly displays the fees and delivery times for each method, helping you make the best choice.

Remitly Transfer Process

Image Source: unsplash

Account Registration

When starting to use Remitly transfers, you first need to register an account. You only need to prepare a valid email address. The registration process is very simple and suitable for most users. You need to provide the following basic information:

- Name

- Address

- Payment information (e.g., debit or credit card details)

For small transfers, the platform usually doesn’t require additional documents. When registering a business account, you need to provide additional business-related information, including business name, address, operating name, EIN or ITIN, state of incorporation, business description, and entity type. The platform may also require you to provide the names, addresses, and birth dates of beneficial owners and controllers.

Tip: During registration, it’s recommended to use accurate and valid information to ensure smooth subsequent transfers.

Account Verification

After completing registration, Remitly transfers will require you to perform account verification. This step is mainly to ensure fund security and prevent fraud. You need to complete the following actions:

- Verify your email address

- Upload a government-issued photo ID (e.g., passport, national ID, or driver’s license)

- Provide proof of address (e.g., utility bill or bank statement, especially for large transfers)

These documents must clearly show your full name, date of birth, and photo. After uploading, the platform will complete the review in a short time. You can only proceed with formal transfers after passing verification.

Choosing a Transfer Method

On the Remitly transfer platform, you can flexibly choose a transfer method. The platform offers two main options:

| Transfer Method | Fees (USD) | Delivery Time | Applicable Scenarios |

|---|---|---|---|

| Express Transfer | $3-$12+ | Arrives within minutes | Urgent transfers |

| Economy Transfer | $0-$5 | Up to 3 business days | Cost-saving |

You can choose between Express (fast) or Economy (cost-saving) services based on your needs. Express transfers are suitable for situations where funds need to arrive immediately, while Economy transfers are ideal for cost-conscious scenarios.

Entering the Amount

After choosing a transfer method, you need to enter the transfer amount. Remitly transfers will automatically calculate fees based on the destination country, transfer amount, and payment method. The platform will display real-time exchange rates and fees, so you can clearly understand the total cost. You can see the following information on the page:

- Exchange rate (usually competitive but may be slightly below market rates)

- Handling fee (automatically adjusted based on transfer method and amount)

- Estimated delivery time

You can adjust the transfer amount based on this information to ensure the recipient receives the appropriate funds.

Payment Options

On the Remitly transfer platform, you can choose from multiple payment methods. Common payment channels include:

- Debit card

- Credit card

- Bank transfer

You can select the most suitable method based on your funding source and convenience. The platform will clearly display the fees and delivery speeds for each method on the payment page. When choosing a payment method, it’s recommended to prioritize licensed bank accounts in Hong Kong to ensure fund security and delivery efficiency.

Receipt Methods

When setting up recipient information, you can choose from multiple receipt methods. Remitly transfers support the following options:

- Bank account deposit

- Mobile wallet deposit

- Cash pickup

The recipient can receive funds directly in their bank account or choose to pick up cash at a nearby physical location. Mobile wallets are suitable for recipients without bank accounts. When transferring in mainland China, some regions also support Alipay or WeChat receipt, subject to the platform’s display.

Tip: When choosing a receipt method, it’s recommended to communicate with the recipient in advance to ensure they can receive the funds smoothly.

Transfer Confirmation

After completing all information, you need to carefully review the transfer details. Remitly transfers will display the following on the confirmation page:

- Transfer amount

- Exchange rate and fees

- Recipient information

- Estimated delivery time

After confirming everything is correct, you can submit the transfer. The platform will send a confirmation via email or SMS, including a unique tracking number (RTN). You can verify the tracking number to ensure there are no spelling errors or missing digits.

Tracking Progress

After completing the transfer, you can track its progress at any time. Each transaction has a unique tracking number. You can enter the tracking number on Remitly’s official website or mobile app to check the transfer status in real time. The platform will notify you of each step via email or SMS, ensuring you stay informed about the funds’ status. If the tracking number doesn’t work, you can contact Remitly customer support to resolve the issue promptly.

Tip: During the transfer process, it’s recommended to save all confirmation information and tracking numbers for future reference and communication.

Fees and Limits

Image Source: pexels

Fee Details

When using Remitly transfers, the platform charges different fees based on your transfer amount, destination, and selected service type. Economy service fees are generally lower, suitable for cost-saving scenarios. Express services charge higher fees but allow funds to arrive faster. You can clearly see all fee details on the payment page. Common fee structures are as follows:

- Economy service: Fees generally range from $0-$5

- Express service: Fees typically range from $3-$12 or more

For first-time users, the platform often offers zero-fee or discounted promotions. You can follow promotional information and plan your transfer timing to enjoy more savings.

Tip: When choosing a payment method, note that credit card payments may incur additional fees, so it’s recommended to prioritize debit cards or bank transfers.

Delivery Time

When transferring, the delivery time depends on the service type and recipient country. Economy services typically take 2 to 3 days, while Express services can be completed within minutes. You can refer to the table below for the average delivery times of main channels:

| Transfer Service | Transfer Time |

|---|---|

| Remitly | Usually takes 2 to 3 days, but faster options are available (with additional fees) |

During operation, the platform will display the estimated delivery time in real time. You can choose the service type based on the recipient’s needs to ensure timely fund arrival.

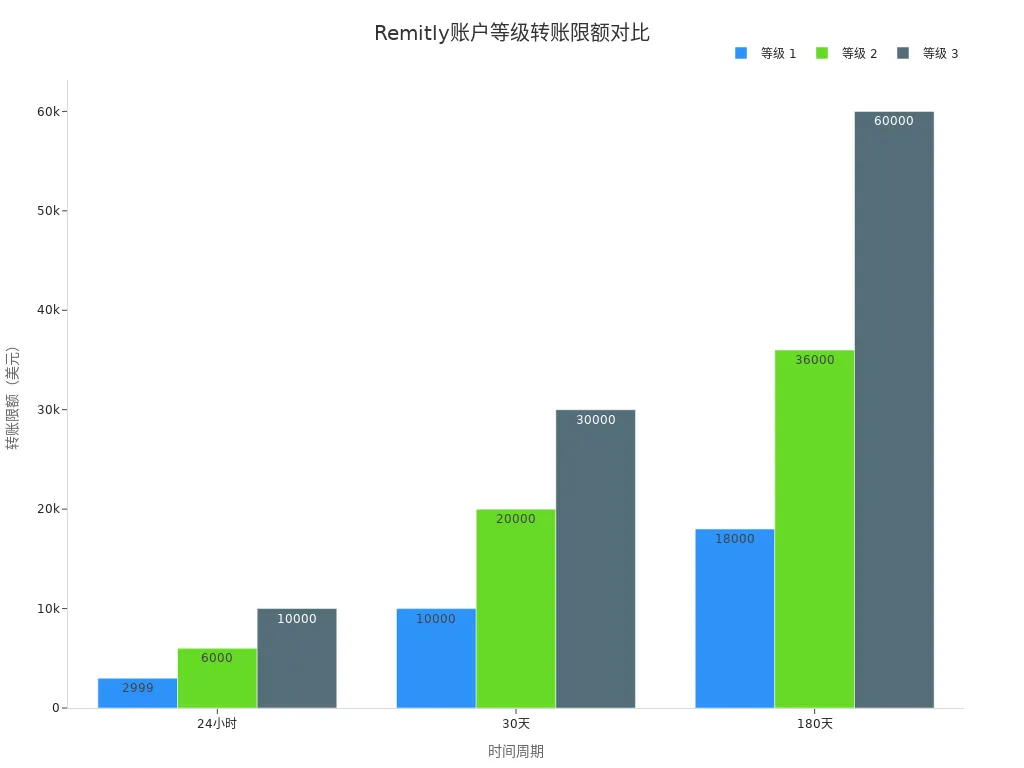

Transfer Limits

When using Remitly transfers, the platform sets different transfer limits based on your account verification level. After completing basic verification, you can transfer up to $2,999 every 24 hours. If you need higher limits, you can submit additional identity and address proof to upgrade your account level. The table below shows the transfer limits for different levels:

| Sending Limit | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| 24 Hours | $2,999 | $6,000 | $10,000 |

| 30 Days | $10,000 | $20,000 | $30,000 |

| 180 Days | $18,000 | $36,000 | $60,000 |

You can refer to the chart below for a more intuitive understanding of limit changes across levels:

Tip: When upgrading your account level, it’s recommended to prepare relevant proof documents in advance for quick review.

Pros and Cons Summary

Advantages

When using Remitly for international transfers, you can experience several significant advantages:

- You can enjoy extremely fast delivery speeds, especially with the Express service, where funds can reach the recipient’s account within minutes.

- The platform is highly efficient with a simple interface, suitable for quickly completing the transfer process.

- Remitly is highly reliable, regulated by financial authorities in multiple countries, ensuring fund security.

- You can manage transfer progress anytime, anywhere through a user-friendly app.

- Customer service is excellent, able to promptly address your questions.

- The platform uses multiple security measures to protect your account and personal information.

These advantages make your cross-border transfers more secure and efficient.

Disadvantages

When using Remitly, you should also be aware of some limitations. The table below summarizes the main drawbacks and their descriptions:

| Disadvantage | Description |

|---|---|

| Exchange Rate Fluctuations | Rates may fluctuate, affecting the actual amount received, especially when stable amounts are needed. |

| Customer Support | Although generally well-rated, response delays may occur during peak times, which can be inconvenient in emergencies. |

| High-Value Transfer Restrictions | If you need large or commercial payments, Remitly does not support batch processing or currency hedging. |

| Credit Card Fees | When paying with a credit card, fees are higher, and banks may charge additional fees. |

| Transfer Limits | Initial account transfer limits are low, requiring more identity proof to increase limits. |

You should also note that Remitly’s operations may be affected by changes in U.S. immigration policies and the rise of cryptocurrencies. These external factors may impact the platform’s long-term service stability.

Suitable Users

If you belong to the following user groups, Remitly is a suitable choice:

| User Group/Scenario | Applicability Description |

|---|---|

| Areas with underdeveloped banking systems | You can easily receive funds through cash pickup and mobile wallet services. |

| Users needing cash pickup services | You can receive transfers at designated locations without a bank account. |

If you’re in mainland China or other areas with limited banking services, Remitly’s diverse receipt methods can meet your actual needs. You can also flexibly choose between licensed bank accounts in Hong Kong and mobile wallets to enhance your transfer experience.

By choosing Remitly transfers, you can experience safe, fast, and diverse services. The platform supports over 170 countries, offering bank deposits, mobile wallets, and cash pickup options. You simply need to register an account, verify your identity, choose a transfer method, and check fees and exchange rates to easily complete transfers. The table below compares the main features of Remitly and Wise, helping you quickly determine which platform suits you best:

| Feature | Remitly | Wise |

|---|---|---|

| Transfer Support | Over 170 countries and 100+ currencies | Direct transfers to bank accounts |

| Delivery Methods | Bank deposits, mobile wallets, cash pickup | Limited to bank accounts |

| Transfer Speed | Can be expedited based on selected service | Typically standard transfer times |

| Customer Support | Multi-channel support | Primarily digital channel support |

| Geographic Coverage | Broader country coverage and multiple payment methods | Fewer target countries, focused on direct bank delivery |

You can choose the most suitable international transfer method based on your needs.

FAQ

What payment methods does Remitly support?

You can choose a debit card, credit card, or licensed bank account in Hong Kong for payment. The platform will display the fees and delivery speeds for each method on the payment page.

What information is needed to transfer to mainland China?

You need to provide the recipient’s name, bank account information, or mobile wallet account. Ensure all information is accurate to avoid delays in delivery.

How long does it take for a transfer to arrive?

When choosing the Express service, funds arrive within minutes. Economy services typically take 2 to 3 business days. The platform will display the estimated delivery time during operation.

How can I check the transfer progress?

You can log into Remitly’s website or app and enter the tracking number to check the progress in real time. The platform will also notify you of each step via SMS or email.

Are there transfer amount limits?

After basic verification, you can transfer up to USD 2,999 every 24 hours. Submitting additional identity documents will increase the limit. Refer to the account page for specific limits.

Are you paying high fees for fast transfers on Remitly, or losing money to hidden exchange rate markups? BiyaPay offers a smarter, more cost-effective alternative for international money transfers. We support seamless conversion between 30+ fiat currencies and 200+ cryptocurrencies, with fees as low as 0.5% — no hidden charges, ever. Use our real-time exchange rate tool to lock in the best rate and maximize the value of your transfer. Whether sending to Africa, Asia, or the Americas, BiyaPay enables same-day sending and same-day delivery directly to the recipient’s bank account. We adhere to strict global compliance standards to ensure security and reliability. Visit BiyaPay today and register in minutes to experience a faster, cheaper, and more transparent way to send money worldwide — a powerful alternative to high-cost remittance platforms.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.