- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What is the exchange rate for Remitly's remittance to India? Understand the transfer requirements and security measures from the US to India

Image Source: pexels

When you use Remitly to transfer money from the U.S. to India, the exchange rate directly affects the amount the recipient actually receives. See the table below:

| Provider | Arrival Time | Exchange Rate | Transfer Fee (USD) | Amount Received (INR) |

|---|---|---|---|---|

| Other Providers | 6-9 days | 88.3727 | 0.00 | 88,372.74 |

| Remitly | 12 hours | 88.7433 | 11.72 | 87,703.23 |

You can choose Remitly’s fast service with a more transparent fee structure:

- Each transfer costs only $3.99, with the fee waived for first-time transactions or transfers over $1,000.

- Multiple payment methods are available, including bank transfers, debit cards, credit cards, and mobile wallets.

You need to keep track of exchange rates and transfer fees to better calculate the actual amount received and plan your transfers effectively.

Key Points

- When using Remitly for transfers, the exchange rate directly impacts the amount the recipient receives. Monitor rate changes and choose the best time to send money.

- Remitly’s fee structure is transparent, with small transfers costing just $3.99, and fees waived for first-time transactions or amounts exceeding $1,000.

- Transfers require valid identification documents to ensure accuracy and avoid delays or failures.

- Remitly uses advanced encryption technology to ensure user data security and adheres to strict compliance standards.

- Choose the right transfer method: economy service takes 3-5 days, while express service is typically completed within hours.

Exchange Rates and Fees

Image Source: unsplash

Exchange Rates

When you choose Remitly for transfers from the U.S. to India, the exchange rate is a primary concern. Remitly’s USD to INR exchange rate directly affects the amount the recipient receives. You can refer to the table below to understand how Remitly’s recent exchange rates compare with other mainstream services:

| Time | Remitly Rate (USD→INR) | Wise Rate (USD→INR) |

|---|---|---|

| Recent | ₹69,910.00 | ₹70,092.73 |

Remitly’s exchange rates are typically updated multiple times daily. When you transfer, the system adjusts the rate in real-time based on global financial market changes, economic conditions, and central bank policies. You can check the current rate before placing an order and select the optimal time for your transfer.

- Exchange rate fluctuations directly affect the amount your family in India receives.

- The transfer amount is calculated based on the exchange rate at the time of your order, and rate changes may result in a different final amount received.

- Transfer fees also impact the final amount received.

- For example, if the exchange rate is ₹83 per USD, $1,000 would equal ₹83,000, with the amount reduced after fees.

Remitly strives to offer competitive exchange rates, helping you maximize returns when market conditions are favorable. You can monitor rate changes and flexibly schedule your transfers.

Fee Structure

When using Remitly for transfers, in addition to exchange rates, you need to understand the fee structure. Remitly’s fee structure is transparent and primarily includes the following categories:

| Fee Type | Description | Notes |

|---|---|---|

| Transfer Fee | Varies based on service type (standard or express). | Additional processing fees may apply |

| Exchange Rate Difference | Advertised rates may differ from actual rates; express service fees may be higher. | More noticeable for large transfers |

| Recipient Bank Fees | Indian receiving banks may charge additional fees; check regulations in advance. | Read service terms carefully |

Remitly’s fee structure is simpler compared to traditional banks and some international transfer services. You can refer to the table below for a fee comparison between Remitly and other services:

| Service | Fee Structure Description |

|---|---|

| Remitly | Transparent fees based on transfer amount, location, receiving method, and payment method. |

| Western Union | Complex fee structure influenced by transfer method, destination, and amount; higher fees for credit card payments. |

When choosing a transfer service, Remitly typically saves you more costs. The table below shows the average fee and exchange rate comparison between Remitly and traditional banks:

| Service Type | Exchange Rate | Fees |

|---|---|---|

| Remitly | Better | Lower |

| Traditional Banks | Lower | Higher |

In practice, you may encounter common hidden fees, such as transfer fees, exchange rate markups, and cash advance fees. Remitly has been committed to making international transfers faster, simpler, and more transparent since 2011. Millions have chosen Remitly for secure and affordable transfers.

Tip: Before transferring, carefully review the fee details to avoid hidden fees impacting the received amount. Choosing a platform with better exchange rates and lower fees ensures your family receives more funds.

Transfer Requirements

Identity Verification

When using Remitly to transfer money from the U.S. to India, you must prepare compliant identification documents. The platform requires you to upload or provide the following:

- Valid government-issued photo ID, such as a passport, driver’s license, or state ID

- Proof of address, such as a utility bill or bank statement, especially for large transfers

- Additional documents, such as proof of income or bank account verification, for high-value transfers

When you register for the first time or increase your transfer limit, the system will prompt you to submit these documents. Identity verification helps prevent fraud and money laundering, ensuring your funds’ safety.

Tip: When uploading documents, ensure the information is clear and within the validity period to avoid delays due to non-compliant materials.

Recipient Information

When filling out recipient information, you need to be especially careful about accuracy. The platform typically requires you to provide the recipient’s full name, bank account number, bank name, and branch code. Errors in this information can lead to transfer delays or returns.

- Verify the recipient’s name spelling and bank account details to ensure they match the information registered with the Indian bank.

- If the recipient uses a mobile wallet or other receiving method, confirm the account type and contact details are correct.

While the system automatically validates some fields, the ultimate responsibility lies with you. Accurate information ensures faster transfers and minimizes issues.

Amount Limits

Remitly sets different levels of limits for transfers from the U.S. to India. You can choose the appropriate limit based on your needs. The table below shows the daily and monthly limits for different transaction types:

| Transaction Type | Daily Limit (USD) | Monthly Limit (USD) |

|---|---|---|

| Self-Transfer | $30,000.00 | $150,000.00 |

| Non-Self Transfer | $3,000.00 | $5,000.00 |

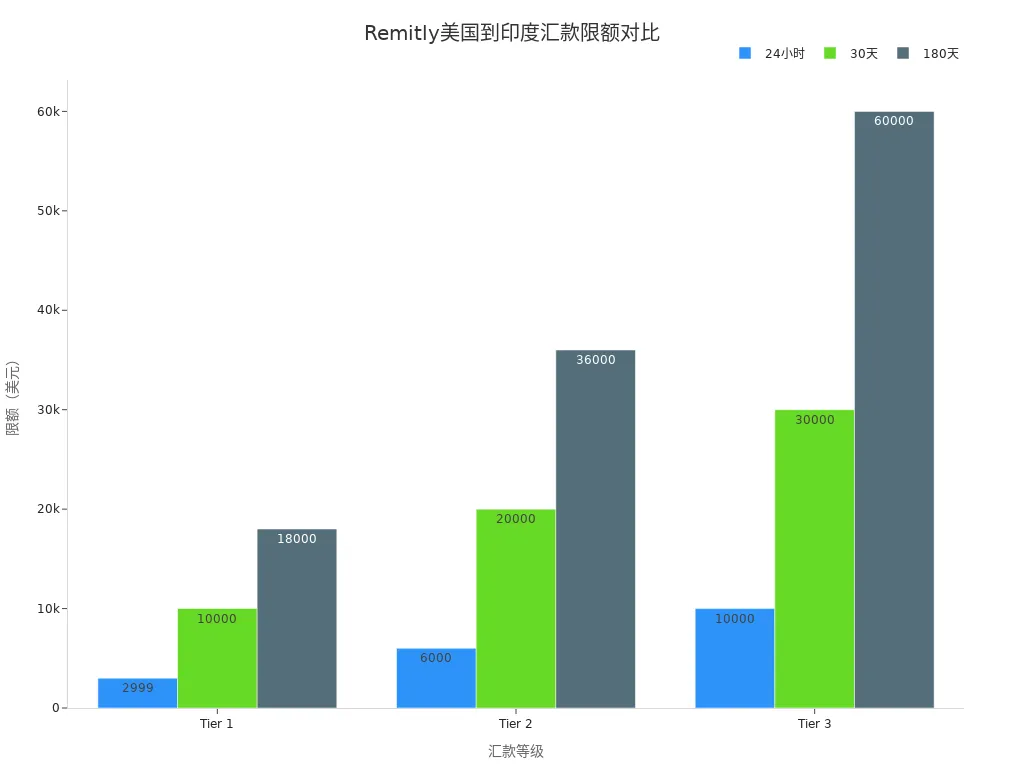

You can also refer to the different tiers of transfer limits:

| Sending Limit | 24 Hours | 30 Days | 180 Days |

|---|---|---|---|

| Tier 1 | $2,999 | $10,000 | $18,000 |

| Tier 2 | $6,000 | $20,000 | $36,000 |

| Tier 3 | $10,000 | $30,000 | $60,000 |

When transferring, you must comply with relevant regulations. Remitly adheres to U.S. anti-money laundering laws and the Reserve Bank of India’s international transfer caps. Recently, India introduced a 3.5% remittance tax for non-citizens (e.g., green card or H1B visa holders) and requires providers to report transactions exceeding $5,000, enhancing KYC verification. For large transfers, check the latest policies and plan accordingly.

Note: Exchange rates and amount limits affect the funds your family in India receives. Before transferring, consider your needs and policy changes to choose the best amount and timing.

Safety Measures

Image Source: pexels

Data Encryption

When using Remitly for U.S. to India transfers, data security is a top priority. Remitly employs multiple advanced encryption technologies to ensure your personal information and funds are protected during transmission and storage. The table below outlines Remitly’s main data encryption technologies:

| Encryption Technology | Description |

|---|---|

| Transport Layer Security (TLS) | Ensures secure transmission of user information. |

| AES256 | A modern encryption protocol ensuring data security. |

| 2048-bit RSA | Used for encrypting and decrypting data, providing robust security. |

Each time you log into your Remitly account, the system protects your login information through secure server connections (https://). All transfer data is encrypted with TLS to prevent hacking. Remitly also uses industry-leading AES256 and 2048-bit RSA protocols to ensure your sensitive information remains secure.

Remitly’s data security standards align with global financial industry practices. You can confidently use the platform, as Remitly not only protects your data but also continuously upgrades its security technology to counter emerging cyber threats.

- Remitly uses advanced encryption to protect all transmitted data.

- Complies with industry-specific regulations and international data protection standards, such as GDPR and PCI DSS.

- Implements advanced fraud prevention tools to detect and prevent fraudulent activities.

- Conducts regular audits to maintain compliance.

- Uses industry-standard encryption to protect sensitive information.

Compliance

When choosing an international transfer service, the platform’s compliance and regulatory credentials are critical. Remitly holds strict financial licenses and certifications in multiple global markets. The table below shows Remitly’s compliance status and regulatory bodies in different regions:

| Regulatory Region | Compliance Status | Annual Compliance Cost |

|---|---|---|

| United States | Fully Compliant | $7,500,000 |

| Canada | Fully Licensed | $2,100,000 |

| United Kingdom | FCA Registered | $1,800,000 |

| Australia | AUSTRAC Compliant | $1,200,000 |

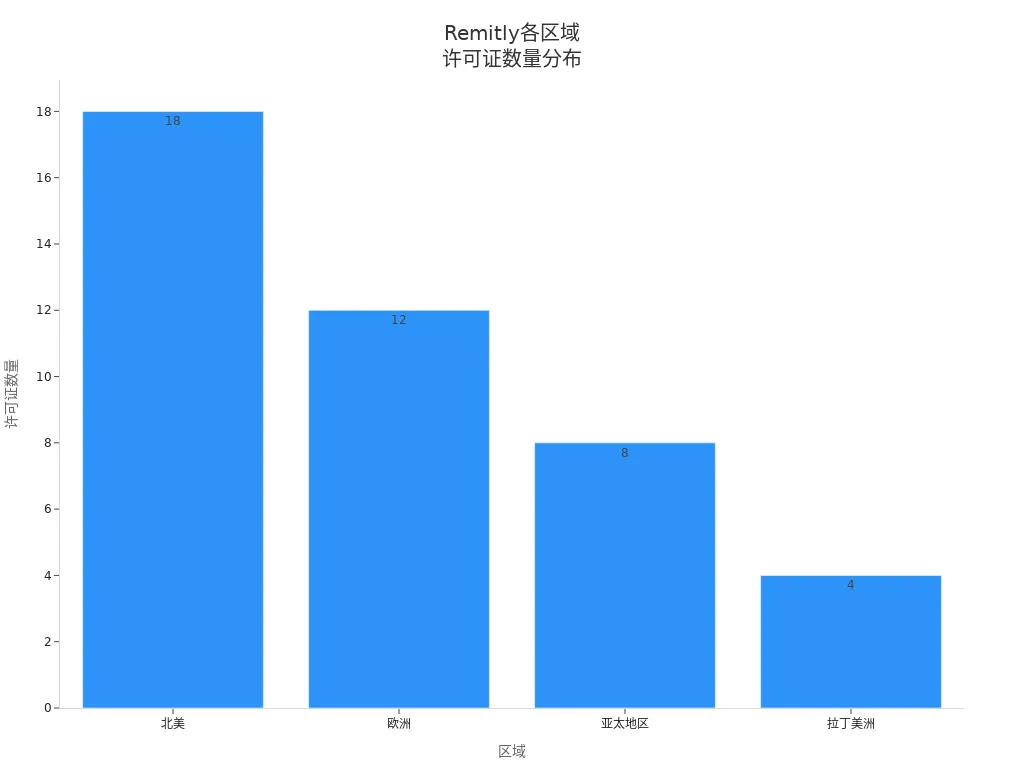

Remitly holds multiple financial licenses in North America, Europe, Asia-Pacific, and Latin America, regulated by authorities like FinCEN, FCA, and AUSTRAC. You can view the number of licenses Remitly holds globally in the chart below:

Remitly strictly adheres to anti-money laundering (AML) and know-your-customer (KYC) policies. When registering and transferring, the platform requires you to submit identity information and monitors every transaction. Remitly partners with licensed banks in various countries to ensure each transfer complies with local laws and international standards.

- Remitly follows strict AML and KYC guidelines.

- Implements identity verification and transaction monitoring to prevent illegal activities.

- Partners with licensed banks in various countries to ensure compliance with standards.

You can trust Remitly’s compliance system and risk management capabilities. The platform invests significant funds annually in compliance management to protect your funds and legal rights.

Customer Support

If you encounter any issues during the transfer process, you can contact Remitly’s customer support team at any time. Remitly offers 24/7 multilingual customer service to help resolve issues related to accounts, transfers, and identity verification.

- Track transfer status in real-time to monitor fund movements.

- Receive notifications at each transaction stage for transparent information.

- Access a 24/7 customer support team that responds quickly to your needs.

- Deploys manual and automated risk management processes to identify suspicious activities promptly.

You can contact Remitly’s customer support via phone, email, or online chat. If you notice unauthorized transactions, contact Remitly immediately. The platform recommends regularly logging into your account to check transaction records and protect against unauthorized activities. If you report lost or stolen information within 2 business days, your liability is limited to $50. Failure to report unauthorized transactions within 60 days may result in unrecoverable losses.

Tip: If you detect any unusual transactions, contact Remitly’s customer support immediately. The platform will assist in freezing your account and investigating to minimize losses.

Remitly continuously improves the customer experience. If you encounter issues like inconsistent service, canceled transfers, or delayed tracking, you can provide feedback through official channels. Remitly values user feedback and strives to enhance service quality for a smoother and safer transfer experience.

Transfer Speed and Service Comparison

Arrival Time

When choosing a transfer service, arrival time is a key consideration. Remitly partners with international licensed banks like JP Morgan Bank to ensure secure and fast transfers. You can choose economy or express services. Economy transfers typically take 3-5 business days, while express transfers are completed within hours. The table below shows the average transfer times for different methods:

| Transfer Method | Average Transfer Time |

|---|---|

| Remitly Economy | 3-5 business days |

| Remitly Express | Within hours |

| Industry Average | Hours to days |

For urgent needs, you can prioritize Remitly Express, and the platform will automatically match the fastest delivery channel based on your payment method and receiving bank.

Service Comparison

When comparing Remitly with other mainstream transfer platforms, focus on fees, exchange rates, and arrival times. Remitly charges a $3.99 fee for small transfers, with fees waived for amounts over $1,000, but includes a 0.4% to 1.4% exchange rate markup. Wise uses the mid-market rate with fees starting at 0.48%. The table below highlights their differences:

| Feature | Remitly | Wise |

|---|---|---|

| Sending Fees | $3.99 (small transfers); waived for large transfers | Starting at 0.48% |

| Exchange Rate | 0.4%-1.4% markup | Mid-market rate, no markup |

| Speed | Economy 3-5 days, Express within hours | 60% instant, 95% within one day |

You can choose the most suitable platform based on your transfer amount and delivery needs.

User Experience

When using Remitly, you’ll find its transfer speed and customer service highly rated by users. Trustpilot scores it 4.6, with users praising transfers completed within hours. Remitly offers 24/7 customer support via live chat, email, and in-app messaging. The table below summarizes commonly mentioned advantages:

| Advantage | Description |

|---|---|

| Transfer Speed | Users praise fast transfers, often completed within hours |

| Customer Service | 24/7 support, quick responses, helpful staff, and clear guidance |

If you encounter issues, you can contact Remitly’s customer support anytime. The platform prioritizes your experience, ensuring secure, timely, and smooth transfers.

When choosing Remitly for U.S. to India transfers, you get real-time updated USD to INR rates, transparent fees, and multiple delivery speed options. The table below summarizes Remitly’s main advantages:

| Feature | Description |

|---|---|

| Exchange Rate | Real-time updates with rate locking to reduce market fluctuation impact. |

| Fees | Low fees for small transfers; economy and express options meet different needs. |

| Security | Multiple encryption technologies and strong compliance ensure fund safety. |

| Service Speed | Express option delivers within hours; economy option is more cost-effective. |

When transferring, keep the following in mind:

- Comply with the Reserve Bank of India’s annual transfer limit (up to $250,000 per person per year) and ensure legitimate use.

- Carefully verify recipient information to avoid delays or failures.

- Monitor transfer fees and exchange rate changes to plan transfers effectively.

- Keep records of high-value transfers and track their status promptly.

You can select the most suitable transfer method based on your needs to ensure fund safety and delivery efficiency.

FAQ

How Long Does It Take for a Remitly Transfer to Reach India?

When you choose the express service, funds typically arrive within hours. Economy service generally takes 3-5 business days. Arrival times vary based on the receiving bank and payment method.

Can I Lock the Exchange Rate for a Transfer?

You can lock the current exchange rate when placing an order. The system calculates the amount based on the rate at the time of your order, avoiding fluctuations affecting the recipient’s funds.

What Are the Receiving Options for Transfers?

You can choose bank accounts, mobile wallets, or cash pickup. Some methods may require additional recipient information. Verify recipient account details in advance.

Are There Minimum or Maximum Amount Limits for Transfers?

Each transfer has minimum and maximum amount limits. Different account tiers have varying daily, monthly, and semi-annual limits. Check specific limits in your account settings.

How Does Remitly Ensure Fund Security?

When transferring, Remitly uses TLS and AES256 encryption to protect data. The platform complies with U.S. and Indian regulations, implementing multiple identity verification and risk monitoring measures.

When using Remitly for US-to-India remittances, you might grapple with exchange rate markups, steep small-transfer fees, rigorous ID verification, and compliance hurdles like TCS taxes—challenges that often inflate costs and complicate support. Envision a platform with a total fee as low as 0.5%, real-time rate queries for transparent mid-market pricing, seamless conversions between 30+ fiat currencies and 200+ digital assets, worldwide coverage, and same-day delivery. How could that enhance your efficiency?

BiyaPay is designed for such scenarios. As a trusted digital finance platform, we streamline mobile transfers from the US to India, handling KYC and RBI limits effortlessly. Access our real-time exchange rates to leverage transparent mid-market rates, dodging hidden premiums. With multi-layer encryption, FinCEN and MSB compliance, BiyaPay guarantees secure, trackable transactions. Quick signup supports large sends to Indian banks or UPI, surpassing conventional options.

Streamline your India remittances now! Visit BiyaPay to check live rates and plan cost-effective transfers. Sign up for a BiyaPay account today and discover rapid, secure cross-border solutions that make family aid worry-free and dependable.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.