- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use MoneyGram for International Remittances: Understanding Fees, Exchange Rates, and Usage Restrictions

Image Source: unsplash

When you want to use MoneyGram for international transfers, you need to first register an account, complete identity verification, and then fill in the recipient’s information. After selecting the transfer and receipt methods, the system will display real-time exchange rates and fees. During the process, you may often encounter issues such as transfer delays, high fees, account suspensions, or frozen funds. You also need to pay attention to delivery times and amount limits to avoid delays due to complex processes or poor service quality.

Friendly Reminder: Carefully verify each step to ensure accurate information and reduce unnecessary issues.

Key Points

- Registering a MoneyGram account and completing identity verification is the first step for international transfers, ensuring accurate information to avoid delays.

- Choosing the right transfer method, online operations are usually faster and lower-cost, suitable for users looking to save on fees.

- Before transferring, be sure to understand the fees and exchange rates; using MoneyGram’s website or app fee estimator can help you make informed choices.

- Pay attention to per-transaction and 30-day transfer limits, ensuring not to exceed USD 10,000 to avoid transaction failures.

- When choosing cash pickup, funds typically arrive within minutes; bank transfers take 1 to 3 business days, so plan your fund usage accordingly.

MoneyGram International Transfer Process

Image Source: unsplash

Online Operations

You can complete transfers through MoneyGram’s international transfer website or mobile app. The entire process is very intuitive, suitable for users looking to save time and costs. You need to follow these steps:

- Register an account. You need to provide your full name, residential address (not a P.O. box), phone number, date of birth, and Social Security Number or Individual Taxpayer Identification Number.

- Complete identity verification. You need to upload a valid, non-expired government-issued ID (such as a passport or driver’s license) and provide proof of address (such as a utility bill, bank statement, or lease agreement).

- Enter recipient details. You need to input the recipient’s name, country, city, and contact information.

- Choose transfer and receipt methods. You can select instant transfer or standard transfer. Instant transfer is suitable for urgent needs with higher fees; standard transfer is more economical, typically taking 1-3 business days.

- Confirm exchange rate and fees. The system will automatically display real-time exchange rates and fees, which vary by destination country and amount.

- Pay for the transfer. You can choose to pay by debit card, credit card, or bank transfer.

Tip: Online transfers typically offer more competitive rates and lower fees, suitable for you if you want to save on costs.

During the process, the system will prompt you for the required information at each step. If you encounter issues, you can check the Help Center or contact customer service at any time.

Offline Operations

If you prefer face-to-face service, you can visit a MoneyGram international transfer agent location. Offline operations are suitable for users who need cash transactions or prefer on-site support. You need to follow these steps:

- Bring a valid ID (such as a passport or driver’s license) and proof of address to the agent location.

- Fill out a transfer application form, including your personal information and recipient details.

- Choose transfer and receipt methods. The staff will explain the differences between instant and standard transfers and help you select the appropriate service.

- Confirm exchange rate and fees. The staff will inform you of the day’s exchange rate and fees, and you will need to sign for confirmation.

- Pay for the transfer. You can pay with cash or a debit card.

- Receive a transfer reference number. You need to share the reference number with the recipient for them to pick up the funds.

The table below compares the processing times for online and offline operations:

| Transfer Method | Processing Time |

|---|---|

| Online Transfer | Minutes to days |

| Offline Transfer | Usually longer, hours to days |

Note: Offline operations typically have higher fees due to agent commissions and operational costs. You should consider your needs and budget when choosing.

Pre-Transfer Preparation

Before making a MoneyGram international transfer, you need to prepare the following:

- Ensure the recipient’s information is accurate, including name, country, city, and contact details.

- Prepare a valid ID and proof of address.

- Understand the destination country’s regulations and amount limits, as different countries have varying requirements for transfer amounts and receipt methods.

- Choose the appropriate transfer method. Instant transfers are suitable for urgent needs with higher fees; standard transfers are more economical but take longer.

- Estimate fees and exchange rates. You can check these in advance on MoneyGram’s international transfer website or app to avoid unexpected costs affecting your transfer plan.

Friendly Reminder: When using licensed banks in mainland China or Hong Kong, it’s recommended to prepare all documents in advance to avoid delays due to incomplete information.

Throughout the process, you should ensure consistency in information to avoid transfer failures or delays due to errors. If you encounter issues, promptly contact MoneyGram’s international transfer customer service to minimize unnecessary trouble.

Fees

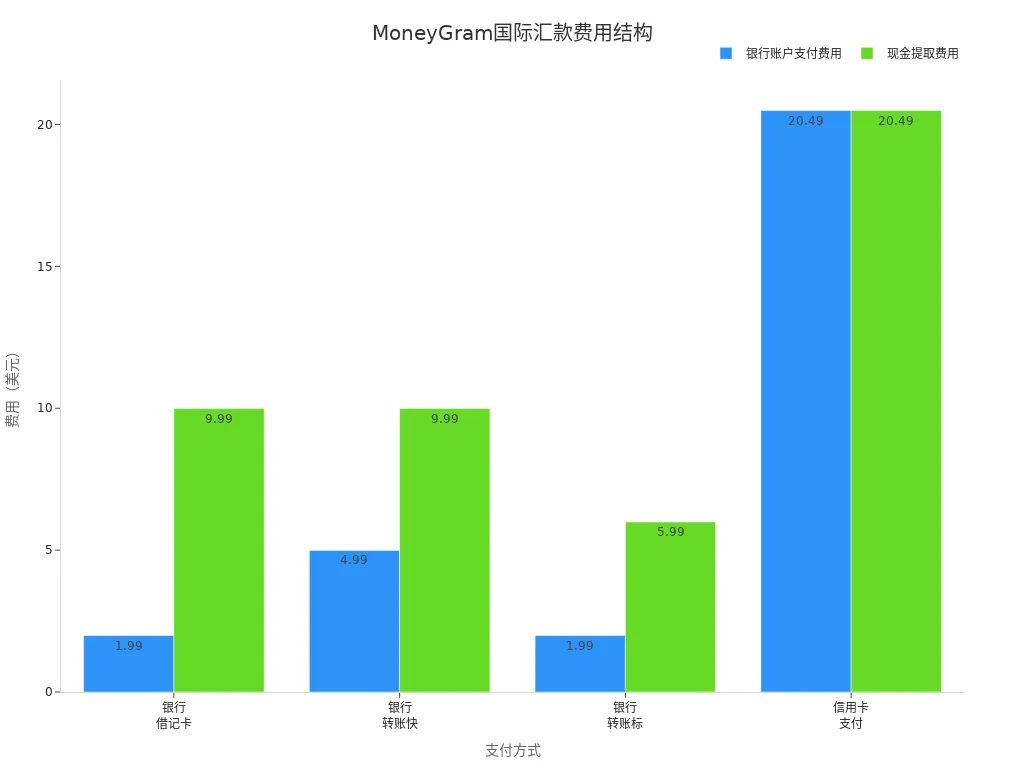

Fee Structure

When using MoneyGram for international transfers, fees consist of two parts: fixed fees and exchange rate fees. Fixed fees refer to the service fee charged for each transfer. Exchange rate fees arise because MoneyGram’s rates are typically lower than the mid-market rate, and this difference affects your actual costs.

Fees vary significantly depending on the payment and receipt methods. You can refer to the table below to understand the fees for transferring USD 500 to Europe with different payment and receipt methods:

| Sending USD 500 to EUR | Bank Account Payment Fee | Cash Pickup Fee |

|---|---|---|

| Using Debit Card | USD 1.99 | USD 9.99 |

| Using Bank Transfer - Express | USD 4.99 | USD 9.99 |

| Using Bank Transfer - Standard | USD 1.99 | USD 5.99 |

| Using Credit Card | USD 20.49 | USD 20.49 |

| Cash Payment | Varies by sending location | Varies by sending location |

You can see that choosing a debit card or standard bank transfer results in the lowest fees. If you use a credit card, fees increase significantly. Cash payment fees depend on the specific agent location.

The chart below illustrates a comparison of fees across different payment methods to help you better understand the differences:

Fees are influenced by multiple factors. You can refer to the table below to understand the main factors affecting fees:

| Influencing Factor | Description |

|---|---|

| Sending Country | Fee structures may vary by country. |

| Receiving Country | The receiving country also affects fees. |

| Transfer Amount | The size of the transfer directly impacts fees. |

| Payment Method | Using a credit card typically incurs higher fees. |

| Delivery Method | The choice of delivery method also affects the final fee. |

When using licensed banks in mainland China or Hong Kong, the fee structure is similar to the above, but specific amounts may vary by country, amount, and payment method. Before transferring, you must verify all fee details to avoid increased costs due to improper choices.

Tip: You can effectively reduce fees by consolidating multiple small transfers into a single larger transfer or choosing online operations.

Fee Inquiry

Before making a formal transfer, you can use the fee estimator on MoneyGram’s international transfer website or app to check and estimate fees in advance. This tool automatically calculates the total fees based on your transfer amount, sending country, receiving country, payment method, and receipt method.

| Tool/Resource | Description |

|---|---|

| MoneyGram Fee Estimator | Users can log in to view all available sending and receiving options and start a transfer. |

You simply need to input the relevant information, and the system will display all available fees and exchange rates in real time. This allows you to flexibly choose the most suitable transfer method based on your budget and needs.

You can also reduce fees and improve exchange rates through the following methods:

- Send funds online instead of visiting an agent location in person.

- Pay attention to MoneyGram’s international transfer promotions.

- Consolidate multiple transfers to reduce per-transaction fees.

- Compare fees and exchange rates with other international transfer providers.

Suggestion: Before transferring, compare options and choose payment and receipt methods wisely to effectively save costs.

Exchange Rates

Obtaining Rates

When using MoneyGram for international transfers, the exchange rate is a key factor determining the actual amount received. You can check current exchange rates in real time via MoneyGram’s website, mobile app, or agent locations. The system will automatically display the corresponding rate after you enter the transfer amount and receiving country. When processing MoneyGram transfers through licensed banks in Hong Kong, staff will inform you of the day’s exchange rate. Before confirming the transfer, you can compare rates across different channels to choose the best option.

Friendly Reminder: Always verify the exchange rate before transferring, as rates fluctuate daily and directly affect the USD amount received by the recipient.

Influencing Factors

MoneyGram’s exchange rates are influenced by multiple factors. You need to pay attention to the following:

- Transfer Amount: Larger transfers may sometimes receive more favorable rates.

- Sending and Receiving Countries: Exchange rate policies and market fluctuations in different countries affect MoneyGram’s pricing.

- Payment Method: Rates may vary when using a credit card, debit card, or bank transfer.

- Market Conditions: Global forex market fluctuations cause MoneyGram to adjust rates.

When choosing an international transfer provider, you can refer to the table below to understand how MoneyGram compares to other major providers in terms of rates and fees:

| Provider | Fees | Exchange Rate | Pickup Time | Applicable Scenarios |

|---|---|---|---|---|

| MoneyGram | Higher | Below mid-market | Minutes (cash) | Urgent cases, global cash pickup |

| Western Union | Higher | Below mid-market | Minutes (cash) | Urgent cases, global cash pickup |

| Wise | Lower | Mid-market rate | 2-5 days (bank transfer) | Cheaper for non-urgent use |

You can see that MoneyGram and Western Union typically offer rates below the mid-market rate with higher fees, suitable for urgent cash pickup needs. Wise uses the mid-market rate with lower fees but longer delivery times, better for non-urgent scenarios to save costs. When choosing a provider, you should weigh delivery speed and rate costs based on your needs and budget.

Amount Limits

Per-Transaction and Daily Limits

When using MoneyGram for international transfers, you must pay attention to per-transaction and periodic limits. MoneyGram has clear regulations for single transactions and 30-day transfer amounts. The table below shows the main limits for the U.S., UK, and Canada:

| Country | Per-Transaction Limit | 30-Day Limit |

|---|---|---|

| United States | USD 10,000 | USD 10,000 |

| United Kingdom | USD 10,000 | USD 10,000 |

| Canada | USD 10,000 | USD 10,000 |

Each transfer cannot exceed USD 10,000, and the cumulative transfer amount within 30 days must also not exceed USD 10,000. If you process MoneyGram international transfers through licensed banks in mainland China or Hong Kong, actual limits may vary due to local regulatory policies or bank rules. Before transferring, it’s recommended to confirm specific limits with the bank or MoneyGram customer service to avoid transaction failures due to exceeding limits.

Friendly Reminder: You can split large transfers into multiple smaller ones to meet funding needs while avoiding limit-related issues.

Compliance Requirements

When making international transfers, you must comply with relevant regulations. MoneyGram and local financial institutions strictly enforce international anti-money laundering and fund oversight policies. You need to pay attention to the following main compliance requirements:

- Transactions exceeding USD 10,000 must be reported to the U.S. IRS.

- Financial institutions and transfer providers are obligated to report international transfers exceeding USD 10,000.

- Under FATCA, receiving international wire transfers is sufficient to confirm assets in foreign accounts, requiring reporting to the IRS.

When processing international transfers through licensed banks in mainland China or Hong Kong, banks will require you to provide detailed explanations of the fund’s source and purpose. You must ensure all documents are authentic and complete to avoid account freezes or fund delays due to compliance issues. During the transfer process, it’s recommended to keep all transaction records for future inquiries or compliance reviews.

Note: If you frequently make large international transfers, it’s advisable to understand the destination country’s legal and tax requirements in advance to ensure fund safety and compliance.

Delivery and Receipt

Image Source: unsplash

Delivery Time

When using MoneyGram for international transfers, delivery speed is one of your primary concerns. MoneyGram’s delivery times vary based on the transfer method and receiving country. When choosing cash pickup, funds typically arrive within minutes, ideal for urgent needs. If you choose bank account transfers, delivery generally takes 1 to 3 business days. The table below shows typical delivery times for different methods:

| Transfer Method | Typical Time |

|---|---|

| Cash Pickup | Within minutes |

| Bank Account Transfer | 1 to 3 business days |

During actual operations, delivery speed may be affected by multiple factors, such as compliance inquiries, inaccurate payment details, destination country policies, currency conversion, banking relationships, bank holidays, and time zone differences. Transfers during holidays or weekends may take longer. Transfers to major cities are typically faster than to remote areas. Ensure accurate information when filling out details to avoid delays due to errors.

Friendly Reminder: Before transferring, you can consult licensed banks in Hong Kong or MoneyGram customer service to understand specific delivery times and plan fund usage accordingly.

Receipt Methods

You can choose different receipt methods based on the recipient’s actual needs. MoneyGram supports cash pickup, bank account transfers, and mobile wallets, each with varying speeds and convenience:

| Receipt Method | Speed | Convenience |

|---|---|---|

| Cash Pickup | Within minutes | Requires visiting a designated location to collect cash |

| Bank Transfer | 1 to 3 business days | Directly deposited into a bank account |

| Mobile Wallet | Varies by processing time | Mobile operation, supported in some countries |

When processing through licensed banks in mainland China or Hong Kong, the recipient needs to bring a valid ID and transfer reference number to a designated location to collect cash. The specific process is as follows:

- Locate a MoneyGram agent location.

- Fill out a receipt form if required.

- Submit the form and a valid photo ID to collect the funds.

When choosing a receipt method, consider the recipient’s situation and local policies. Cash pickup is suitable for recipients without bank accounts, while bank transfers are safer and more convenient. Before transferring, confirm the recipient’s required documents to ensure smooth delivery.

Note: If you encounter delivery delays, you can log into your MoneyGram account to check progress or contact customer service for assistance.

Considerations

Credit Card Impact

When using MoneyGram for international transfers with a credit card as the funding source, you need to pay special attention to the following:

- Using a credit card incurs additional fees, making the overall cost higher than bank account or debit card payments.

- Credit card transactions typically have higher exchange rates, which may reduce the actual amount received.

- Before transacting, proactively inquire about specific fees and exchange rates to avoid impacting your transfer plan due to high costs.

You can prioritize bank account or debit card payments to effectively reduce fees and exchange rate losses. If you must use a credit card, plan your fee budget in advance to ensure sufficient funds.

Risk Prevention

During MoneyGram international transfers, you must prioritize safety and fraud prevention. MoneyGram verifies your identity to protect your personal and financial information, helping you prevent fraud. You can take the following measures to enhance security:

- Always verify recipient information to ensure the name and reference number are accurate.

- Avoid trusting strangers or unknown callers and do not disclose account details or verification codes.

- When using licensed banks in Hong Kong, keep all transaction records for future inquiries.

You can visit MoneyGram’s fraud and security page for more prevention tips. In case of suspicious activity, promptly contact MoneyGram customer service or bank staff to ensure fund safety.

Common Questions

When using MoneyGram for international transfers, you may have some questions. The table below summarizes the most common questions and authoritative answers to help you quickly understand relevant information:

| Question | Answer |

|---|---|

| How to send money in person? | Visit a MoneyGram agent location, prepare required information, complete the transaction, and notify the recipient. |

| How to send to a bank account? | Provide the recipient’s bank name and account number. |

| How to send to a mobile wallet? | Provide the recipient’s phone number and international dialing code. |

| How to receive money? | Requires a government-issued ID and reference number. |

| What are the fees? | Fees vary by sending/receiving country and amount, priced in USD. |

| What are the sending amount limits? | Limits depend on legal requirements and transaction specifics. |

| What payment methods are available? | Most agents accept only cash payments. |

| When are funds available for pickup? | Usually available for pickup within minutes of a successful transfer. |

| What currency options are available? | MoneyGram offers multiple currency options in some countries. |

| Can the recipient choose the receiving currency? | No, the sender must select the receiving currency. |

Before transferring, you can refer to these common questions to prepare in advance and improve transfer efficiency and safety.

By choosing MoneyGram for international transfers, you can enjoy global coverage, convenient operations, and fast delivery. The table below summarizes the main advantages:

| Advantage | Description |

|---|---|

| Global Coverage | Covers over 200 countries and regions, allowing you to transfer anytime. |

| Multiple Transfer Options | Supports online, app, and offline operations, flexibly meeting different needs. |

| Speed and Reliability | Many transactions complete within minutes, with secure and reliable funds. |

| Blockchain-Supported Settlement | Uses blockchain to enhance transaction speed and security. |

| Customer-Centric Platform | Multi-channel services with a modern mobile platform experience. |

When choosing a transfer method, you should note the following:

- Understand compliance challenges and ensure documents are authentic and compliant.

- Choose the appropriate transfer method and focus on fee transparency.

- Stay updated on policy changes, such as remittance taxes and rate adjustments.

Understanding regulations in advance and choosing the right receipt method can effectively reduce risks and ensure fund safety.

FAQ

How to check real-time fees and exchange rates for MoneyGram international transfers?

You can log into MoneyGram’s website or app, enter the transfer amount and receiving country. The system will automatically display the current fees and exchange rates, all priced in USD.

What to do if recipient information is entered incorrectly?

You need to contact MoneyGram customer service or a licensed bank in Hong Kong as soon as possible. Customer service will guide you to amend the information or cancel the transaction to avoid fund delays or losses.

How long does a MoneyGram international transfer take to arrive?

When choosing cash pickup, funds typically arrive within minutes. Bank account transfers generally take 1 to 3 business days, depending on the receiving country and method.

Are there limits on transfer amounts?

Each transfer and the cumulative amount within 30 days must not exceed USD 10,000. Actual limits may vary due to policies of licensed banks in mainland China or Hong Kong, so consult in advance.

Can I use a credit card to pay for MoneyGram international transfers?

You can use a credit card, but fees are higher, and exchange rates are less favorable than bank account or debit card payments. Verify all fee details before paying.

While MoneyGram offers global reach, high fees, hidden exchange rate markups, and slow bank transfers can eat into your remittance value. If you’re looking for a faster, more cost-effective alternative, BiyaPay delivers. Enjoy international transfers with fees as low as 0.5%, and seamless conversion between 30+ fiat currencies and 200+ cryptocurrencies. Our real-time exchange rate calculator provides transparent, market-competitive rates so you know exactly what you’re getting. With quick registration and robust security, BiyaPay supports same-day transfers to recipients in the Philippines and beyond. Whether for family support or business payments, experience a smarter way to send money across borders. Visit BiyaPay today and sign up to start sending fast, secure, and affordable transfers worldwide.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.