- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

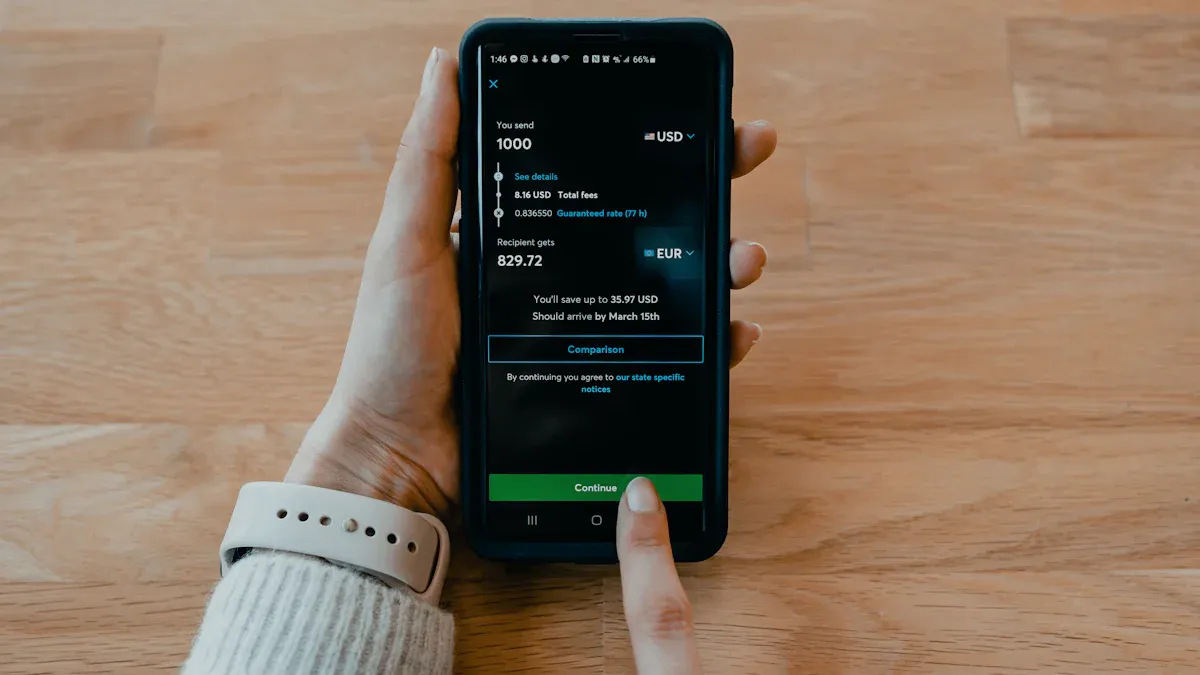

How to Remit Money from Pakistan to the US: A Detailed Explanation of the Process, Fees, and Security Measures

Image Source: unsplash

When handling remittances from Pakistan, you often encounter complex processes and overwhelming information. You need to understand each step clearly to ensure your funds reach the USA securely. You can flexibly choose the right channel based on your needs to avoid common risks. By prioritizing safety and compliance and selecting legitimate platforms, you can effectively protect your personal information and funds.

Key Takeaways

- Choose the right remittance method. Bank transfers, third-party platforms, and cash agent services each have their pros and cons, so select based on your needs.

- Ensure accurate recipient information. Using the correct SWIFT/BIC code can prevent delays or errors in remittances.

- Pay attention to fees and exchange rates. Compare fees and rates across channels to choose the most cost-effective option.

- Use legitimate channels for remittances. Regulated banks and platforms can effectively safeguard your funds and personal information.

- Regularly check the remittance status. Keep remittance receipts and track fund transfers to ensure secure delivery.

Remittance Methods from Pakistan

Image Source: unsplash

When choosing a method to send money from Pakistan to the USA, you can make decisions based on your needs and circumstances. There are three common remittance methods: bank transfers, third-party platforms, and cash or agent services. Each method has distinct processes and features.

Bank Transfers

You can process remittances from Pakistan through a licensed Hong Kong bank. Banks typically use the SWIFT system for wire transfers. You need to provide recipient details at a bank counter or through online banking, including the SWIFT/BIC code, account number, and recipient’s name for the US account. Banks charge a handling fee, typically between $20-50. You also need to monitor exchange rate fluctuations, as bank rates may differ from market rates. Bank transfers are suitable for users with high demands for fund security and compliance.

Tip: Be extra careful when filling in the SWIFT/BIC code to avoid delays or returns due to incorrect information.

Third-Party Platforms

You can also choose third-party platforms for remittances from Pakistan, such as international money transfer services. These platforms typically support online operations, offering simple processes, transparent fees, and exchange rates close to market levels. Some platforms allow anonymous transfers or partial identity concealment, ideal for users with higher privacy needs. You simply register an account, upload identity documents, and fill in recipient details to complete the process. Fees generally range from $5-15, with faster processing times.

- Advantages: Convenient operation, low fees, and good privacy protection.

- Disadvantages: Some platforms impose limits on single transaction amounts.

Cash and Agent Services

If you don’t have a bank account, you can opt for cash agent services. You can visit a local authorized agent to handle remittances from Pakistan using cash. The agent will assist you in filling out forms and inform you of the transfer progress. Fees vary by amount, typically between $10-30. You need to keep the receipt for future inquiries.

Note: While cash agent services are convenient, you must choose authorized agents to avoid financial risks.

Remittance Process

When processing a remittance from Pakistan to the USA, you need to follow a specific process to ensure the funds arrive securely. Below is a detailed breakdown of the three key steps: account opening and identity verification, information filling, and submission and tracking.

Account Opening and Identity Verification

You first need to select a licensed Hong Kong bank and research its US dollar account products. Many banks offer Roshan Digital Accounts, supporting non-resident Pakistanis and POC holders to open US dollar accounts online. You can follow these steps to open an account:

- Choose a bank and account type that suits your needs.

- Gather required documents, including a valid passport or CNIC, proof of address, proof of employment or income, and documents for the source of initial deposit funds.

- Submit the account opening application online or in person, uploading or presenting the required documents.

- Add funds to the account, typically requiring a minimum initial deposit.

- Once the bank completes verification, you can start remittance transactions.

Tip: For identity verification, prepare valid ID (e.g., passport, national ID, or driver’s license), recent bank statements, proof of fund purpose (e.g., invoices, purchase orders, or contracts). For single remittances exceeding $10,000, you’ll also need to provide proof of fund source (e.g., payslips, tax documents, or financial statements).

Information Filling

When filling out remittance information, you must ensure the accuracy of recipient details. You should prepare the US recipient’s name, account number, and the SWIFT/BIC code of the receiving bank. The SWIFT/BIC code is a critical identifier for international transfers, directly affecting whether funds reach the designated account accurately.

- Using the correct SWIFT/BIC code ensures your funds are transferred to the US recipient’s account promptly and securely.

- Incorrect information may lead to delays, rejections, or funds being transferred to the wrong account, compromising transaction safety.

Tip: When filling in the SWIFT/BIC code, double-check it and, if necessary, confirm with bank staff to avoid losses due to errors.

Submission and Tracking

After completing the information, you can submit the remittance request through a bank counter, online banking, or a third-party platform. Processing times vary by channel:

| Channel | Processing Time |

|---|---|

| Traditional Banks | 3 to 5 business days |

| Online Remittance Services | Within 24 hours or instant processing |

You can choose the appropriate channel based on your needs. Bank transfers typically take 3 to 5 business days, while online services can deliver funds within 24 hours.

After submitting the remittance, you can track its status in real-time via the bank or platform’s online system. You should keep remittance receipts and related documents for future tracking and issue resolution.

Note: Throughout the remittance process from Pakistan, ensure all information is accurate, choose legitimate channels, and protect your financial security.

Fees and Exchange Rates

Image Source: unsplash

Fee Comparison

When sending money from Pakistan to the USA, fees are one of your primary concerns. Fee structures vary significantly across channels. You can refer to the table below to compare Wise and traditional banks’ main fees and delivery times:

| Provider | Delivery Time | Exchange Rate | Transfer Fee (USD) | Amount Received (PKR) |

|---|---|---|---|---|

| Wise | 12 hours | 281.400 | 12.97 | 277,750.24 |

| Traditional Banks | 6-8 days | 280.300 | 0.00 | 280,300.00 |

When choosing Wise, although the fees are higher, the delivery is faster, and the exchange rate is close to the market rate. Traditional banks may show zero fees, but they take longer, and their rates are slightly lower. You need to weigh speed versus cost based on your needs.

Tip: When selecting a remittance channel, prioritize platforms with transparent fees to avoid unexpected cost increases.

Exchange Rate Impact

During the remittance process, the exchange rate directly affects the final amount received. Platforms like Wise typically use near-market real-time exchange rates, minimizing your losses. Traditional banks, despite lower fees, often use rates below the market, reducing the amount received. You should monitor rate fluctuations and choose platforms with better rates.

Note: Before sending money, check real-time rates on the platform or bank’s website to maximize your returns.

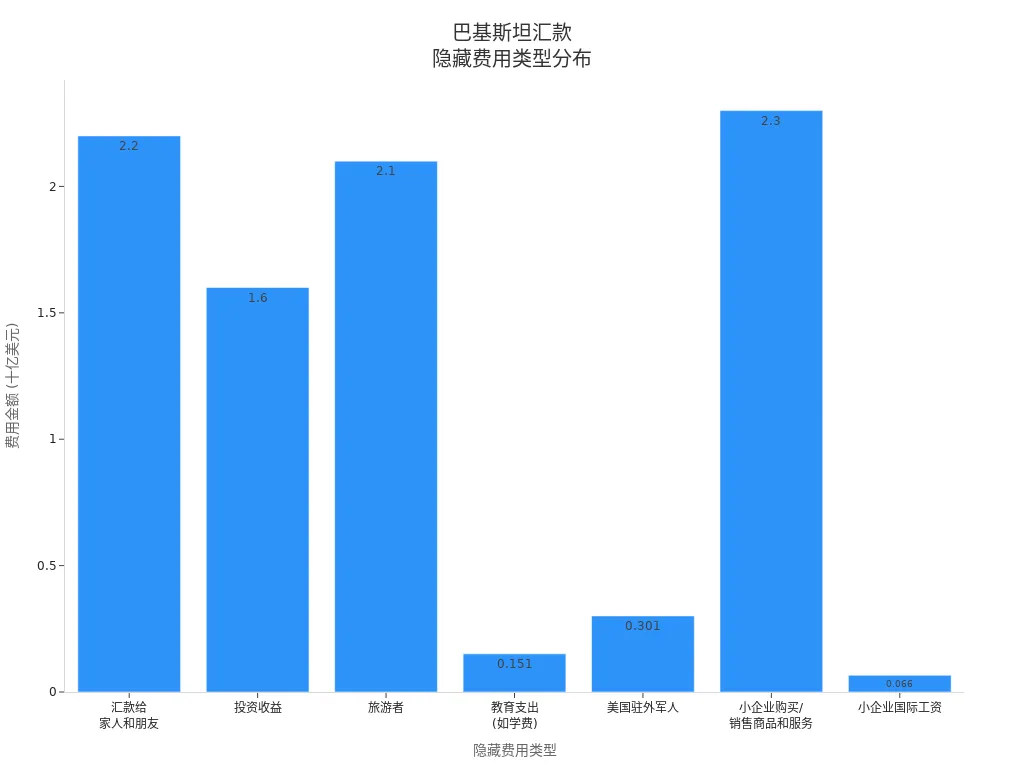

Hidden Fees

When processing remittances from Pakistan, beyond visible fees and rates, you must beware of hidden costs. Many institutions and platforms charge extra through exchange rate margins or service fees. The chart below illustrates the distribution of hidden fee amounts:

You should note the following:

- Many platforms advertise “no fees” but charge through exchange rate margins.

- Hidden fees for remittances to family, friends, tuition, or investments can reach billions of dollars.

- Small businesses face additional costs for international payroll and goods transactions.

When choosing a remittance channel, thoroughly review all fee terms to avoid unexpectedly high costs due to hidden fees.

Safety Measures

Legitimate Channels

When processing remittances from Pakistan, choosing legitimate channels is critical. Pakistani banks and major third-party platforms employ various encryption technologies to secure your funds and information. The table below shows common encryption technologies and their applications in Pakistani banks:

| Technology | How It Works | Applications in Pakistan |

|---|---|---|

| Lattice-Based Cryptography | Uses complex mathematical lattice problems to resist quantum attacks | Protects mobile banking apps and wallets |

| Hash-Based Signatures | Uses cryptographic hash functions to create quantum-resistant signatures | Digital identity, e-KYC authentication |

| Code-Based Cryptography | Relies on error-correcting codes for strong encryption | Secures cross-border remittances |

| Multivariate Cryptography | Uses polynomial equations, hard for quantum computers to crack | Government payment portals and e-procurement |

By using regulated banks or platforms, you benefit from encryption and background checks. Banks conduct compliance reviews for each remittance to ensure legitimate fund sources, reducing theft risks.

Information Protection

Protecting personal information during remittances is crucial. Banks and platforms typically require you to upload identity documents and recipient details. You must submit information only through official channels to avoid data leaks. Platforms use digital identity authentication and e-KYC technologies to enhance security. You can regularly update passwords and enable two-factor authentication to reduce account theft risks.

Tip: When filling out and uploading information, use a secure network and avoid public Wi-Fi.

Risk Prevention

When processing remittances from Pakistan, you may encounter various scams. Below are common remittance-related fraud types and prevention tips:

- Phishing: Scammers impersonate banks or platforms via email to trick you into entering account details. Verify sender identities and avoid clicking unknown links.

- Card Skimming: Fraudsters install devices at ATMs or terminals to steal card data. Use secure ATMs and check for equipment anomalies.

- Identity Theft: Criminals illegally obtain your personal information for financial fraud. Safeguard ID documents and avoid sharing personal details casually.

You can prevent risks by regularly checking accounts, setting transaction alerts, and promptly freezing suspicious accounts. Choosing legitimate channels and safety measures maximizes fund security.

Compliance and Restrictions

Amount and Frequency

When sending USD from Pakistan to the USA, you need to be aware of bank-imposed limits on amounts and frequency. Most banks allow up to $10,000 per personal remittance without additional documents. For daily cumulative remittances exceeding $10,000 to $20,000, banks require proof of fund source and purpose. Annual limits vary based on bank policies and economic conditions. You should consult your bank in advance to ensure compliance with the latest regulations.

- Pakistani banks set daily remittance limits, typically $10,000 to $20,000.

- Annual limits vary based on bank policies and regulatory requirements.

- Remittances exceeding limits require additional proof of fund source and purpose.

Tip: Before sending money, review the bank’s latest policies to avoid delays or returns due to exceeding limits.

Age and Identity

When processing remittances, you must meet the bank’s age and identity requirements. Banks typically require you to be at least 18 years old and hold valid government-issued ID, such as a passport. You also need to provide proof of fund source to ensure compliance. Banks conduct strict identity checks to prevent illegal fund flows.

- You must be at least 18 to process USD remittances.

- You need to provide valid ID (e.g., passport).

- You must submit proof of fund source.

Note: Ensure all submitted information is accurate to avoid delays due to identity mismatches or incomplete documents.

Anti-Money Laundering Regulations

When sending money from Pakistan to the USA, you must comply with strict anti-money laundering regulations. Banks and institutions conduct Know Your Customer (KYC) and compliance reviews for each remittance. Regulators require all remittances to go through approved channels to prevent illegal fund flows. Non-compliance may result in hefty fines or criminal liability.

| Anti-Money Laundering Measure | Details |

|---|---|

| Know Your Customer (KYC) | Banks verify your identity and fund source to ensure transaction legitimacy. |

| Approved Channel Requirements | Remittances must go through approved banks, money service businesses, exchange companies, or remittance operators. |

| Illegal Fund Risks | Informal systems like Hawala or Hundi carry money laundering risks, with regulators increasing oversight. |

| Penalties for Non-Compliance | Non-compliant remittances may face fines up to 5,000,000 PKR, with severe cases leading to license revocation or criminal liability. |

Tip: Choose regulated institutions and cooperate with compliance reviews to ensure fund safety and legality.

Remittances Without a Bank Account

Cash Process

If you don’t have a bank account, you can still send money from Pakistan to the USA via cash remittance. Western Union offers a convenient process. You can follow these steps:

- Visit the Western Union website or download its mobile app, then register or log in.

- Initiate a remittance on the platform, filling in the US recipient’s details.

- Within 24 hours, visit a local Western Union branch, pay the remittance amount and service fee in cash (typically $10-30 depending on the amount).

- Prepare your identity documents for submission to complete the process smoothly.

After completing these steps, Western Union will provide a remittance reference number. You can use this to track the remittance status in real-time, ensuring secure delivery to the USA.

Agent Operations

You can choose reliable agent networks for cash remittances. Ria Money Transfer and Western Union are two widely recognized providers in Pakistan. The table below outlines their key features:

| Agent Network | Features |

|---|---|

| Ria Money Transfer | Partners with the Pakistan Remittance Initiative, offering fee-free remittances for USD 100 or more, supporting cash pickup and bank deposits. Recognized in 2023 as a top institution for global Pakistanis. |

| Western Union | Fast and reliable, with fee-free remittances for USD 200 or more, supporting cash pickup and bank transfers. Funds can be sent in minutes, offering convenience. |

When processing remittances at agent points, you only need to provide recipient details, submit cash, and present ID. The agent will assist with the process and provide a receipt and reference number for future inquiries.

Risk Warnings

When using agent services for remittances, note the following risks:

- Agent services may carry expected and unexpected risks, with fund safety affected by agent compliance.

- Some agents may not strictly adhere to anti-money laundering regulations, potentially linking your funds to illegal activities.

- Money laundering risks are higher, especially with client identity, geographic location, and agent management issues.

Tip: Choose regulated, reputable agents, cooperate with identity verification and compliance checks to ensure fund safety and legality.

Remittance Inquiries

Status Tracking

After completing a remittance from Pakistan to the USA, you’ll likely want to confirm if the funds have arrived safely. You can track the status in real-time via online systems provided by banks and platforms. Many banks offer convenient tracking methods. The table below shows tracking methods for major banks:

| Bank Name | Tracking Method |

|---|---|

| Allied Bank | Enter the remittance code in the online tracking system for instant updates. |

| NBP | Offers e-remittance tracking services to monitor transactions. |

| Meezan Bank | Allows beneficiaries in Pakistan to receive remittances from abroad with multiple tracking options. |

After sending money, keep the remittance reference number or transaction receipt. You can log into the bank’s website or mobile app, enter the details, and check the transfer progress. If you notice issues, contact the bank’s customer service immediately.

Issue Resolution

During the remittance process, you may encounter issues like incorrect transfer details, delays due to bank hours or regulations, or choosing unreliable services. The table below outlines common issues and solutions:

| Issue | Solution |

|---|---|

| Incorrect Transfer Details | Ensure all details are accurate, including recipient’s name, address, and account information. |

| Delays Due to Bank Hours or Regulations | Allow extra business days for transaction clearing. |

| Unreliable Remittance Service | Switch to a more reliable service and retain transaction receipts for reference. |

Double-check remittance details to ensure accuracy. For delays, wait a few business days. If using an unreliable platform, switch to a regulated provider and keep all transaction records.

Complaints and Appeals

If your remittance fails, is delayed, or has errors, you can file a complaint or appeal through the following process:

- Contact the remittance provider immediately to report the issue.

- Submit a verbal or written error notice, providing details like your name, transfer amount, and error description.

- The provider must investigate within 90 days of receiving the error notice and inform you of the results within three business days.

- You have 180 days from the remittance availability date to report errors to the provider.

When filing a complaint, provide detailed descriptions and attach all relevant documents. This helps the provider resolve issues faster and protects your financial rights.

When sending money from Pakistan to the USA, you need to consider service availability, fees, exchange rates, government regulations, and tracking options. You can choose reputable banks and services like HBL, UBL, and MCB to ensure fund safety. Understand various fees and rates to select the most cost-effective channel. You must comply with Pakistan and US banking regulations to avoid legal risks. Using SWIFT codes enhances the accuracy and security of international transfers.

When choosing a remittance method, prioritize reliable providers, compare fees and rates, and protect your funds and privacy.

| Remittance Method | Fee Structure | Notes |

|---|---|---|

| Western Union | Fixed fees for small amounts, higher fees for larger amounts | Offers extensive pickup options |

| MoneyGram | Varies by remittance method | Supports cash pickup and bank transfers |

| Wise | Competitive rates and low fees | Transparent rates close to mid-market |

| Xoom | Competitive rates, fast transfers | Typically completed in minutes |

| Remitly | Low fees and competitive rates | Ideal for interbank transfers |

If you encounter issues with fees, rates, or security, you can refer to this blog’s FAQ section for quick assistance.

FAQ

How fast can a remittance from Pakistan to the USA arrive?

When using third-party platforms, funds can arrive within 24 hours. Bank wire transfers typically take 3 to 5 business days. Choose the channel based on urgency.

What information is required for a remittance?

You need to provide the recipient’s name, US bank account number, and SWIFT/BIC code. You also need valid ID. Accurate information prevents delays.

Are there minimum or maximum amount limits for remittances?

Most banks allow up to $10,000 per transaction. Amounts exceeding this require proof of fund source. Some platforms have minimum requirements, so check in advance.

How can I check the remittance status?

Log into the bank or platform’s website, enter the remittance reference number to track progress. Keep receipts and contact customer service for issues.

What should I do if a remittance is delayed or fails?

First, verify the accuracy of the provided information. If correct, contact the provider’s customer service with the reference number and receipts to request an investigation and resolution.

Are you tired of high fees, slow processing times, and unclear exchange rates when sending money from Pakistan to the USA? BiyaPay offers a smarter, secure, and cost-effective alternative. With fees as low as 0.5% and no hidden charges, our platform supports seamless conversions between 30+ fiat currencies and 200+ cryptocurrencies. Use our real-time exchange rate calculator to lock in the best rates and maximize what your recipients receive. Whether you’re supporting family, paying tuition, or managing business payments, BiyaPay enables same-day transfers with same-day delivery to U.S. bank accounts. We adhere to strict KYC and AML regulations, ensuring full compliance and peace of mind. Join thousands of users who trust BiyaPay — visit BiyaPay today and register in minutes to experience fast, transparent, and secure cross-border transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.