- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Transfer Money to Portugal Efficiently and at Low Cost?

Image Source: pexels

If you want to efficiently transfer money to Portugal, you can choose bank accounts, online remittance platforms, or SEPA transfers. These methods are widely used in the Portuguese market, with e-wallets and bank transfers together holding a market share of nearly 60%.

Through mainstream platforms like Remitly and Western Union, you can complete transfers with lower fees and faster speeds, with some services delivering funds in minutes and ensuring security. You can flexibly choose the most suitable transfer method based on your needs.

Key Points

- Choose the right transfer method. Bank transfers are suitable for large amounts, online platforms are ideal for small, quick transfers, and SEPA transfers are best for euro account holders.

- Use online remittance platforms like Wise and WorldRemit, with fees as low as USD 2-5 and fast delivery, typically within minutes to 24 hours.

- Ensure you select reputable platforms, check user reviews, secure funds, and avoid online scams and hidden fees.

- Understand the required materials for transfers, including recipient information and valid identification, ensuring accurate and valid details to avoid delays.

- Pay attention to exchange rate losses, choose platforms with transparent rates, and use euro accounts to avoid currency conversion losses.

Efficient Transfer Methods

Image Source: unsplash

Bank Account Transfers

You can choose to transfer money efficiently to Portugal through a bank account. This method is suitable for scenarios requiring large fund transfers or high security. Many Hong Kong-licensed banks support international remittance services. You need to prepare the following materials:

- The recipient’s bank account details, including name, IBAN, and BIC.

- Valid identification, such as a passport or government-issued ID.

- The sender’s personal information, including full name, address, and contact details.

- The recipient’s detailed information, including full name and address.

- In some cases, banks may require proof of the source of funds, such as bank statements or payslips.

- A statement of the transfer purpose, such as personal expenses or business transactions.

International bank transfers typically take 1 to 5 working days to arrive. You can process transfers via online banking or at a bank branch, with some banks supporting mobile app operations. Fees generally range from USD 20-50, depending on the bank’s policy and transfer amount. Bank account transfers are suitable for users with high requirements for fund security and compliance.

Tip: If you choose a Hong Kong-licensed bank for efficient transfers, it’s advisable to inquire about fee and exchange rate policies in advance to avoid unnecessary losses.

Online Remittance Platforms

You can also use online remittance platforms for efficient transfers. Mainstream platforms like Wise, WorldRemit, and Paysend support transfers from mainland China and Hong Kong to Portugal. These platforms typically offer the following advantages:

- Low fees, with some platforms as low as USD 2-5.

- Transparent exchange rates, displaying real-time conversion prices to minimize rate losses.

- Fast delivery, with some platforms completing transfers in minutes and most within 24 hours.

- Convenient operation, requiring only account registration, recipient information, and identity verification to complete transfers.

Online platforms use multiple security measures to protect your funds, including encryption technology, two-factor authentication, and real-time monitoring systems. You can operate on your phone or computer at any time, suitable for frequent small transfers or scenarios needing quick delivery.

Note: Choose reputable platforms for efficient transfers, ensuring you verify their credentials and user reviews to secure funds.

SEPA Transfers

If you have a euro account in Hong Kong or mainland China, you can use SEPA transfers to efficiently send money to Portugal. SEPA (Single Euro Payments Area) covers all EU and EEA member states, including Portugal. The SEPA transfer process is as follows:

| Information Type | Description |

|---|---|

| SEPA Transfer Definition | SEPA stands for Single Euro Payments Area, simplifying fund transfers between European countries. |

| Participating Countries | Includes all EU and EEA member states, including Portugal. |

| Required Information | Recipient’s full name, IBAN, BIC, transfer amount and currency, payment reference, sender’s name, and bank details. |

SEPA instant transfers can arrive in as little as 10 seconds, while standard SEPA transfers typically complete within 1 working day. Fees are extremely low, with some banks even waiving fees. SEPA is ideal for users needing fast, low-cost transfers within the eurozone.

Reminder: SEPA transfers are limited to euro accounts, so confirm in advance whether the recipient’s bank supports SEPA services.

You can choose the most suitable efficient transfer method based on your needs. Online platforms and SEPA transfers offer advantages in speed and cost, while bank account transfers are a secure choice for high security and compliance needs.

Advantages and Disadvantages

Bank Accounts

When choosing bank accounts for efficient transfers to Portugal, you benefit from high security and compliance assurance. Hong Kong-licensed banks typically support international remittance services, with convenient online banking operations. You only need to fill in the recipient’s details and transfer amount via online banking or a mobile app to complete the process. Bank account transfers are suitable for large fund transfers and scenarios with high security requirements.

| Advantages | Disadvantages |

|---|---|

| Convenient online banking transfers | High fees (typically USD 20-50) |

| Secure and reliable interbank transfers | Unfavorable exchange rates (bank rates are often less competitive) |

| Strong fund compliance | Potential hidden fees |

Bank account transfers are generally slower, typically requiring 1 to 5 working days to arrive. You may also face exchange rate losses and additional fees. Interbank SWIFT international transfers have higher fees, and exchange rates are less transparent than online platforms or SEPA transfers. You need to understand the bank’s fee structure and exchange rate policies in advance to avoid unnecessary losses.

Tip: For efficient transfers, bank accounts are suitable for large amounts and scenarios with special security needs, but fees and exchange rate losses should be evaluated in advance.

Online Platforms

You can choose online remittance platforms for efficient transfers to Portugal. Mainstream platforms like Wise, WorldRemit, and Paysend support users from mainland China and Hong Kong, offering simple operations and fast delivery. You only need to register an account, fill in recipient details, and upload identity verification to complete the transfer.

| Advantages | Disadvantages |

|---|---|

| Fair exchange rates | Possible fees (USD 2-5) |

| Strong security | Sender and recipient need to register on the same platform |

| Easy to use | Some services lack personal interaction |

| Fast transaction speed |

- The Wise platform offers interbank real-time exchange rates, with fees as low as 0.4-1% of the transfer amount, and delivery typically within 1-2 days.

- Online platform transfers are much faster than traditional banks, with some services delivering in minutes and most completing within 24 hours.

- You can operate on your phone or computer at any time, suitable for frequent small transfers or scenarios needing quick delivery.

| Method | Transfer Speed | Fees |

|---|---|---|

| Online Transfer Platforms | Fast (minutes to hours) | Low fees (USD 2-5) |

| Traditional Banks | Slower (1-5 days) | High fees (USD 20-50) |

Note: Online platforms are ideal for users seeking efficient transfers and low costs, but ensure you choose reputable platforms and verify user reviews to secure funds.

SEPA

If you have a euro account, you can use SEPA transfers to efficiently send money to Portugal. SEPA covers all EU and EEA member states, including Portugal. You only need to provide the recipient’s IBAN and BIC details to complete the process.

| Advantages | Disadvantages |

|---|---|

| Allows flexible payments within the SEPA area | Limited to 36 member countries, not global |

| Free, fast, and secure | Possible currency conversion fees |

| High transaction efficiency | Limited applicability |

| Standardized format | Currency conversion fees may offset savings |

| Potential cost savings | Limited network coverage |

- SEPA transfers are processed in euros, simplifying international transfers with costs similar to domestic payments, significantly reducing expenses.

- In Portugal, SEPA transfers are treated as bank transfers, offering fast fund delivery. Some banks, like CGD, charge as little as USD 1 for instant transfers (online).

- SEPA instant transfers can arrive in as little as 10 seconds, while standard SEPA transfers typically complete within 1 working day.

- Each transfer can reach up to USD 100,000 (if not restricted by the provider), suitable for both business and personal large fund movements.

Reminder: SEPA transfers are ideal for efficient transfers within the eurozone with low fees and fast delivery, but they are limited to euro accounts, and some banks may charge currency conversion fees.

Fee Comparison

Image Source: pexels

Transfer Fees

When choosing efficient transfers to Portugal, fees are the most direct cost. Different methods have significant fee variations. International bank account transfers typically charge less than USD 15 (for amounts under USD 50,000), while large transfers may cost USD 30 or more. Some Hong Kong-licensed banks may not charge additional fees for SEPA transfers to the eurozone, and if domestic transfers for euro accounts in China/mainland China are free, transfers to Portugal may also be free. Online remittance platforms like Wise and Paysend typically charge USD 2-5, significantly lower than traditional banks. Refer to the table below:

| Transfer Type | Fee Range |

|---|---|

| International Bank Transfers | Typically less than USD 15 (under USD 50,000) |

| Large Bank Transfers | USD 30 or more |

| SEPA Transfers | Same as domestic transfers, some banks waive fees |

| Bank Account Monthly Fees | USD 5–7 |

| Online Platforms | USD 2-5 |

Tip: For frequent small transfers, online platforms are more suitable. For one-time large transfers, bank accounts or SEPA transfers may be more cost-effective.

Exchange Rate Losses

When making cross-border transfers, exchange rate losses are a significant cost. Traditional banks often use unfavorable rates, potentially including hidden fees, resulting in higher overall costs. Online remittance platforms offer more transparent rates with clear pricing and lower losses. SEPA transfers are settled in euros, avoiding exchange rate losses if you have a euro account. Consider the following:

- International bank transfers have high fees, with exchange rate differences embedded in the total cost.

- Online remittance companies offer better rates, faster speeds, and transparent fees.

- Choosing providers specializing in Portugal transfers helps save costs and ensures secure delivery.

You can choose the optimal method based on transfer amount and frequency. For frequent small transfers, use online platforms; for single large transfers, prioritize bank accounts or SEPA transfers. This approach enables truly efficient transfers with lower overall costs.

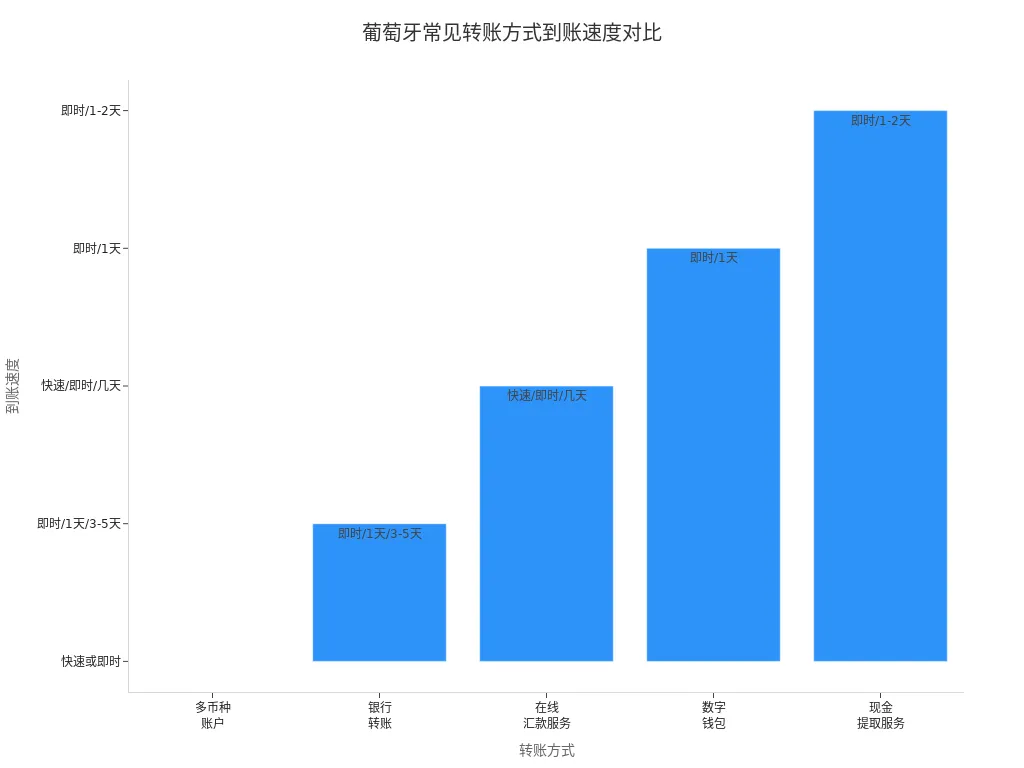

Delivery Time

When choosing efficient transfers to Portugal, delivery time is a key factor affecting the experience. Different methods have significant variations in delivery speed, directly impacting whether recipients can access funds promptly. Below is a detailed comparison of the delivery speeds for the three mainstream transfer methods.

Bank Transfer Speed

International transfers through Hong Kong-licensed banks typically take 1 to 5 working days. Actual delivery time depends on factors such as the transfer method, recipient country regulations, bank practices, and intermediary bank involvement. Refer to the table below for average Portugal bank transfer times:

| Country | Currency | Transfer Time |

|---|---|---|

| Portugal | EUR | 0-1 banking working day |

Bank transfers may be delayed during holidays or if processed after bank cut-off times. Traditional SWIFT transfers involve intermediaries, lengthening processing times. You need to plan fund arrangements in advance to avoid delays impacting receipt.

Tip: When choosing bank transfers, prioritize SEPA channels to significantly reduce delivery time.

Online Platform Speed

Online remittance platforms like Wise, WorldRemit, and Paysend deliver much faster than traditional banks. Wise uses smart technology to connect local bank accounts, avoiding slow SWIFT processing. You can achieve delivery within minutes to 24 hours in most cases. The table below shows delivery speeds for different platforms:

| Platform | Transfer Speed | Other Features |

|---|---|---|

| Xoom | Cash pickup in minutes, bank deposits in about 3.5 hours | Secure, affordable, supports PayPal accounts |

| Wise | 95% of transfers complete within 24 hours, 64% in just 20 seconds | Fast, secure, easy to track |

Wise also offers two-factor authentication and real-time notifications to ensure fund security. Online platforms are ideal for scenarios needing quick delivery and low costs, especially for frequent small transfers by users in China/mainland China.

Note: Delivery speeds vary by transfer amount, recipient bank, and operation timing, so check platform details in advance.

SEPA Delivery Speed

SEPA transfers are the preferred choice for efficient transfers within the eurozone. Standard SEPA credit transfers typically complete within 1 working day, while SEPA instant credit transfers can arrive in seconds. Refer to the table below:

| Transfer Type | Processing Time |

|---|---|

| SEPA Credit Transfer | One working day |

| SEPA Instant Credit Transfer | Seconds |

SEPA electronic transfers are fast, while paper-based transfers take at least two days. Operations during holidays or weekends may delay delivery. If you have a euro account in China/mainland China, choosing SEPA enables truly efficient transfers with low fees and fast delivery.

Reminder: SEPA instant transfers require recipient bank support, so confirm related services in advance.

You can choose the most suitable method based on the urgency and amount of funds. Online platforms and SEPA transfers offer advantages in speed and cost, while traditional bank transfers are suitable for large amounts and high-security scenarios.

Process

Basic Steps

When transferring money to Portugal from mainland China or Hong Kong-licensed banks, you can follow these steps:

- Open a Bank Account: You need to open an account with a Portugal or Hong Kong-licensed bank. As an expatriate, opening a Portuguese bank account requires documents like a passport and proof of address. Some online platforms don’t require a local account, only registration and linking a bank card.

- Choose a Remittance Service: You can select bank counters, online banking, or online remittance platforms (e.g., Wise, Paysend). These platforms support international transfers with low fees and transparent rates.

- Enter Recipient Information: You need to input the recipient’s full name, address, IBAN, and BIC details. For SEPA transfers, ensure the recipient’s bank supports SEPA services.

- Enter Transfer Amount and Currency: You can choose to transfer in USD or EUR. The platform will display real-time exchange rates and fees.

- Confirm and Submit Transfer: After verifying all information, submit the transfer request. Some platforms offer real-time tracking, while bank counters provide receipts.

Tip: Understand each platform’s fees and delivery times in advance to arrange funds effectively.

Identity Verification

When conducting international transfers, you must complete identity verification and compliance checks. Common requirements include:

- Valid identification documents, such as a passport or national ID.

- Proof of address, such as utility bills or bank statements.

- Recipient information, including full name, address, and bank details.

- Some cash remittance services may require additional recipient ID or tracking reference numbers.

- Transfers exceeding USD 10,000 are monitored and reported by the IRS. Amounts over USD 16,000 may be considered taxable gifts. Foreign financial assets exceeding USD 50,000 must be reported to the IRS.

- Portuguese law requires all financial institutions to comply with anti-money laundering and anti-terrorism financing regulations. You need to cooperate with banks or platforms to complete compliance processes during transfers.

Note: Ensure all information is accurate and valid to avoid delays or rejections. Choosing reputable platforms and banks helps ensure fund security and compliance.

Precautions

Risk Prevention

When conducting cross-border transfers, fund security and information protection are critical. You need to be cautious of online scams and fraudulent platforms. Choosing reputable banks or well-known online remittance platforms can effectively reduce the risk of fraud. During operations, verify recipient details to avoid fund losses due to errors.

It’s recommended not to process transfers on public networks to prevent personal information theft. You can regularly update account passwords and enable two-factor authentication to enhance account security.

You should also note that some platforms or banks may have hidden fees. Before transferring, carefully review the terms of service and understand all fee details. Save transfer receipts and transaction records for future inquiries or disputes.

Compliance Requirements

When transferring money to Portugal from mainland China or Hong Kong-licensed banks, you need to comply with relevant laws and regulations. Different countries and providers have caps on transfer amounts, depending on platform policies and local laws.

- The Portuguese government strictly regulates large transfers to ensure compliance with local and international financial rules.

- Transfers from the US to Portugal are generally tax-free if for gifts or personal use.

- Large transfers may trigger reporting requirements in the US and Portugal, especially for amounts exceeding specific thresholds.

- Consult tax professionals in China/mainland China and Portugal before large transfers to ensure compliance.

During transfers, banks or platforms will require valid identification and proof of fund sources. You need to provide accurate information to avoid delays or rejections due to discrepancies. Choosing reputable platforms and banks better ensures fund security and compliance.

Platform Recommendations

Wise

Wise is a highly practical platform for transferring money to Portugal. You can enjoy low fees and fast delivery. Wise saves customers approximately USD 4 million monthly, with fees significantly lower than traditional banks. When operating on Wise, you can see real-time exchange rates, avoiding hidden fees. Wise supports multi-currency accounts, allowing you to obtain local bank details in 10 currencies for convenient fund management. You can also track transfer progress in real-time for added security. Wise charges no currency conversion fees, only minimal transaction fees, helping you save on international transfer costs.

| Feature/Advantage | Description |

|---|---|

| Low Fees | Saves customers ~USD 4 million monthly, much lower than traditional banks. |

| Fast Transfers | Typically arrives in hours, much faster than traditional banks’ 1-5 days. |

| Transparent Rates | Real-time rate display, no hidden fees. |

| Multi-Currency Accounts | Supports local account details in 10 currencies for easy management and transfers. |

| Real-Time Tracking | Track transfer progress anytime for added security. |

| No Conversion Fees | Minimal transaction fees, saving on international transfer costs. |

You only need to register a Wise account, fill in recipient details, upload identity verification, select the amount and currency, and confirm to complete the transfer.

WorldRemit

WorldRemit is suitable for flexible transfers to Portugal. You can operate via phone or computer with a simple process. WorldRemit supports multiple receipt methods, including bank accounts, cash pickups, and mobile wallets. You can view fees and rates in real-time on the platform, with fees typically USD 2-5. Delivery is fast, with most transfers completing within 24 hours. You only need to register an account, fill in recipient details, upload identity verification, select the receipt method and amount, and confirm to complete the transfer.

Tip: WorldRemit is ideal for frequent small transfers and users needing diverse receipt methods.

Paysend

Paysend offers convenient international transfer services. You can transfer directly to Portugal using a bank card with a streamlined process. Paysend fees are low, typically USD 2-3 per transfer. You can view rates and fees in real-time on the platform, with most transfers completing in minutes to hours. Paysend supports various bank card types, suitable for quick delivery and low-cost scenarios. You only need to register a Paysend account, link a bank card, fill in recipient details, select the amount, and confirm to complete the transfer.

Tip: Paysend is ideal for cross-border transfer needs requiring fast delivery and low fees.

You can choose online remittance services for efficient transfers to Portugal. Platforms like Wise, Remitly, and Paysend offer low fees, transparent rates, and fast delivery. Cryptocurrency transfers can also provide lower fees and faster delivery. Prioritize reputable providers to ensure fund security and compliance. It’s advisable to stay updated on policy changes and platform dynamics to flexibly adjust transfer methods.

FAQ

How Fast Can Transfers to Portugal Arrive?

Using online remittance platforms or SEPA instant transfers, funds can arrive in seconds. Bank account transfers typically take 1 to 5 working days.

What Are Typical Transfer Fees?

Online platform transfers typically cost USD 2-5. International bank account transfers have higher fees, potentially reaching USD 20-50.

How to Avoid Exchange Rate Losses?

Choose online platforms for real-time rates to minimize losses. SEPA transfers using euro accounts avoid currency conversion losses.

What Identity Verification Materials Are Needed?

You need valid identification, such as a passport or ID. Some platforms also require proof of address and fund source documentation.

How to Ensure Fund Security?

Choose Hong Kong-licensed banks or reputable online platforms with encryption and two-factor authentication. Verify recipient details to avoid operational errors.

Sending money to Portugal doesn’t have to mean high fees and slow transfers. BiyaPay offers a smarter, faster, and more affordable alternative with fees as low as 0.5%. Enjoy seamless transfers between 30+ fiat currencies and 200+ cryptocurrencies, and benefit from transparent, competitive exchange rates via our real-time converter. With quick registration and robust security, BiyaPay supports same-day transfers directly to Portuguese bank accounts. Whether for personal or business use, experience a more efficient way to send money globally. Visit BiyaPay today and sign up to start sending fast, secure, and low-cost remittances to Portugal.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.