- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding Guatemalan Currency and Remittance Methods: Analysis of Remittance Services, Bank Transfers, and Investment Opportunities

Image Source: pexels

When living in Guatemala or engaging in economic activities with the country, you first need to understand Guatemala’s currency. The table below shows the basic characteristics of the main circulating currency:

| Feature | Details |

|---|---|

| Currency | Quetzal (GTQ) |

| Issuing Country | Guatemala |

| Year of Issue | 1925 |

| Denominations | 5 Quetzales, 20 Quetzales |

| Material | Gold (.900), Copper (.100) |

| Shape | Circular |

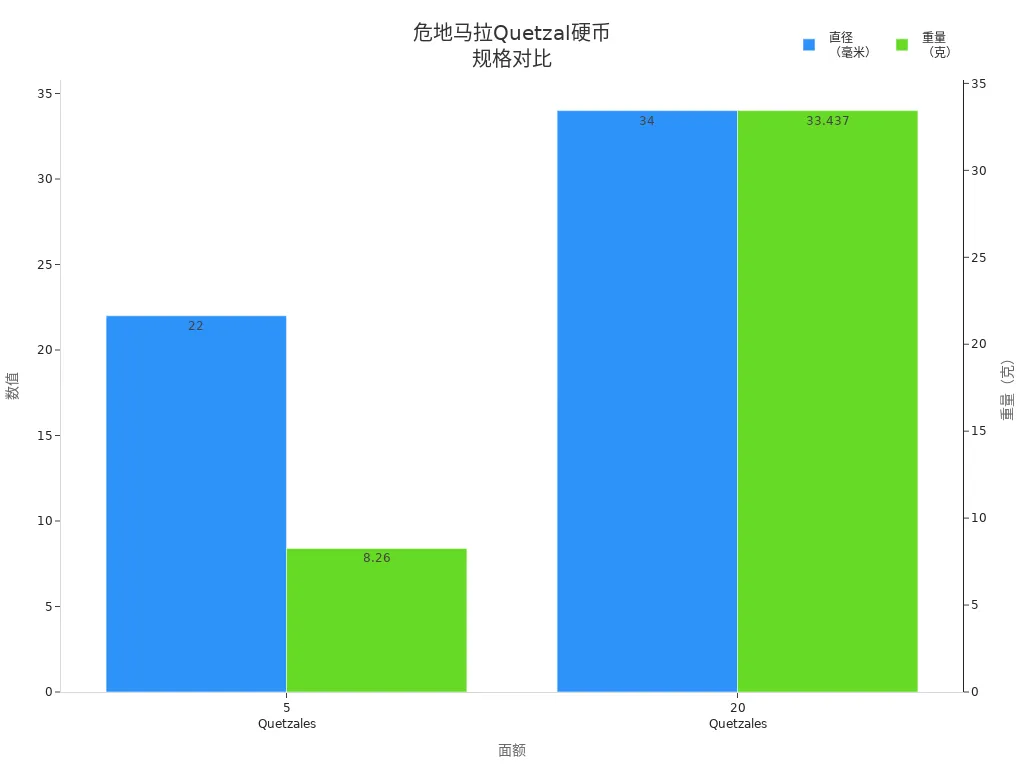

| Diameter | 22 mm (5 Quetzales), 34 mm (20 Quetzales) |

| Weight | 8.26 g (5 Quetzales), 33.437 g (20 Quetzales) |

| Edge | Reeded |

| Notes | These coins are no longer in circulation but can still be exchanged at face value by the Bank of Guatemala. |

When remitting, you can choose online remittance apps, digital wallets, or bank transfers, each suited to different needs. Bank transfers are a popular choice for many users due to their standardized process and high security. If you are considering fund investments, selecting the right financial service is equally important.

Key Points

- Understand that Guatemala’s main currency is the Quetzal (GTQ), widely used in daily transactions, with the U.S. dollar also accepted.

- When choosing a remittance method, online remittance apps, digital wallets, and bank transfers each have advantages and disadvantages, so select the most suitable option based on your needs.

- When exchanging currency, prioritize secure official channels, such as banks and licensed exchangers, to avoid high fees.

- When investing, focus on sectors like agriculture, manufacturing, and services, evaluate returns and risks, and choose compliant channels.

- When selecting a financial service provider, ensure its compliance and security, and pay attention to fee transparency and customer service quality.

Guatemala’s Currency

Image Source: pexels

Currency Types

In daily life in Guatemala, you will encounter various currencies. The main circulating currency is the Guatemalan Quetzal (GTQ), which is Guatemala’s official currency and the most commonly used for shopping and paying service fees. The U.S. dollar is also widely used in Guatemala, especially in foreign currency accounts and certain international transaction scenarios. When conducting banking transactions, you can usually choose to deposit or withdraw in Quetzal or U.S. dollars.

Tip: When opening a bank account in Guatemala, you can choose a Quetzal account or a U.S. dollar account. A dollar account is suitable for users with international remittance needs.

When understanding Guatemala’s currency, you should pay attention to the exchange rate fluctuations of the Quetzal against major international currencies. The table below shows the current exchange rates of the Quetzal against the U.S. dollar and Euro (in USD):

| Currency Pair | Current Rate | Change Rate |

|---|---|---|

| USD/GTQ | 7.66115 | +0.091% |

| GTQ/EUR | 0.1113 | N/A |

If you have been tracking exchange rate trends over the past 30 days, you can refer to the table below:

| Currency Pair | 30-Day High | 30-Day Low | 30-Day Average |

|---|---|---|---|

| GTQ/EUR | 0.1122 | 0.1101 | 0.1113 |

When exchanging currency, rates fluctuate with market conditions. It’s recommended to check the latest exchange rates before exchanging to manage funds effectively.

Exchange Methods

In Guatemala, you can exchange currency through various channels. Official channels include banks and licensed exchange providers, while unofficial channels include some private exchange points. When choosing an exchange service, you should prioritize safety and legality.

Below are common currency exchange service providers in Guatemala:

| Exchange Provider | Address | Contact Information |

|---|---|---|

| RapiXchangE | of. 502 edificio, Design Center, Diag. 6 12-42, Cdad. de Guatemala 01010, Guatemala | +502 2307 5402 |

| Global Exchange | Ciudad de, 9 Avenida 14-75, Cdad. de Guatemala 00013, Guatemala | +502 1801 000 2222 |

| MoneyGram | 3a Calle Poniente 19, Antigua Guatemala, Guatemala | +502 2271 9600 |

| Western Union Guatemala | Edificio Torre Internacional, 16 Calle 0-55, Cdad. de Guatemala 01010, Guatemala | +502 2410 1111 |

When exchanging currency, you should not only focus on exchange rates but also be aware of service fees and commissions. Some exchange providers may offer seemingly favorable rates but charge high fees, which can affect the actual value of your funds.

Recommendation: Before exchanging, inquire about all fees in detail and choose transparent, regulated channels to avoid unnecessary losses.

During the currency exchange process in Guatemala, banks typically offer higher security and compliance assurances. Some licensed Hong Kong banks also have a good reputation in international remittance and exchange services. When selecting exchange channels, prioritize banks and licensed exchange providers to ensure fund safety.

Remittance Methods

When remitting funds in Guatemala, you can choose from various methods. With the development of financial technology, remittance services have become more diverse and convenient. You can flexibly choose online remittance apps, digital wallets, or bank transfers based on your actual needs. Each method has different characteristics in terms of process, fees, and transfer times. Below is a detailed explanation:

Online Remittance Apps

You can use mainstream online remittance apps to transfer funds to Guatemala quickly and securely. Many apps support mobile or computer operations, allowing you to complete remittances anytime, anywhere. The table below lists online remittance service providers commonly used in Guatemala:

| Company Name | Description |

|---|---|

| Western Union | Globally renowned remittance service provider |

| PayPal/Xoom | Offers fast online remittance services |

| Viamericas | Specializes in remittance services for Latin America |

| Remitly | Provides convenient mobile remittance solutions |

| MoneyGram | Traditional remittance company with a wide network |

| Ria | Offers multiple remittance options |

| Intermex | Focuses on remittance services for the Americas |

When remitting to Guatemala, at least one-third of households rely on remittances as a primary income source. Online remittance apps typically support multiple payment methods, including bank accounts, debit cards, and credit cards. You simply need to register an account, enter recipient information, select the remittance amount and payment method, and complete the operation.

When choosing a remittance app, you should focus on fees and transfer times. Below are the fees and transfer limits for some mainstream apps:

| Service Name | Fees | Transfer Limits |

|---|---|---|

| Pangea Money Transfer | Low fixed fees | $20 - $2,999 |

| Ria Money Transfer | Depends on payment method | Depends on bank restrictions |

| Remitly | $0 (bank account payment) or $3.99 (debit card payment) | Cash withdrawal limits for $500 or more |

| MoneyGram | N/A | N/A |

When remitting via debit or credit card, funds can arrive as quickly as the same day. Bank account payments typically take 3-5 business days. Some apps, like Pangea Money Transfer, can complete transfers in as little as 30 seconds. You should carefully check fees and transfer times before remitting to manage funds effectively.

Tip: When using online remittance apps, prioritize platforms with international compliance certifications to ensure fund safety.

Digital Wallets

In Guatemala, you can also use digital wallets for remittances. Digital wallets support mobile operations, making it convenient to manage funds anytime. You simply need to download the app, register an account, link a bank card or credit card, and perform quick remittances. Digital wallets are ideal for small transfers, suitable for daily life and urgent fund needs.

When using digital wallets, the process is simple:

- Register and verify account information

- Add recipient information

- Enter the remittance amount

- Select payment method

- Confirm and send funds

When remitting via digital wallets, fees are low, and transfer speeds are fast. Some digital wallets support instant transfers, while others may take 1-2 business days. When choosing a digital wallet, consider the platform’s security certifications and user reviews.

Note: When using digital wallets in Guatemala, some platforms may have remittance amount limits, so check relevant regulations in advance.

Bank Transfers

When performing bank transfers in Guatemala, you can use licensed Hong Kong banks or local banks. Bank transfers are suitable for large fund transfers, offering high security and standardized processes. To complete a bank transfer, follow these steps:

- Register or log in to your bank or remittance platform account

- Select Guatemala as the recipient country

- Add the recipient’s bank account information, including bank name, account number, recipient’s name, phone number, and address

- Enter the remittance amount and review the actual payment amount and fees

- Choose a payment method (bank account, debit card, or credit card)

- Review the information, confirm, and send

When performing bank transfers, funds are securely sent to the recipient’s Guatemalan bank account. Transfer times are typically 3-5 business days, though some platforms support same-day transfers. When remitting from the U.S. market to Guatemala, transfers can often be completed within minutes, but bank processing or holidays may cause delays of one to two days.

When using bank transfers, fees are transparent, and security is high. Banks will notify you of the fund status in real-time, ensuring safety. When choosing a bank service, prioritize compliant, reputable banks or licensed financial institutions.

Recommendation: When performing bank transfers, double-check recipient information to avoid delays or losses due to errors.

When managing remittances in Guatemala, choosing the right method can improve fund transfer efficiency and ensure safety.

Banking Services

Fund Transfers

When handling fund transfers in Guatemala, banks provide efficient services. You can process remittances through online banking, mobile banking, or in-person at a branch, whether for personal transfers or business fund flows. When using licensed Hong Kong banks or local banks, the fund transfer process is standardized and transparent. You simply need to provide recipient information, select the remittance amount, and the bank will automatically calculate fees and inform you of the transfer time. When remitting from the U.S. market to Guatemala, banks typically support USD settlement, facilitating cross-border fund management.

Tip: For large fund transfers, book bank services in advance to ensure secure and timely delivery.

Savings and Investments

In Guatemalan banks, you can choose from various savings and investment products. Banks offer fixed deposits, demand deposits, and loan services. When selecting savings products, you can refer to the following interest rate information:

| Product Type | Average Interest Rate |

|---|---|

| Deposit Rate | 7.06% (July 2025) |

| Loan Rate | 12.40% (2024) |

You can also review deposit rate trends over recent years:

- 2017 deposit rate: 5.370%

- 2016 deposit rate: 5.475%

- Average deposit rate from 1997 to 2017: 5.452%

When managing savings with banks, your funds are secure, and interest rates are stable. For investments, you can choose bank wealth management products or USD fixed deposits for higher returns. When selecting investment products, consider interest rate changes and product risks to manage funds effectively.

Security Measures

When conducting banking transactions in Guatemala, banks employ multiple security measures to protect your funds. You can refer to the table below for key security measures:

| Security Measure | Description |

|---|---|

| Identity Verification | Uses passwords, security tokens, and biometric technology to verify user identity. |

| Fraud Detection and Prevention | Monitors transactions in real-time, using machine learning algorithms to detect and prevent suspicious activities. |

| Compliance | Adheres to data security standards like PCI DSS to ensure customer information safety. |

| Multi-Factor Authentication | Requires multiple verifications to initiate transactions, enhancing security. |

| Dual Control | Requires two-person authorization for transactions to prevent risks from single-person operations. |

| Tokenization | Replaces sensitive information with unique identifiers to prevent data leaks. |

When handling remittances, savings, or investments, banks will notify you of fund status in real-time. If unusual transactions occur, banks will proactively alert you and assist with resolution. When choosing banking services, prioritize institutions with robust security measures and high compliance to ensure fund safety.

Investment Opportunities

Image Source: pexels

Investment Sectors

In Guatemala, you can choose from various investment sectors. Agriculture, manufacturing, services, real estate, energy, and infrastructure are the most popular areas. Agriculture includes export products like coffee and bananas, manufacturing focuses on textiles and clothing, and services account for 60% of GDP, growing rapidly. Real estate has potential in tourism and urban areas, energy focuses on hydropower and geothermal, and infrastructure supports national development.

The table below shows key investment sectors and their historical performance:

| Investment Sector | Historical Performance and Notes |

|---|---|

| Agriculture | Influenced by political stability and international trade agreements, accounts for nearly 10% of GDP. |

| Manufacturing | A key component of economic growth, contributes 22% to GDP, attracts foreign investment. |

| Services | Fastest-growing sector, accounts for 60% of GDP. |

| Real Estate | High potential in tourism and urban areas. |

| Energy | Renewable energy projects supported by policies. |

| Infrastructure | A critical area for national development. |

When choosing investment sectors, screen based on your capital size and risk tolerance.

Returns and Risks

When investing in Guatemala, you need to consider returns and risks. In 2023, GDP was $102 billion, with an economic growth rate of 3.5%. The private sector accounts for 85% of GDP, with agriculture and manufacturing as key industries.

Investment returns depend on sector performance, but you should also note the following risks:

- Corruption and an inefficient legal system may impact investment safety.

- The business environment carries higher risks, and policy changes may introduce uncertainty.

- Small and medium-sized enterprises face funding and training barriers.

Before investing, thoroughly understand sector conditions, assess risks, and choose compliant channels.

Regulatory Environment

When investing in Guatemala, you need to understand the relevant regulatory bodies and laws. The Commercial Code allows foreign companies to establish branches, specifying legal obligations. The Foreign Investment Law, in place since 1998, protects foreign investors’ rights, ensuring equal treatment with local investors. The Export and Processing Promotion Law, Renewable Energy Project Development Incentive Law, and Public-Private Partnership Law promote investments in specific sectors. Guatemala has signed bilateral investment treaties with multiple countries, further safeguarding investor rights.

The table below lists key regulatory bodies and laws:

| Regulatory Body/Law | Main Content |

|---|---|

| Commercial Code | Allows foreign companies to establish branches and specifies legal obligations. |

| Foreign Investment Law | Protects foreign investors’ rights, ensuring equal treatment. |

| Export and Processing Promotion Law | Promotes investment in export and processing industries. |

| Renewable Energy Project Development Incentive Law | Promotes investment in renewable energy. |

| Public-Private Partnership Law | Promotes cooperation between public and private sectors. |

| Bilateral Investment Treaties | Protect foreign investors’ rights. |

Before investing, thoroughly understand relevant laws and policies, and choose compliant channels to protect your interests.

Choosing Financial Services

Institutional Standards

When selecting a financial service provider, you should focus on its compliance and security. Licensed Hong Kong banks and Guatemalan local licensed banks typically have strict regulatory qualifications. You can check if the bank is approved by local financial regulators and whether it discloses service terms and fees transparently. When handling remittances or investments, prioritize banks with international compliance certifications. Consider the following standards:

- Holds a valid financial license

- Transparent fee structure

- Robust customer service system

- Offers multiple identity verification and security measures

Tip: When opening an account or conducting transactions, you can request the bank to provide proof of qualifications to protect your interests.

Regulatory Bodies

When conducting financial transactions in Guatemala, you should understand the responsibilities of key regulatory bodies. These bodies oversee the compliance of financial services and protect consumer rights. The table below shows Guatemala’s main financial regulatory bodies and their functions:

| Regulatory Body | Function Description |

|---|---|

| Financial Intelligence Unit | Oversees anti-money laundering, under the Banking Supervision Authority. |

| Guatemala Tax Authority | Oversees tax compliance. |

| Customer Service Department | Protects consumer and service user rights. |

| Stock and Commodities Market Registry | May oversee the use of virtual currencies in investment contracts. |

When choosing financial services, check if the institution is supervised by the above regulatory bodies. In case of disputes, you can file complaints or seek assistance from relevant authorities.

Anti-Fraud Recommendations

When conducting financial transactions, you should stay vigilant against financial fraud. You can take the following measures to protect your funds:

- Choose regulated licensed banks or financial institutions and avoid unverified channels.

- Do not disclose personal information or account passwords.

- Verify remittance and investment contract details, avoiding signing unclear documents.

- Stay informed about safety alerts from banks and regulators.

- Contact the bank or regulatory authorities immediately if suspicious transactions occur.

Note: When receiving remittance or investment offers from strangers, stay cautious to avoid losses due to scams.

By following these measures, you can effectively reduce the risk of financial fraud and protect your assets.

When choosing remittance and investment methods in Guatemala, focus on safety and convenience. Different user groups have varying needs:

- Women, youth, rural, and informal economy populations face economic vulnerability, and financial inclusion and formal savings can enhance income and resilience.

- Remittance inflows continue to grow, with a projected growth rate of 5.5% in 2024, surpassing foreign direct investment, highlighting their importance to household economies.

- When choosing financial services, pay attention to bank fee transparency, service quality, and credit thresholds. Digital financial services and financial education can improve accessibility.

- Guatemala’s financial services are regulated by multiple laws, including the Banking and Financial Groups Law, Insurance Activity Law, and anti-money laundering regulations, making regulated institutions more reliable.

You should rationally choose compliant and secure financial solutions based on your needs, stay informed about regulatory updates, and avoid potential risks.

FAQ

What are the main remittance methods available in Guatemala?

You can choose online remittance apps, digital wallets, and bank transfers. Online apps support mobile operations, bank transfers are suitable for large funds, and digital wallets are ideal for small daily remittances.

How long does it take for a remittance to arrive?

Using online remittance apps, funds can arrive as quickly as the same day. Bank account payments typically take 3-5 business days. Some platforms support transfers within minutes, but holidays may cause delays.

What are the bank remittance fees in Guatemala?

When remitting through banks, fees vary by amount and channel, typically ranging from USD 3-10 per transaction. Consult the bank in advance for specific fee details.

What are the main investment risks in Guatemala?

When investing in Guatemala, consider risks such as legal system inefficiencies, policy changes, and business environment uncertainties. Corruption and regulatory gaps may affect investment safety.

How do I choose a safe and reliable financial service provider?

Prioritize licensed banks or compliant financial institutions. Check if the institution discloses fee structures and security measures transparently. For questions, consult local financial regulators.

Tired of high fees and slow processing when sending money to Guatemala? BiyaPay offers a faster, fully digital alternative with fees as low as 0.5% — no hidden charges. We support 30+ fiat currencies and 200+ cryptocurrencies, giving you more flexibility than traditional bank transfers. You can check real-time exchange rates to maximize value, visit the BiyaPay official website to explore seamless cross-border transfers, or create your account now and enjoy same-day delivery to Guatemalan bank accounts.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.