- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Understand and Use the ABA Routing Number to Ensure Smooth Transfers

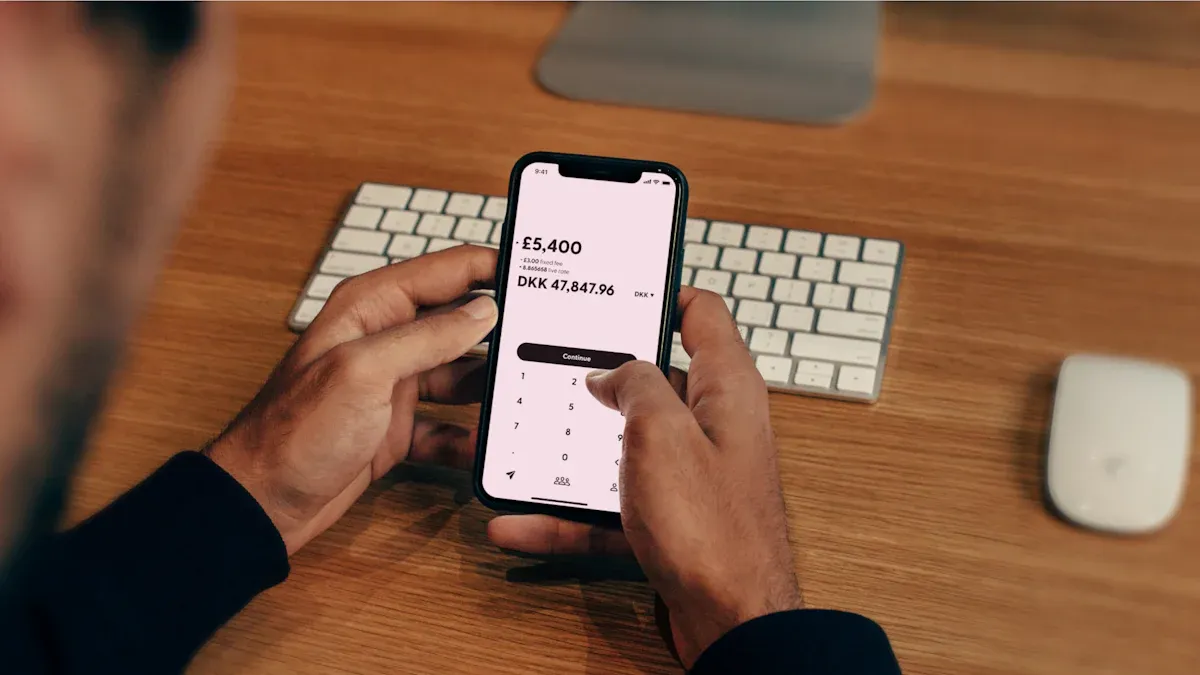

Image Source: pexels

When making bank transfers in the United States, the ABA routing number plays a critical role. Entering the correct number ensures funds are transferred smoothly. Incorrect entries may lead to the following consequences:

- Funds delayed or transactions returned

- Funds sent to the wrong account

- Banks may charge additional fees

“If a payment fails, it ultimately means someone doesn’t get paid on time, or worse, it could mean project delays or someone losing access to utilities.”

You should pay special attention to accurately finding and entering the ABA routing number to avoid common mistakes and ensure the security of your funds.

Key Points

- The ABA routing number is critical for bank transfers in the U.S., ensuring secure and timely fund delivery.

- When entering the ABA routing number, verify every digit to avoid delays or losses due to errors.

- You can obtain the ABA routing number from checks, the bank’s website, or customer service to ensure a reliable source.

- In international transfers, the ABA routing number is used alongside the SWIFT code to ensure accurate cross-border fund transfers.

- Before each transfer, carefully verify the ABA routing number and recipient information to ensure fund security.

Role of the ABA Routing Number

Basic Definition

When handling banking transactions in the U.S., you often encounter the ABA routing number. It is a unique nine-digit identifier assigned by the American Bankers Association (ABA). You can find this number at the bottom left of U.S. checks. The ABA routing number consists of two parts: the first part indicates the bank’s geographic location, and the second part identifies the specific bank. Only financial institutions authorized by the Federal Reserve Bank can apply for and use ABA routing numbers.

Since its establishment in 1911, the ABA routing number has become an indispensable identification tool in the U.S. financial system. It simplifies the clearing and settlement process for checks, improving the efficiency of fund transfers between banks.

The table below illustrates the structure of the ABA routing number:

| Component | Description |

|---|---|

| First Two Digits | Regional Federal Reserve Bank |

| Third Digit | Check Processing Center |

| Fourth Digit | Federal Reserve District State |

| Fifth to Eighth Digits | Financial Institution Identifier |

| Ninth Digit | Check Digit (Verification Character) |

Primary Uses

When conducting bank transfers, direct deposits, or wire transfers, the ABA routing number plays a key role. It helps the system accurately identify and route each transaction, ensuring your funds reach the designated account securely and on time. The main uses of the ABA routing number include:

- Facilitating check payment clearing to ensure checks are processed correctly.

- Supporting electronic ACH (Automated Clearing House) transfers between U.S. financial institutions, including direct debits and deposits.

- Enabling wire transfers, particularly for urgent or large payments.

The ABA routing number not only simplifies payment processing but also reduces errors from manual entry of bank information. When handling banking transactions in the U.S., accurately entering the ABA routing number significantly enhances the security and efficiency of fund delivery.

Only financial institutions deemed qualified by the Federal Reserve Bank can obtain an ABA routing number. This system ensures the standardization and security of financial transactions.

Structure and Meaning

Nine-Digit Composition

When entering the ABA muove routing number, you’ll notice it always consists of nine digits. These digits are not arranged randomly. Each digit serves a specific function. The table below outlines the role of each digit:

| Digit Position | Meaning |

|---|---|

| 1-4 | Federal Reserve Routing Symbol |

| 5-8 | Unique ABA Identifier for the Bank |

| 9 | Checksum for Validating Routing Number Accuracy |

When handling bank transfers in the U.S., the system uses these nine digits to automatically identify the fund’s destination. Whether for check clearing or wire transfers, accurately entering this number helps avoid delays or misdirected funds.

Tip: If your bank undergoes a merger or acquisition, the acquiring bank typically takes over the original ABA routing number. You need to update your account information promptly. The bank will notify you of changes and provide detailed instructions.

Digit Meanings

You may wonder what each digit specifically represents. Below is a concise list explaining their roles:

- First four digits: Federal Reserve routing symbol, determining which Federal Reserve Bank the funds are directed to first.

- Next four digits: Specific bank identifier, ensuring funds reach the target bank accurately.

- Ninth digit: Checksum, used to verify the accuracy of the entire ABA routing number, preventing entry errors.

When entering the number, understanding the significance of each digit helps avoid common mistakes. The system uses the checksum to automatically detect if the number is valid. If you enter it incorrectly, the bank system will prompt you to recheck, ensuring fund security.

Finding the ABA Routing Number

Image Source: unsplash

Check Lookup

You can quickly find the ABA routing number by checking a U.S. standard check, where the nine-digit number is printed at the bottom left. The information on checks is arranged systematically for easy identification and verification. The table below shows the position of each piece of information on a check:

| Position | Content |

|---|---|

| Bottom Left | ABA Routing Number (Nine Digits) |

| Middle | Account Number |

| Bottom Right | Check Number |

When entering transfer information, simply verify the nine-digit number at the bottom left. The check lookup method is simple and intuitive, ideal for quickly obtaining information in daily banking tasks.

Tip: If you have multiple checks, verify the number multiple times to ensure consistency. The bank system uses the check digit to validate the number, but proactive verification further reduces error risks.

Website and Customer Service

You can also find and verify the ABA routing number through the bank’s website or official customer service channels. Many banks provide dedicated lookup pages on their websites, where you can enter the bank name or branch information to obtain the accurate routing number. The Federal Reserve Bank also offers authoritative online lookup tools for public use. The table below lists commonly used official resources and their access links:

| Resource Name |

|---|

| E-Payments Routing Directory |

| Search for Fedwire Participants |

| Federal Reserve Routing Information |

| Fedwire Treasury Routing Information |

| Routing Number Directory Frequently Asked Questions |

When using these official channels, you can ensure you obtain the most up-to-date and accurate routing number information. Bank customer service staff can also assist in verifying information, especially in special cases or when you have questions. It’s recommended to call the bank’s customer service or visit a branch for assistance.

It’s advisable to avoid obtaining routing numbers from unofficial channels. Using outdated or incorrect information may lead to payment failures, potentially causing USD 12.00 in additional losses and affecting your financial security and reputation.

Other Methods

If you cannot obtain the ABA routing number via checks or the bank’s website, you can try the following methods:

- Log in to the bank’s online portal or mobile app, where the account information page typically displays the routing number.

- Review monthly bank statements, as some banks include the routing number on statements.

- Contact bank customer service directly or visit a local branch, where staff can provide the accurate number.

To ensure routing number accuracy, banks typically employ multiple verification mechanisms. For instance, banks use automated validation tools to cross-check with the American Bankers Association’s database in real time, regularly update records, and train staff. For large transactions, banks may also conduct manual reviews to ensure every transfer is secure.

When finding and entering the ABA routing number, ensure the information source is authoritative and up-to-date. Incorrect or outdated numbers may lead to transaction failures, financial losses, and customer churn. Each verification is a step toward ensuring your funds’ safety.

Considerations for Entering the ABA Routing Number

Image Source: unsplash

Correct Entry Steps

When entering the ABA routing number, follow these steps to ensure accuracy:

- Select the banking service you wish to use, such as online banking or a third-party payment platform.

- Gather the recipient’s details, including full name, account number, and ABA routing number.

- If using a third-party service, register an account or log in to the bank’s online system.

- Navigate to the payment or transfer page and locate the relevant entry fields.

- Enter the transfer amount, confirming the currency is USD.

- Add all recipient details and carefully verify each item.

- Complete security verification steps and submit after confirming all information is correct.

Tip: Obtain the latest ABA routing number via the bank’s website, checks, or customer service. Verify the number’s validity before submitting to avoid delays due to incorrect information.

Common Errors

When entering the ABA routing number, you may encounter the following common errors:

- Entering incorrect bank information or account numbers.

- Using an incorrect ABA number, especially confusing between transaction types (e.g., ACH vs. wire transfers).

- Relying solely on manual checks without using official tools or customer service for verification.

- Providing an ABA number instead of a federal wire routing code, leading to improper transaction processing.

- Misspelling the recipient’s name, city, or country.

- Omitting or incompletely filling in the bank address.

- Errors in account numbers, SWIFT, or IBAN codes, such as missing digits or mixing letters.

- Mismatched currency types with the receiving bank or omitting intermediary bank information.

For example, a company mistakenly used an Arizona ABA number for a Southern California number, causing payment delays and affecting supplier relationships. According to ACH Genie, incorrect ABA numbers are a primary reason for ACH payment rejections. You should prioritize the accuracy of every piece of information.

Special Cases

In international wire transfers or transfers involving credit unions, pay attention to the following special cases:

- For international wire transfers, the ABA number identifies U.S. banks and is typically used alongside a SWIFT code to ensure accurate cross-border transfers.

- When sending international wire transfers, provide the recipient’s full name, address, account information, and the originating bank’s ABA number and SWIFT code.

- For transfers from other countries to U.S. bank accounts, confirm the ABA number through the recipient bank’s website or customer service.

- The U.S. international dollar clearing systems, mainly FEDWIRE and CHIPS, use ABA routing numbers for FEDWIRE, while CHIPS may use other identifiers.

- If entered incorrectly, the bank will contact you to confirm the correct ABA number and suggest reviewing bank statements, checks, or contacting customer service directly to resubmit accurate information.

When handling special cases, ensure all information sources are authoritative and up-to-date. Incorrect ABA numbers may prevent funds from arriving or cause returns, affecting transaction progress and fund security.

Key Role and Recommendations

Fund Security

When making bank transfers, the ABA routing number provides critical assurance for fund security. Correctly entering the routing number allows the bank system to accurately identify the recipient institution, reducing errors and fraud risks during fund transfers. Each time you use an ABA number, it adds a layer of security to the transaction. The following points help you understand the role of ABA numbers in fund security:

- ABA routing numbers accurately identify financial institutions, ensuring the security of fund transfers.

- They ensure funds are accurately delivered to the recipient’s bank account, minimizing errors and fraud risks.

- Proper use of routing numbers adds a layer of security, reducing the likelihood of misdirected funds.

When conducting cross-border transfers in the U.S. market or with licensed Hong Kong banks, banks employ multiple security measures to protect your account information. Common security measures include:

| Security Measure | Function |

|---|---|

| Digital Banking Features | Protect customer information, preventing unauthorized access |

| Fraud Alerts | Notify customers of potential fraudulent activity in real time |

| Secure Authentication | Ensure only authorized users can access accounts |

| Enhanced Security Checks | Further verify user identity to prevent fraud |

You can further reduce the risk of funds being misused or misdirected by leveraging these measures.

Tip: Before each transfer, verify all information, especially the ABA number and recipient account details, to ensure secure transactions.

Practical Recommendations

In daily banking operations, following practical recommendations can effectively avoid delays or losses due to ABA number errors. Consider the following practices:

- Always verify your ABA number before any financial transaction.

- Contact your bank if you have any questions or concerns.

- Use online tools; many websites offer routing number lookup services by entering the routing number for validation.

- Visit the American Bankers Association (ABA) website to access the official routing number directory.

- Contact bank customer service directly to confirm the accuracy of the routing number.

You can also use the bank’s digital management tools to receive real-time fraud alerts and security tips. Banks protect your account through secure authentication and enhanced security checks. When working with the U.S. market or licensed banks in Mainland China and Hong Kong, prioritize official channels to obtain and verify ABA numbers to avoid losses due to unreliable sources.

Each careful verification is a commitment to your funds’ safety. Properly using the ABA routing number ensures every transaction reaches its destination securely and efficiently.

When making bank transfers, accurately entering the ABA routing number is crucial. By verifying the routing number multiple times, you can effectively reduce the risk of transaction delays and financial losses. The table below summarizes the role and security considerations of routing numbers in different transaction types:

| Transaction Type | Role of Routing Number | Security Considerations |

|---|---|---|

| ACH Transactions | Process batch payments | Verify sender’s bank to ensure fund security |

| Wire Transactions | Real-time fund transfers | Require accurate recipient bank account and routing number |

When performing transactions, use the bank’s website or customer service to obtain the latest numbers to avoid issues with funds not arriving. With the rise of digital payment methods, the accuracy of traditional routing numbers remains critical to ensure every transaction is secure.

FAQ

Where can I find the ABA routing number?

You can find the ABA routing number at the bottom left of a check. You can also log in to the bank’s website or contact customer service to obtain the accurate number. Bank statements and mobile apps often display this information.

What should I pay attention to when entering the ABA routing number?

You need to carefully verify each digit. Avoid confusing different types of routing numbers. Use the bank’s official tools or customer service for validation to ensure accuracy.

What is the role of the ABA routing number in international transfers?

In international transfers, the ABA routing number identifies the U.S. recipient bank. You typically need to provide a SWIFT code as well. Confirm all information with the recipient bank in advance.

What should I do if I enter the wrong ABA routing number?

Contact bank customer service immediately. The bank will assist in verifying and correcting the information. You may need to resubmit the transfer request to ensure funds arrive securely.

While ABA routing numbers are essential for domestic U.S. transfers, international remittances often come with high fees and slow processing when using traditional banks. For a smarter alternative, BiyaPay offers fast, secure, and affordable cross-border payments with fees as low as 0.5%. Seamlessly convert between 30+ fiat currencies and 200+ cryptocurrencies, and enjoy transparent, competitive exchange rates through our real-time exchange rate calculator. With quick registration and robust security, BiyaPay supports same-day transfers to U.S. bank accounts, making it ideal for bill payments, family support, or business transactions. Say goodbye to hidden costs and delays. Visit BiyaPay today and sign up to send money globally with confidence and ease.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.