- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

NVIDIA's Capital Expenditure Revealed: Why Computing Clusters Are AI "Super Competitive Edge"?

With the rapid development of artificial intelligence technology, especially in the fields of deep learning and large-scale data processing, computing power has become one of the key factors driving the progress of AI. In recent years, with the increasing attention and investment of multiple companies in artificial intelligence, the role of computing clusters in the AI field has become increasingly important. Among many AI technology providers, NVIDIA occupies an indispensable position in the AI computing field with its powerful GPU.

Despite some innovative companies, including DeepSeek, demonstrating more efficient training architectures, NVIDIA has still consolidated its position as an AI “Competitive Edge” through the advantages of its computing clusters.

Compute Clusters: The True Competitive Edge of AI

The development of artificial intelligence has gone through several rounds of technological iterations, especially in the field of deep learning, where algorithms and models have been continuously optimized. From the earliest artificial neural networks to today’s convolution neural networks and transformer models, the technological progress of AI mainly focuses on the innovation of model architecture and algorithms. However, although the replication speed of training algorithms far exceeds that of data centers and computing clusters, computing clusters themselves are still the “Competitive Edge” of artificial intelligence.

The core role of a computing cluster is to provide powerful computing support in large-scale data processing, Model Training, and inference processes. NVIDIA has become a core hardware provider supporting AI infrastructure through its leading GPU technology. Although DeepSeek and similar companies have improved training efficiency through innovative algorithms, they still cannot escape the limitations of relying on computing clusters. The advantage of computing clusters is not only that they can handle huge amounts of data, but also that they can achieve low-latency computing to meet the needs of Deep learning and large-scale AI Model Training.

To better understand this, we can give an example: even though DeepSeek can reduce training costs by optimizing algorithms, its algorithms still rely on powerful computing clusters to complete complex computing tasks. Currently, computing clusters are far beyond the reach of other single training architectures in terms of scale, efficiency, and stability.

NVIDIA’s Role: Leader of Computing Clusters

NVIDIA is a leader in GPU computing, especially playing a key role in AI and Deep learning computing. NVIDIA’s GPU products, especially models such as A100 and H100, have become standard configurations for top technology companies and research institutions worldwide. By providing powerful parallel computing capabilities, NVIDIA enables efficient execution of artificial intelligence training on large-scale datasets.

Unlike many AI companies, NVIDIA not only holds a leading position in the hardware field, but also continuously innovates in the software ecosystem. Through the CUDA platform, NVIDIA provides developers with comprehensive tools, greatly improving the development efficiency of AI applications. Therefore, NVIDIA’s computing cluster not only relies on hardware, but also includes comprehensive software support, keeping it in a leading position in the AI infrastructure field.

According to NVIDIA’s financial report, in 2024, the revenue of NVIDIA’s Data Center business increased by 55% year-on-year, and the revenue contribution of this part mainly came from the increasing demand for AI computing hardware. As more companies begin to apply AI to their actual businesses, NVIDIA’s computing clusters will continue to be the core driving force behind this process.

Capital expenditure: investment trends in AI infrastructure

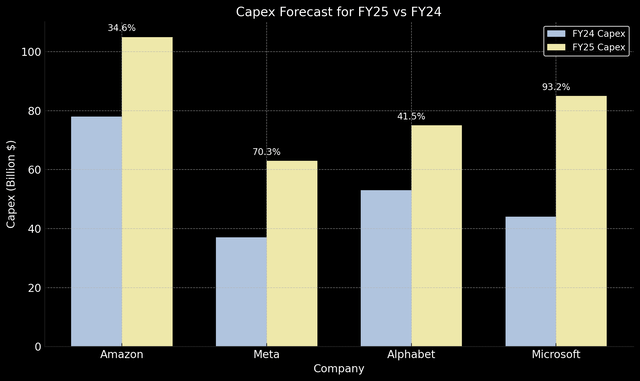

With the increasing popularity of artificial intelligence technology, global technology companies have increased their investment in AI infrastructure. These investments are not only reflected in hardware procurement, but also in the construction and maintenance of data centers. For example, in the 2025 fiscal year, Amazon plans to invest more than $100 billion in the expansion of data centers and the construction of Cloud Service infrastructure. Companies such as Meta, Alphabet, and Microsoft have also announced plans to significantly increase capital expenditures, most of which will be used to support the development of AI technology, especially for expanding computing clusters and data centers.

One important goal of these investments is to ensure the sustainable development and competitiveness of its AI technology. As the demand for computing power in AI training continues to rise, giant technology companies must meet the growing computing demand through large-scale investment. For example, Microsoft recently announced that it will invest billions of dollars to support the AI computing capabilities of its Azure Cloud Computing Platform to meet the needs of future AI applications.

NVIDIA’s role is particularly important in this trend. As a leading global GPU supplier, NVIDIA not only occupies an important position in the AI computing field, but also has a place in the capital expenditure of AI infrastructure. With the increase in demand for AI infrastructure, NVIDIA’s GPU market demand will further increase, providing it with long-term growth momentum.

DeepSeek’s Challenge: Can Innovative Architecture Change the Rules of the Game?

DeepSeek, as an emerging AI company, has attracted a lot of attention from investors through its efficient training architecture. DeepSeek’s R1 model has made breakthroughs in training efficiency, allowing efficient training tasks to be completed with less computing resources. This technological innovation shows that algorithm optimization can indeed reduce the consumption of computing resources in AI development.

However, despite DeepSeek’s breakthroughs in algorithm and training architecture, it still faces the reality that computing clusters are irreplaceable. In practical applications, although DeepSeek’s algorithm can improve efficiency, it still needs to rely on powerful computing clusters for large-scale training. This also indicates that although algorithm innovation can optimize resource utilization, the underlying support role of computing clusters cannot be replaced in the short term.

Therefore, although DeepSeek’s technological breakthroughs may affect the training costs of some AI applications in the short term, the core position of computing clusters will not change. Current technological trends indicate that only through large-scale and efficient computing clusters can AI companies maintain competitiveness in data processing, Model Training, and inference.

Valuation of NVIDIA stock: Future growth potential

From a valuation perspective, NVIDIA remains one of the most promising stocks in the AI field.

When evaluating the valuation of NVIDIA’s stock, we can conduct in-depth analysis based on the Price-To-Earnings Ratio and discounted cash flow model. After further research, my target price is relatively conservative, based on the revised 45 times end point Price-To-Earnings Ratio, which is moderate and achievable. Considering NVIDIA’s current growth potential, this valuation still appears relatively attractive compared to the industry average.

When conducting discounted cash flow analysis, I used an equity stake cost of 18.655%, which was calculated by multiplying the fixed maturity rate of 10-year Treasury bonds (4.495%) with the Beta Index of NVIDIA stock (2.36) by a market premium of 6%. This Universal Discount Rates reflects the relative risk of NVIDIA as a technology leader and also reflects the widespread market recognition.

Based on this valuation framework, NVIDIA’s stock price still has high investment attractiveness in the short term. Conservative basic analysis shows that it may bring at least a 50% return rate. This return rate reflects NVIDIA’s continued leading position in the AI infrastructure field, especially in the strong demand for GPU market and computing cluster construction.

Despite the conservative valuation, NVIDIA’s stock may still have considerable room for appreciation in the next year. With the continuous growth of demand in the AI and Data center markets, NVIDIA will maintain a relative advantage in its leadership position.

If you are optimistic about NVIDIA’s growth prospects and want to seize investment opportunities, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting US and Hong Kong stock and digital currency transactions.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Challenges faced: Uncertainty brought about by technological innovation

Although NVIDIA holds a leading position in the field of computing clusters, the rapid progress of technology means that it faces certain challenges. Especially in the field of AI, the pace of innovation is changing rapidly, and new hardware and algorithms are constantly emerging, which may affect NVIDIA’s leadership position in the GPU market.

For example, Google’s TPU and AMD’s GPU have both formed competition with NVIDIA to some extent. Although these alternative solutions have not yet completely surpassed NVIDIA in performance, with the advancement of technology, they may gradually erode NVIDIA’s market share. Therefore, NVIDIA must continue to invest in research and development to ensure that its GPU and computing cluster can maintain a leading position in the fierce market competition.

In summary, although technological innovation and competition in the AI field are becoming increasingly fierce, computing clusters are still the core of building a “Competitive Edge” for artificial intelligence. NVIDIA occupies an important position in global AI infrastructure building through its powerful GPU technology and benefits from continuous growth in capital expenditures. Therefore, NVIDIA’s stock prospects in the next few years are still optimistic, especially its continued investment in AI infrastructure and data center fields will drive its long-term business growth.

Despite facing new technological challenges, NVIDIA remains one of the most promising companies in the AI industry with its leadership position in the GPU field. For investors, NVIDIA’s stock may face market fluctuations in the short term, but its growth potential is still worth paying attention to in the medium to long term.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.