- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Short-term decline, long-term bullish: How will AMD's stock price go in the future?

Over the past year, AMD’s stock price has not performed well, falling from a high of about $227 to around $110 currently. Despite recent fluctuations in the stock price, AMD still has strong potential in the medium to long term.

So, why was AMD’s stock price able to climb to such a high level a year ago? The main reason was that the market’s expectations for artificial intelligence were too optimistic. Obviously, this optimism far exceeded AMD’s actual performance. The problem now is that AMD’s stock price has experienced a 53% decline and has almost entered a bear market in the past 11 months. Is such a big drop reasonable? Will the stock price hover at this level, or is the market overreacting and AMD becoming an opportunity worth buying?

From a technical perspective, has AMD hit rock bottom?

From a technical analysis perspective, AMD’s stock price may have bottomed out near the key support level of $110 to $100. After AMD released its latest financial report, the stock price once fell below $107, but a clear bullish signal appeared a few days ago, accompanied by high trading volume. This indicates that the stock price may have entered oversold territory and may even rebound.

In addition, AMD’s stock price is currently significantly below its 200-day moving average, down about 33%. This situation indicates that AMD’s stock price may have been oversold by the market. From other technical indicators, such as CCI and RSI, AMD’s stock is also oversold. It is particularly important to note that the RSI indicator is no longer hitting new lows, which means that the stock price may soon usher in a more positive trend.

Why did AMD fall so deeply?

AMD entered an overbought state in early 2024 for several reasons. Firstly, from a Technical Fundamental perspective, the stock price rose by nearly 150% in a short period of time, clearly exceeding its reasonable valuation range. Secondly, from a fundamental perspective, AMD’s stock price was significantly overvalued at that time, with its forward Price-To-Earnings Ratio reaching about 45 times. At that time, the stock price was about $225, while the expected earnings per share for 2025 was $5. Thirdly, the artificial intelligence boom was too optimistic about AMD’s expectations at that time, but over time, the sales expectations for AI GPUs in 2025 were lowered, and the market began to realize that this expectation was not entirely realistic.

Now, AMD has become cheaper

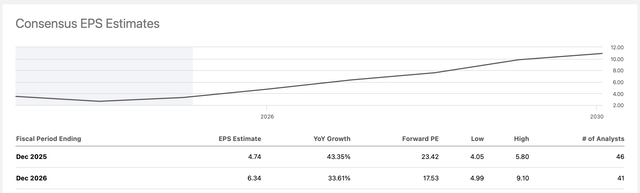

Currently, the pessimistic market sentiment has pushed AMD’s stock price very low, so it now looks like a relatively cheap option. Last year, AMD’s Price-To-Earnings Ratio was expected to be between 40 and 50 times, while now, the expected earnings per share in 2026 are about $6.34, and the Price-To-Earnings Ratio has dropped to around 18 times.

It should be noted that although the lowest earnings per share expectation is about $5, the high-end expectation is close to $9, which means that in a slightly more optimistic scenario in 2025, AMD’s earnings may exceed expectations and reach a level higher than $6.34.

In fact, AMD’s current situation may not be as bad as the recent stock price trend seems. Although it is currently in a challenging stage, it does not mean that the future is bleak. The problem mainly lies in software-related challenges and Nvidia’s continued dominance in the artificial intelligence GPU field, which has caused AMD to fail to achieve its AI GPU sales target.

Originally, the gap between AMD and Nvidia should be narrowing, especially since AMD has a larger share in the lucrative AI Enterprise Services market. Unfortunately, due to software and other factors, AMD still lags behind Nvidia.

However, this does not mean that AMD’s market position cannot be improved, nor does it mean that Nvidia will always maintain such a rapid lead. The market’s conclusion may have come too early, and AMD still has the opportunity to play an important role in the competition of AI GPUs.

Data center revenue surges 69%

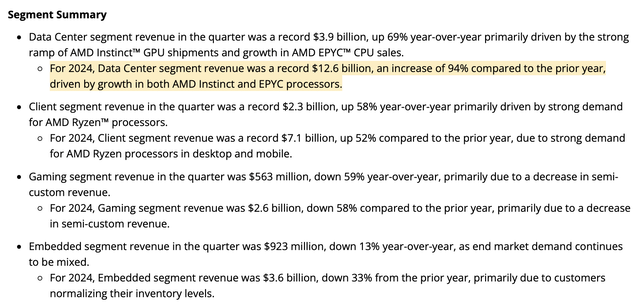

Although the market’s reaction to AMD’s recent performance has been mixed, the reality is that AMD’s performance is quite solid. Firstly, AMD’s data center business has shown significant growth, accounting for 50% of total sales in 2024. Especially in the fourth quarter, data center sales increased by 69% year-on-year, reaching $3.90 billion. In addition, due to strong customer demand, AMD plans to advance production of the MI350 series to mid-2025, which has been confirmed by the CEO.

This indicates that although AMD may face some challenges in the first half of 2024, especially in some areas where sales pressure may still exist, AMD’s sales in the second half of the year may significantly exceed market expectations.

Considering the forward-looking market, this stage may be a good buying opportunity, especially with the possibility of stronger performance in the second half of 2025. If you want to seize investment opportunities, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

In addition, AMD also reported good financial data: earnings per share were $1.09, total sales were $7.70 billion, a year-on-year increase of 24%, exceeding market expectations by $170 million. In addition, AMD also provided reliable performance guidance for Quarter 1, expecting sales to reach $7.10 billion, higher than the market’s consensus expectation of $6.99 billion. This means that sales increased by approximately 30% year-on-year, and gross profit margin is expected to remain relatively high at 54%.

In order to better compete with Nvidia, AMD is also continuously improving its software to capture a larger share of the lucrative data center market. Although some pessimistic expectations suggest that AMD may only achieve AI data center GPU sales of $70- $8 billion in 2025, its total data center sales may actually reach $150- $16 billion. Last year, AMD’s sales of AI data center GPUs were about $5 billion, but its broader data center business set a record of $12.60 billion.

In 2024, AMD’s Data Center division saw a 94% year-over-year increase in sales. Despite AMD’s AI Data Center GPU sales reaching an impressive $5 billion +, most of the revenue still comes from its CPU EPYC processors. AMD is taking share from Intel in the Data Center CPU market, which is an important growth driver for AMD.

As more and more companies choose more cost-effective solutions than Nvidia or lean towards using CPUs instead of GPUs in their AI strategies, AMD may also benefit from this trend. Therefore, considering AMD’s potential in the CPU and GPU data center market, we expect that AMD’s revenue in the data center field in 2025 may reach $150- $16 billion or even more.

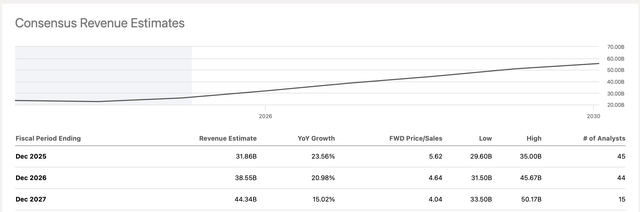

AMD sales could rise to $33 billion this year

AMD’s data center growth and strong performance in the Client business are expected to effectively offset the weakness in its gaming and embedded businesses. In 2024, AMD’s Client business sales have reached $7.10 billion, a year-on-year increase of 52%. Therefore, it is expected that AMD’s sales in this field will increase to around $10 billion by the end of the year. At the same time, the gaming and embedded businesses may also rebound in the coming period, further pushing this year’s total sales to $32 billion to $33 billion, and even possibly breaking through this range.

In addition, if AMD’s GPU demand resumes growth in the future, its performance next year is likely to be better than expected, further driving revenue growth. According to market forecasts, AMD’s sales are likely to increase to about $40 billion to $42 billion by 2026, resulting in a significant increase in earnings per share.

Where might AMD’s stock price go in the future?

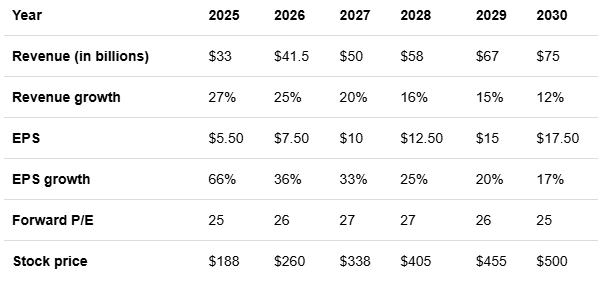

AI Data Center is a highly potential market that is expected to continue to grow in the coming years. AMD’s role in this market is gradually increasing, and although its current performance may not fully match Nvidia’s, it still has the opportunity to occupy a place in this lucrative field. This trend is expected to bring considerable sales and profit growth to AMD, and may even drive the expansion of Price-To-Earnings Ratio.

AMD’s current Price-To-Earnings Ratio has dropped significantly, and the expected Price-To-Earnings Ratio may rebound to 25 to 30 times or even higher in the next few years. If AMD can continue to improve in sales and profitability, it is expected that the stock price will rise significantly, especially around 2030, and the stock price may break through the $500 mark or even higher.

In the short term, despite facing some challenges, I remain optimistic about AMD’s 12-month target stock price range, which is expected to fluctuate between $180 and $200. In the long run, AMD has the ability to achieve greater breakthroughs in the AI Data Center field, thereby bringing higher returns to shareowners.

Investing in AMD What are the risks?

Of course, investing in AMD is not without risks. Firstly, AMD’s AI GPU may continue to face significant issues, which may lead to lower-than-expected growth in this key area. Although AMD has made breakthroughs in multiple areas, it still cannot ignore strong competitors like Nvidia. To occupy a place in the AI GPU market, AMD not only needs to improve hardware technology, but also solve software and ecosystem problems.

In addition, AMD must continue to innovate in CPU and other related fields in order to maintain its leading position, especially in the competition with competitors such as Intel. In order to truly benefit from the explosion of AI technology, AMD needs to continue to have strong execution in product development to ensure a competitive advantage in the market.

If AMD fails to regain market dominance in the AI field, the stock price may continue to decline, especially in the short term. However, in the long run, AMD still has great potential in multiple technology fields, and investors need to consider these uncertain risk factors when making decisions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.