- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Amazon's Q4 financial report is impressive. Will there be new opportunities under tariff changes?

Over the past year or so, Amazon has been the focus of investors. In particular, in the financial report released in October 2024, Amazon demonstrated its strong potential in artificial intelligence platforms and autonomous chip development, especially the progress of Bedrock and Trainium technologies, which filled the market with expectations.

Currently, Amazon’s stock price is close to its historical high, but it still maintains its investment attractiveness. The continuous growth of AWS and the promotion of these innovative technologies are expected to further improve the company’s profit margin, thereby supporting the expansion of its Price-To-Earnings Ratio. However, the recent rise in stock price reflects the market’s optimistic expectations for the company’s future development, but also brings some new risk factors. Especially in the context of tariff policies and the released Q4 financial report, these uncertain factors require investors to be more cautious.

AMZN Stock: Fourth Quarter Earnings Review

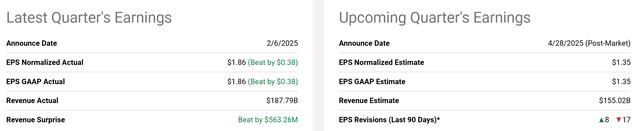

Amazon’s recently released Q4 financial report for fiscal year 2024 is undoubtedly an important factor driving up the stock price. The company’s performance in the past quarter exceeded market expectations, with significant growth in both major product lines. Standardized earnings per share (EPS) reached $1.86, far exceeding the expected $0.38 and exceeding market expectations by more than 20%. EPS calculated by GAAP also exceeded expectations, with total revenue reaching $187.79 billion and unexpected revenue growth of $563 million.

This strong financial report undoubtedly boosted market confidence. Amazon’s financial performance is impressive, especially considering that the company can still deliver such an impressive performance in the face of increasingly fierce market competition. With the release of this data, Amazon’s stock price has risen, which has also made investors look forward to its performance in the coming months.

AMZN Stock: Tariff Impact Could Reverse

The Trump administration announced some tariff changes in February 2024, the most notable of which was the cancellation of the small tax exemption clause. Previously, this clause allowed small packages worth less than $800 from China to be exempt from tariffs and inspections. The cancellation of this policy may have a significant impact on Amazon’s competitors, such as Shein and TEMU (brands under PDD and PDD Holdings). As these companies rely heavily on low-value packages from China, this change means that their costs will rise significantly, which may slow down their expansion in the US market.

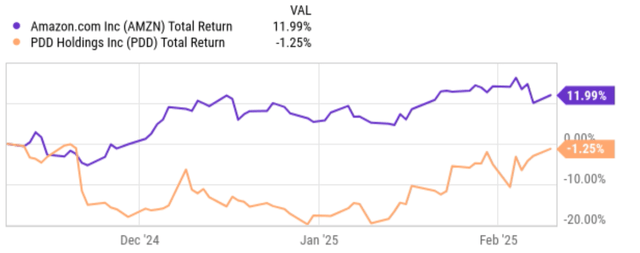

On the other hand, Amazon is expected to benefit from this policy change, and the performance of its stock price reflects this. As shown in the figure below, there is a significant difference in stock performance between Amazon and Pinduoduo. In the past few months, Amazon’s stock price has risen strongly by nearly 12%, while Pinduoduo’s stock price has fallen sharply. Even after a strong rebound in the market, Pinduoduo’s stock price still suffered a negative return of -1.25%.

This trend reflects that Amazon may be in a favorable position in tariff policy changes, especially as competitors’ costs rise. However, it is worth noting that the Trump administration signed an executive order on February 7th to suspend the policy of canceling tax exemptions, which has brought short-term breathing space to many affected companies. Nevertheless, considering the large number of low-value packages, the tax levied on each package is not high, which makes it possible for this tax exemption clause to continue to exist.

Other risk factors

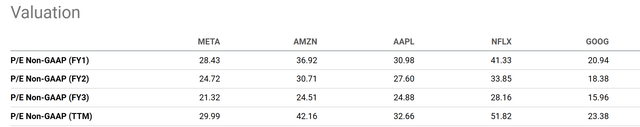

Although Amazon’s stock price is currently performing strongly in the market, the potential risks cannot be ignored. Firstly, the rise in stock price has also driven up the valuation multiple, making Amazon’s current valuation relatively high. As of now, the FWD Price-To-Earnings Ratio (non-GAAP and FY1) is 36.92 times, while the TTM Price-To-Earnings Ratio is even higher, reaching 42.16 times. Compared with similar companies (such as other FAANG companies), these multiples are particularly prominent, especially compared to other members outside of Netflix (NFLX).

Although these Price-To-Earnings Ratios may match Amazon’s growth potential, it is also necessary to recognize that the current high valuation may bring significant risks. Higher valuations mean that the potential for future stock price increases will become more limited, especially in the short term if there is any negative news or economic slowdown in the market, which may exacerbate stock price fluctuations.

In addition, due to changes in tariff policies and other external uncertainties, Amazon’s financial performance may be affected in the coming quarters. Therefore, although the company’s performance in the past period has been impressive, more market signals may be needed in the short term to confirm whether the stock price can continue to rise.

Interested investors can go to BiyaPay to monitor Amazon’s market trends in real-time, seize investment opportunities in a timely manner, and its multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting trading of US and Hong Kong stocks and digital currencies.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

Overall, Amazon demonstrated strong financial performance in Q4 2024, especially driven by AWS and innovative technologies, with revenue and revenue exceeding market expectations further proving its leading position in the industry.

Nevertheless, the rise in stock prices has also led to an increase in valuation, which means that future growth space may be limited. At the same time, changes in tariff policies and upcoming external risks still bring uncertainty to investors. Although Amazon may benefit from the adjustment of tariff policies, the cost pressure of competitors also makes the market environment full of variables.

Therefore, although Amazon still maintains strong growth potential, investors need to remain cautious in the current market environment, pay attention to more market signals, and ensure more robust decisions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.