- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Advantages and User Guide of GCash's International Remittance Service

Image Source: unsplash

Are you still troubled by the cumbersome process and high costs of sending money to the Philippines? The GCash international remittance service offers a revolutionary solution that completely transforms the traditional bank wire transfer model. It demonstrates significant advantages in convenience, cost, and speed.

The remittance market in the Philippines reached $0.68 billion in 2022 and is expected to grow to $1.84 billion by 2030.

Faced with such a massive market demand, this guide will help you easily master every aspect of the remittance process and safely deliver funds to their destination.

Key Points

- The GCash international remittance service is convenient and fast; you can send money anytime, anywhere using your phone.

- GCash remittance fees are low with transparent exchange rates, helping you save more money.

- GCash remittances are fast; recipients typically receive the money in minutes.

- GCash collaborates with official partners and uses multiple security technologies to ensure the safety of your funds.

- You can send money to GCash through platforms like AlipayHK and Wise, with simple operations and fast arrival.

Core Advantages of GCash International Remittance Service

Image Source: unsplash

When you choose the GCash international remittance service, you are selecting a modern, efficient, and economical method of fund transfer. It abandons the complex processes of traditional banks and brings you four core advantages.

Ultimate Convenience with Mobile Experience

Say goodbye to the era of queuing and filling out tedious forms. You only need a smartphone to initiate a remittance anytime, anywhere. The entire operation process is completed within the mobile application, with an intuitive and user-friendly interface design that allows you to send care to family and friends in the Philippines in just a few minutes. This purely mobile experience elevates the convenience of international remittances to new heights.

Low Cost and Transparent Exchange Rates

Cost is one of the most important considerations when remitting money. Compared to traditional bank wire transfers, remittances through GCash partners are usually lower in cost.

Mobile remittance services aim to provide more economical options. They ensure that more of the funds you send actually reach the recipient through lower transaction fees and more competitive exchange rates.

This means that the GCash international remittance service not only helps you save considerable service fees but also provides better USD to Philippine Peso exchange rates, making every penny worth it.

Minute-Level Efficient Arrival Speed

Have you ever experienced the long wait of several days for traditional wire transfers? GCash has completely changed this situation. Through its efficient digital network, many remittances conducted through its partners can achieve near-real-time processing. In most cases, your recipient can receive and use the funds immediately within minutes, solving urgent needs.

Official Partnership Security Assurance

Fund security is of utmost importance. GCash and its official partners (such as Western Union, Remitly, etc.) adopt multiple advanced technologies to protect every transaction you make.

- Data Encryption: Your personal information is encoded during transmission and storage to ensure privacy and security.

- Multi-Factor Authentication (MFA): Accessing your account requires providing multiple verification methods, such as one-time passwords (OTP) and biometric login, adding a solid layer of protection to your account.

All partners must comply with the same strict security protocols as GCash, working together to create a worry-free remittance environment for you.

User Types for GCash International Remittance

To fully utilize the GCash international remittance service, you first need to understand the solutions it provides for different user groups. Depending on whether you are a Philippine citizen, the operation paths will differ. Basically, users can be divided into the following two categories.

Overseas Filipino Citizens (GCash Overseas)

If you are a Filipino citizen living abroad, you can directly register a GCash Overseas account. You no longer need a local Philippine SIM card; you can complete registration using your mobile number from your current country (such as the United States, Canada, Japan, etc.).

Core Advantage: Having your own GCash account means you can directly receive remittances and immediately use all of GCash’s functions. This includes paying bills, online shopping, or transferring money to other GCash users in the Philippines, allowing you to manage funds as conveniently as if you were in the Philippines.

This account makes you part of the GCash ecosystem, providing you with great flexibility.

Non-Philippine Residents (Through Partners)

You are not a Philippine resident? This is not a problem at all. You do not need to have a GCash account to easily send money to family, friends, or business partners in the Philippines.

Your role is the “sender,” and what you need to do is complete the transaction through GCash’s official international remittance partners. These platforms act as bridges, securely and quickly transferring funds from your bank account or credit card to the recipient’s GCash e-wallet. Some widely popular platforms that support this service include:

- WorldRemit

- Wise

You only need to initiate the remittance on these partner platforms, select “GCash” as the receiving method, and then enter the recipient’s information. The entire process is equally simple and convenient for you.

Step-by-Step Operation Guide: How to Send Money to GCash

Now that you understand the advantages of GCash remittances and user types, let’s move on to the actual operation. This guide will take you through the remittance step by step, ensuring your funds arrive safely and quickly at their destination.

Prepare Recipient Information

Before starting the remittance, accurate recipient information is the key to success. Incorrect information may cause delays or even failure of the remittance. Be sure to confirm with your recipient and prepare the following two core pieces of information:

- Recipient’s Full Name: Must exactly match the official name registered on their GCash account.

- GCash-Registered Mobile Number: This is the unique identifier of the GCash account, usually in the format of a 10-digit Philippine mobile number (for example, 917xxxxxxx).

Operation Tip: Before initiating the remittance, it is recommended that you copy and paste the information provided by the recipient instead of manually entering it to minimize spelling or numerical errors to the greatest extent. A simple verification can save you a lot of time and effort.

Specific Platform Operation Examples

There are many remittance platforms worldwide that cooperate with GCash. Here, we take several mainstream platforms as examples to show you the specific operation processes.

Case One: AlipayHK - Real-Time Remittance Driven by Blockchain Technology

For Hong Kong users, AlipayHK is an excellent choice for sending money to GCash. It utilizes advanced blockchain technology to provide a near-instant remittance experience.

Technical Highlight: Traditional cross-border remittances are like a relay race, where funds need to be confirmed node by node. The remittance service between AlipayHK and GCash is based on blockchain technology, more like a synchronized broadcast. When you initiate a remittance, all parties involved (including settlement banks such as Standard Chartered Bank) receive the information simultaneously and process it collaboratively. This allows transactions to be completed in just a few seconds with a highly transparent and secure process.

The operation steps are as follows:

- Open the AlipayHK App: Find and click the “Remit” function on the homepage.

- Select the Recipient Region: Choose “Philippines” from the remittance destination list.

- Enter the Remittance Amount: Enter the HKD amount you wish to send, and the system will automatically calculate the Philippine Peso (PHP) amount the recipient will receive based on the real-time exchange rate. Fees and exchange rates will be clearly displayed.

- Choose the Receiving Method: Select “GCash” in the receiving method.

- Fill in Recipient Information: Accurately enter the recipient’s full name and GCash-registered mobile number that you prepared in advance.

[A screenshot of the AlipayHK recipient information filling interface can be inserted here] - Confirm and Pay: After verifying that all information is correct, choose the payment method from your linked licensed Hong Kong bank account or balance, enter the payment password to complete the transaction.

- Complete the Remittance: After successful payment, the funds will almost immediately be deposited into the recipient’s GCash wallet.

Alternative Options: Wise and Western Union

If AlipayHK is not suitable for you, Wise and Western Union are also reliable choices.

| Platform | Main Features | Suitable For |

|---|---|---|

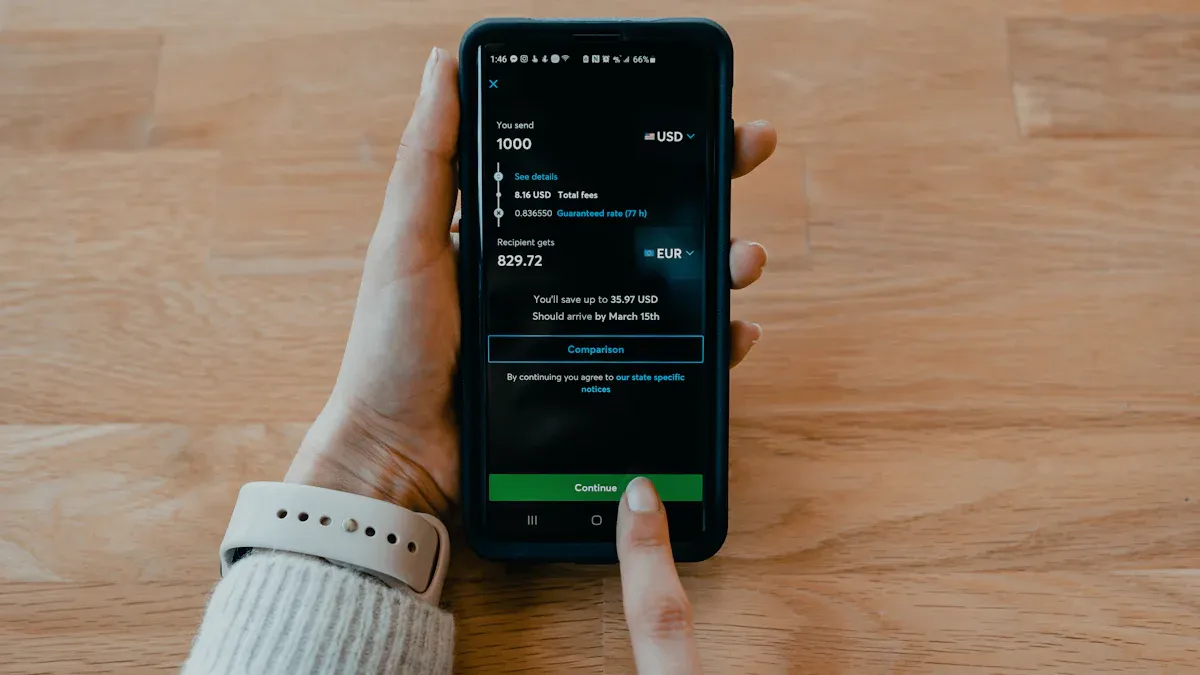

| Wise | Known for using the mid-market exchange rate with an extremely transparent fee structure and no hidden markups. The operation process is simple with a good website and App experience. | Users seeking the best exchange rates and fee transparency. |

| Western Union | Has a vast global network and supports multiple payment methods, including credit cards, debit cards, bank transfers, and even cash payments in some regions. | Users who want diverse payment methods or have higher trust in traditional brands. |

Special Note for U.S. Users: When using services like Wise, Remitly, or Western Union in the United States to send money to GCash, you usually need to complete identity verification first and link your U.S. bank account or credit/debit card to the remittance platform. This is an important step to ensure compliance of fund sources and transaction security.

Remittance Status Tracking Methods

After sending the remittance, you definitely want to know where the funds are. Almost all modern remittance platforms provide convenient tracking functions.

- Transaction Reference Number: After completing the remittance, you will usually receive a unique transaction reference number, such as Western Union’s Money Transfer Control Number (MTCN). You can share this number with the recipient.

- In-App Tracking: You can directly view the transaction status on the “History” or “Activity” page of the remittance app, such as “Processing,” “Completed,” or “Deposited.”

- Email and SMS Notifications: The platform will usually send key node notifications to you and the recipient via email or SMS, such as the remittance has been sent and the funds have arrived.

Through these methods, you can track the funds’ movement throughout the process and wait with peace of mind for the recipient to confirm receipt.

Detailed Explanation of Fees, Limits, and Arrival Times

Image Source: pexels

Understanding the fees, limits, and expected times in the remittance process can help you make the most informed choice. This section will provide a detailed analysis of these three key factors.

Service Fees and Exchange Rate Structure

The total cost of a remittance consists of two parts: “service fees” and “exchange rate spreads.” Some platforms may appear to have low service fees but hide markups in the exchange rate.

- Wise: Known for its transparency. Wise uses the mid-market exchange rate you see on Google without adding any markup. Its profit model is through charging a clear transfer fee.

- Panda Remit and AlipayHK: These two platforms usually include a markup in the exchange rate. For example, the exchange rate used by AlipayHK is set by its partner institutions and may include profits.

| Feature | Panda Remit | Wise |

|---|---|---|

| Exchange Rate | Includes Markup | No Markup |

Selection Tip: The true cost of a platform needs to consider both service fees and exchange rates comprehensively. Before confirming the remittance, be sure to carefully check the total amount you pay and the exact amount the recipient receives.

In addition, platforms like Western Union have variable fees depending on multiple factors. Generally, paying through a bank account is the most economical, while using a credit card may incur higher fees. It is worth noting that Western Union often offers a “0 transfer fee” promotion for first-time online transfers to GCash users.

Remittance Limits for Each Platform

Each remittance platform sets different remittance limits based on user verification levels.

AlipayHK Your remittance limit depends on your account verification level. Intermediate and advanced accounts have the same daily limit, but there is a significant difference in the annual total limit.

Wise Wise provides high flexibility for remittances to the Philippines:

- Single transfer limit is $10,000.

- Monthly transfer limit is $50,000.

- If you pay by wire transfer, the single transaction limit can be as high as $1,000,000.

Expected Arrival Time

Arrival speed is a major advantage of digital remittances, but the specific time varies depending on the platform and various factors.

AlipayHK Remittances from AlipayHK to GCash are usually instant arrival. Its service is available 24 hours a day, 7 days a week, providing you with great convenience.

Wise Transfers from Wise to GCash are often instant as well. However, you need to pay attention to the following factors that may cause delays:

- Payment Method: Bank card payments are usually the fastest, while bank transfers require longer processing times.

- Security Verification: Sometimes the platform needs to conduct additional security checks, which may take up to 2 business days.

- Holidays: Banks do not process business on weekends and public holidays, which will postpone your arrival time.

Before you confirm payment, Wise will always display an estimated delivery time so you know what to expect.

The GCash international remittance service makes your cross-border fund transfers simple, fast, and economical. Now, you have mastered all the key information. To help you make the best choice, you can refer to the comparison of the following two mainstream platforms, which have their own characteristics in exchange rates and fees.

| Feature | AlipayHK (Remittance to Philippines) | Wise (Remittance to Philippines) |

|---|---|---|

| Exchange Rate Type | Real-time exchange rate (provided by EMQ), usually better than banks but not the mid-market rate, may include hidden fees. | Actual mid-market exchange rate, no hidden fees, transparently displays the recipient amount. |

| Exchange Rate Example (1 HKD) | 7.1143 PHP | 7.1224 PHP |

| Fees | No service fee via GCash; 15 HKD for cash pickup and bank transfer. | Specific fees not explicitly mentioned, but emphasizes no hidden fees. |

| Remittance Limit (Verified Account) | Daily: 5,000 HKD; Monthly: 10,000 HKD; Annual: 100,000 HKD. | Specific limits not mentioned. |

| Minimum Remittance Amount | 20 HKD. | Not mentioned. |

Hope this guide helps you choose the most suitable remittance partner and experience seamless, efficient remittance services immediately.

FAQ

What if the recipient’s GCash account is not verified?

If the recipient’s GCash account has not yet completed verification, they can only receive a limited amount per month. Remittances exceeding the limit may fail. It is recommended that you remind the recipient to complete account verification in advance to ensure smooth receipt.

Does the recipient must have a GCash account?

Yes, you must send funds to a valid GCash-registered mobile number. This service is designed specifically for transferring to GCash e-wallets. If the recipient does not have a GCash account, they will not be able to receive the funds.

Can I cancel a remittance that has already been sent?

Once a remittance is successfully sent, it usually cannot be revoked. Therefore, you must carefully verify all information before confirming payment. If you encounter problems, please immediately contact the customer service of the remittance platform you are using for assistance.

How is the currency converted for the remittance?

Currency conversion is automatically completed by the remittance platform you choose (such as AlipayHK or Wise). You enter the amount in your local currency, and the platform will calculate the Philippine Peso amount the recipient will receive based on the day’s exchange rate and clearly display it to you.

In exploring the Gcash international remittance service, we’ve seen how mobile payments simplify cross-border transfers, addressing pain points like high fees, opaque exchange rates, and lengthy waits from traditional banks. However, if your remittance needs extend beyond the Philippines to more global regions, or require seamless integration of cryptocurrencies with fiat currencies, a more comprehensive platform can offer even greater convenience. BiyaPay stands out as a trusted leader in cross-border payments, providing real-time exchange rate queries and conversions for over 30 fiat currencies and 200+ cryptocurrencies, ensuring you always get the best rates without hidden costs.

Picture this: With a quick registration in just minutes, you gain access to remittance fees as low as 0.5%, covering most countries worldwide and even supporting same-day arrivals. This isn’t just about saving money—it’s about boosting efficiency, whether you’re an overseas Filipino managing family funds or a non-resident handling business transfers. BiyaPay’s robust security features and transparent processes safeguard your money, offering flexibility that surpasses single-platform limitations and protects against exchange rate volatility.

The time to act is now! Head to the real-time exchange rate query page to check the latest rates and start your free account. Join millions of users and enjoy efficient, low-cost global remittances that make your money flow freer and smarter.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.