- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Memory Revolution and AI Rise: Can Micron Find New Growth Points?

Investment is not 100% guaranteed. You may think you have figured out how artificial intelligence computing expands, after all, most technology companies are telling you to look further ahead. But suddenly, DeepSeek, a company headquartered in China, has made the technology circle and investors in Silicon Valley start to reflect. Everyone is also starting to re-examine whether leaders in the field of artificial intelligence, such as OpenAI and Anthropic, can really have their own “Competitive Edge” in these cutting-edge technologies, and even maintain this Competitive Edge.

This is obviously crucial for Micron, as the memory market is shifting towards Data centers and Cloud Service providers, as well as NVIDIA, whose investment in artificial intelligence continues to increase rather than decrease. As memory chip manufacturers, Micron and other companies are also increasing their efforts to promote higher bandwidth memory chips to meet the growing memory demand of GPUs in advanced Data centers, which are supporting increasingly large artificial intelligence clusters.

Can Micron find a breakthrough in the AI-driven transformation?

Recently, the $500 billion OpenAI-SoftBank-Oracle joint venture Stargate once dominated the AI field, but then DeepSeek released its open weight R1 inference model, which completely changed the rules of the game. This revolutionary innovation may change the way AI developers and enterprises view artificial intelligence models and accelerate their widespread adoption.

Considering how important Micron and its memory peers are driven by NVIDIA’s success, they must take action to keep up with this rapidly developing field of artificial intelligence. In the next few years, Micron must increase its efforts to launch more advanced HBM memory chips to meet the growing demand for AI computing. Recently, large technology companies announced plans to invest $325 billion in capital expenditures in 2025 in their earnings reports, which also demonstrates their emphasis on the future artificial intelligence market.

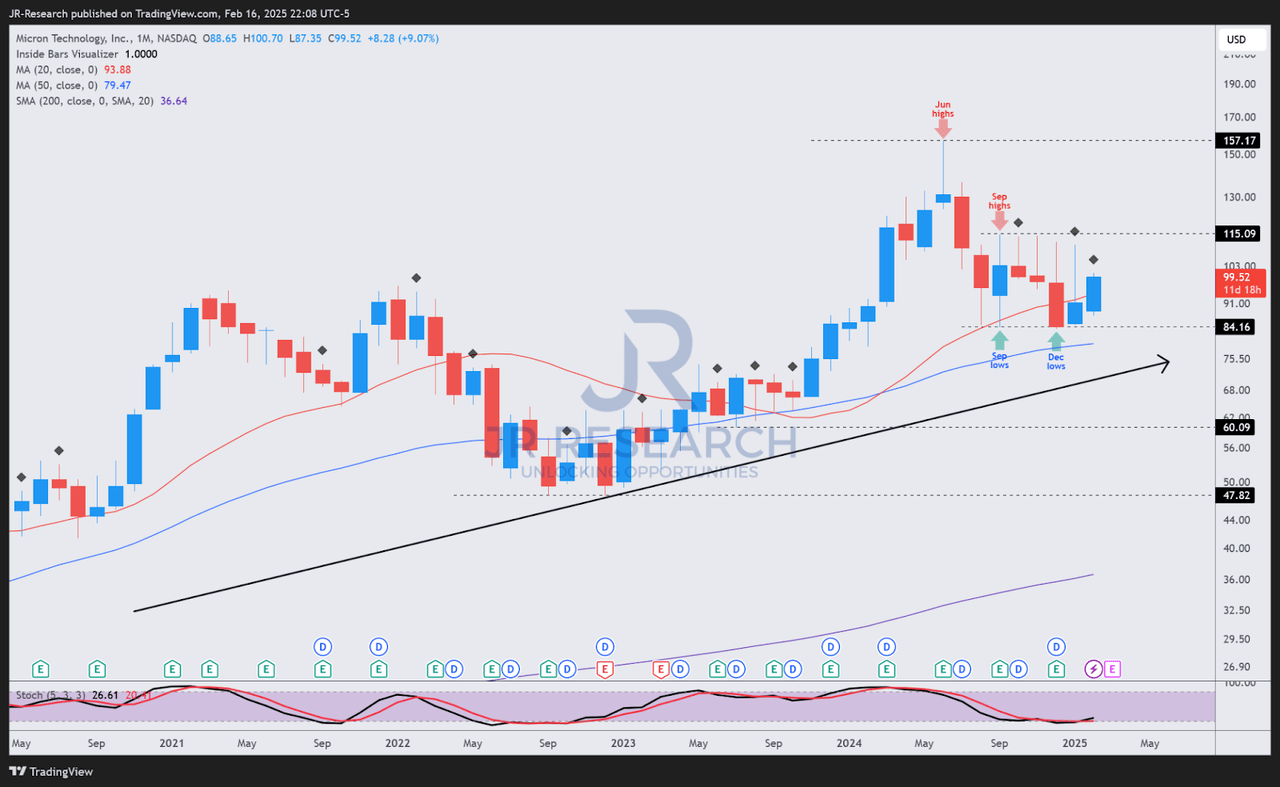

However, Micron’s stock price has been fluctuating around the support level of $85 and has never broken through the range of $115, which seems to suggest that it is in a consolidation period. Buyers seem to have lost their motivation to push up the stock price. Currently, semiconductor industry investors may hold a pessimistic view of this stock, especially as Samsung and SK Hynix accelerate the pace of promoting HBM4.

Although Micron is also accelerating the production of HBM4 and plans to start production in 2026, this also reflects that although the progress of artificial intelligence chips may drive long-term growth, the “commoditization” phenomenon of the memory industry is still serious. Although SK Hynix occupies a leading position in the HBM3E field and occupies most of the HBM4 market share, the situation is still unstable because Micron and Samsung are both striving to occupy a place in the $100 billion HBM market by 2030.

What risks and challenges does Micron face?

However, DeepSeek’s “unexpected” innovation in the cost-effectiveness of artificial intelligence reminds the market of an important fact: maintaining industry leadership in “commoditized” platforms or markets is basically unsustainable.

Since December 2023, Micron’s performance has still outperformed the S & P 500 Index (SPY), but the stock price is still far below the high point of 2024. This price level may be difficult to break through in the short term, especially due to market concerns about the adverse impact of memory oversupply in 2025. Possible headwinds include:

- In 2025, the competition for artificial intelligence computing power may be dominated by stronger computing demand. However, it is also possible that the early release of artificial intelligence computing power in 2025 will lead to a digestion stage by 2026, which cannot be ignored.

- Samsung is expected to enter the HBM3E and HBM4 markets, which may change the market share competition landscape between SK Hynix and Micron. Although Micron is confident of maintaining a market share of over 20%, this is still an uncertain number. Therefore, Samsung’s advantage may last for some time.

- It is expected that Trump’s upcoming semiconductor tariffs will pose a significant challenge to South Korean chip manufacturers, while US chip manufacturers will increase their investment in domestic production capacity through the CHIPS Act. In the long run, this may benefit Missouri State University.

- However, due to the strict review of relevant provisions by the Biden administration, the funding delay of the CHIPS Act has also brought new uncertainty, which may affect the progress of the University of Missouri’s $100 billion expansion plan.

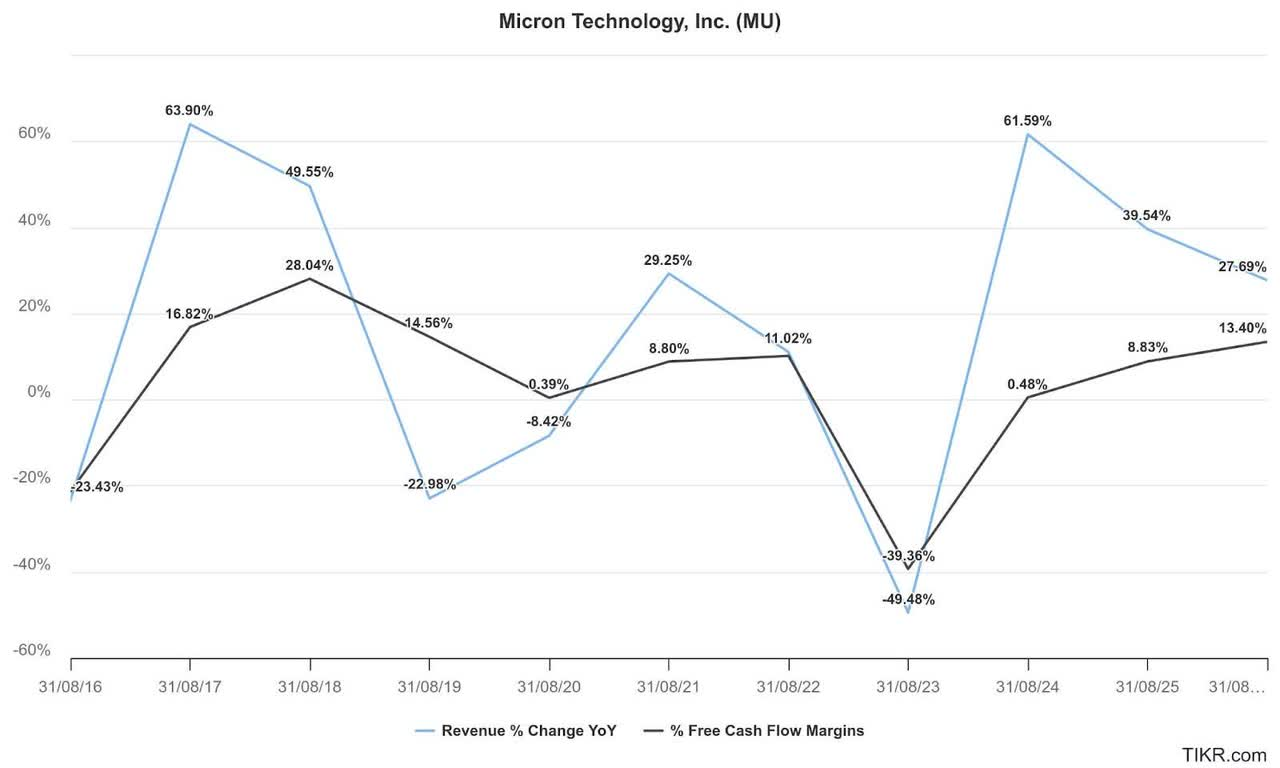

Therefore, the market may begin to focus on whether Micron can achieve growth in free cash flow profit margin, especially if revenue growth is limited. Considering future challenges, Wall Street has lowered its expectations for Micron’s recent revenue and adjusted earnings per share. In addition, Micron also mentioned in the February meeting that due to Nvidia’s cyclicality and low utilization rate, the near-term profit margin may be under pressure, although a recovery is expected in the second half of 2025.

In other words, Micron’s growth still relies on the continuous progress of HBM3E and subsequent HBM4 chips, which helps the company consolidate its market position and improve Operational Efficiency, while resisting the competitive pressure that Samsung may bring. Whether it can succeed remains to be seen. However, the impact of oversupply like in the 2023 fiscal year cannot be ignored, although this is not the most likely scenario at present.

Micron faces greater risks, especially against the backdrop of investors’ expectations that NVIDIA CEO Huang Renxun will show higher optimism in the financial report on February 26th. With the popularity of artificial intelligence and smartphones, the recovery of the smartphone market may bring some unexpected benefits.

However, this change will not have a significant impact on Micron’s rating in the short term, as Micron’s focus is still on the artificial intelligence memory chips of the Data Center, and the main driving force for its growth still depends on the development of the next two to three years.

If you are interested in investing in Micron, BiyaPay’s multi-asset wallet will provide you with convenience. BiyaPay provides efficient and secure deposit and withdrawal services, supporting US and Hong Kong stock and digital currency transactions.

Through it, you can quickly recharge digital currency, exchange it for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account for convenient investment. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensure fund safety and liquidity needs.

How will Micron’s future stock price trend be?

The stock price trend of the US stock market seems hopeful. Buyers seem ready to enter when the stock price approaches the support level of $85, although the subsequent trend is not entirely encouraging. Considering that the stock still maintains a long-term upward trend, the overall situation is not too bad.

Therefore, as long as the growth trend of artificial intelligence remains valid, sellers will not be eager to sell their stocks, although the recent reconfiguration of Chinese technology stocks may affect the rerating of stock prices in the short term.

Micron’s expected PEG ratio is 0.38, which means its valuation already reflects many negative factors and is much lower than its peers by about 80%. Is this really the case? However, unless there is a large-scale liquidation in artificial intelligence computing, which further worsens the oversupply of HBM chips, this pessimistic sentiment does not seem reasonable.

In addition, the Trump administration’s support for domestic work in progress manufacturing may enhance investors’ confidence in Micron, especially in competition with leading Korean chipmakers. This may be good news for investors who want to reconfigure their investments in US memory chipmakers.

Overall, Micron is still a choice worth paying attention to. Investors with investment intentions can focus on market trends and seize investment opportunities.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.