- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

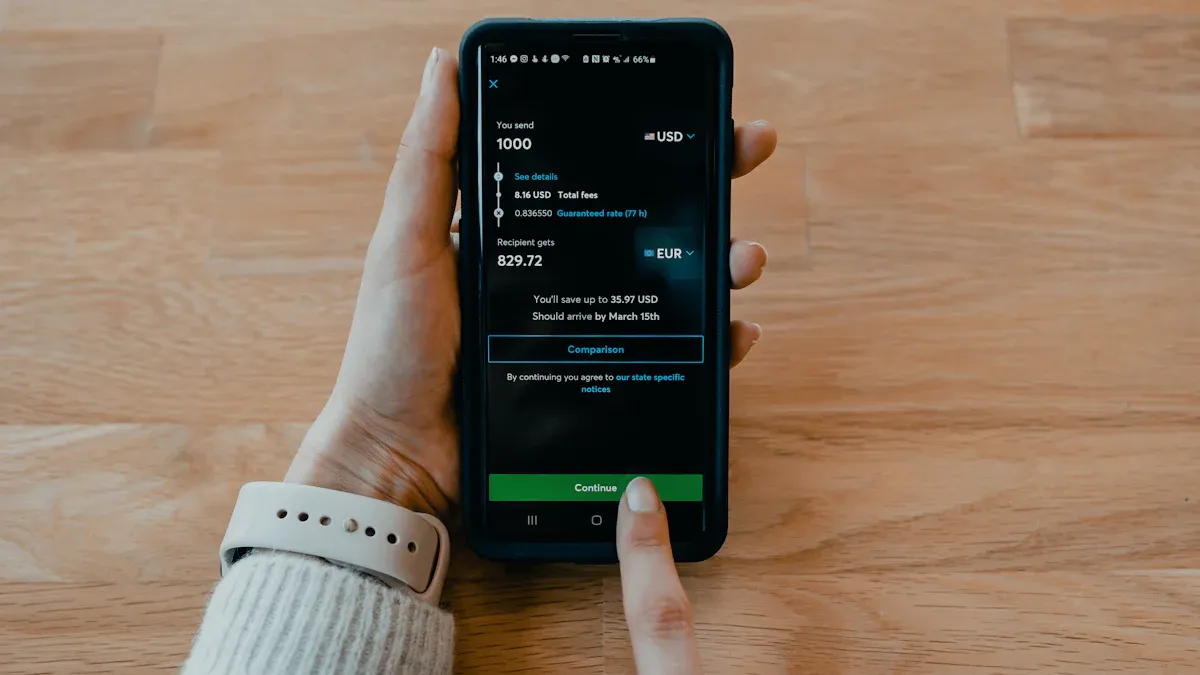

Exchanging US Dollars to Indian Rupees via Remitly: A Safe and Economical International Remittance Platform

Image Source: unsplash

Are you one of the 569,000 Indian diaspora members living in the United States? You may need a safe and cost-effective way to send money to your family in India. Remitly offers you a reliable option for this purpose.

The United States is the largest source country for remittances to India. In the 2023–2024 fiscal year, the total remittances from the US to India reached an astonishing $129 billion.

Compared to traditional banks, Remitly typically offers faster speeds and lower costs, helping your every remittance go further.

Key Highlights

- Remitly provides a secure and cost-saving way to send money from the US to India.

- You can choose different transfer speeds and fees based on your needs, such as fast arrival or more cost-effective options.

- Remitly has different transfer limits, and you can easily increase your limit to meet larger remittance needs.

- New users can enjoy special promotions, making your first transfer more cost-effective.

- The remittance process is simple; you can easily create an account, fill in the information, and track the transfer status.

Remitly Transfer Limits

To ensure the security of your funds and comply with financial regulations, Remitly has set tiered transfer limits. You will automatically receive a Tier 1 limit when creating your account. This limit is usually sufficient for small or irregular transfers.

Detailed Explanation of the Three-Tier Transfer Limits

Your transfer limits are divided into three tiers. Each tier corresponds to different maximum transfer amounts within 24 hours, 30 days, and 180 days. The maximum amount for a single transfer from the US to India can reach $30,000, providing you with great flexibility.

Here is an overview of the limits for each tier:

| Limit Tier | Within 24 Hours | Within 30 Days | Within 180 Days |

|---|---|---|---|

| Tier 1 | $2,999 | $10,000 | $18,000 |

| Tier 2 | $10,000 | $30,000 | $60,000 |

| Tier 3 | $30,000 | $60,000 | $180,000 |

Please note: The amounts in the table above are all in US dollars (USD). Limits may be adjusted according to specific regulations; please refer to the information in your account.

How to Increase Your Transfer Limit

If you need to send funds exceeding your current tier limit, you can easily apply to increase your limit. The entire process is completed online and is very convenient.

Upgrade to Tier 2: You need to provide more personal information to complete identity verification. Prepare the following documents and information:

- Confirm your full name, date of birth, and address

- Upload a valid government-issued photo ID (such as a passport)

- Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Provide a bank statement or pay stub as proof of source of funds

Upgrade to Tier 3: To obtain the highest transfer limit, you must first reach Tier 2. After that, you can apply for Tier 3 by following these steps:

- Log in to your account.

- Go to the “Increase Limit” page.

- Select the Tier 3 limit you wish to apply for.

- Answer questions about your purpose for using the platform as prompted and submit your application.

The review is usually completed within 48 hours.

Transfer Speed and Cost Options

When sending money from the US to India via Remitly, you can choose between speed and cost based on your needs. The platform offers two clear transfer modes: Express (fast) and Economy (cost-effective). Understanding their differences can help you make the most informed decision.

Express Fast Mode

If you need funds to arrive quickly, the Express fast mode is the ideal choice.

- Arrival Speed: Funds typically reach the recipient’s bank account within minutes.

- Payment Method: This mode requires payment using a debit card or credit card.

- Cost Consideration: To achieve ultra-fast arrival, the service fee will be slightly higher, and the exchange rate may be slightly lower than the economy mode.

Applicable Scenarios: When family members urgently need money, such as paying unexpected medical expenses or emergency bills, the Express fast mode ensures funds arrive immediately to resolve urgent needs.

Economy Cost-Effective Mode

If your time requirements are not urgent and you want to maximize the amount received, the Economy cost-effective mode is a more economical choice.

- Arrival Speed: Funds typically take 3 to 5 business days to arrive.

- Payment Method: You need to pay via bank account (ACH) transfer.

- Cost Consideration: This mode has lower service fees and usually offers more competitive exchange rates. This means your recipient will ultimately receive more Indian rupees.

For a more intuitive comparison, please see the table below:

| Feature | Express Fast Mode | Economy Cost-Effective Mode |

|---|---|---|

| Arrival Speed | Within minutes | 3-5 business days |

| Service Fee | Higher | Lower |

| Exchange Rate | Standard | More favorable |

| Payment Method | Debit/Credit Card | Bank Account (ACH) |

How to Choose? Ask yourself a simple question: “Does this money need to arrive immediately, or can it wait a few days?” If the answer is the former, choose Express; if you can wait, choosing Economy will make your transfer more cost-effective.

Supported Payment Methods

Image Source: pexels

When choosing transfer speed and cost, the payment method is a key factor. The platform provides you with two main payment options, each directly corresponding to a different transfer mode.

Debit Card and Credit Card Payments

If you prioritize speed, using a debit card or credit card for payment is the best choice. This payment method is usually tied to the Express fast transfer, allowing funds to reach the recipient within minutes.

Paying with a debit card is very straightforward with a simple fee structure. However, when paying with a credit card, you need to consider additional costs. While credit card payments are convenient, they are usually not the most economical choice.

Important Note: Your credit card company may treat this remittance transaction as a “cash advance.” This means the issuing institution may charge you additional cash advance fees and higher interest, which are not charged by the remittance platform.

To help you clearly understand the fees, please refer to the table below:

| Fee Type | Details |

|---|---|

| Credit Card Service Fee | In the US, paying with a credit card requires an additional fee of 3% of the total transfer amount. |

Therefore, if you want a fast transfer but also control costs, using a debit card is a wiser choice than a credit card.

Bank Account (ACH) Payment

If you value cost savings more, paying via bank account (ACH) is the ideal solution. This option corresponds to the Economy cost-effective transfer.

By paying through a bank account, you can enjoy lower service fees and more favorable exchange rates, meaning the recipient will ultimately receive more Indian rupees. Although ACH payments clear quickly, the associated Economy cost-effective transfer typically takes 3 to 5 business days to complete the entire process.

Choosing bank account payment means you are willing to trade a slightly longer wait time for maximized transfer amounts. This is a very cost-effective choice for planned remittances, such as regular family living expense support.

Fee Structure and Promotions

Understanding the total cost of a remittance is key to making an informed choice. Your total fees consist of two core parts: a fixed service fee and the exchange rate provided by the platform. Below, we will break down these fees in detail for you and explain how to use promotions to save money.

Service Fees and Exchange Rate Composition

When preparing to send money, you will see a clear “Transfer Fee.” This fee varies depending on the transfer speed and amount you choose. For example, if you choose the Express fast service to send funds to India, the fee structure is typically as follows:

| Send Amount | Transaction Fee |

|---|---|

| Less than $1,000 | $3.99 |

| More than $1,000 | $0 |

Please note: Although large transfers may waive the service fee, the total cost is also affected by the exchange rate.

The exchange rate is key to determining how many Indian rupees the recipient ultimately receives. The exchange rate provided by the platform usually includes a small markup, which generally ranges between 0.4% and 1.4%. This means it will be slightly lower than the real-time mid-market rate you see on Google.

- For example: Suppose the real-time mid-market rate is 1 USD = 85.00 INR. The platform may offer an exchange rate of 1 USD = 84.50 INR. This 0.50 INR difference is how the platform covers operating costs and earns profit. For a $5,000 transfer, this difference means the recipient receives approximately 2,500 fewer Indian rupees.

Exclusive Promotions for New Customers

If you are using the platform for the first time, you will have the opportunity to enjoy highly attractive exclusive promotions. These promotions are designed to provide you with the best initial experience, allowing you to send more funds with less money.

New customers can typically enjoy one or more of the following benefits:

- Special Promotional Exchange Rate: Your first transfer (up to $10,000) will apply a special exchange rate better than the standard rate. This means your recipient will receive more Indian rupees.

- Service Fee Waiver: In addition to the promotional exchange rate, your first transaction may also enjoy a service fee discount or complete waiver.

Friendly Reminder: These new customer promotions are time-limited, and the specific details may change. Before making your first transfer, be sure to check the latest promotion details on the official website or App.

Factors Affecting Total Cost

To maximize the value of your remittance, you need to comprehensively consider the following factors. They collectively determine the total cost you ultimately pay.

- Transfer Amount: This is the most direct factor. As mentioned above, transfers exceeding $1,000 typically waive the Express fast mode service fee.

- Transfer Speed: Your need for speed directly affects the cost. Express fast mode is fast but has higher service fees and slightly lower exchange rates; Economy cost-effective mode saves you money through lower service fees and more favorable exchange rates.

- Payment Method: While paying with a credit card is convenient, your card issuer may charge up to 3% in cash advance fees, significantly increasing your costs. Using a debit card or bank account (ACH) is a more economical choice.

- Your Customer Status: As a new customer, do not miss the exclusive promotional exchange rates and fee waivers. This may be your most cost-effective transfer opportunity.

By weighing these factors, you can flexibly formulate the most economical and efficient remittance plan based on your specific needs.

Remitly Transfer Operation Guide

Image Source: unsplash

Now that you understand the fees and options, it’s time to start your first transfer. The entire process is very simple and intuitive, requiring just a few steps to complete. Below is a detailed operation guide to help you smoothly send funds to India.

Account Creation and Identity Verification

Before starting a transfer, you need to create an account. This process is quick and secure.

- Visit the official website or App: You can go to the Remitly official website or download its mobile application.

- Start Registration: Click the “Sign Up” button. You need to provide your full name, email address, and create a secure password.

- Perform Identity Verification: To ensure transaction security and comply with financial regulations, the platform will require you to verify your identity. The system will prompt you to upload a valid government-issued photo ID.

The verification process usually takes just a few minutes. To ensure smooth approval, make sure the ID photo you upload is clear, complete, and within the validity period.

You can choose one of the following documents for verification from this list:

- Primary ID Documents

- Driver’s License

- State-Issued ID Card

- Passport

- Passport Card

- Secondary ID Documents

- Military ID

- Special ID Documents

- Enhanced Driver’s License

- REAL ID

- Tribal Identification

Filling in Recipient Information

Accurate recipient information is key to ensuring funds arrive smoothly. Please carefully review all the information you fill in.

You need to provide the following key information:

- Recipient’s Full Name: Must exactly match the name on the recipient’s bank account and ID.

- Bank Account Details: Including bank name, account number, and India’s financial system code (IFSC Code).

- Contact Information: Provide the recipient’s phone number for contact if needed.

Important Reminder: Any minor errors in information, such as misspelled names or mismatched addresses, may cause transfer delays or even failure. Before submitting, be sure to confirm the accuracy of all information with your recipient again.

Payment and Tracking the Transfer

After filling in the recipient information, you can proceed to the final step: payment and tracking.

The steps to initiate a transfer are as follows:

- Enter Transfer Details: Choose the amount you want to send and decide whether to use Express fast mode or Economy cost-effective service.

- Choose Receiving Method: For India, usually select “Bank Deposit”.

- Select or Add Recipient: Choose a recipient from your saved list or add a new recipient as prompted.

- Enter Payment Information: Depending on the transfer type you choose, enter your debit card, credit card, or bank account information.

- Confirm and Send: Carefully check all information, including fees, exchange rate, and estimated arrival time. After confirming everything is correct, click “Confirm Transfer” to send.

After the transfer is sent, your primary concern is the whereabouts of the funds. The platform provides real-time tracking functionality, allowing you to monitor the transfer status at any time.

- Track via Website or App: Log in to your account, and you will see a unique tracking number (also known as the “remittance reference number”). With this number, you can view every step of the transfer progress.

- Receive Real-Time Notifications: The system will send updates to you via email or SMS. You will know when the funds are received, processed, and finally deposited into the recipient’s account.

Regardless of the transfer speed you choose, the tracking feature is always available, giving you and your family peace of mind while waiting.

In summary, Remitly provides you with a secure, cost-effective, and flexible remittance option. As a regulated financial service, it has fees far lower than traditional banks, allowing you to save more. You can choose different speeds based on your needs and enjoy services days faster than bank wire transfers.

Take advantage of new customer promotions now, experience the convenience and affordability Remitly offers, and start your first transfer today!

FAQ

Can I cancel a transfer?

Yes, you can cancel a transfer. You must do so before the recipient receives the funds. Please log in to your account, find the transaction in your transfer history, and select cancel. The platform will process your full refund.

What does my recipient in India need to do?

Your recipient does not need to have a Remitly account. They only need a valid Indian bank account. When sending the transfer, provide their full name, account information, and phone number that match their bank records. The funds will be directly deposited into their account.

Is using Remitly safe?

Yes, the platform is very secure. Remitly is a government-regulated financial services company. It uses bank-level encryption technology and security protocols to verify accounts and protect your personal information and funds, ensuring every transaction is safe and worry-free.

How do I track my transfer?

You can track your transfer at any time. After logging into your account, you will see a unique tracking number. You can view the real-time status of the transfer through the website or App. The platform will also send progress updates to you via email or SMS.

Through this Remitly-to-India guide’s in-depth walkthrough, we’ve highlighted the adaptability of its Express/Economy modes and clear limits, effectively easing traditional banks’ 3-5 day lags, up to 3% card fees, and rate markups (0.4%-1.4%)—perfect for U.S.-based Indian diaspora family aid or large deposits. Yet, for USD-to-INR conversions broadening to global multi-currency exchanges, digital asset fusions, or elevated volumes, a fuller, low-fee platform boosts performance, circumventing Remitly’s tiered reviews and ACH holds. BiyaPay, the cross-border finance frontrunner, supplies real-time exchange rate queries and conversions for over 30 fiat currencies and 200+ cryptocurrencies, nailing optimal mid-market rates like the current USD/INR around 88.40, sans any covert charges.

Just register effortlessly to access remittance fees as low as 0.5%, hitting most countries worldwide with same-day deliveries. This eclipses Remitly’s $30,000 per-transfer ceiling and weekend rate wobbles, reinforced by multi-layer encryption, KYC adherence, and live tracking for secure funds landing in Indian bank accounts. Whether handling IFSC code registrations or abrupt market turns, BiyaPay’s worldwide lens amplifies your INR worth and eases multi-platform navigation.

Seize the moment for hassle-free remittances! Visit the real-time exchange rate query to track live USD/INR fluctuations and start your free account. Opt for BiyaPay, making every dollar-to-rupee pivot streamlined and steadfast.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.