- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Long Does a MoneyGram Remittance Take? Understand the Speed, Fees, and Limits

Image Source: unsplash

Want to know how long a MoneyGram remittance takes? The answer is straightforward: it can arrive in as little as a few minutes, making it an ideal choice for urgent remittances.

Core Tip: While arrival in minutes is possible, the final speed depends on the chosen receiving method and destination. Actual arrival times range from 10 minutes to 3 business days.

Key Points

- MoneyGram transfers are fast, arriving in as little as a few minutes, but exact timing depends on the receiving method and destination.

- Cash pickup is the fastest, usually available within 10 minutes; bank deposits take a few hours to 3 business days.

- Remittance fees include handling fees and exchange rate margins; you can check total costs in advance on the MoneyGram website or app.

- MoneyGram has limits on transfer amounts, with caps on single transactions and totals within 30 days, varying by country.

- You can track transfer status online using a reference number; if funds are not claimed, you can cancel the transfer.

Factors Affecting MoneyGram Arrival Speed

To accurately predict when your MoneyGram transfer will arrive, you need to understand three key factors: receiving method, payment method, and destination. Different combinations can result in significant differences, from a few minutes to several days.

Receiving Method: Cash vs. Bank

The receiving method you choose for the recipient is the primary factor determining arrival speed.

- Cash Pickup: Fastest If you want funds available immediately, cash pickup is the best choice. After a successful remittance, the recipient can usually go to any MoneyGram agent location within 10 minutes, present valid ID and the transfer reference number, and collect the cash. This makes it ideal for handling emergencies.

- Deposit to Bank Account: Takes More Time Depositing funds directly into the recipient’s bank account (such as a Hong Kong bank account) is convenient but slower. Funds typically take a few hours to 1-3 business days to appear in the account. This process depends on the receiving bank’s processing efficiency, so actual times vary.

Special Service Tip MoneyGram also offers the

ExpressPayment®service for paying bills to specific companies (such as utilities). While transaction information can be received by the company within 15 to 20 minutes, the funds may take longer to be officially credited to your account, depending on the company’s internal processing procedures.

To help you choose more intuitively, refer to the table below:

| Feature | Cash Pickup | Bank Deposit |

|---|---|---|

| Estimated Speed | Within 10 minutes | A few hours to 3 business days |

| Suitable Scenarios | Emergencies, recipient has no bank account | Routine remittances, bill payments, no immediate need for funds |

| Receiving Requirements | Valid ID, transfer reference number | Accurate bank account information |

Payment Method: Card vs. Transfer

The way you pay for the remittance determines when MoneyGram starts processing your transaction.

- Paying with a Bank Card (Debit or Credit Card): This is the fastest way to initiate a remittance. Your payment is usually confirmed immediately, and funds can start transferring right away.

- Bank Account Transfer: If you choose to transfer directly from a bank account, allow extra processing time.

Important Reminder: Bank Clearing Delays Standard bank account transfers (ACH payments) typically take up to 3 business days to clear before reaching MoneyGram. This means your entire remittance process will be extended by several days.

Destination Country and Banking System

Finally, some external factors beyond your direct control also affect arrival speed, especially for bank deposits.

- Weekends and Public Holidays: Weekends and public holidays in the destination country are not banking business days. If you initiate a bank deposit remittance during these times, the transaction will not be processed until the next business day, causing delays. In contrast, some cash pickup agent locations may still be open during holidays.

- Bank Operating Hours and Systems: Each bank has its own operating hours and system processing cycles. Even if you remit on a business day, if you miss the receiving bank’s daily cutoff time, funds may not be credited until the next day.

- Local Regulatory Requirements: Financial regulatory policies in different countries or regions may require additional review steps, occasionally extending processing time.

Before initiating an important MoneyGram remittance, it’s recommended to verify the recipient’s local holiday schedule and bank operating hours in advance to avoid unnecessary waiting.

MoneyGram Remittance Fees and Exchange Rates

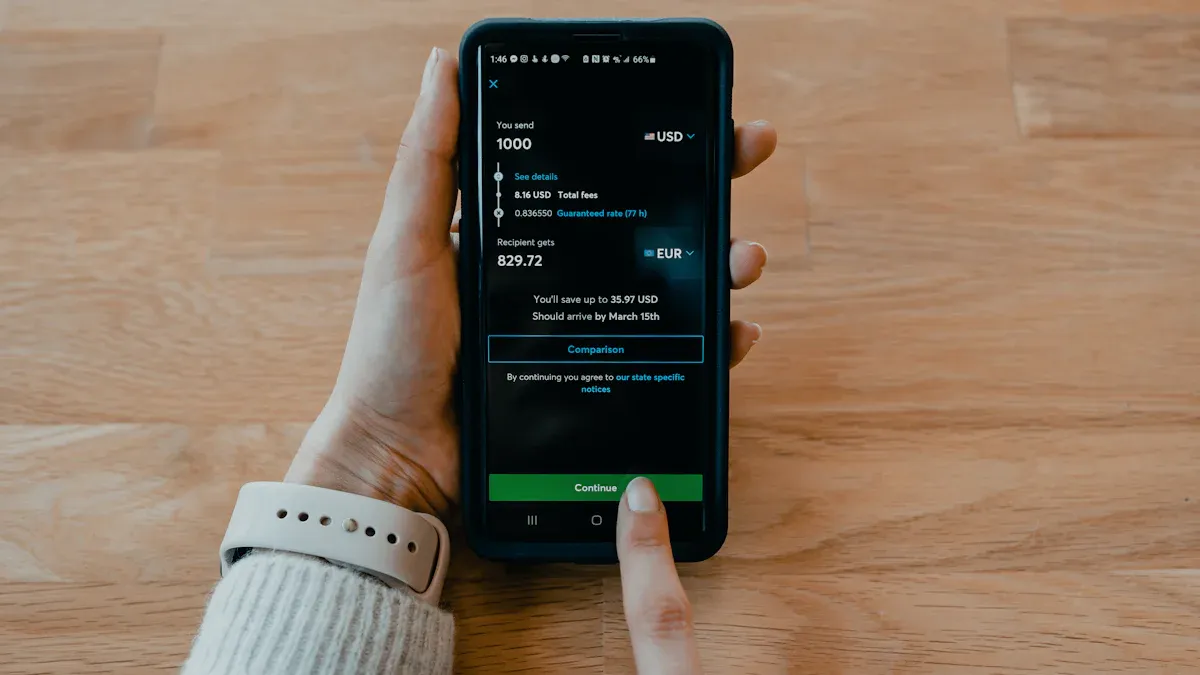

Image Source: unsplash

Understanding the total cost of your MoneyGram remittance is very important. The total cost consists of two parts: explicit transfer fees and the margin hidden in the exchange rate.

Fee Structure

MoneyGram’s fee structure is very straightforward. The fees you need to pay vary based on the remittance amount, destination country, and your payment method (such as bank card or bank account).

Important Tip: Fees are only paid by the sender at the time of sending. In most cases, the recipient does not need to pay any fees to MoneyGram when picking up cash or receiving a bank deposit.

However, note that if funds are deposited into a bank account, the recipient’s own bank may charge a fee for receiving the funds. These are third-party fees beyond MoneyGram’s control. Typically, transfers paid with a credit card have higher fees than those paid with a bank account.

How Exchange Rates Are Calculated

In addition to transfer fees, the exchange rate is another key factor affecting total cost. Like many remittance companies, MoneyGram profits by adding a margin to the exchange rate.

This means the exchange rate you see on MoneyGram will be slightly lower than the real-time market mid-rate (the rate you find by searching on Google). This small difference is one of MoneyGram’s service profits.

| Exchange Rate Type | Explanation |

|---|---|

| Market Mid-Rate | The “real” rate used for transactions between banks and large financial institutions. |

| MoneyGram Rate | The actual rate you receive for the transaction, including the service margin. |

Therefore, even if a transaction has a low transfer fee, an unfavorable exchange rate can make your total cost higher.

Online Total Cost Estimation

Before finalizing a remittance, the best approach is to use the fee estimation tool on the MoneyGram website or app. Simply enter the remittance amount and destination, and the system will immediately display:

- The exact transfer fee

- The real-time exchange rate you will receive

- The final amount the recipient will receive

This tool helps you clearly understand all fees before payment, avoiding surprises. To give you a general idea of market fees, the chart below compares the costs of sending $500 USD to India with different companies:

By estimating in advance, you can make the most informed choice.

MoneyGram Amount Limits

Before preparing a remittance, understanding amount limits is a crucial step. MoneyGram sets caps on single transactions and total amounts within specific periods, primarily to ensure transaction security and comply with financial regulations worldwide.

Single and Daily Limits

MoneyGram itself sets a standard set of online remittance limits. You need to understand these basic rules.

General Online Limit Reference

- Single Transaction: Usually up to $10,000 USD.

- Every 30 Days: Total remittance amount usually cannot exceed $10,000 USD.

Note that this is just a general guideline. As a new user or based on your transaction history, you may face lower initial limits. Limits at offline agent locations may differ from the online platform.

Limit Variations by Country

The destination country of your remittance is a key factor determining the final limit. Due to different financial regulations and laws in each country, the amount that can be sent or received is strictly limited.

This means that even if MoneyGram’s general limit is $10,000 USD, if the recipient’s country only allows receiving $5,000 USD per transaction, your remittance cap is $5,000 USD. Certain countries’ monetary policies or anti-money laundering regulations may result in limits far below the general standard. Therefore, the maximum remittance amount for a single transaction varies depending on the specific conditions of the destination country.

How to Check Specific Limits

Want to know the exact limit for your remittance? The most direct method is to use MoneyGram’s official tools for a simulated operation.

- Visit the Website or App: Log in to your MoneyGram account.

- Enter Remittance Information: Select the destination country and input the amount you wish to send.

- View System Prompts: If the amount you enter exceeds the allowed limit (whether MoneyGram’s limit or the country’s limit), the system will usually display an error message or prompt clearly stating the maximum allowable remittance amount.

This simple test allows you to clearly understand all restrictions before payment, avoiding subsequent operation failures.

How to Manage Your Remittance

Image Source: unsplash

After sending a remittance, you can still manage the transaction. Knowing how to track, cancel, or seek help gives you more confidence in the entire process.

Tracking Remittance Status

Want to know where your funds are? MoneyGram provides a convenient online tracking tool. You just need two pieces of information to check the latest status of your remittance at any time.

- Reference Number

- Sender’s Last Name

Enter this information on the tracking page of the website or app, and the system will immediately show whether your funds have been claimed or deposited into the bank.

Conditions for Canceling a Remittance

If you change your mind or find an error in the information, canceling a remittance is possible, but it must meet one key condition: the funds have not yet been claimed by the recipient or deposited into their bank account.

You can apply for cancellation by logging into your account and using the self-service portal. If you need to modify recipient information, the standard process is to cancel the current transaction and then initiate a new remittance.

Refund Policy Notes

- Full Refund: Cancel within 1 hour of payment, or if a cash remittance remains unclaimed for over 90 days, you can usually receive a full refund.

- Bank Transfer Issues: If funds fail to deposit into the recipient’s account, you will receive a full refund (including fees), unless the bank information you provided was incorrect.

Contact Customer Service for Help

When you encounter complex issues that self-service cannot resolve, contacting MoneyGram customer service is the best choice. The customer service team can provide various types of assistance.

Whether it’s routine questions, complaints and suggestions, or reporting suspicious fraudulent activity, they can provide support. MoneyGram offers 24/7 customer service in the US.

- General Customer Service: (800) 926-9400

- Report Fraud: (800) 955-7777

When contacting customer service, please have your remittance reference number ready so they can assist you more quickly.

MoneyGram’s core advantage lies in its amazing speed. As many users say, “funds can arrive in minutes”, making it a reliable choice for emergencies.

If you need the fastest speed, cash pickup is your best option, usually completed within 10 minutes. If the remittance is not urgent, bank deposit is also a convenient option, but allow 1-3 business days for processing.

Action Recommendation: Before making any MoneyGram remittance, be sure to use the calculator on the official website or app. Confirm fees, exchange rates, and estimated arrival time in advance to ensure your funds arrive smoothly.

FAQ

What if the recipient’s name is misspelled?

You need to cancel the transaction immediately, provided the funds have not been claimed. After successful cancellation, you can re-initiate a new remittance with the correct recipient information. This is the standard process to ensure the security of your funds.

What documents are needed for cash pickup?

The recipient needs to provide two things:

- The remittance reference number (Reference Number) you provided.

- A government-issued photo ID (such as a passport), and the name on the ID must exactly match the remittance information.

Does the recipient need a MoneyGram account?

No. For cash pickup, the recipient does not need an account; they can collect the money with the reference number and ID. For bank deposit, they only need a valid bank account to receive the funds, without registering with MoneyGram.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.