- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

In-depth comparison between Amazon and Google: Who is more worth paying attention to in 2025?

If DeepSeek has caused a stir in Silicon Valley, Amazon and Google seem to have been unaffected. Amazon CEO Andy Jassy recently revealed that Amazon plans to invest $100 billion in artificial intelligence this year. Although the release of DeepSeek did not go as hot as expected, even causing the US stock market to evaporate nearly $1 trillion in market value, Amazon still decided to increase investment in the AI field. Most of the funds will be invested in Amazon’s Cloud Service department - AWS. Despite facing fierce competition from abroad, Amazon still sees a “huge demand” for its huge data center and AI technology.

Although DeepSeek has proven that it can surpass some AI giants in the US at ultra-low cost, its emergence undoubtedly puts pressure on Google. Google’s R1 model claims to be comparable to Google’s products, but the price is much cheaper, which also prompted Google CEO Sundar Pichai to defend the company’s plan to invest $75 billion in AI development in its recent financial report. He said that the opportunities brought by AI are “extremely huge”, which is why Google invests so heavily in AI technology.

How have Amazon and Google performed in their recent financial reports?

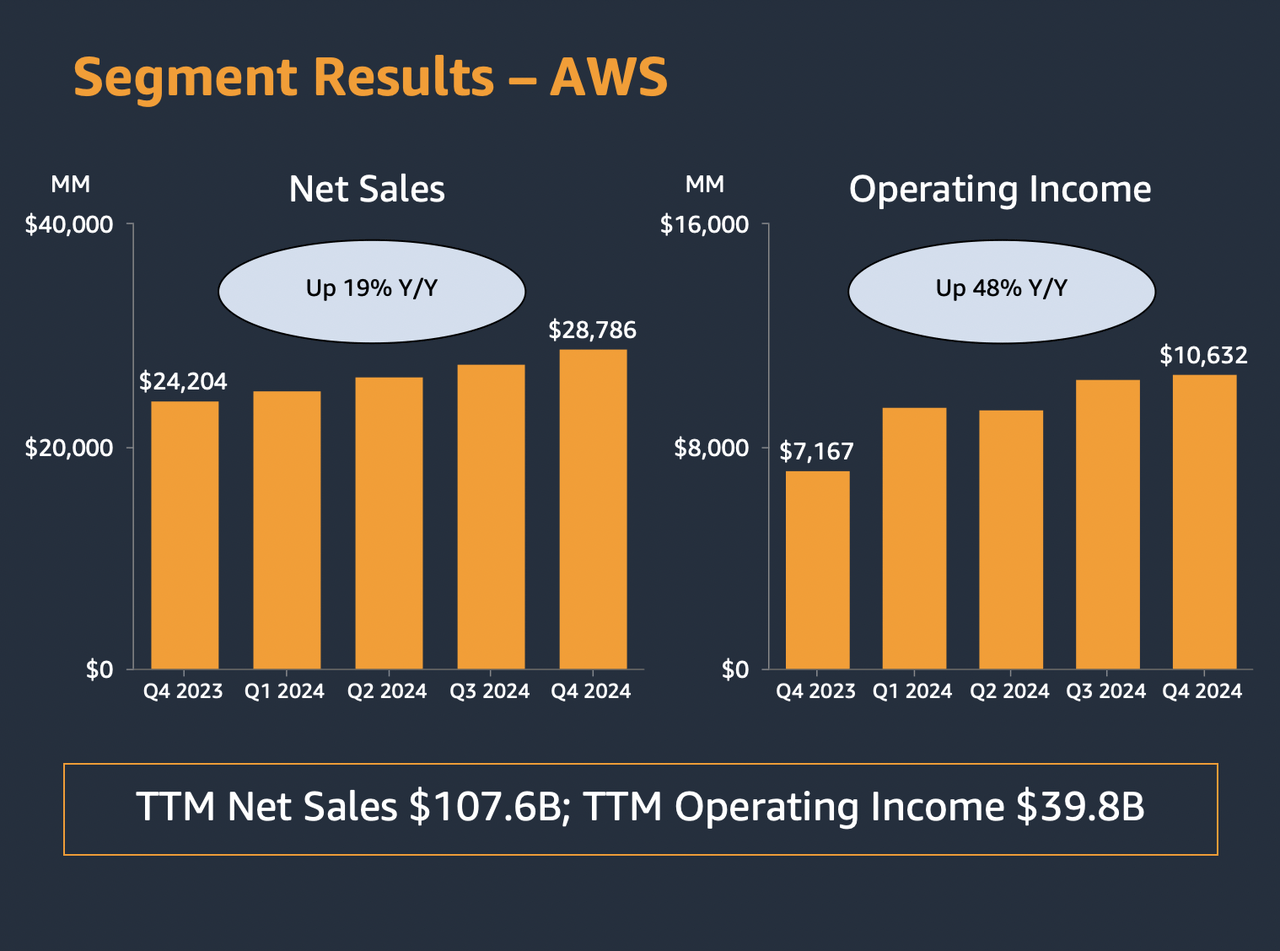

Despite facing some challenges, Amazon and Google’s financial performance in Q4 was quite good. Amazon’s earnings per share in Q4 2024 were $1.86, exceeding Wall Street’s expectations of $0.38. This was mainly due to strong demand for AI services and data centers. The company’s revenue also exceeded the expected $187.20 billion by $500 million, reaching $187.79 billion. Especially in the AWS department, revenue increased by 48% year-on-year to $39.80 billion, which is a very strong performance.

However, the forward-looking performance is not so exciting. Amazon expects its revenue for Quarter 1 in 2024 to be between $151 billion and $155.50 billion, which is much lower than the market’s expected $158.33 billion. The moderate outlook, coupled with a 19% sales growth of $28.80 billion, is also slightly lower than expected, which caused Amazon’s stock price to fall by more than 5% after the financial report was released. The tight supply chain has made it difficult to purchase some key AI components, and the energy problem required to support AI development has also brought significant challenges to the company.

Google’s Q4 financial report was also good, with earnings per share of $2.15, exceeding analysts’ expectations of $0.02 and a significant increase from $1.64 in the same period last year. Other highlights include a 12% year-on-year increase in revenue, reaching $96.40 billion, although it was about $200 million less than expected. Net Income increased by 28% year-on-year, reaching $26.50 billion, and operating profit margin also significantly improved to 32%. However, Google’s cloud business growth was slightly slower, with revenue 200 million less than expected, which caused Google’s stock price to fall by about 7% on the day of the financial report release. Investors are excited about Google’s plan to invest $75 billion in AI, but also concerned about the growth prospects of its cloud business.

Amazon vs. Google: Who is more worth paying attention to?

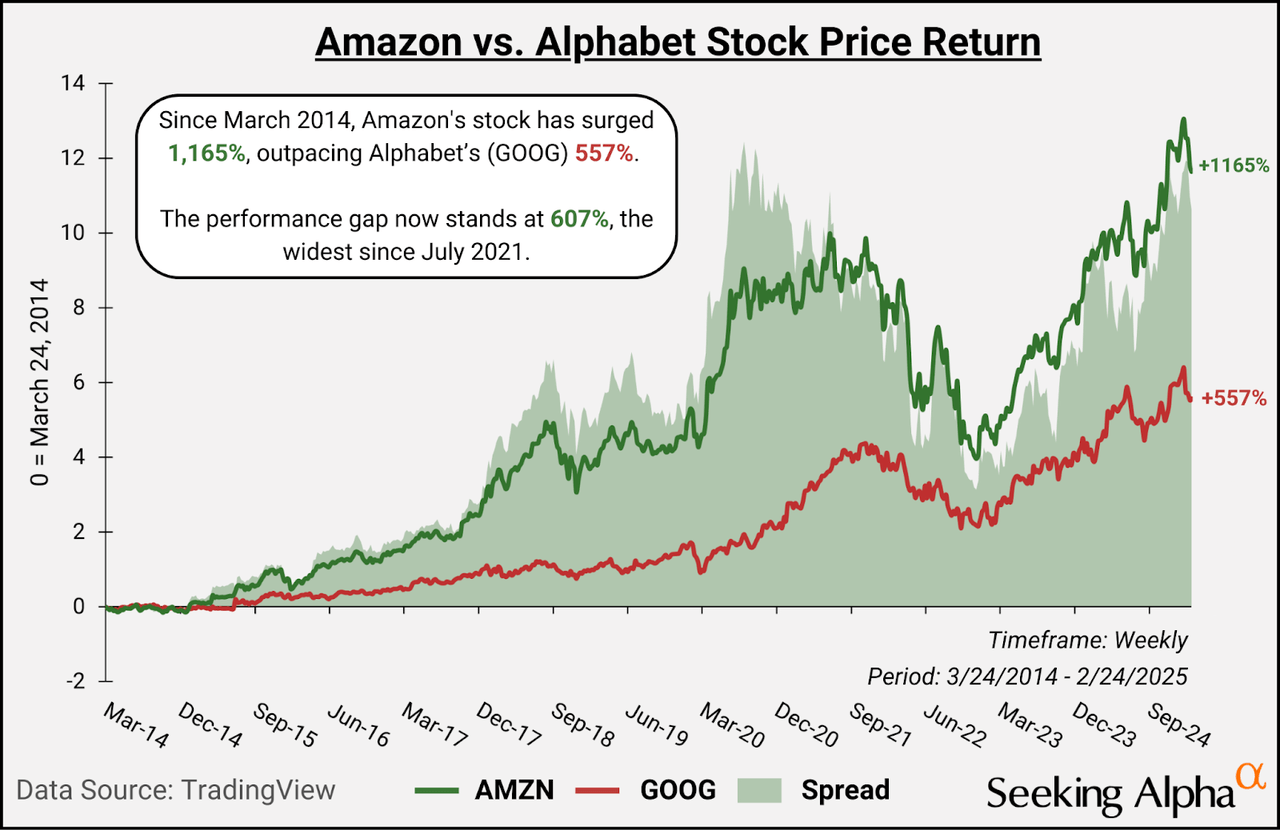

Now let’s take a look at the stock performance of Amazon and Google. Since March 2014, Amazon’s stock price has risen by an astonishing 1165%, while Google’s stock price has risen by 557%. This means that Amazon’s stock price performance is about 607% higher than Google’s. The last time this gap was so obvious was in July 2021, but by December 2022, the gap had narrowed to 180%.

Although both companies face their own challenges, their fundamentals remain solid and both are expected to make huge breakthroughs in the AI field. Amazon’s AWS continues to be a powerful profit engine, driving the company’s growth in e-commerce and Cloud Services. At the same time, Google is not to be outdone. Its powerful Gemini 2.0 AI model can not only handle text, but also video, images, and audio, showing great potential. As SA analyst Noah’s Arc Capital Management said:

For investors, Google is the only US company that is building a strong LLM (Large Language Model) and expanding its Customer relationships by selling Cloud as a Service, while controlling the core GPU Data Center network.

Let’s take a deeper look at the quantitative data of these companies and see which stocks are more worth paying attention to.

How about quantitative data?

Amazon

As of February 26, 2025, Amazon ranked among the top four in the quantitative industry, third in the non-essential consumer category, and second in the comprehensive retail category. Amazon’s rating was upgraded from “hold” to “strong buy” on February 14, when the stock price was $228.68, but now it has dropped to $214.18. Despite the stock price correction, which reflects the market’s correction of its valuation, Amazon’s fundamentals remain strong. The AWS department has driven Amazon’s growth, but it has also brought greater uncertainty.

If Amazon’s financial situation continues to be strong, its stock price may rise again. However, this increase may not be sustainable, so if there is a pullback, it may be a good opportunity to “buy on dips”. As SA analyst Yiannis Zourmpanos said:

“With its dominant position in e-commerce and multiple growth levers, Amazon remains an attractive long-term investment, and any pullback can be seen as a buying opportunity.”

As of February 26, 2025, Google ranked 48th in the quantitative industry and 16th in the communication industry. Despite Google’s good Q4 financial report and strong momentum in artificial intelligence, Google’s stock price has remained around $181.09 since November last year, and the quantitative system rates it as “hold”. Since the beginning of this year, Google’s stock price has fallen by nearly 5%, although it has still risen by more than 6% since the beginning of the year, it is slightly inferior to the performance of other market indices.

Despite Google’s current high valuation and falling stock price, it is still the leader in the global artificial intelligence competition. With a huge product ecosystem and sufficient cash reserves, Google has enough funds to promote the further expansion of AI, making it a reliable choice for long-term investors. As SA analyst Manuel Paul Dipold said:

Gemini’s advanced version is just a part of Google One’s highly attractive AI suite. We are just beginning to integrate it into various applications, such as AI in Google Maps and real-time voice output translation. No other company can seamlessly integrate AI technology into so many products like Google, providing users with practical convenience in life.

Both Amazon and Google are good investment choices. If you have confidence in these two companies and want to enter the market, you may want to regularly monitor stock prices at traditional securities firms such as Interactive Brokers, Jiaxin, and Tiger, or at the new multi-asset trading wallet BiyaPay, and buy or sell stocks at the appropriate time.

Among them, BiyaPay supports trading of US and Hong Kong stocks and digital currencies. Through it, you can quickly recharge digital currencies, exchange them for US dollars or Hong Kong dollars, and then withdraw the funds to your personal bank account, making it convenient to invest in Amazon and Google. With advantages such as fast arrival speed and unlimited transfer limit, it can help you seize market opportunities in critical moments, ensuring fund safety and liquidity needs.

This method can be said to be fast, with no limit on the amount, no deposit or withdrawal troubles, and can also keep track of the stock market trends at any time, which can bring you a safe and efficient investment experience.

From the perspective of valuation, Amazon and Google

Amazon’s overall C-valuation rating includes a B-level Price-To-Earnings Ratio growth rate of 1.59, which is 7.7% higher than the industry median of 1.47. However, its expected Price-To-Earnings Ratio is 34.23, which is 88% higher than the industry’s 18.2, making it relatively weak in terms of attractiveness.

Google’s expected GAAP Price-To-Earnings Ratio is 20.21, with a score of B-, which is similar to its peers and slightly higher than the industry median of 19.6, only 3.4%. Google’s expected PEG is 1.22, which belongs to the C + level and is 11% lower than the industry median of 1.37. This indicates that compared with other technology companies, Google’s valuation is relatively reasonable, despite its large scale.

However, Google’s Price Value Ratio, price-to-cash ratio, and only 0.33% dividend yield (91.1% lower than the industry median) performed poorly, which dragged its overall valuation rating down to an F.

Both Amazon and Google have performed very well in terms of profitability, with an overall score of A +. Although our quantitative system compared them to different industries - GOOG belongs to communication stocks, Amazon belongs to non-essential consumer goods stocks - both have achieved industry-leading levels in operating cash flow ($115.90 billion and $125.30 billion, respectively), total capital return, and total return on assets.

Analysts hold a pessimistic attitude towards Amazon’s future performance. In the past 90 days, Amazon’s earnings per share have been revised upwards 35 times and downwards 16 times. Its revenue has also been revised more frequently, with 52 downgrades and only 5 increases. In contrast, Google’s EPS revision is more complex, with 28 increases and 24 decreases in the past 90 days. Similar to Amazon’s revenue revision, the situation is not optimistic, with 30 downgrades and 18 increases.

Overall, there is not much difference in various indicators between Amazon and Google, so choosing which stock has more investment value depends on your priorities as an investor. Amazon’s current value is slightly better. However, from the overall industry situation, the valuations of these two stocks are still reasonable. On the other hand, as Google continues to improve in competition and integrates artificial intelligence technology into its full range of products, Google’s momentum in the field of artificial intelligence is obviously stronger.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.