- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to Western Union Withdrawals: Analysis of Withdrawal Limits, Fees, and Security Matters

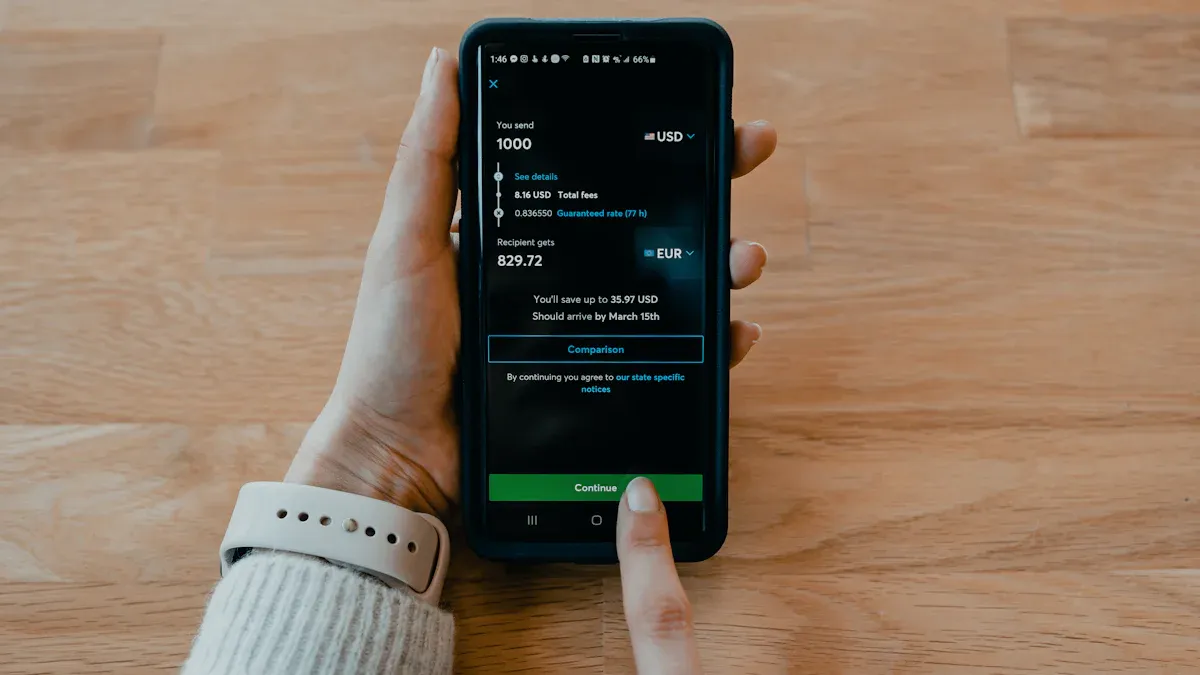

Image Source: pexels

To receive a Western Union remittance in China, you have several convenient options. You can visit a partner bank branch or directly use Alipay or online banking to complete the receipt.

Three Core Elements for Withdrawal Regardless of the method chosen, please prepare in advance: the Money Transfer Control Number (MTCN), your valid identification document, and ensure your personal annual foreign exchange quota is sufficient.

As the recipient, you typically do not need to pay fees. This Western Union withdrawal guide reminds you to always operate through officially authorized channels to ensure the safety of your funds.

Key Points

- In China, you can receive Western Union remittances through bank branches, the Alipay app, online banking, or WeChat, choosing the most convenient method.

- For withdrawals, you need to prepare the Money Transfer Control Number (MTCN), a valid ID, and ensure your annual foreign exchange quota is sufficient.

- As a recipient, you usually don’t need to pay fees, but be aware of the national annual $50,000 foreign exchange limit and per-transaction limits of each channel.

- Protect your MTCN and personal information, don’t share them with strangers, and stay vigilant against various remittance scams to ensure fund safety.

- If the MTCN is lost or the sender misspells your name, contact the sender immediately to resolve it to ensure a smooth withdrawal.

Western Union Withdrawal Guide: Four Methods Explained

Image Source: unsplash

Understanding different withdrawal methods can help you choose the most suitable option. Below, this Western Union withdrawal guide will detail four mainstream receiving channels.

Bank Branch Withdrawal

This is the most traditional and reliable withdrawal method, especially suitable for those accustomed to offline transactions or needing to withdraw large cash amounts.

The process is very straightforward:

- Prepare Documents: Before heading to the bank, ensure you have all necessary documents ready.

- Money Transfer Control Number (MTCN): This is a 10-digit code provided by the sender.

- Remittance Information: Includes the sender’s name, sending country, and approximate amount.

- Valid ID: Your personal ID is required.

- Visit a Branch: Bring the above documents to any Western Union partner bank branch, such as China Postal Savings Bank or Agricultural Bank of China.

- Fill Out the Form: Obtain and complete a “Receipt Form” at the counter. You need to accurately enter the MTCN, sender information, and your personal and account details.

- Complete the Withdrawal: Submit the form and ID to the bank staff. Upon verification, funds can be deposited directly into your bank account, or you can choose to receive cash.

Friendly Reminder: Plan Your Time Note that Western Union services at banks have specific processing hours. In China, online processing hours for partner banks are typically from 7:30 AM to 9:45 PM. If opting for in-person withdrawal, visit during the bank’s public business hours.

Alipay App Withdrawal

For users seeking efficiency and convenience, receiving funds via the Alipay app is undoubtedly the best choice. You can complete the process in minutes without leaving home.

Specific steps are as follows:

- In the Alipay app’s homepage search bar, enter

Cross-Border Remittance. - After entering the “Cross-Border Remittance” mini-program, select the

Receive Moneyoption. - Choose

Western Unionand accurately input the 10-digit MTCN, remittance amount, and other information as prompted. - If it’s your first time using this service, the system will guide you to complete identity verification and sign an electronic service agreement.

- Select a savings card for receiving funds, confirm the information, and submit. Funds are typically deposited in RMB to your bank card within minutes.

Online or Mobile Banking Withdrawal

Many banks’ mobile apps or online banking platforms also integrate Western Union functionality, offering another convenient digital receiving channel. Additionally, through a partnership with Tencent Financial Technology, you can now receive Western Union remittances via WeChat.

General Bank App Process:

- Log into your mobile banking app or online banking.

- Find

Cross-Border Finance,Cross-Border Remittance, or directly search forWestern Unionin the menu. - Enter the receiving page, input the MTCN and other information, and follow the prompts to complete the foreign exchange settlement.

Receiving via WeChat: An Emerging Convenient Method Senders can now send funds directly to your WeChat.

- Sender Action: The sender selects “Mobile Wallet” as the receiving method on the Western Union platform and chooses “WeChat”.

- Receive Notification: You’ll receive an SMS notification containing a receiving link.

- Complete Receipt: Click the link to enter the “WeRemit” mini-program, where you can deposit funds into your WeChat wallet balance or linked bank card. First-time users need to complete identity verification.

This Western Union withdrawal guide recommends prioritizing these digital channels, as they save significant time.

Business Account Withdrawal

If your remittance is for business purposes, you need to receive it through a business account. This process is stricter than personal withdrawals.

Key points to note:

| Item | Description |

|---|---|

| Applicable Parties | This method is only for registered businesses receiving legitimate commercial trade payments. |

| Required Documents | In addition to the MTCN, you need to prepare the company’s business license, bank account details, and possibly trade contracts or other proof. |

| Pre-Verification | A critical step: Before the transfer, ensure the sender confirms with Western Union whether B2B transfers to your region’s business bank account are supported. Not all banks support this service. |

Due to the complexity, it’s advisable to consult your bank in advance to understand the specific requirements and process for receiving Western Union business remittances.

Core Limits and Fees

Image Source: pexels

Understanding Western Union’s limits and fees can help you complete withdrawals more smoothly. This Western Union withdrawal guide will break down the key information to give you a clear understanding of the process.

Withdrawal Limits Explained

When withdrawing Western Union remittances in China, you’ll face two main restrictions. You must comply with both regulations.

- National Foreign Exchange Limit According to China’s State Administration of Foreign Exchange (SAFE), each Chinese citizen has an annual limit of $50,000 for receiving and settling foreign exchange. This limit applies to the total of all your cross-border receipts, not specific to Western Union.

- Partner Channel Per-Transaction Limit In addition to the annual cap, Western Union’s partner channels (e.g., banks or Alipay) have per-transaction amount limits, which vary by channel.

Per-Transaction Limit Reference Different banks or platforms have varying processing capacities, with single transaction limits typically ranging from $7,500 to $9,000. If your single remittance exceeds this range, you may need to receive it in batches or choose a bank branch that supports larger amounts.

Fee Structure Breakdown

Good news: as the recipient, you typically pay no fees. All fees are borne by the sender. Understanding the sender’s fee structure can help you communicate better with them.

The sender’s fees consist of two main parts:

- Transfer Fee: A fixed service fee that varies based on the sending country, payment method, and amount. For example, sending less than $850 from the U.S. may incur a $5 fee.

- Exchange Rate Margin: Western Union profits through its set exchange rate, which may differ from the market’s real-time exchange rate, with the difference forming a hidden cost.

Note: Mobile Wallet Withdrawal Fee If you choose to receive funds in a mobile wallet (e.g., WeChat Wallet), be aware that the platform may charge a withdrawal fee when you later transfer the money from the wallet balance to a bank card.

Safety Tips and Common Issues

Ensuring the safety of your funds is the most critical part of the receiving process. This Western Union withdrawal guide will introduce key safety knowledge to help you identify risks and resolve common issues.

Key Safety Checklist

The Money Transfer Control Number (MTCN) is like a package tracking code, crucial for transaction security. Before withdrawing, verify the following with the sender to ensure everything is correct:

- Money Transfer Control Number (MTCN): A 10-digit number.

- Sender’s Full Name: Ensure it matches the sender’s provided information.

- Expected Amount: Verify the specific remittance amount.

- Sender’s Country: Sometimes city or state information is also needed.

Add an Extra Layer of Security The sender can set a security question that you must answer correctly to access the funds. This is an important Western Union procedure combined with identity verification to ensure funds are delivered to the correct recipient.

Beware of Common Remittance Scams

Remember one core principle: Never send money to someone you don’t know or trust. Scammers often exploit Western Union’s convenience to perpetrate fraud. Be vigilant about these common scams:

- Family Emergency Scam: Scammers pose as family or friends, claiming emergencies (e.g., injury or arrest) and urging immediate remittances.

- Lottery or Inheritance Scam: You’re told you’ve won a prize or inherited money but must pay a “tax” or “processing fee” to claim it.

- Romance Scam: Scammers build emotional connections via social media, then request money for various reasons.

- Online Shopping Scam: You purchase goods online, but the seller demands payment via Western Union.

Clear Scam Signals If someone requests a fee to claim a supposed prize, loan, or inheritance, it’s almost certainly a scam. Legitimate organizations do not require upfront fees to access your funds.

What to Do Without an MTCN

Lost your MTCN? Don’t panic.

The best first step is to immediately contact the sender and ask them to provide the MTCN again. The sender can find this number in their remittance receipt or online transaction history.

If you cannot reach the sender, try tracking the remittance with alternative information:

- Sender’s phone number

- Sender and recipient names

- Receiving country (China)

- Approximate amount and date of the remittance

You can bring this information to a bank branch for assistance or contact Western Union’s customer service representative directly for inquiries.

Now you understand the various receiving methods. Bank branches offer traditional, reliable service. Digital channels like Alipay are highly efficient, with funds typically arriving within minutes.

Keep These Two Core Points in Mind:

- Strictly adhere to China’s annual $50,000 personal foreign exchange limit. Exceeding this requires approval from the foreign exchange authority.

- Safeguard your MTCN and personal information, never sharing them with strangers.

We hope this Western Union withdrawal guide helps you complete every receipt safely and confidently.

FAQ

Does the MTCN have an expiration date?

Yes. The Money Transfer Control Number (MTCN) is typically valid for 90 days. If the remittance remains unclaimed for too long, the sender needs to contact Western Union to reprocess it. It’s best to complete the receipt as soon as you receive the MTCN.

Can someone else withdraw the money on my behalf?

No. To ensure the safety of your funds, only the recipient can withdraw the money with a valid ID. This is a strict Western Union policy to prevent fraud and incorrect payments.

What if the sender misspells my name?

You won’t be able to withdraw successfully. You must immediately contact the sender to have them contact Western Union’s customer service to correct the name. The recipient’s name must exactly match the information on your ID.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.