- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Analysis of the Arrival Time of Remittances to Cameroon: The Best Choices among Banks, Prepaid Cards, and Mobile Payments

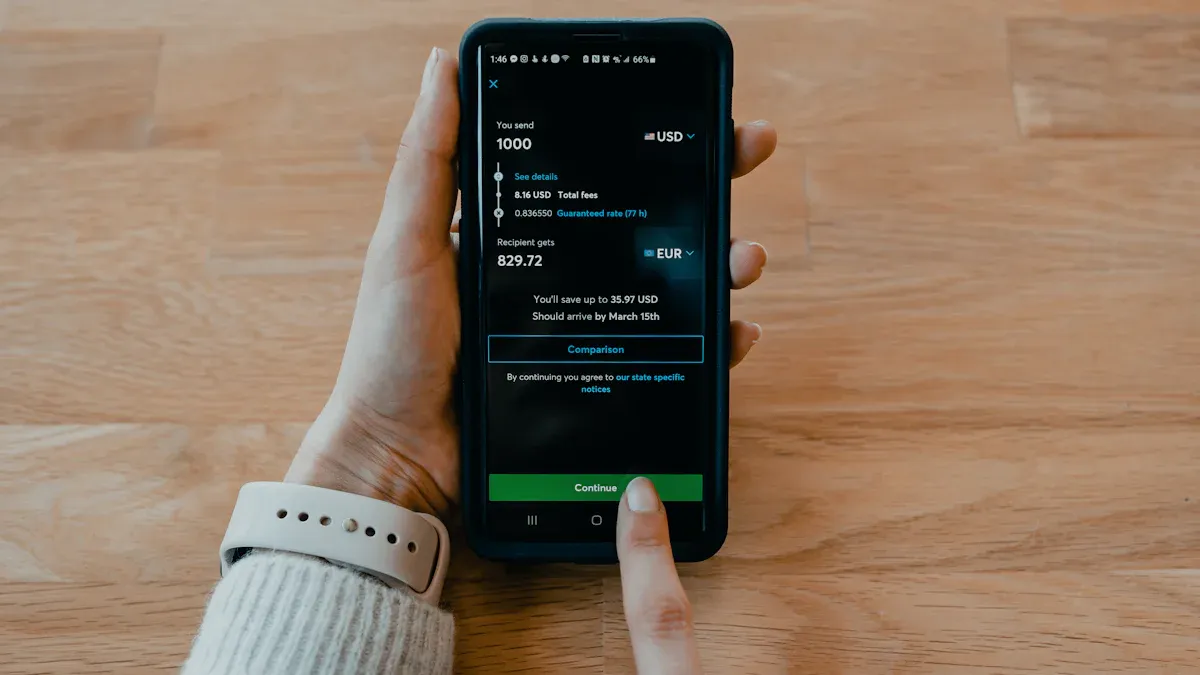

Image Source: unsplash

When sending money to Cameroon via remittance, cash pickup and mobile payments (Mobile Money) are currently the fastest options. Funds typically reach the recipient within minutes.

This Cameroon money transfer time analysis will help you understand the different options. Want to know which method can get your urgent transfer to your family in minutes? Keep reading to find the best solution for you.

Key Takeaways

- Cash pickup and mobile payments are the fastest ways to send money to Cameroon, with funds typically arriving in minutes.

- Bank transfers require 1 to 5 business days but are better suited for large transfers and transactions requiring formal records.

- When choosing a transfer method, you need to balance speed, cost, and convenience, as no single method is universally the best.

- Mobile payments are highly popular in Cameroon, making them an efficient choice when the recipient has a mobile wallet.

- Before sending, carefully verify the recipient’s information and confirm whether they have a bank account or mobile payment account.

Cameroon Money Transfer Time Analysis: Comparing Core Methods

To help you make a quick decision, we first summarize the key differences between transfer methods in a clear table. This Cameroon money transfer time analysis provides an intuitive reference.

Quick Comparison of Four Transfer Methods

The table below compares the average delivery times and main advantages of four mainstream transfer methods.

| Transfer Method | Average Delivery Time | Main Advantages |

|---|---|---|

| Cash Pickup | Within Minutes | Extremely fast, no bank account required for recipient |

| Mobile Payment | Within Minutes | Convenient, funds deposited directly into mobile wallet |

| Prepaid Card | Usually Within 1 Hour | Flexible, can be used for online and offline purchases |

| Bank Transfer | 1-5 Business Days | Secure and reliable, ideal for large transactions |

Balancing Speed, Cost, and Convenience

When choosing the best transfer method, speed isn’t the only factor to consider. Cost and ease of operation are equally important. You often need to make trade-offs between these three factors.

Key Tip: The fastest method isn’t always the cheapest, and the cheapest method may be the slowest. Your best choice depends on your personal priorities for speed, cost, and convenience.

For example, cash pickup is fast but may have relatively higher service fees. Bank transfers, while taking 3-5 business days, offer unmatched security and formal documentation for large, non-urgent transfers.

Some modern transfer services are working to bridge this gap. For instance, certain services initiated from North America and Europe, like Sendwave, can deliver funds to the recipient’s mobile wallet in seconds while maintaining low costs. This provides more efficient and cost-effective options in your Cameroon money transfer time analysis. Ultimately, you need to find the perfect balance based on your specific situation.

Cash Pickup: Instant Delivery for Urgent Needs

Image Source: unsplash

When you need funds to reach Cameroon almost instantly, cash pickup is an unmatched choice. This method is designed for speed and emergencies, effectively addressing urgent needs.

Delivery Time and Mechanism

The core advantage of cash pickup is its “instantaneous” nature. After you complete the transfer, funds are typically ready within minutes. The mechanism is straightforward: transfer providers have extensive global agent networks. You deposit funds in the sending country, and the system immediately authorizes a partner location in Cameroon to pay out the equivalent cash to your recipient. This bypasses complex bank clearing systems, enabling minute-level delivery.

This method means your family or friends can pick up cash at locations across Cameroon moments later, resolving urgent financial needs.

Providers and Agent Network Distribution

In Cameroon, cash pickup services are primarily offered by well-known international remittance companies.

- Western Union: As an industry leader, Western Union is renowned for its extensive network and efficient emergency transfer services.

- MoneyGram: Another reliable option with numerous partner locations, also offering fast cash delivery.

These providers’ agent locations are typically found in banks, post offices, or authorized convenience stores, covering major cities and some rural areas in Cameroon, providing great convenience for recipients.

Process and Precautions

The process is generally simple and straightforward. You only need to provide the recipient’s name and location, and upon completing the payment, you’ll receive a unique transaction number. To ensure smooth pickup, remind the recipient of the following:

- Bring Valid ID: In Cameroon, recipients need to present a valid photo ID to collect cash transfers.

- Provide Transaction Number: At some pickup locations, staff may require the transaction number you provide for verification.

- Verify Name Accuracy: Ensure the recipient’s name you enter matches their ID exactly, as any spelling errors could lead to pickup failure.

This Cameroon money transfer time analysis recommends confirming that the recipient has a convenient agent location nearby before choosing cash pickup.

Mobile Payments: Minute-Level Delivery for Convenience

Image Source: unsplash

Mobile payments are another convenient way to achieve minute-level delivery. They deposit funds directly into the recipient’s mobile wallet in Cameroon, making them ideal for users familiar with smartphone operations.

Instant Delivery Mechanism

The speed of mobile payments stems from their fully digital process. When you initiate a transfer through a remittance provider, funds are directly deposited into the recipient’s mobile wallet account. This process bypasses traditional bank clearing networks, enabling near-instant fund transfers. This convenience has driven its rapid growth in Cameroon. According to telecommunications regulatory data, Cameroon’s mobile money user base grew by over 110.24% in a single year, highlighting its immense popularity potential.

Main Mobile Wallet Services

In Cameroon, the mobile payment market is dominated by two major telecom operators. Before sending, confirm which service the recipient uses.

- MTN Mobile Money: As the market leader, MTN Mobile Money had nearly 6 million active users in Cameroon as of mid-2025.

- Orange Money: Since its launch, Orange Money has amassed over 10 million account holders, making it another mainstream option.

Many international remittance providers support transfers to these wallets. For example, ACE Money Transfer and NALA allow you to easily send funds to the recipient’s MTN or Orange wallet.

Ensuring Fastest Delivery

To ensure a seamless transfer process, this Cameroon money transfer time analysis provides key tips.

Tips for Fast Delivery:

- Carefully Verify Phone Number: This is the most critical step. A single incorrect digit could lead to transfer failure or funds being sent to the wrong account.

- Confirm Recipient’s Service Provider: Ensure the wallet provider (MTN or Orange) matches the one the recipient uses.

- Choose Off-Peak Hours: Sending during non-peak business hours can avoid brief delays due to system congestion.

By following these simple tips, you can maximize the chances of funds reaching the recipient quickly and accurately.

Bank Transfers: Day-Level Delivery for Traditional Options

If you’re not prioritizing speed but value transaction security and formal records, bank transfers remain a highly reliable option. While slower, this traditional method has irreplaceable advantages in specific scenarios.

Delivery Time Range

International bank transfers typically take 1 to 5 business days to reach the recipient’s bank account in Cameroon. This timeframe is the standard processing cycle for international wire transfers.

Key Tip: Bank transfers cannot achieve instant delivery. You need to plan ahead, allowing sufficient time for bank processing, clearing, and potential reviews.

Key Factors Affecting Speed

Several factors may affect the speed of your bank transfer, potentially causing delays. Understanding these can help you better manage expectations.

- Incorrect Recipient Information: This is the most common cause of delays. A single error in the recipient’s name, bank account number, or SWIFT code could lead to transaction rejection or require manual verification.

- Compliance Reviews: To comply with international regulations like anti-money laundering (AML), banks review cross-border transactions. If your transfer amount is large or triggers certain rules, banks may need additional time for compliance checks.

- Intermediary Banks and Processing Efficiency: International transfers often involve one or more intermediary banks. Additionally, the processing efficiency and automation level of Cameroon’s local banking system also affect the final delivery speed.

- Holidays and Foreign Exchange Controls: If you initiate a transfer or funds arrive in Cameroon during weekends or public holidays, banks will not process transactions. Local foreign exchange control policies may also add extra approval steps.

Suitable Scenarios for Bank Transfers

Despite their slower speed, bank transfers are the best choice in the following scenarios:

- Handling Large Transfers: For larger amounts, banks offer greater security and higher limits.

- Requiring Formal Records: When you need formal proof of funds for purposes like home purchases, business payments, or legal matters, bank statements are irreplaceable evidence.

- Non-Urgent Transactions: If the urgency of fund delivery is low, you can opt for potentially lower-cost bank transfer services.

In summary, the transfer method you choose depends entirely on how much you prioritize speed. This Cameroon money transfer time analysis provides the following decision guide:

- Prioritizing Maximum Speed: Cash pickup and mobile payments are the best choices.

- Handling Large Transfers: Bank transfers offer superior reliability.

Be sure to consider the recipient’s situation. Given that Cameroon’s mobile money accounts (19.1 million) far outnumber traditional bank accounts, mobile payments are often the more efficient choice. We hope this article helps you find the most suitable solution.

FAQ

Which Transfer Method to Cameroon Is the Fastest?

When prioritizing speed, choose cash pickup or mobile payments. These methods typically deliver funds to the recipient in minutes, making them ideal for emergencies.

What Should I Do If I Entered Incorrect Recipient Information?

Contact the customer service of your remittance provider immediately. They will guide you on correcting the information or canceling the transaction. Act quickly, as recovering funds after they’ve been picked up is difficult.

What If the Recipient Doesn’t Have a Bank Account?

If your recipient lacks a bank account, cash pickup is the best option. They only need a valid ID to collect cash at agent locations across Cameroon.

Are Fees for Transfers to Cameroon High?

Fees vary by method and amount. Typically, the fastest methods like cash pickup and mobile payments have slightly higher fees than slower bank transfers. Compare providers’ fees before sending.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.