- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to Remitting Money from the United States to Bangladesh: An Analysis of the Safest and Most Convenient Ways

Image Source: unsplash

When sending money from the USA to Bangladesh via remittance, you always face a trade-off between cost, speed, and security. Official data shows that remittances from the USA to Bangladesh reached $4.73 billion in FY 2025. This massive flow of funds makes choosing the best remittance method critically important.

Core Answer: For most individual users, reputable online remittance services (such as Wise and Remitly) are typically better choices than traditional bank wire transfers.

This guide will help you thoroughly understand various options to find the solution best suited to your personal needs.

Key Points

- Online remittance platforms are generally better suited for personal transfers than traditional banks, offering lower fees and faster speeds.

- The total cost of remittance includes transfer fees and exchange rate margins, which require careful comparison.

- Choosing a licensed platform, protecting personal information, and carefully verifying recipient details can ensure fund security.

- Before sending money, you should use comparison tools to find the most cost-effective remittance method.

Comparison of Mainstream Remittance Methods

Image Source: unsplash

When choosing a remittance method, you’ll find two main categories: modern online platforms and traditional bank channels. Each has its pros and cons, and understanding their differences is the first step to making an informed choice.

Online Remittance Platforms

Online platforms have become the mainstream choice for personal remittances due to their low costs, high efficiency, and ease of use. These companies typically offer better exchange rates and lower fees.

Tip: Online platforms are ideal for small to medium transfers below $10,000. They generally outperform traditional banks in terms of cost and speed.

Here are several highly rated service providers you can compare based on your needs:

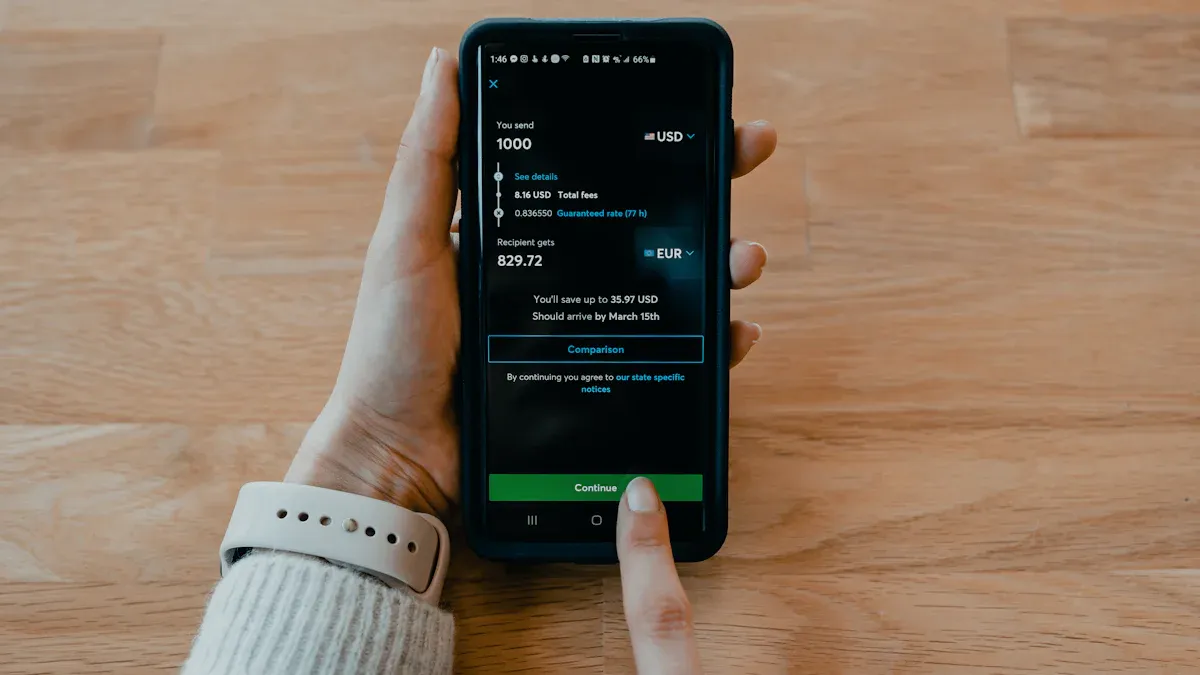

1. Wise (formerly TransferWise)

Wise is renowned for its transparent fee structure and real mid-market exchange rates. The fees you see are the fees you pay, with no hidden exchange rate markups.

- Best for: Users seeking fee transparency and the best exchange rates.

- Pros: Uses mid-market exchange rates, clear fee structure, no exchange rate markups.

- Cons: Fees for large transfers may not be the lowest, and speed is not the fastest.

- Fee Structure: Fees depend on the payment method. For example, sending $1,000 from the USA to Bangladesh:

Payment Method Fixed Fee Variable Fee (Percentage of Transaction Amount) Bank Direct Debit (ACH) $1.17 USD 0.8% Debit Card None Approx. 1.44% (including Wise fees) - Speed: Typically arrives within 1-2 business days.

2. Remitly

Remitly offers great flexibility in recipient options, especially for those needing cash pickup. It also frequently provides promotional exchange rates or fee waivers for new users.

- Best for: Recipients who prefer cash pickup or first-time users.

- Pros: Over 9,700 cash pickup locations in Bangladesh, express transfer options, and frequent promotions for new users.

- Cons: Fees and exchange rates for express services may be less competitive than economy options.

- Recipient Options: Bank deposit, cash pickup, mobile wallet deposit.

- Speed and Fees:

- Economy: Lower fees, typically arrives in 3-5 business days.

- Express: Slightly higher fees (e.g., $2.99 for cash pickup), but debit card payments can complete in minutes.

3. Xoom (A PayPal Service)

As a PayPal service, Xoom’s biggest advantage is speed. If both you and the recipient have PayPal accounts, the process is even more seamless.

- Best for: Users prioritizing speed.

- Pros: Extremely fast transfers, often completed in minutes, with high brand credibility.

- Cons: Fees and exchange rates are typically not the most competitive, better suited for small urgent transfers.

- Speed: Most transactions complete within minutes.

4. WorldRemit

WorldRemit specializes in mobile transfer experiences, particularly for sending money to popular mobile wallets in Bangladesh (e.g., bKash, Nagad).

- Best for: Users sending directly to recipients’ mobile wallets.

- Pros: Supports multiple recipient methods, especially mobile wallets, and allows recurring payments.

- Cons: Fees and exchange rates require careful comparison at the time of use.

- Unique Feature: Easily set up recurring transfers, ideal for regular remittances (e.g., supporting family).

5. Paysend

Paysend’s standout feature is sending money directly to bank cards (debit or credit) with a simple process requiring only the recipient’s name and card number.

- Best for: Users sending directly to a recipient’s bank card.

- Pros: Fixed low fees for card transfers (around $1.60 USD) and no fees for bank account transfers.

- Cons: Has specific transfer limits, requiring identity verification to increase limits.

- Transfer Limits: Paysend sets different limits based on your verification level.

Traditional Bank Methods

Despite the rise of online platforms, traditional banks remain a reliable choice in certain scenarios, particularly for large transactions or business remittances.

1. Bank Wire Transfer

Wire transfers are a traditional international remittance service offered by banks, available through online banking or in-person at bank branches.

- Pros: High security, supported by nearly all banks, suitable for large transfers.

- Cons: Expensive fees, less favorable exchange rates, and longer processing times (typically 3-5 business days).

- Fees: Bank wire transfer fees are typically high. For example:

- Bank of America charges $45 USD for USD wire transfers.

- Chase charges $40 USD for online USD wire transfers, or $50 USD in-branch.

- In addition to fixed fees, banks add significant margins to exchange rates for profit.

2. Bank Draft

A bank draft is a more traditional remittance method, similar to a check guaranteed by the bank.

- Pros: Extremely secure, as funds are locked by the bank upon issuance.

- Cons: The process is very slow. You need to purchase the draft from the bank, mail it internationally to the recipient, who then deposits it into their bank. The entire process can take weeks.

- Use Case: This method is now uncommon, suitable only for situations with no time constraints but high security requirements.

This guide aims to clarify your options. In summary, online platforms have a clear advantage in the personal remittance market, while banks maintain their position for large and traditional transactions.

Understanding True Remittance Costs

The total cost of a remittance is not just the number you see on the payment page. It consists of two parts: explicit transfer fees and hidden exchange rate margins. Understanding both is key to saving money.

Surface Costs: Transfer Fees

Transfer fees are the fixed or percentage-based fees charged by the service provider for processing your transaction. These fees vary widely.

Quick Comparison: Sending $500 USD can have vastly different fees depending on the channel.

- Traditional Banks: Fees typically range from $25 to $50 USD.

- Online Remittance Services: Fees generally range from $5 to $15 USD.

Some platforms offer “zero-fee” promotions to attract users. For example, Taptap Send and WorldRemit may waive transfer fees under specific conditions, and Western Union offers zero-fee transfers for new customers. However, this doesn’t mean the remittance is entirely free.

Hidden Costs: Exchange Rate Margins

This is the true “hidden cost.” Most banks and some remittance services profit by offering an exchange rate below the market standard. This margin is the extra money you pay.

- Mid-Market Exchange Rate: The “real” rate used by banks and large financial institutions for currency transactions, available on Google or Reuters.

- Service Provider Rate: The rate offered by the service provider, typically including a markup over the mid-market rate.

For example, Wise is known for using the real mid-market exchange rate without any markup, charging only a transparent service fee. In contrast, many providers with low fees profit through exchange rate margins, as Western Union states, “Western Union makes money from currency exchange”.

Calculating Total Cost

To find the most cost-effective deal, you must calculate the total cost. A simple formula is:

Total Cost = Transfer Fee + (Exchange Rate Margin × Transfer Amount)

Manual calculations are tedious. Fortunately, you can use online comparison tools to do the work.

| Recommended Tool | Description |

|---|---|

| RemitAnalyst | A free online comparison tool that compares fees and exchange rates in real-time, calculating the final amount received, including all hidden costs. |

User feedback confirms the value of these tools. Freelancer Priyanka B. said it helped her easily compare fees and secure the best exchange rate, while PhD student Hasita K. praised it for saving significant time comparing rates. Spending a minute using such tools before each transfer ensures your money is well spent.

Step-by-Step Remittance Guide

Image Source: unsplash

After understanding the pros and cons of different methods, the actual process is quite simple. Modern online platforms streamline complex international remittances into a few clear steps. This step-by-step guide will walk you through the process using a mainstream online platform as an example.

Register and Verify Your Account

First, you need to create an account on your chosen remittance platform (e.g., Remitly or Wise). This typically requires only your email and password. To comply with financial regulations and ensure fund security, the platform will require identity verification.

Tip: Prepare your identity documents in advance to speed up the verification process.

Typically, you’ll need to provide one or more of the following to verify your U.S. residency:

- Primary Identification: Such as a driver’s license, state-issued ID, or passport.

- Secondary Documents: In some cases, a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Non-Citizen Proof: If you’re not a U.S. citizen, a permanent resident card (green card) or a foreign passport with a valid visa.

Create a Remittance Order

Once verified, you can start creating your first transfer.

- Enter Amount: Log into your account and input the USD amount you wish to send. The system will automatically display the Bangladeshi Taka (BDT) amount the recipient will receive and the real-time exchange rate.

- Select Recipient Method: Choose the fund receipt method based on the recipient’s convenience, such as bank deposit, cash pickup, or mobile wallet deposit.

- Choose Payment Method: Select how you’ll pay for the transfer. Common options include:

- Bank Debit (ACH)

- Debit or credit card

- Apple Pay / Google Pay

Note that platforms impose transfer limits. For example, Remitly allows up to $100,000 per transaction, but specific limits may vary based on the recipient country and payment method.

Enter Recipient Information

This is the most critical step to ensure funds arrive accurately. Carefully verify information to avoid delays or failures due to spelling errors. For bank transfers, you typically need to provide the following:

| Required Information | Format Requirements |

|---|---|

| Recipient’s Full Name | Must exactly match the name on their bank account |

| Bank Name | E.g., Dutch-Bangla Bank |

| Branch Name and Region | Specific branch information of the recipient’s bank |

| Bank Account Number | Up to 17 digits |

Pay and Track the Transfer

After filling out all information and confirming its accuracy, you can complete the payment. Upon successful payment, you’ll immediately receive a notification with a confirmation number or transaction ID.

You can use this number to track the transfer status in real-time on the platform’s website or mobile app. Most services, like WorldRemit, notify you and the recipient via email or SMS at key stages (e.g., sent, processing, available for pickup). This makes the process transparent and reassuring, concluding this remittance guide.

Key Guidelines for Ensuring Fund Security

While enjoying the convenience of online remittances, ensuring fund security is critical. By following these key guidelines, you can effectively reduce risks and ensure every dollar reaches its destination safely.

Verify Platform Credentials

Choosing a legitimate and compliant platform is the first line of defense for fund security. Reputable remittance companies must comply with strict federal and state regulations in the USA.

Important Note: A trustworthy platform never hesitates to display its regulatory information.

You should know that remittance services operating in the USA are primarily regulated by the following authorities:

| Authority Type | Name | Responsibilities |

|---|---|---|

| Federal | Financial Crimes Enforcement Network (FinCEN) | Oversees anti-money laundering compliance for Money Services Businesses (MSBs). |

| State | State Banking or Financial Regulators | Issue licenses and regulate remittance services operating within their state. |

| Federal | Consumer Financial Protection Bureau (CFPB) | Ensures financial companies treat consumers fairly, protecting your rights. |

For example, companies like Paysend are licensed by relevant regulators in each U.S. state where they operate. You can usually find license information at the bottom of these platforms’ websites and verify it on your state’s regulatory agency website.

Protect Personal Information

Your personal information and account security are equally important. Adopt good security habits.

- Create Strong Passwords: Set a complex password for your remittance account with letters, numbers, and symbols.

- Avoid Public Networks: Refrain from using public Wi-Fi for remittance operations, as these networks are more vulnerable to hacking.

- Safeguard Login Information: Never share your account password or security question answers with anyone.

Carefully Verify Recipient Information

A single spelling error can lead to delays or transfer failures. Before clicking “Send,” double-check all recipient information.

Ensure the recipient’s name exactly matches the name on their bank account. A single letter difference could cause the bank to reject the deposit.

Verify that the bank name, branch information, and account number are accurate. Copying and pasting this information, rather than typing it manually, can effectively reduce errors.

Beware of Remittance Scams

Scammers often exploit people’s goodwill and urgency. Stay vigilant about remittance requests, especially those from unofficial channels. Using unregulated channels risks not only financial loss but also potential legal violations.

- Impersonation Scams: Scammers pose as family or friends, claiming emergencies to urge immediate transfers.

- Phishing: You may receive fake emails or texts that appear legitimate, tricking you into entering account details on fraudulent websites.

- Fake Investments: Scammers promise high investment returns to lure you into sending money to designated accounts.

- Lottery Scams: You’re notified of a prize but asked to pay a “processing fee” or “tax” first.

If you suspect a scam, stop the transaction immediately and report it to U.S. authorities. You can file complaints with:

- Federal Trade Commission (FTC): Submit via its official fraud reporting website.

- Consumer Financial Protection Bureau (CFPB): File a complaint if the issue involves a financial service company.

The core message of this guide is clear: For personal remittances from the USA to Bangladesh, online platforms offer significant advantages in cost, speed, and convenience.

Remember, there’s no absolute best method, only the one best suited to your needs.

Make your decision based on your primary needs—whether saving money, speed, or specific recipient methods. Our final advice: Before each transfer, spend a few minutes comparing real-time fees and exchange rates on comparison websites to ensure you get the best deal.

FAQ

Are there limits on sending money to Bangladesh?

Yes, all platforms impose remittance limits. These depend on the service provider, your account verification level, and the payment method. For example, Remitly allows up to $100,000 per transaction. You can usually increase your transfer limit by completing higher-level identity verification.

What information does the recipient need to provide?

This depends on the receipt method.

- Bank Deposit: You need the recipient’s full name, bank name, branch information, and bank account number.

- Cash Pickup: You only need the recipient’s full name and phone number.

- Mobile Wallet: You need the phone number associated with the mobile wallet.

What if my transfer is delayed or canceled?

If there’s an issue with your transfer, contact the platform’s customer service immediately. Have your transaction confirmation number ready. They’ll help you check the status or process a refund. Most platforms offer 24/7 customer support via phone, email, or live chat.

What are the benefits of sending to a mobile wallet?

Sending to a mobile wallet (e.g., bKash) is highly convenient and fast.

- Funds arrive almost instantly.

- Recipients don’t need to visit a bank or pickup point.

- They can use the funds directly in the mobile wallet for bill payments or shopping, ideal for daily small transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.