- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Analysis of Santander Bank's Wire Transfer Service: Remittance Process, Fees, and Security

Image Source: unsplash

You can use Santander Bank’s wire transfer service to easily send funds to over 100 countries worldwide. The bank is committed to leveraging advanced technology to provide you with a secure and efficient transfer experience.

Santander Bank is one of the pioneers in applying blockchain technology. Its service (such as One Pay FX) has the potential to handle up to 50% of international payments, aiming to achieve faster and more transparent cross-border transfers.

This makes the international transfer process more modern, providing you with a reliable option.

Key Points

- Santander Bank offers global wire transfer services, allowing you to send money online or offline.

- Before transferring, you need to prepare the recipient’s complete information, including bank codes and account numbers.

- Wire transfer fees include transaction fees, intermediary bank fees, and exchange rate markups, with SEPA transfers being more cost-effective.

- Santander Bank uses multiple technologies to protect your funds, such as multi-factor authentication and blockchain technology.

- You should safeguard your account information, stay vigilant against scams, and contact the bank promptly if issues arise.

Santander Bank Wire Transfer Process

Image Source: unsplash

Completing an international wire transfer may sound complex, but with proper preparation, the process is very smooth. Below, we will break down each step of Santander Bank’s wire transfer service to help you complete the operation effortlessly.

Pre-Transfer Preparation

Before initiating a transfer, please ensure you collect and verify the following recipient information. Accurate information is key to ensuring funds arrive quickly and securely.

Tip: It’s recommended to store this information in a secure location and double-check it during input to avoid delays or failures due to errors.

List of recipient information you need to prepare:

- Recipient’s Full Name: Must match the name on the recipient’s bank account exactly.

- Recipient’s Complete Address: Including street, city, province/state, and country.

- Recipient’s Bank Information:

- Bank name and address.

- Bank SWIFT/BIC code (this is the international bank identification code, critical for the transfer).

- Recipient’s Account Number:

- For Europe, you typically need to provide the IBAN (International Bank Account Number).

- For Mexico, you need to provide the recipient’s 18-digit CLABE account number.

- For other countries, provide the standard bank account number.

- Routing Code: Some countries or banks may require additional routing codes; confirm with the recipient in advance.

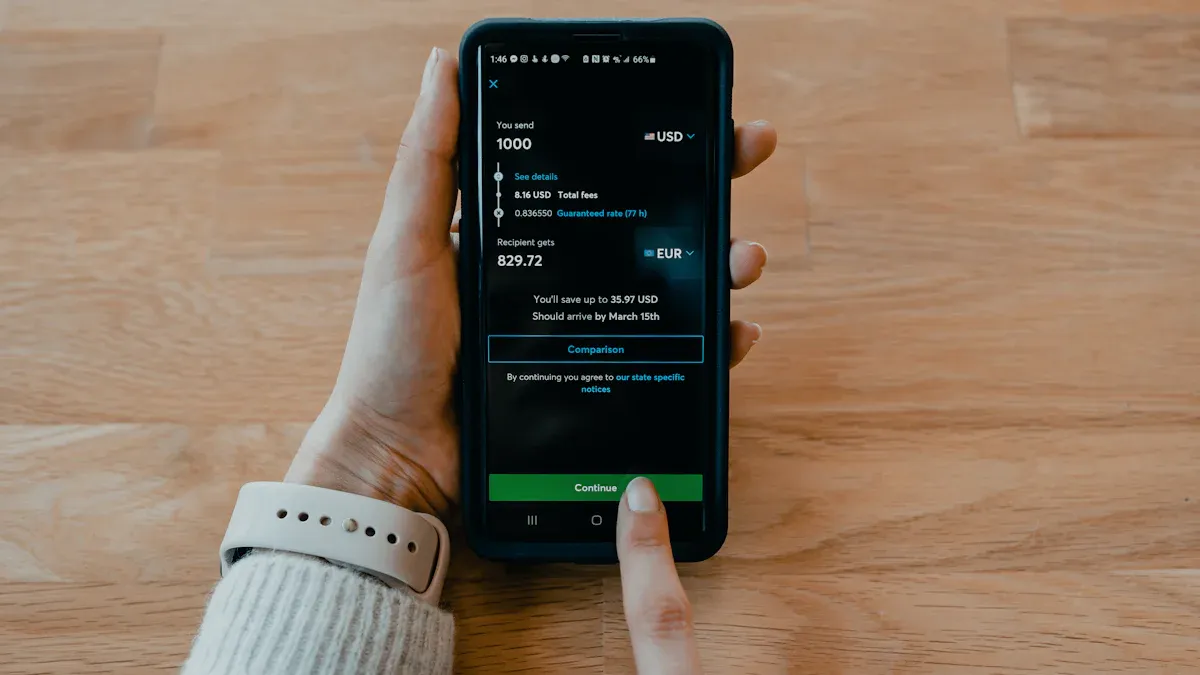

Online Banking and App Transfer Steps

Through Santander Bank’s online banking or mobile app, you can initiate transfers to over 100 countries without leaving home. The process is typically very intuitive.

Here is a general step-by-step guide for online transfers:

- Log into Your Account: First, log into your Santander Bank online banking or mobile banking app.

- Select Transfer Function: Navigate to the “Transfers & Payments” menu or a similar option, then select “International Transfer” or “Wire Transfer.”

- Enter Transfer Information: Input all the recipient information prepared earlier, including name, address, bank SWIFT code, and account number.

- Enter Transfer Amount: Specify the amount and currency you wish to send. The system typically displays estimated exchange rates and fees automatically.

- Review and Confirm: Before submission, the system will show a summary page of all details. Carefully review each detail and submit the transfer request once confirmed.

- Complete Verification: Depending on the bank’s security settings, you may need to complete final security verification via SMS code or app push notification.

In-Person Branch Counter Operations

If you’re not comfortable with online operations or need to send a large transfer, you can visit any Santander Bank branch to process the transfer.

Personal account holders can visit a branch to conduct international wire transfers. Simply bring your identification documents and the prepared recipient information, and bank staff will assist you in completing all forms and subsequent steps.

Note that Santander Bank’s official website does not explicitly state daily or per-transaction limits for international wire transfers conducted at branches. While in-person channels typically have higher limits, we recommend calling the bank’s customer service in advance to inquire about specific limit policies to ensure your transfer needs are met.

Transfer Processing and Delivery Time

After submitting the transfer, your main concern is when the funds will arrive. The processing time for international transfers is influenced by several factors.

- Currency and Cutoff Time: Different currencies have different processing speeds. For example, if you submit a euro or USD payment before the bank’s cutoff time, funds can typically arrive on the same business day. Non-urgent SEPA transfers (for the Eurozone) will arrive the next business day. If you miss the cutoff time, your transfer will be processed the next business day.

- Holidays and Weekends: International holidays and weekends are major factors affecting delivery time. Most countries’ banks do not operate on weekends, directly causing transfer delays. Additionally, note that weekend definitions vary by country (e.g., the UAE’s weekend is Friday and Saturday). If the recipient’s country has a bank holiday during the transfer process, funds will also be delayed.

Therefore, when planning a transfer, please account for these potential delays, especially for time-sensitive funds.

Wire Transfer Fee Structure and Cost-Saving Tips

Understanding the fee structure is crucial when making international transfers. This helps you estimate total costs and find the most economical transfer method. Santander Bank’s wire transfer fee structure is relatively transparent, but the total cost typically consists of several components.

Fee Components Explained

When you pay for an international wire transfer, the amount deducted from your account may include more than just the transfer principal and a fixed fee. Your total cost typically includes the following components:

- Transfer Fee: This is the service fee Santander Bank charges directly for processing your transfer request.

- Intermediary Bank Fees: If your funds need to pass through one or more intermediary banks to reach the final recipient bank, these banks may charge a pass-through fee, deducted from your transfer principal.

- Exchange Rate Markup: This is a “hidden” cost that may arise during currency conversion.

The exchange rate provided by the bank is typically not the real-time market rate (mid-market rate) you find online. The bank adds a markup (typically around 2%-4%) to profit, meaning the amount of foreign currency you receive is slightly less than calculated at the market rate.

Specific Fee Standards

Santander Bank has different fee standards for different types of wire transfers. Understanding these standards helps you choose the most suitable transfer path for your needs.

For a standard international wire transfer (via the SWIFT network), Santander Bank typically charges a fixed fee.

- International Wire Transfer Fee: $30 per transaction.

This fee is independent of the transfer amount, whether you send $500 or $10,000.

However, please note that the final cost may vary depending on the currency used and the transfer destination. For example, when transferring in foreign currencies, in addition to the $30 fee, you need to consider the exchange rate markup and potential intermediary bank fees mentioned above.

How to Effectively Save on Fees

While international transfers inevitably incur fees, choosing the right transfer method can significantly reduce costs.

Tip 1: Prioritize SEPA Transfers (If Applicable)

If your recipient is in a Eurozone country (e.g., Germany, France, Spain), SEPA (Single Euro Payments Area) transfers are your most economical option. Compared to standard international SWIFT wire transfers, SEPA transfers have much lower fees.

Refer to the table below for a clear comparison of the fee differences:

| Payment Type | Santander Bank Fee | Applicable Scope |

|---|---|---|

| Standard International Payment (SWIFT) | $30 | Most countries worldwide |

| SEPA Payment (Non-Urgent) | $0 | Eurozone countries |

As you can see, choosing the SEPA path can directly save you $30 in fees. Additionally, per regulations, recipient banks cannot charge extra fees for SEPA receipts, further ensuring the full amount reaches the recipient.

Tip 2: Compare Total Costs Comprehensively

When initiating a transfer, don’t focus solely on the bank’s advertised “low fees” or “zero fees.” You need to combine transaction fees and exchange rate markups to calculate your total cost. Sometimes, an institution with lower fees may offer a less favorable exchange rate, resulting in higher overall costs.

Fund Security and Technological Advantages

Image Source: unsplash

When making international transfers, fund security is the top priority. Santander Bank not only employs traditional security measures but also embraces cutting-edge technology to provide dual protection.

Multi-Layered Technical Security Measures

Your account security is the bank’s first line of defense. Santander Bank protects your information through multiple methods.

- Multi-Factor Authentication (MFA): When logging in or transacting, the bank requires secondary verification via SMS or app push notifications.

- Biometric Technology: You can use fingerprint or facial recognition for quick and secure mobile banking logins.

- Security Monitoring: The bank’s system continuously monitors account activity to promptly detect and alert you to potential unauthorized transactions.

Blockchain Technology Application

Santander Bank is a pioneer in applying blockchain technology. Its international payment service, “OnePay FX, is built on Ripple’s xCurrent technology.” This technology aims to revolutionize the traditional wire transfer experience.

Santander Bank’s innovation director has stated that blockchain technology is applied to meet consumer expectations for more convenient and frictionless international payments.

Compared to traditional wire transfers, which take 3-5 days, blockchain technology brings significant improvements:

- Near-Real-Time Speed: By reducing intermediary steps, transaction processing time is shortened from days to seconds.

- Higher Transparency: You can track funds in real time, with clear visibility of fees, exchange rates, and estimated delivery times.

- Enhanced Security: Transactions recorded on the blockchain are immutable, ensuring secure and reliable fund transfers.

User Security Operation Recommendations

While the bank provides technical safeguards, you also need to enhance your personal security awareness. Please follow these recommendations to protect your account.

1. Protect Your Account Credentials

- Set Strong Passwords: Regularly change your password and avoid using easily guessed information like birthdays or phone numbers.

- Never Share Information: Do not share your one-time verification codes or full passwords with anyone, as even bank staff will not request this information.

- Beware of Scam Emails: Cybercriminals may impersonate the bank to send fake security alerts, tricking you into clicking malicious links.

Scam Email Example

My Name is Mr. Angel Santodomingo, the CFO & Executive Director, of Santander Bank UK, Plc, There is a deal worth of the sum of $85,000,000.00.USD… I am proposing to Make this transfer to any preferable account of yours… our sharing rates shall be 50% for me while 50% for you.

If you receive such an email, delete it immediately and do not reply or click any links.

2. Identify Common Transfer Scams

- Shopping Scams: Be cautious of sellers requesting advance payment for unseen goods.

- “Safe Account” Scams: If someone posing as the bank or police claims your account is at risk and asks you to transfer funds to another “safe account,” it’s definitely a scam.

Issue Resolution and Customer Support

If you encounter issues during the transfer process, don’t panic. Follow these steps:

- Transfer Delays: Check the transfer’s reference number and status on the “Transaction History” page in online banking or the app. If the funds haven’t arrived after a long time, contact customer service immediately with the reference number, and they can track the funds for you.

- Incorrect Information: If you notice errors in the recipient information, contact Santander Bank immediately. While recalling a sent wire transfer is very difficult, the bank will do its best to assist you in contacting the recipient bank to attempt recovery. The sooner you act, the higher the success rate.

Comprehensive security technology combined with your cautious operations ensures a more secure experience with Santander Bank’s wire transfer service.

Santander Bank’s wire transfer service offers a convenient, advanced, and transparent option. Based on your specific needs, you can choose the most suitable transfer method.

Pursuing Low Costs: If sending euros to Eurozone countries, SEPA transfers are your ideal choice. Pursuing Efficiency and Global Coverage: Standard wire transfers meet your needs for sending to most countries worldwide.

For the most accurate fee and process information, we recommend visiting Santander Bank’s official website or contacting their customer service team directly.

FAQ

Do transfer fees vary with the amount?

When you make a standard international wire transfer, Santander Bank charges a fixed fee. This fee is $30, regardless of the transfer amount. The fee remains the same whether the amount is large or small.

Are there limits on online transfers?

Yes, online transfers typically have daily limits. Specific limits may vary depending on your account type and security settings. You can check your personal limit on the transfer page in online banking or contact customer service for the most accurate information.

How do I track my transfer status?

You can log into online banking or the mobile app. On the “Transaction History” page, you can find the transfer’s reference number and current status. If you need further assistance, provide the reference number to customer service, and they will check the detailed progress for you.

Can I initiate a wire transfer by phone?

Typically, you cannot initiate a new international wire transfer directly by phone. Santander Bank primarily offers three channels: online banking, mobile app, and in-person branch counters. Phone customer service is mainly for inquiries and resolving transfer issues.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.