- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Is the Customer Service Experience of Remitly? Remittance Advantages and Answers to Common Questions

Image Source: pexels

You may be wondering what the Remitly customer service experience is truly like. Overall, user feedback is mixed.

Did you know? According to a Kimola report, approximately 40% of users express satisfaction with Remitly’s customer service. This data clearly reflects the dual nature of its service experience.

Remitly offers round-the-clock multilingual support, which is a significant advantage. However, the response speed of customer service is indeed a focal point of complaints for some users. Understanding these details can help you better evaluate whether it meets your needs.

Key Takeaways

- Remitly offers multiple remittance options, allowing you to choose between fast delivery or more cost-effective methods.

- Remitly’s transfer fees are low, and its exchange rates are competitive, helping you save on costs.

- Remitly’s customer service supports multiple languages and provides assistance 24/7.

- You can easily track your transfer status through Remitly’s app or website, ensuring funds arrive safely.

- Remitly supports transfers to over 170 countries worldwide and offers various receiving methods.

Remitly Customer Service Experience

Image Source: pexels

A comprehensive Remitly customer service experience involves multiple aspects. You need to understand its support channels, real user feedback, and the efficiency of customer service responses. This information can help you build a complete expectation.

Diverse Support Channels

Remitly provides multiple ways to contact customer service, ensuring you can always find help when needed.

- Live Chat: You can use the live chat feature through Remitly’s app or website. This is one of the fastest ways to resolve urgent issues.

- Phone Support: If you prefer direct communication, you can opt for phone support.

- Email: Suitable for handling complex issues that don’t require immediate responses.

- Help Center (Help Center): This is a comprehensive self-service database. You can find answers to common questions here without waiting for customer service.

Key Highlight: 24/7 and Multilingual Remitly’s customer service operates 24/7, including weekends. No matter when you encounter an issue, you can reach them. More importantly, the customer service team supports multiple languages, including English, Spanish, French, and Filipino, among over ten languages, greatly facilitating users from different countries and regions.

Real User Reviews

User reviews on public platforms are an important reference for evaluating the Remitly customer service experience. Data from various platforms reveal an interesting trend: users have mixed opinions about Remitly’s transfer features and customer service.

First, Remitly’s app has received high ratings across major app stores.

| Platform | Star Rating (Out of 5) |

|---|---|

| Apple App Store | 4.8 |

| Google Play | 4.6 |

| Trustpilot | 4.1 |

These high scores are primarily due to the strengths of its core remittance services. Many positive reviews focus on the following aspects:

- Fast Transaction Speed: Funds arrive quickly, especially with the Express service.

- User-Friendly Interface: The app and website are intuitively designed and easy to use.

- Transparent Fees: Fees and exchange rates are clearly displayed with no hidden charges.

- Competitive Exchange Rates: Offers favorable rates, helping users save costs.

However, negative feedback about the Remitly customer service experience also exists on review sites like Trustpilot. Complaints mainly center on cumbersome account verification processes, transfers being paused due to compliance issues, and long wait times when contacting customer service.

Customer Service Response Efficiency

Customer service response efficiency is a key factor affecting the overall Remitly customer service experience. While Remitly promises 24/7 support, the actual response speed can vary.

Based on user feedback, when using live chat or phone support, you may connect immediately or have to wait in a queue, especially during peak business hours. For users needing urgent resolution of fund-related issues, this uncertainty can sometimes be frustrating.

Practical Tips

- Non-Urgent Issues: It’s recommended to first visit the Help Center or contact customer service via email. This allows you to systematically describe your issue and receive detailed written responses.

- Urgent Issues: Use live chat or phone support directly. Prepare your transaction details and personal information in advance so customer service can quickly locate and resolve your issue.

In summary, Remitly’s customer service system is comprehensive, but the consistency of response efficiency could use improvement.

Remitly’s Core Remittance Advantages

Image Source: unsplash

Beyond customer service, Remitly’s true appeal lies in its robust and flexible remittance features. When you need to send money to family or friends overseas, speed, cost, and security are the three key factors you care about most. Remitly offers highly competitive solutions in these areas.

Two Speed Options

Remitly provides two different transfer speed options, allowing you to choose the best one based on your urgency and budget.

- Express Service: If you need funds to arrive instantly, this is your go-to option. Paid via debit or credit card, transfers can reach the recipient almost immediately. This option is ideal for urgent situations. However, its fees may be slightly higher, or the exchange rate may not be as favorable as the Economy option.

- Economy Service: If time is not a pressing concern, this option helps you save more. Funds are typically paid through a bank account and take 3 to 5 business days to arrive. In return, you usually get lower fees and better exchange rates.

How to Choose?

- Choose Economy Service: When making regular transfers (e.g., living expenses) and time is not critical, this is a cost-effective choice.

- Choose Express Service: When your family urgently needs funds or you want the money to arrive immediately, the Express service is a more reliable option.

Transfer Limit Tiers

To meet diverse user needs and comply with financial regulations, Remitly sets tiered transfer limits. You can start sending money with minimal information and provide additional details to increase your limits as needed.

Here are Remitly’s standard limit tiers, using USD as an example:

| Verification Tier | Daily Sending Limit (USD) | 30-Day Sending Limit (USD) |

|---|---|---|

| Tier 1 | $2,999 | $10,000 |

| Tier 2 | $6,000 | $20,000 |

| Tier 3 | $10,000 | $30,000 |

To upgrade from Tier 1, you may need to provide additional information, such as your Social Security Number (SSN) and a government-issued photo ID. To apply for the higher Tier 3 limit, Remitly may require proof of funds, such as bank statements or pay stubs.

Fees and Exchange Rates

Fees and exchange rates are the two key factors determining the total cost of a transfer. Remitly demonstrates high transparency and competitiveness in this regard.

First, Remitly’s fee structure is clear and straightforward. Before confirming a transfer, it clearly displays the fees you’ll pay. On many popular transfer routes, its fees are very low. For example, when sending $1,000 USD or more from the U.S. to Mexico, both Express and Economy services have a fee of $0 USD.

Second, regarding exchange rates, Remitly earns a profit by adding a small markup to the market mid-rate. This markup typically ranges from 1% to 3%, covering its operational costs. While this means you won’t get the real-time market mid-rate, Remitly’s overall cost remains highly competitive.

Cost Advantage According to Finzc’s evaluation data, in over 70% of comparisons, Remitly is one of the cheapest options for international transfers. This is due to its low fees and competitive exchange rates.

Full Transfer Tracking

In international transfers, not knowing where your funds are can be the most unsettling feeling. Remitly eliminates this concern with its robust full tracking feature, keeping you informed about every step of the transfer.

After initiating a transfer, both you and the recipient receive real-time status updates.

- For the Sender: You can track the transfer status in real-time through Remitly’s app or website, with statuses like “In Progress,” “Pending Pickup,” or “Delivered.” You’ll receive an immediate mobile notification or email when the funds are successfully delivered to the recipient.

- For the Recipient: The recipient also receives notifications informing them when the funds are available for pickup or have been deposited into their account.

Many users praise this feature for being intuitive and user-friendly. Even if you’re not tech-savvy, you can easily track your funds’ movement. This complete transparency provides great peace of mind, ensuring your hard-earned money is safely and accurately delivered to your family.

Remitly’s Global Remittance Network

A robust global network is the cornerstone of an international remittance service. Remitly excels in this area, offering extensive coverage and great flexibility to ensure your funds can be sent safely and conveniently worldwide.

Extensive Service Countries

Remitly’s remittance network is vast. You can use it to send money from over 20 countries, including the U.S., Canada, and the U.K., to more than 170 countries and regions worldwide. This broad coverage means that, whether your family or friends are in Asia, Africa, Europe, or Latin America, you’re likely to find a corresponding transfer destination, such as the Philippines, Mexico, India, and mainland China.

Multi-Currency Support

Remitly supports over 100 currencies, providing greater flexibility for your international transfers. In addition to supporting major fiat currencies like USD, EUR, and GBP, Remitly is actively exploring the use of digital currencies, staying at the forefront of the industry.

This forward-thinking approach means you may enjoy more efficient and cost-effective cross-border payment experiences in the future.

Flexible Receiving Methods

Remitly understands that recipient convenience is equally important. Therefore, it offers multiple flexible receiving methods, allowing your family or friends to choose the most convenient option for their situation.

- Bank Deposit: Funds can be deposited directly into the recipient’s bank account, such as a licensed bank account in Hong Kong. This is one of the safest and most common receiving methods.

- Cash Pickup: Recipients can pick up cash at one of Remitly’s tens of thousands of partner locations worldwide (e.g., banks, supermarkets) with valid identification.

- Mobile Money: In countries where mobile payments are prevalent, funds can be transferred directly to the recipient’s mobile wallet, offering convenience and speed.

- Home Delivery: In some regions, Remitly even offers cash home delivery, providing significant convenience for recipients with limited mobility.

These diverse options ensure that, no matter where the recipient is, there’s a way for them to receive your support easily.

Overall, Remitly excels in its remittance features, offering fast, low-cost, and transparent services. However, the Remitly customer service experience is mixed, with response speed variability being a factor to consider.

Strong Growth Momentum Remitly’s rapid growth demonstrates its market competitiveness:

- For the 12 months ending December 31, 2024, annual revenue grew by 33.85%.

- In the fourth quarter of 2024, annual revenue increased by 35.12%.

Ultimately, you’ll need to weigh its strong remittance advantages against potential customer service delays to determine if it’s the best choice for your needs.

FAQ

Here, we’ve compiled some of the most common questions about Remitly to help you find answers quickly.

Is Remitly Safe for Transfers?

Remitly is a government-regulated financial service company. It uses security technologies like data encryption to protect your personal information and funds. You can rest assured that your transfers are well-protected.

What Should I Do If My Transfer Is Paused?

If your transfer is paused, first check your email. Remitly typically sends an email explaining the reason and next steps. You can also prepare your transaction details and contact customer service directly for assistance.

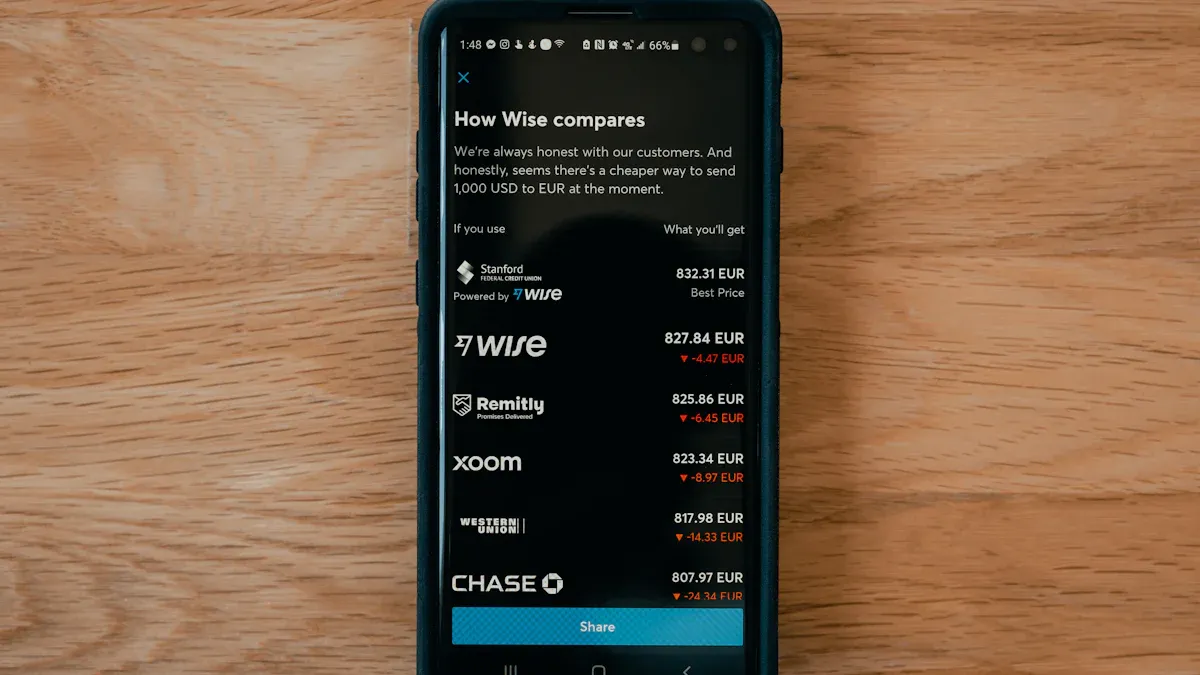

Is Remitly Always the Cheapest Option?

Remitly is highly competitive on many routes but isn’t always the cheapest. Fees and exchange rates fluctuate in real-time. To get the best deal, it’s recommended to compare options before each transfer.

Can I Cancel an Ongoing Transfer?

Yes, as long as the transfer hasn’t been completed, you can cancel it. Log in to your account, find the transaction in “Transfer History,” and select cancel. The refund will be returned to your payment account.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.