- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Transferring Money from the Philippines to the United States: Amount Limits, Remittance Methods, and the Best Options

Image Source: unsplash

When you plan to transfer money from the Philippines to the USA, you need to understand one key piece of information. Single transactions typically have a $10,000 limit, but there is no legal cap on the total amount you can send.

You may be looking for the one “best” remittance method, but in reality, there isn’t one.

Your best option depends entirely on your personal needs. Do you prioritize low fees, high speed, or ease of use? These factors will determine the most suitable solution for you.

Key Takeaways

- Transferring money from the Philippines to the USA typically has a $10,000 limit per transaction, but there is no legal cap on the total amount.

- Online remittance platforms are often the best choice, offering low fees, good exchange rates, and fast speeds.

- For fast transfers, online remittance platforms and digital wallets are the best methods.

- If the recipient in the USA does not have a bank account, cash remittance companies like Western Union or MoneyGram can be used.

- Before transferring, prepare identification documents and compare real-time exchange rates and total fees across different services.

Detailed Explanation of Transfer Limits

When preparing to transfer money from the Philippines to the USA, understanding the amount limits is a crucial step. These regulations are not meant to restrict you but to ensure the safety of the financial system and prevent illegal activities like money laundering. Understanding these rules can make your remittance process smoother.

Single Transaction Limits

You may have heard that a single transaction cannot exceed $10,000. This is generally a common guideline. In reality, the Bangko Sentral ng Pilipinas (BSP) has more detailed regulations. These rules vary depending on the type of transaction and whether the sender is an individual or a business.

Note: The following limits are based on BSP’s foreign exchange transaction regulations and apply to transactions conducted through authorized institutions like banks.

To give you a clearer understanding of the official limits, refer to the table below, which details the daily foreign currency purchase limits:

| Transaction Type | Individual Limit (Daily) | Business/Other Entity Limit (Daily) | Notes |

|---|---|---|---|

| Purchase of foreign currency for non-trade current account transactions | $500,000 | $1,000,000 | Requires a completed foreign exchange purchase application form |

| Purchase of foreign currency for non-trade current account transactions (over limit) | Over $500,000 | Over $1,000,000 | Requires additional supporting documents |

| Carrying Philippine Pesos in/out of the Philippines | Approx. $900 (equivalent to 50,000 PHP) | Approx. $900 (equivalent to 50,000 PHP) | Amounts exceeding this require BSP written authorization |

| Carrying foreign currency in/out of the Philippines | $10,000 equivalent | $10,000 equivalent | Amounts exceeding this require written declaration |

The term “non-trade current account transactions” may sound complex, but it actually covers many common needs, such as paying for tuition in the USA, medical expenses, or travel costs.

Large and Multiple Transfers

If you need to transfer funds exceeding the single transaction limit, there’s no need to worry. The law does not prohibit sending large amounts. The most common and legal method is to split the transfer into multiple transactions below the limit, completed over a few days. For example, if you need to send $50,000, you can divide it into several transactions below the limit over a few days.

Important Reminder: Large or multiple transfers are entirely legal. Banks or remittance institutions may require proof of the source of funds and report the transactions as required. This is a standard compliance process, and as long as your funds are legitimate, there’s no need to worry excessively.

Banks and financial institutions are obligated to report certain types of transactions to the Philippine Anti-Money Laundering Council (AMLC). This does not mean your transaction is problematic; it’s part of regulatory requirements. Understanding which transactions are reported can help you prepare better.

| Report Type | Trigger Amount/Condition |

|---|---|

| Currency Transaction Report (CTR) | Cumulative daily cash transactions exceeding approx. $9,000 (500,000 PHP) |

| Suspicious Transaction Report (STR) | No amount limit, but suspicious transaction behavior (e.g., inconsistent with your financial profile) |

| Cross-Border Fund Transfer Report | Carrying or shipping cash exceeding $10,000 across borders |

| Remittance and Fund Transfer Service Report | Transactions exceeding approx. $9,000 (500,000 PHP) |

| Virtual Asset Service Provider (VASP) Report | Virtual asset transactions exceeding approx. $9,000 (500,000 PHP) |

Special Rules for Cash Transfers

While electronic transfers are the norm, some may consider carrying cash across borders. The Philippine Customs Service has strict regulations for this. If you plan to carry large amounts of cash, you must comply with the following rules:

- Declaration Threshold: Any individual carrying cash or negotiable instruments (e.g., traveler’s checks) exceeding $10,000 (or equivalent in other currencies) out of the country must declare it.

- Declaration Method: You need to complete a Foreign Currency Declaration Form before departure. You can also use the electronic Customs Declaration Form (e-CDF).

- Obtaining Forms: You can request a paper form from customs officials at the airport or download it from the Bangko Sentral ng Pilipinas (BSP) website.

Safety Warning: We strongly advise against carrying large amounts of cash for international travel. This not only poses significant risks of loss or theft but, if not properly declared, could lead to cash confiscation and legal penalties. Choosing regulated electronic remittance services is a safer and more efficient option.

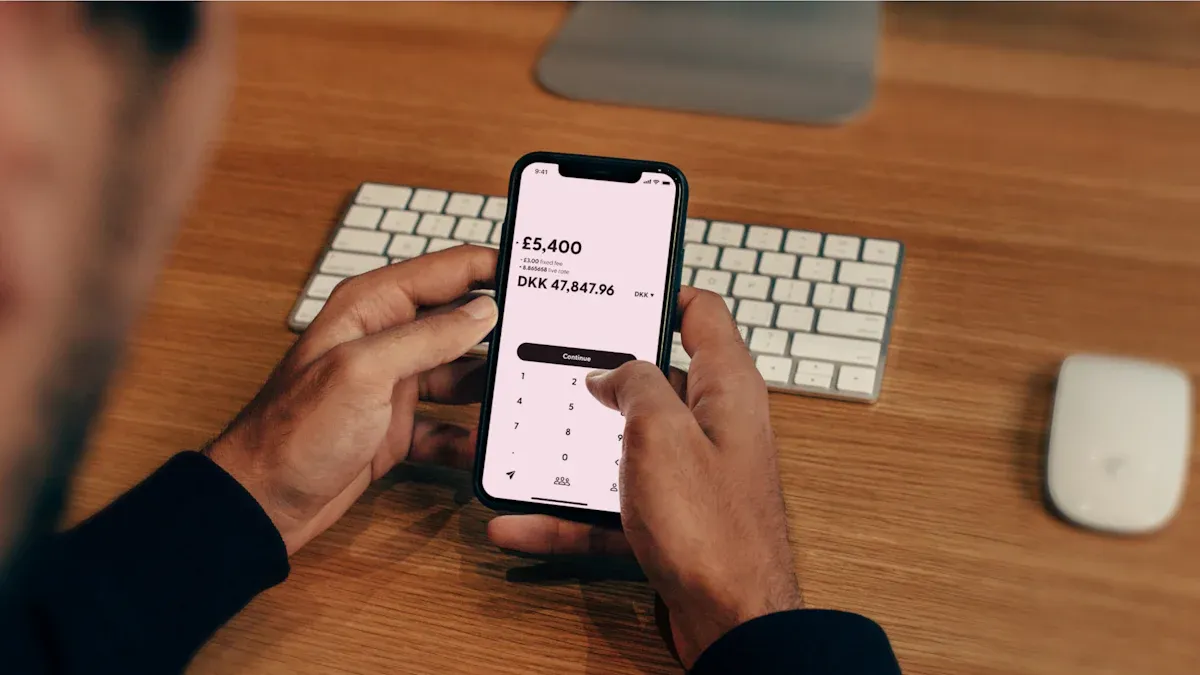

Transfer Methods from Philippines to USA: Comparison

Image Source: unsplash

Choosing the right remittance method can save you time and money. Each method has its unique pros and cons, and understanding them can help you make an informed decision. Below, we compare the main methods for transferring money from the Philippines to the USA.

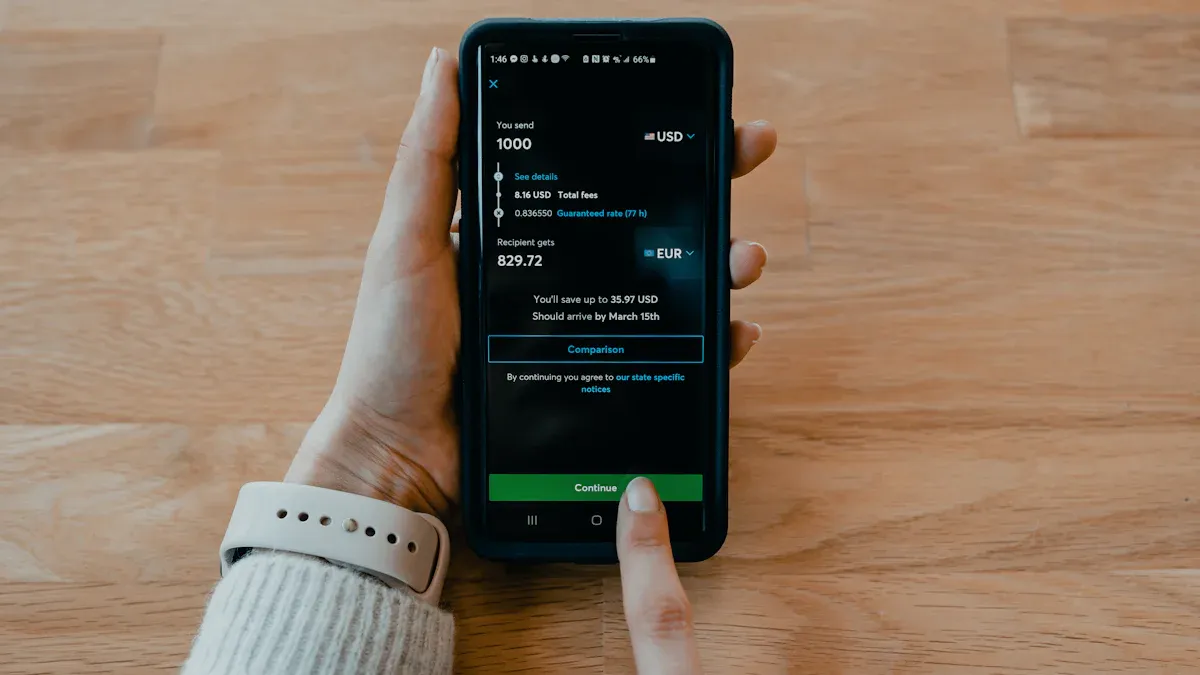

Online Remittance Platforms

If you prioritize cost-effectiveness and speed, online platforms (e.g., Wise, WorldRemit) are often the best choice.

Their biggest advantage is transparent fees and fair exchange rates. They typically use near-market mid-market rates (e.g., 1 PHP ≈ 0.01706 USD) and clearly list all fees with no hidden markups. For large transfers exceeding $25,000, some platforms offer fee discounts.

- Advantages: Low fees, good exchange rates, fast speed (as quick as a few minutes).

- Disadvantages: Requires both you and the recipient to have bank or digital accounts.

Traditional Bank Wire Transfers

For large sums or business transactions, wire transfers through major international banks are one of the safest options.

Banks provide robust security and clear transaction records, giving you peace of mind. However, this reliability comes at a cost.

- Advantages: Extremely secure, ideal for large transfers.

- Disadvantages: Expensive fees (often including handling fees and cable charges), long processing times (3-5 business days), and typically poor exchange rates.

Cash Remittance Companies

If your recipient in the USA does not have a bank account, cash remittance companies (e.g., Western Union, MoneyGram) are a viable option.

They have extensive global agent networks, allowing recipients to conveniently pick up cash at nearby locations.

- Advantages: Supports cash pickup, extensive network, no bank account required.

- Disadvantages: Typically the highest fees and worst exchange rates among all options.

Digital Wallet Cross-Border Transfers

For small, frequent transfers, using local Philippine digital wallets (e.g., GCash, PayMaya) is highly convenient.

You can complete the process directly through a mobile app, making it simple and fast. This method is ideal for sending small amounts for living expenses to family or friends in the USA.

- Advantages: Extremely convenient, suitable for small transfers.

- Disadvantages: Typically has lower single and daily transfer limits, not suitable for large remittances.

Decision Guide for the Best Remittance Method

You’ve learned about different remittance methods, but how do you choose based on your specific situation? This guide will help you quickly find the best solution based on your most important needs.

Prioritizing Low Costs

If you want to maximize the amount received and minimize costs, this is your top priority.

Best Choice: Online remittance platforms (e.g., Wise, WorldRemit)

Online platforms are typically the most cost-effective option. Their biggest advantage is exchange rates very close to the market mid-rate, with transparent fees. In contrast, traditional bank international wire transfer fees can be as high as $45, not including hidden markups in the exchange rate.

Cash remittance services, while convenient, are also costly. The table and chart below clearly show the fee differences across services. You can see that bank international transfer fees are the highest.

| Service Type | Fees |

|---|---|

| Western Union (US cash deposit point to Mexico cash pickup) | $8 (fixed fee) |

| Western Union (via agent, sending $500 for cash pickup in Mexico) | $15 |

| Traditional Financial Institution (deposit at other institutions) | $2.50 |

| Traditional Financial Institution (using out-of-network ATM) | $2.50 |

| Traditional Financial Institution (international USD transfer) | $45 |

Therefore, if you’re cost-conscious, spending a few minutes comparing real-time exchange rates and total fees across online platforms can save you significant money.

Prioritizing High Speed

When you need funds to reach the USA quickly, time is everything.

Best Choice: Online remittance platforms or digital wallets

Many online remittance services can achieve near-instant transfers, with funds reaching the recipient’s bank account in minutes. Local Philippine digital wallets (e.g., GCash) are also very fast when transferring to partnered overseas services.

You should avoid traditional bank wire transfers. While secure, they are typically the slowest option, with funds taking 3 to 5 business days to arrive.

No Bank Account for Recipient

If your recipient in the USA does not have a bank account or prefers receiving cash, your choice is clear.

Only Choice: Cash remittance companies (e.g., Western Union, MoneyGram)

The biggest advantage of these companies is their extensive global agent network. Your recipient can pick up cash directly at any partnered location with identification and a pickup code, making the process very convenient and solving the issue of not having a bank account.

However, this convenience comes at a cost. Cash remittances typically have the highest fees and worst exchange rates. You’ll need to weigh convenience against cost.

Large Fund Security

When transferring large sums from the Philippines to the USA, security is your top concern. The good news is that both traditional banks and reputable online platforms offer robust security.

Reliable Choice: Traditional bank wire transfers or strictly regulated online remittance platforms

Traditional banks, with their long history and strict regulations, provide significant peace of mind for many. If you’re uneasy about newer platforms, bank wire transfers are a highly reliable option.

Meanwhile, modern online platforms like Wise have established multiple security mechanisms to protect your large funds. They are not banks but operate through a mechanism called “safeguarding”.

- Segregated Funds: They keep your funds separate from company operating funds, stored in top-tier commercial banks or secure government bonds. This means your money isn’t used for lending or investments and is always accessible.

- Additional Insurance: For US customers choosing certain features (e.g., interest), their USD balances may even be eligible for up to $250,000 in FDIC pass-through insurance through partner banks.

- Technical Safeguards: These platforms use two-factor authentication, end-to-end encryption, fraud prevention systems, and dedicated large transaction teams to ensure the safety of every transfer.

In summary, as long as you choose a legitimate service regulated by financial authorities (e.g., BSP), whether it’s a bank or an online platform, your large funds are well-protected.

Pre-Transfer Preparations and Considerations

Image Source: unsplash

Before clicking the “send” button, spending a few minutes on preparation can ensure your funds reach their destination safely and quickly. Understanding verification requirements and true costs are among the most critical steps.

Identity Verification Requirements (KYC)

When using a remittance service for the first time, you’ll need to complete a “Know Your Customer” (KYC) identity verification process. This is a legal requirement for all legitimate financial institutions to prevent money laundering and protect your account security.

You’ll need to prepare the following two types of documents:

- Identification Documents:

- Primary ID: Passport, driver’s license, or Unified Multi-Purpose ID (UMID).

- Secondary ID: SSS card, TIN card, or voter’s ID.

- Proof of Address Documents:

Tip: Preparing clear photos or scans of these documents in advance can significantly speed up your first transfer review process.

Checking and Locking Exchange Rates

The exchange rate directly determines how much money your recipient will ultimately receive. Don’t just rely on the rate displayed by the service provider; compare it to the “market mid-rate,” which is the real rate used between banks and major financial institutions.

You can use reliable online tools to check real-time exchange rates:

- Wise (formerly TransferWise): Offers a free currency converter showing real-time market mid-rates.

- Xe Currency Converter: A widely used exchange rate lookup tool for quick reference.

Some modern online platforms (e.g., Wise) also offer a “lock exchange rate” feature. This allows you to lock in a favorable rate when initiating a transfer, avoiding losses due to market fluctuations.

Identifying Hidden Fees

The total cost of a transfer isn’t just the stated handling fee. The biggest “hidden fee” often comes from unfair exchange rates.

Many banks and remittance services add a 1.7% to 3.5% markup to the market mid-rate as profit. This fee is often not explicitly disclosed.

For example: Suppose the market rate is 1 USD = 58 PHP. If you send $1,000, it should convert to 58,000 PHP. But if the bank adds a 3% markup, their rate becomes 1 USD = 56.26 PHP, and your recipient only receives 56,260 PHP, a difference of 1,740 PHP (about $30).

Additionally, when using bank wire transfers, you may encounter intermediary bank fees. These banks act as intermediaries in the transfer chain and may charge $15 to $50, deducted from your transfer amount.

When transferring money from the Philippines to the USA, keep in mind that single transactions typically have limits, but there is no cap on the total amount.

For most people, online remittance platforms offer the best balance of speed, cost, and convenience.

To ensure a smooth and efficient transfer process, take a few minutes before each transaction to:

- Compare real-time exchange rates and total fees across services.

- Prepare identification documents in advance.

FAQ

Do I need to pay taxes in the USA for money transferred from the Philippines?

Typically, money received from overseas is considered a gift and is not subject to income tax in the USA. However, if the amount is large (e.g., exceeding $100,000 annually), you may need to report the receipt to the IRS.

What’s the fastest way to transfer money from the Philippines to the USA?

Fastest Method: Online remittance platforms and digital wallets.

These services can typically transfer funds to the recipient’s bank account in minutes. In contrast, traditional bank wire transfers may take 3 to 5 business days.

Can I transfer more than $10,000 at once from the Philippines?

Yes, but it’s more complex. While there is no legal cap on the total amount, single transactions are typically limited. You can legally send large amounts by splitting them into multiple transactions. Banks or remittance institutions will require additional documents and report the transactions, which is standard procedure.

What if the recipient in the USA doesn’t have a bank account?

Best Choice: Use cash remittance companies like Western Union or MoneyGram.

These companies have extensive global agent networks. Your recipient can pick up cash at a nearby location with identification and a pickup code, making it very convenient.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.