- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Best Ways to Remit Money to Nepal and a Comparison of Fees

Image Source: pexels

When you need to send money to Nepal through a remittance, you’ll likely find that online platforms like Wise and Remitly are the best choices. These platforms typically offer better exchange rates, lower fees, and faster delivery times compared to traditional banks.

Remittances are crucial to Nepal’s economy. In 2023, remittance income accounted for 26.6% of its GDP, a figure that has consistently exceeded 20% since 2017.

Choosing the right service can save you money and time, making every transfer seamless.

Key Takeaways

- Online platforms are the best choice for sending money to Nepal. They typically offer better exchange rates and lower fees.

- Wise, Remitly, WorldRemit, and LemFi are popular online platforms. Each has unique advantages, such as transparent exchange rates, flexible delivery options, or low fees.

- Traditional bank wire transfers are suitable for large transfers. They offer high security but come with higher fees and slower speeds.

- Western Union is ideal for emergencies. It allows recipients to receive cash quickly, but fees are typically higher.

- The best remittance method depends on your needs. You should consider cost, speed, and transfer amount.

Overview of Remittance Methods

When preparing to send money to Nepal, you’ll find multiple options, each with its unique advantages and disadvantages. To help you make a quick decision, we start with a clear comparison table to provide a high-level overview of these mainstream methods.

Key Metrics Comparison Table

The table below summarizes the performance of different remittance methods across key metrics, giving you an intuitive understanding.

| Remittance Method | Average Fees | Exchange Rate Advantage | Delivery Time | Convenience | Security |

|---|---|---|---|---|---|

| Online Platforms (e.g., Wise, Remitly) | Low, especially for small amounts | Excellent, close to market rates | Fast, minutes to 1 business day | Very high, operable via mobile app | High, regulated by financial authorities |

| Bank Wire Transfer | High, often with fixed fees | Average, banks add exchange rate margins | Slow, typically 2-5 business days | Moderate, may require visiting a branch | Very high, ideal for large transfers |

| Western Union | High | Poor, noticeable exchange rate margins | Very fast, cash available instantly | High, many locations, supports cash pickup without an account | High, established remittance provider |

Key Note: No single method is the absolute “best”; the optimal choice depends on your specific needs.

To help you understand more clearly, here are some key points summarized:

- Online Remittance Platforms: If you prioritize cost and speed, these platforms are the top choice. They typically offer better exchange rates and lower fees, with transfers often completed in minutes. You can flexibly choose delivery methods, such as direct deposits to Nepalese bank accounts or cash pickup.

- Traditional Bank Transfers: If you need to send large amounts and prioritize security, bank wire transfers are a highly reliable option. While fees are higher and processing times longer, banks provide robust security for large fund transfers. International transfers via banks typically take one to five business days to arrive.

- Western Union: In emergencies, Western Union’s global network and rapid cash delivery shine. Even recipients without bank accounts can receive cash within minutes.

Comparison of Online Remittance Platforms

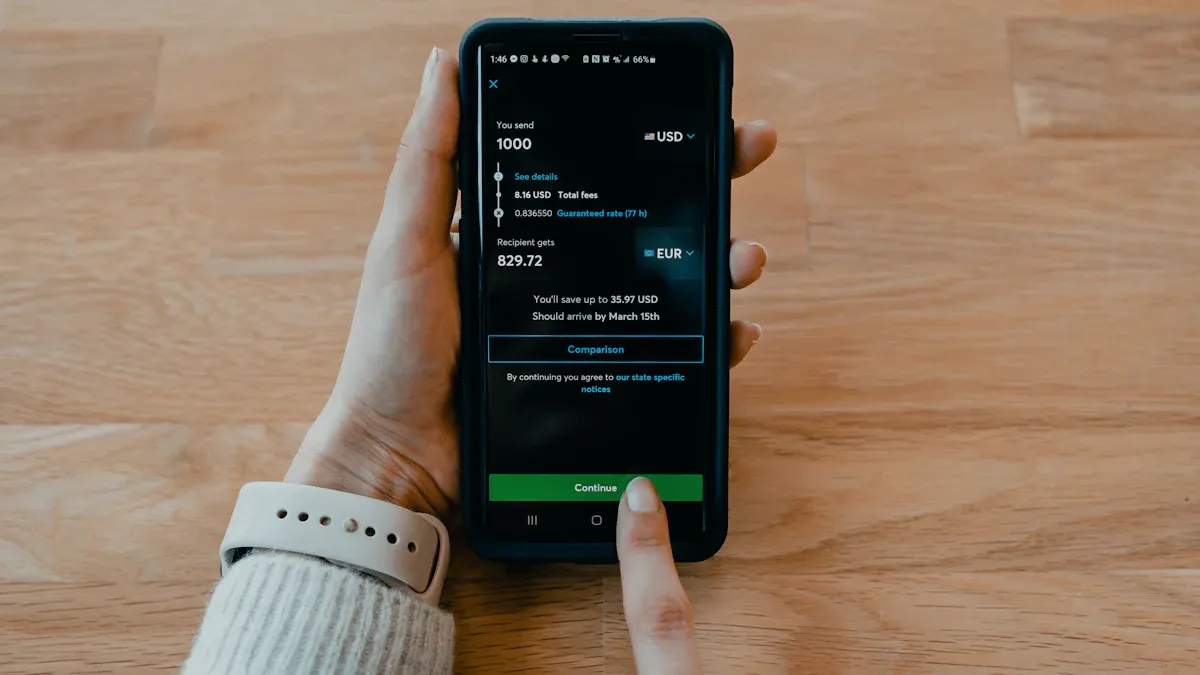

Image Source: unsplash

When sending money to Nepal, online platforms offer modern, efficient, and cost-effective solutions. These services operate entirely online, eliminating the overhead costs of traditional bank branches, enabling competitive exchange rates and lower fees. The process is typically straightforward, allowing you to complete all steps via a mobile app or website.

Next, we’ll dive into a detailed comparison of several major online platforms to help you understand their specific advantages.

Wise

Wise (formerly TransferWise) is renowned for its transparency and fairness. Its standout feature is using the mid-market exchange rate, the real rate you see on Google, without any hidden markups. Wise charges a clear, low upfront fee.

Wise Core Advantages:

- Transparent Exchange Rates: You get the real mid-market rate, fair and square.

- Low Fees: Clear fee structure with no hidden charges.

- Impressive Speed: Some transfers can complete in seconds.

To give you a clearer picture, here’s an example of the fees and speed for sending 1,000 USD from the U.S. to Nepal:

| Amount Sent (USD) | Transfer Fee (USD) | Exchange Rate (NPR/USD) | Estimated Arrival Time | Recipient Receives (NPR) |

|---|---|---|---|---|

| 1,000 | 16.19 | 140.770 (mid-market rate) | Within 9 hours | 138,491.00 |

Wise’s speed is equally impressive. Depending on the recipient’s bank, funds can arrive very quickly:

- Real-Time Delivery: Some transfers can reach the recipient’s account in as little as 15 minutes.

- Same-Day Delivery: Most transfers complete within the same business day.

How secure is Wise? You can fully trust Wise’s security. It is globally regulated and employs multiple measures to protect your funds:

- Customer Verification: Wise verifies all user identities to prevent fraud.

- Two-Factor Authentication (2FA): Your account and transfers are protected by 2FA.

- Fund Protection: Your funds are held in separate, top-tier bank accounts, completely isolated from Wise’s operational funds.

Remitly

Remitly is another highly popular choice, particularly known for its flexible delivery options and promotional offers for new users. It allows you to balance speed and cost.

- Express Option: Slightly higher fees, but funds typically arrive in minutes. Ideal for emergencies.

- Economy Option: Lower fees, but delivery takes 3-5 business days. Suitable for non-urgent, regular transfers.

This flexibility lets you tailor the service to your needs. For example, when sending money from the UAE to Nepal’s Nabil Bank, you can choose different services based on urgency.

New User Benefits Remitly often offers special promotions for first-time users sending to Nepal. For instance, during promotional periods, your first transfer up to 1,000 USD can enjoy a highly competitive special exchange rate. This is a great opportunity to save. These offers are typically limited to new customers’ first transfer.

WorldRemit

If your recipient’s situation varies, WorldRemit might be your best choice. It offers the widest range of delivery methods among platforms, ensuring funds reach recipients in the most convenient form.

WorldRemit’s primary advantage is its delivery flexibility:

- Bank Transfer: Directly deposits funds into major Nepalese bank accounts.

- Cash Pickup: Recipients can collect cash at thousands of partner locations in Nepal without a bank account.

- Mobile Wallet Top-Up: Supports direct top-ups to Nepal’s popular mobile wallets like eSewa or Khalti, highly convenient.

This makes WorldRemit especially practical when recipients lack bank accounts or live in remote areas.

LemFi

LemFi is an emerging remittance platform attracting users with its highly competitive low or zero-fee strategy. If you aim to minimize costs, LemFi is worth your attention.

LemFi’s key highlights include:

- Zero or Low Fees: On many remittance routes, LemFi offers zero-fee transfers, maximizing the amount recipients receive.

- Convenient Delivery Options: Supports direct transfers to Nepalese bank accounts and major mobile wallets.

- Simple Operation: Its mobile app is sleek and user-friendly, allowing you to set up transfers in minutes.

For small, frequent remittances, LemFi offers a highly cost-effective solution.

Traditional Methods for Sending Money to Nepal

Image Source: unsplash

While online platforms excel in cost and speed, traditional remittance methods remain reliable in specific scenarios. When handling large sums or emergencies, understanding the features of bank wire transfers and Western Union becomes crucial.

Bank Wire Transfer

If you need to transfer a large amount and prioritize security, bank wire transfers are your most trusted option. Banks have mature, secure global networks, providing robust protection for large transactions.

However, this security often comes with higher costs and slower speeds. Banks’ exchange rates typically include margins, less transparent than online platforms. Additionally, fees are relatively high, varying by bank and transfer method. For example, international wire transfer fees from major U.S. banks can vary significantly.

In terms of speed, you’ll need patience. An international wire transfer typically takes 2 to 5 business days to reach the recipient’s account in Nepal.

When to Choose Bank Wire Transfers? For large, non-urgent transfers, such as tuition or investment payments, the security provided by bank wire transfers is their greatest advantage.

Western Union

When you face an urgent situation, Western Union’s value becomes evident. Its biggest strengths are its unmatched speed and extensive global network of agent locations.

- Instant Cash: Funds are available for pickup almost immediately.

- No Bank Account Required: Recipients only need a valid ID and pickup code to collect cash at any Western Union agent location.

- Widespread Locations: From cities to towns in Nepal, you can find its service points.

Imagine if your family in Nepal urgently needs money; you can send funds from a Western Union agent in Singapore, and they can collect cash locally within minutes. This convenience is unmatched in emergencies. However, this convenience comes at a cost. Western Union’s fees are typically high, and its exchange rates are far less favorable than online platforms. Thus, for regular remittances to Nepal, it’s not the most cost-effective choice.

How to Choose the Best Option

After learning about various remittance methods, you might wonder, “Which one is right for me?” The answer depends on your specific needs. Below, we provide clear guidance for three common scenarios to help you make an informed decision effortlessly.

Scenario 1: Prioritizing Lowest Cost

If your primary goal is to save money and maximize the amount received, prioritize online platforms offering low or zero fees.

- Look for Zero-Fee Options: Consider services like TransferGo, which offers instant, zero-fee account-to-account transfers. Note that there may be minimum transfer amount restrictions, and very small amounts might not qualify.

- Compare Low-Fee Platforms: Wise, Remitly, and LemFi are excellent choices. Before sending, spend a few minutes entering your transfer amount on their websites to compare fees and exchange rates in real time. This simple step can help you find the most cost-effective option.

Scenario 2: Needing Urgent Delivery

When funds need to reach Nepal in minutes, speed is everything. Fortunately, you have multiple instant delivery options.

Digital Wallets and Cash Pickup

- Instant Digital Transfers: Use services that support instant top-ups to mobile wallets like eSewa or direct transfers to bank accounts via Fonepay Direct using a phone number. Remitly and WorldRemit excel in this area.

- Emergency Cash Pickup: If the recipient urgently needs cash and lacks a bank account, Western Union and Xoom (a PayPal service) are your best choices. Their extensive global agent networks allow recipients to collect cash within minutes with proper identification.

Scenario 3: Sending Large Amounts

When sending large sums (e.g., for tuition or property payments) to Nepal, security and compliance outweigh speed and cost.

- Choose Bank Wire Transfers: Though slower and more expensive, bank wire transfers offer the most reliable security for large funds due to their robust systems.

- Prepare Documentation: To comply with anti-money laundering regulations, banks or remittance providers may require additional documents. Prepare these in advance to ensure a smooth transfer.

- Proof of Identity: Your passport or official ID.

- Proof of Fund Source: Documents explaining the source of funds, such as pay stubs, sales contracts, or inheritance records.

- Transaction Purpose Documents: Such as school admission letters or property contracts.

Preparing these documents in advance can significantly speed up large transfers.

For daily remittances to Nepal, online platforms like Wise and Remitly are undoubtedly the most cost-effective choices. They typically outperform traditional methods in fees, speed, and convenience.

Did You Know? Digital remittances in Nepal are growing rapidly. Data shows that by 2021, 3 out of every 10 remittances were completed via mobile wallets, proving the popularity and convenience of digital channels.

To ensure you get the best deal every time, spend a few minutes before transferring to compare exchange rates and fees in real time using platform websites or tools like Xe.com. Following this guide, you can confidently choose the service that best fits your needs and complete your transfer with ease.

FAQ

What Information Is Needed to Send Money to Nepal?

You typically need to provide the recipient’s basic information.

- Recipient’s Full Name (must match the bank account name)

- Recipient’s Address and Phone Number

- Recipient’s Bank Name and Account Number

Tip: To ensure a smooth transfer, confirm all details with the recipient before sending.

Are There Limits on the Amount I Can Send?

Yes, there are limits on transfer amounts. These vary based on the platform, your account verification level, and applicable regulations. For example, Wise typically has high single-transfer limits, but specific amounts will be displayed during the transfer process. Large transfers may require additional documentation.

What If I Enter Incorrect Recipient Information?

Contact the customer service of the remittance platform immediately. If the funds haven’t yet been deposited into the recipient’s account, they may be able to help you amend the details or cancel the transaction. Therefore, carefully verifying every detail before confirming the transfer is crucial.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.