- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money from the United States to Bancolombia? Analysis of Fees, Methods, and Routing Numbers

Image Source: unsplash

Want to know how to send money to Colombia? You have two main options: modern online money transfer platforms and traditional bank wire transfers. The United States is the largest source of remittances to Colombia, contributing over half of the total remittance amount, which reached $11.848 billion in 2024 alone.

Key Advice: For most people, online money transfer platforms are the better choice. They typically offer lower fees, better exchange rates, and faster delivery compared to bank wire transfers.

Key Points

- Online money transfer platforms are generally better than traditional bank wire transfers. They have lower fees, better exchange rates, and faster delivery.

- When sending money, you need to consider two types of costs: transaction fees and exchange rate margins. The exchange rate margin is a hidden cost that can result in greater losses.

- Paying for the transfer using a bank account (ACH) is the most cost-effective option. Credit card payments are fast but come with high fees.

- Sending money to Colombia requires the recipient’s SWIFT code, not a US routing number. The SWIFT code is the international identifier for banks.

- When choosing a transfer method, compare the final amount of Colombian pesos the recipient will receive. This helps you find the most cost-effective option.

Comparison of Transfer Methods

Image Source: unsplash

When choosing a transfer method, you need to consider four core factors: fees, exchange rates, speed, and convenience. Below, we compare three mainstream methods to help you find the best option for your needs.

1. Online Money Transfer Platforms

Online money transfer platforms are currently the most popular choice. They typically offer more competitive fees and exchange rates than traditional banks, with more flexible operations.

Tip: These platforms are highly competitive and often offer first-time users fee-free transfers or exchange rate discounts. Pay attention to these promotions before signing up.

Below is an analysis of the pros and cons of some mainstream platforms:

- Xoom (a PayPal service) Xoom is known for its convenience and reliability. You can send money not only to bank accounts but also allow recipients to pick up cash at multiple locations in Colombia.

- Pros: Supports direct deposits to 20 different banks in Colombia; allows cash pickup at over 2,300 locations, including Bancolombia, Davivienda, and Éxito or Carulla supermarkets; easy to use with fast delivery.

- Cons: Exchange rates may not be the most favorable, especially for large transfers; credit card payments incur higher fees.

- Fees: Typically $4.99 when paying with a bank account or debit card.

- Wise (formerly TransferWise) Wise is known for its transparent fee structure and mid-market exchange rates, but it has some limitations in the Colombian market.

| Pros | Cons |

|---|---|

| First transfer may be fee-free | Registration and verification process can be cumbersome |

| Funds can arrive within an hour when paid by credit card | Currently only supports transfers to Bancolombia |

| Transparent fee structure | Does not support cash pickup services |

| Wise’s platform may not be user-friendly for beginners. If both you and the recipient use Bancolombia, it’s a viable option. |

- Remitly Remitly is another popular platform offering multiple transfer and receipt options. You can choose different service levels based on your needs for speed and cost. For example, the Express service is faster but slightly more expensive, while the Economy service is cheaper but takes longer to arrive.

- Panda Remit This is a user-friendly platform, especially suitable for those seeking convenience.

- Pros: User-friendly interface, simple process; fast transfers with robust security measures.

- Cons: Supports fewer currencies.

- Fees: Fees for transfers from the US are typically $6.99, but new users often enjoy fee-free promotions.

- Paysend Paysend’s standout feature is its fixed low fees, making it ideal for small transfers.

- Pros: Fixed fee of $1.99 regardless of transfer amount; supports direct transfers to mobile wallets like Nequi.

- Cons: Exchange rates may not be the most competitive.

2. Traditional Bank Wire Transfers

Using your US bank (e.g., Bank of America, Chase) for an international wire transfer is the most traditional method. It feels secure because you’re dealing with a familiar bank. However, this sense of security comes with high costs and slower speeds.

Fee Warning: Bank wire transfers are among the most expensive options.

- Transaction Fees: A single international wire transfer from the US typically costs $45 to $50.

- Exchange Rate Margin: Banks often offer exchange rates worse than the mid-market rate, meaning the recipient receives fewer pesos.

- Intermediary Bank Fees: Funds may pass through one or more intermediary banks before reaching the Colombian bank, with each bank deducting additional fees from your transfer amount.

Wire transfers typically take 1 to 5 business days to process. If you miss the bank’s daily cutoff time (usually between 4 PM and 5 PM ET), your transfer will be processed the next business day.

3. Cash Pickup and Mobile Wallets

If your recipient doesn’t have a bank account or needs cash urgently, this method is very convenient.

- Cash Pickup Many online platforms support cash pickup. For example, you can send money through Xoom or Wells Fargo’s ExpressSend service, and the recipient can collect Colombian pesos in cash at locations like Éxito or Carulla supermarkets across Colombia with a valid ID and transaction code. This is ideal for urgent expenses.

- Mobile Wallets Mobile wallets like Nequi are becoming increasingly popular in Colombia. They function like China’s Alipay or WeChat Pay, linked directly to a phone number. You can now send money directly from the US to a Nequi wallet through platforms like Paysend and Western Union. The process is simple:

- Select “Transfer to a digital wallet” on the platform.

- Enter the recipient’s name and the phone number linked to their Nequi account.

- Confirm the amount and fees, then complete the payment. Funds typically arrive in the recipient’s mobile wallet within minutes, making it very fast.

Understanding these options helps you know how to send money to meet your specific needs.

Fees and Exchange Rates Explained

Image Source: unsplash

When sending money, the total cost consists of two parts: explicit transaction fees and hidden exchange rate margins. Understanding how these work is key to saving money.

1. Transaction Fees

Transaction fees are the direct costs you pay for the transfer service. These vary significantly based on the platform and payment method.

- Traditional Banks: Have the highest fees, typically $45 to $50 for an international wire transfer.

- Online Platforms: Much lower fees, usually between $0 and $7, with many offering fee-free transfers for new users.

Money-Saving Tip: Choose the Right Payment Method The way you pay for the transfer in the US directly impacts the fees. Using your US bank account (ACH transfer) is almost always the cheapest option. According to Forbes, ACH transactions cost an average of $0.26 to $0.50. In contrast, credit card payments are convenient and fast but typically incur high processing fees of 1.5% to 3.5% of the transaction amount.

In summary, unless you urgently need funds and are willing to pay extra, paying via bank account (ACH) is the best way to minimize fees.

2. Exchange Rate Margin

The exchange rate margin is the biggest “hidden cost” in money transfers. It refers to the difference between the exchange rate offered by the platform and the real mid-market exchange rate. Banks and some platforms profit by offering you a less favorable rate.

This means even if a platform claims “zero fees,” it may cost you more through a worse exchange rate.

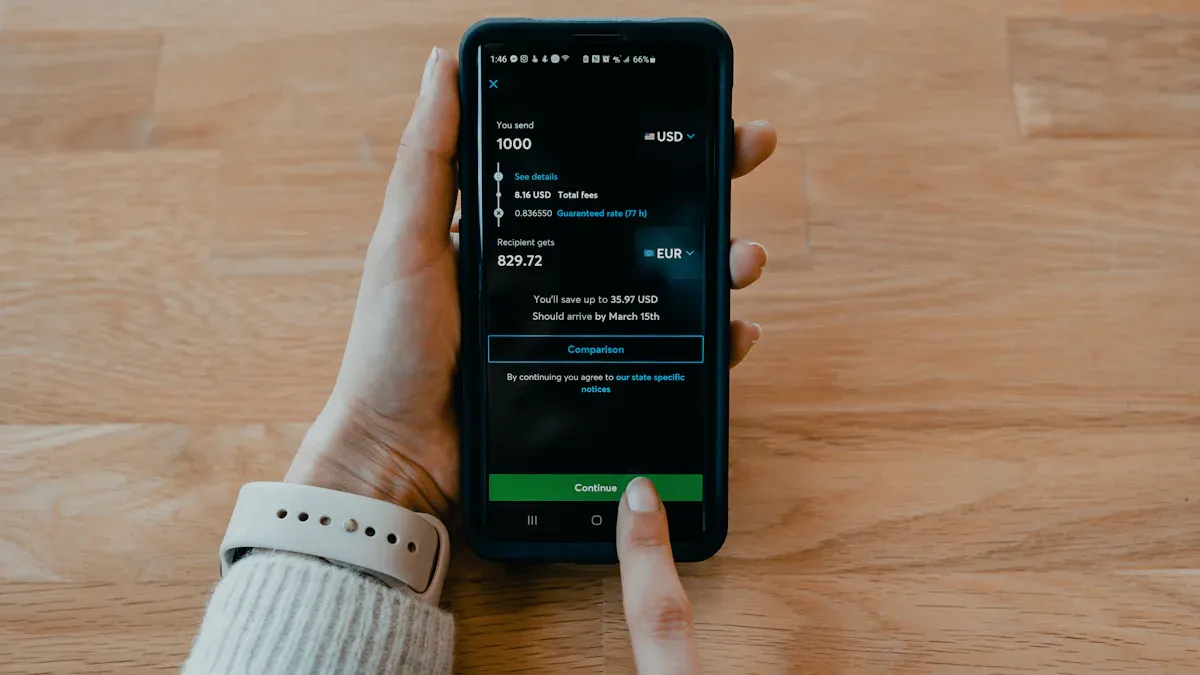

Let’s use a $1,000 transfer as an example to illustrate the impact:

| Transfer Channel | Exchange Rate Markup | Amount Lost on a $1,000 Transfer |

|---|---|---|

| Traditional Bank | 3% - 5% | $30 - $50 |

| Online Platform (e.g., Wise) | Approx. 0.43% | Approx. $4.3 |

As shown in the table, choosing an online platform with transparent exchange rates can save you tens of dollars on exchange rates alone.

3. How to Choose the Most Cost-Effective Option

Now that you understand fees and exchange rates, how do you choose? Follow these simple steps to find the most economical option.

- Focus on the Total Received Amount: Don’t just look at fees. When comparing platforms, input the same dollar amount and compare the final amount of Colombian pesos (COP) the recipient will receive. This figure includes all fees and exchange rate losses.

- Use Platform Calculators: Before deciding, visit the websites of several platforms (e.g., Remitly, Xoom, Wise) and use their homepage calculators for real-time comparisons. Exchange rates fluctuate, and this step helps you lock in the best option at the moment.

- Prioritize Bank Account Payments: As mentioned, using ACH payments avoids the high fees of credit cards.

- Take Advantage of New User Promotions: If you’re new to a platform, look for exclusive fee-free or exchange rate discount offers for first-time users.

By combining these methods, you’ll clearly understand how to send money to maximize the amount the recipient receives.

How to Send Money: Step-by-Step Guide

Now that you know the different transfer methods, the actual process is quite simple. Below, we use a mainstream online platform (e.g., Remitly) as an example to break down the entire process, helping you understand how to send money.

1. Create and Verify an Account

First, you need to create an account on your chosen transfer platform. For security and anti-money laundering compliance, the platform will verify your identity. Prepare the following documents:

- Proof of Identity: Usually your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Proof of Address: If required, you may need to upload a document proving your address, such as:

- Utility bill

- Bank or credit card statement

- Lease agreement

This verification process typically takes just a few minutes, after which you can start sending money.

2. Enter Recipient Information

Accurate recipient information is critical for ensuring funds arrive smoothly. You need to obtain the following information from the recipient in Colombia and double-check it:

- Full Name: Must match the name on the recipient’s ID exactly.

- ID Number: Usually the Colombian citizen ID (Cédula de Ciudadanía). If the recipient doesn’t have a Cédula, they can use a passport or temporary document (Contraseña) issued during Cédula processing.

- Full Address: Including city and province.

- Phone Number.

- Bank Information: Including the bank name (e.g., Bancolombia, Davivienda), account type (savings or checking), and account number.

Important Note: Colombian bank account numbers are 9 to 16 digits long. Double-check with the recipient to ensure the number is correct to avoid transfer delays.

3. Key Information: SWIFT Code

This is the most confusing part of international transfers. You need to use the SWIFT code, not the US routing number.

SWIFT vs. Routing Number

- Routing Number: A 9-digit number used for domestic ACH transfers in the US, like a “postal code” for the US banking system.

- SWIFT/BIC Code: An 8- or 11-character code, the “ID card” for banks in international transfers.

When sending money to a Colombian bank, the platform will automatically match or ask you to provide the recipient bank’s SWIFT code. For example:

- Bancolombia:

COLOCOBM - Davivienda:

CAFECOBB

4. Choose Payment Method and Confirm

The final step is to select how you’ll pay for the transfer. You have the following options:

| Payment Method | Fees | Speed |

|---|---|---|

| Bank Account (ACH) | Lowest | Slower (1-3 business days) |

| Debit Card | Moderate | Faster (minutes to hours) |

| Credit Card | Highest | Fastest (usually within minutes) |

While credit cards are the fastest, we don’t recommend them. Credit card companies often treat transfers as a “cash advance,” incurring high fees and interest. Unless it’s an emergency, using your US bank account (ACH) is the best way to understand how to send money cost-effectively.

Now you understand the various transfer methods. For those prioritizing cost-effectiveness and efficiency, reputable online platforms are usually the best choice.

However, the best option depends on your specific needs. For example, when handling large transactions or needing formal transfer records, a traditional bank wire transfer may be more suitable.

Before deciding, use the calculators on different platforms for real-time comparisons to find the most cost-effective option. Also, pay attention to Colombia’s local transfer limits and tax regulations (e.g., the 4x1000 tax) to ensure a smooth transfer.

FAQ

How Fast Can a Transfer Arrive?

The speed depends on the method chosen. Paying by credit card usually results in funds arriving within minutes. Paying via bank account (ACH) takes 1 to 3 business days. Online platforms are generally faster than traditional bank wire transfers.

Are There Limits on Sending Money from the US to Colombia?

Yes, there are limits. Most online platforms set daily or monthly limits based on your verification level, typically starting at $2,999. You may need to provide additional information to increase the limit. Traditional banks have fewer restrictions for large transfers but involve more complex procedures.

Does the Recipient Need to Pay Taxes on the Money?

Colombia has a “4x1000” financial transaction tax, meaning 4 pesos are deducted for every 1,000 pesos withdrawn or transferred. However, each citizen typically has one tax-exempt account. Ask the recipient to confirm with their bank for specifics.

Can I Use a US Routing Number Directly?

No. A routing number is only used for domestic transfers within the US. To send money to Colombia, you must use the recipient bank’s SWIFT/BIC code, the unique identifier for international bank transfers, to ensure the funds reach the correct destination.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.