- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Does IBAN Mean? An Analysis of the Important Identification Code in International Remittances

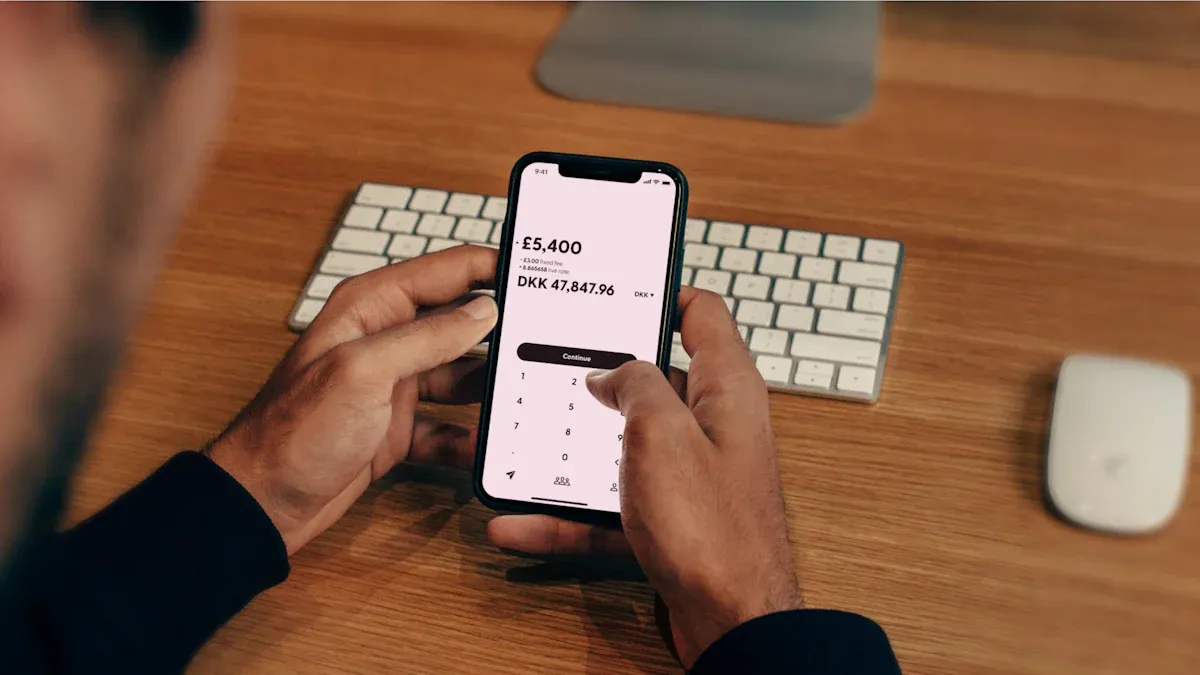

Image Source: unsplash

Have you ever wondered what IBAN means? It’s actually a critical code that ensures your funds reach their destination safely.

IBAN stands for International Bank Account Number. It’s a standardized global identifier specifically designed to precisely locate a particular bank account worldwide.

The core goal of this system is clear: by providing a uniform account format, it significantly reduces errors in cross-border payments. This helps your funds reach the recipient more quickly and accurately, avoiding unnecessary delays.

Key Takeaways

- IBAN is the International Bank Account Number. It helps your money reach foreign accounts safely.

- IBAN consists of a country code, check digits, and local bank account details. It has a specific structure.

- You can find your IBAN on bank statements, online banking, or by contacting your bank.

- IBAN and SWIFT/BIC codes are different. SWIFT/BIC identifies the bank, while IBAN identifies the specific account.

- Mainland China bank accounts do not use IBAN. The US and Canada also do not use IBAN.

What is IBAN? Understanding Its Structure

Image Source: unsplash

Now that you know what IBAN means, a long string of mysterious codes might still seem confusing. Don’t worry—breaking it down, its structure is actually very clear. Every IBAN follows the ISO 13616 standard set by the International Organization for Standardization (ISO). The format registry is now managed by SWIFT (Society for Worldwide Interbank Financial Telecommunication).

A complete IBAN is up to 34 alphanumeric characters long and primarily consists of three parts:

Country Code

The first two characters of an IBAN are always letters.

This is the code for the country where the recipient’s bank is located, following the ISO 3166-1 standard, ensuring global uniqueness. This design prevents remittance errors due to confusion over country names.

DErepresents GermanyFRrepresents FranceGBrepresents Great Britain

With this code, the payment system can accurately identify the destination country in the first step of processing a remittance.

Check Digits

The two digits following the country code are the check digits.

You can think of these two digits as the IBAN’s “anti-fraud tag.” They are calculated using a special algorithm called MOD-97. This algorithm performs a mathematical validation on the entire IBAN string.

When you enter an IBAN, the bank system or online validation tools immediately recalculate the check digits using this algorithm. If the result doesn’t match the check digits in the IBAN, the system will alert you that the IBAN may have an input error, such as transposed digits or omissions. This greatly reduces the risk of remittance failures or funds being sent to the wrong account due to typos.

In short, the check digits are the first line of defense to ensure funds reach the correct account.

Domestic Bank Account Number (BBAN)

The remaining part of the IBAN is called Basic Bank Account Number (BBAN).

This part includes all the familiar local bank account details. While the BBAN format varies by country, it typically includes the following key elements:

| Component | Description |

|---|---|

| Bank Code | Identifies the specific banking institution. |

| Branch Code | Identifies a specific branch of the bank. |

| Account Number | The unique number for your personal or business bank account. |

| Domestic Check Digit | An additional check digit included in some countries’ BBANs. |

The length and structure of BBANs vary significantly across countries, which explains why IBAN lengths differ. For example, Norway’s IBAN is only 15 characters, the shortest, while Malta’s IBAN can be up to 31 characters. To better understand what IBAN means, looking at a few examples is helpful.

| Country | Length | IBAN Example (Fictional) |

|---|---|---|

| Germany (DE) | 22 | DE89 3704 0044 0532 0130 00 |

| France (FR) | 27 | FR14 2004 1010 0505 0001 3M02 606 |

| United Kingdom (GB) | 22 | GB29 NWBK 6016 1331 9268 19 |

Moreover, IBAN is not exclusive to Europe. Many non-European countries, including Brazil, Qatar, and Saudi Arabia, have adopted this standard to streamline international payment processes. Therefore, fully understanding what IBAN means is crucial for your global remittance activities.

How to Quickly Find Your IBAN

Image Source: unsplash

Congratulations! You now fully understand what IBAN means and its components. Now, you might be wondering, “Where is my IBAN?” Don’t worry—finding it is much easier than you might think. Below are the three most common and reliable methods, and you can choose the one most convenient for you.

Check Your Bank Statement

The most traditional way to obtain your IBAN is by checking your bank statement. Whether it’s a paper statement mailed to you by the bank or an electronic PDF downloaded from online banking, it clearly lists your account details.

You can usually find it in the following places:

- Top of the Statement: Many banks place the IBAN alongside your name, address, and other key information in a prominent position.

- Account Details Section: In the area listing account type, account number, and currency, you can also find the IBAN.

Fun Fact: Have you noticed that in some banks’ simplified views, the IBAN seems to “disappear”? This is because IBANs are typically longer than 18 characters, and some systems designed for local accounts may face limitations in processing or displaying them. Therefore, a complete, official bank statement is the most reliable paper source for finding an accurate IBAN.

Log Into Online Banking or Mobile App

In the digital age, the fastest way is logging into your online banking or mobile banking app. This is the most recommended method because it’s convenient and helps avoid manual input errors.

While each bank’s app interface differs slightly, the process is generally similar. Follow these general steps:

- Log into your mobile banking app or online banking portal.

- Select the account you want to query from the main screen.

- Click into “Account Details” (Account Details), “Information,” or a similar menu.

- Here, you’ll see the full IBAN and BIC/SWIFT code.

Tip: Most bank apps provide a “copy” button next to the IBAN. Be sure to use this feature! Copying and pasting directly ensures 100% accuracy of the information you provide to the sender, avoiding remittance failures due to mistyped digits or letters.

Contact Bank Customer Service Directly

If you can’t find your statement or access online banking, there’s a final fallback—contact your bank directly.

You can get assistance through the following methods:

- Call the Customer Service Hotline: Prepare your identity verification information, and the representative can provide your IBAN after verifying your identity.

- Visit a Bank Branch: Bring your identification documents, and a bank teller can print out your account details, including the IBAN.

- Send a Secure Message: Contact customer service via the secure messaging system in online banking or the app, which is also a safe and reliable method.

Safety First! Bank staff will follow strict procedures to verify your identity to protect your account security. Never send or request your IBAN or other sensitive bank information through unsecured channels like email or social media messages.

In summary, finding your IBAN is very simple. Prioritize using the mobile app or online banking, followed by checking your bank statement, and finally contacting customer service. Choose the method that suits you best to easily obtain this critical international remittance code!

Key Differences Between IBAN and SWIFT/BIC

When making international remittances, besides IBAN, you may have encountered another code: SWIFT or BIC. They often appear together but serve entirely different purposes. Confusing them is a common cause of remittance delays.

To help you understand clearly, imagine a simple scenario:

SWIFT/BIC code is like the address of the building where the recipient’s bank is located, ensuring your funds reach the correct banking institution. IBAN is the specific room number within that building, ensuring the funds enter the one correct account.

Next, we analyze their core differences from three perspectives.

Different Functional Purposes

First, understand that these two codes have different design goals.

SWIFT/BIC code, or Business Identifier Code, primarily identifies global banking institutions. According to ISO 9362, this code facilitates wire transfer instructions and communication between banks. Simply put, it establishes the communication channel between banks, ensuring funds flow through the correct banking network.

In contrast, IBAN’s function is more precise. Its goal is to identify a specific account within a bank. Through a standardized format, it allows the banking system to automatically validate an account’s authenticity before processing payments, significantly reducing errors.

Different Identification Targets

Due to their different purposes, the specific targets they identify are also entirely different.

An 8- to 11-character SWIFT/BIC code contains rich information to pinpoint a bank’s branch. Its structure typically looks like this:

- Bank Code (4 letters): Represents the bank’s name, such as the abbreviation for a licensed bank in Hong Kong.

- Country Code (2 letters): Indicates the country or region where the bank is located, e.g.,

HKfor Hong Kong. - Location Code (2 characters): Points to the city where the bank’s headquarters is located.

- Branch Code (3 characters, optional): Identifies a specific branch.

In contrast, IBAN identifies the final recipient’s account. While it also includes bank and branch information (in the BBAN part), its most critical component is the unique personal account number. This is why you cannot use a SWIFT code alone to send money directly to a personal account. To understand what IBAN means, the key point is to remember it points to the “destination account.”

Collaborative Relationship in Remittances

In actual international remittances, IBAN and SWIFT/BIC codes often work together like a well-coordinated team.

Imagine a typical international wire transfer (SWIFT transfer):

- During the remittance, the banking system first reads the SWIFT/BIC code to route the funds to the correct country and recipient bank.

- Once the funds reach the recipient bank, the system then reads the IBAN to ensure the money is accurately deposited into the specified final account.

Important Note: When remitting to many countries and regions, such as Europe and the Middle East, you typically need to provide both IBAN and SWIFT/BIC codes. Missing either one may cause the transaction to fail. However, there are exceptions in certain payment networks, such as for euro transfers within the Single Euro Payments Area (SEPA), usually only the recipient’s IBAN is required.

In summary, the SWIFT/BIC code gets the money to the “right bank,” while the IBAN ensures it goes to the “right account.” For your next remittance, be sure to request and verify both of these critical details from the recipient.

Now, you fully understand what IBAN means. It’s the “unique address” that ensures your international remittances, especially to Europe, reach the recipient’s account accurately and efficiently.

Before initiating any cross-border transfer, always request and carefully verify the IBAN information from the recipient. To avoid delays due to typos or format issues, you can use online validation tools provided by Wise or IBAN.com for secondary confirmation. This is the most effective way to prevent fund loss.

With this knowledge, you can confidently handle every international payment.

FAQ

Here, we’ve compiled some of the most common questions about IBAN to help you quickly clear up any remaining doubts.

Do mainland China bank accounts have an IBAN?

Mainland China has not adopted the IBAN system. Therefore, your mainland China bank account does not have an IBAN. When remitting to mainland China, you need to provide the recipient bank’s SWIFT/BIC code, bank name, address, and the recipient’s account number and name.

Is IBAN the same as my bank account number?

Not exactly. IBAN includes your local bank account number but adds a country code and check digits. Think of it as a more complete “super account number” designed for international remittances. It ensures your funds are accurately identified globally.

What happens if I enter the wrong IBAN?

The remittance may be delayed, returned, or even sent to the wrong account. Fortunately, the IBAN’s check digits are designed to catch most input errors. The banking system will typically prompt you to correct the error immediately. Still, you must double-check to avoid additional fees.

Do the US or Canada use IBAN?

No. The US and Canada have their own systems. For remittances to the US, you need to provide the ABA Routing Number. For Canada, you need the Bank Code and Transit Number.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.