- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What is Venmo? A Detailed Explanation of Its Functions, Limitations, and Alternatives for International Money Transfers

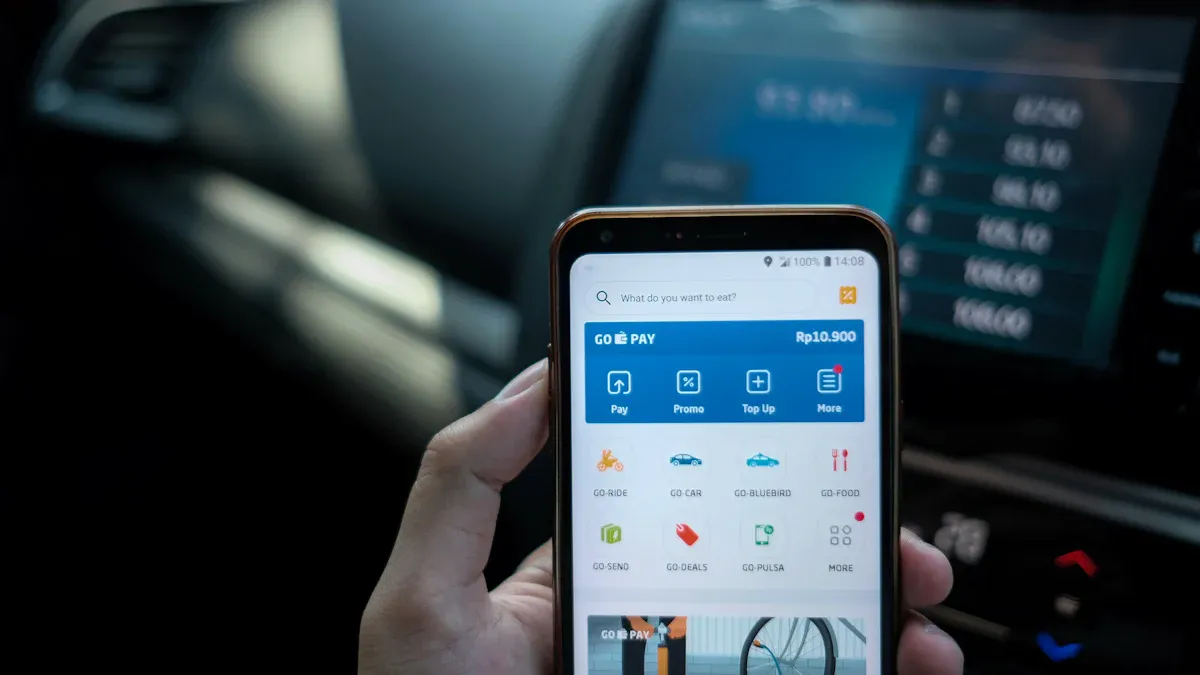

Image Source: unsplash

What is Venmo? It is a highly popular mobile payment application in the United States; users can think of it as a “social version of Alipay.” This app is very popular in scenarios such as splitting meal costs or paying rent among friends due to its convenience and speed. Data shows that its user base is approaching 100 million, with transaction volume reaching $69 billion in the first quarter of 2024 alone.

Among young people in the United States, Venmo’s penetration rate is particularly high. For example, about 40% of Gen Z (18-25 year old consumers) use it for daily small transfers.

Although Venmo is very convenient within the United States, its services are strictly limited to between US users, which raises questions for users needing international transfers.

Key Takeaways

- Venmo is a popular mobile payment app in the United States, convenient for splitting costs among friends.

- Venmo is limited to use within the United States and does not support international remittances to China or other countries.

- Venmo transactions only support USD and cannot perform currency exchange.

- For international remittances, choose professional platforms like Wise or Remitly, which have transparent fees and good exchange rates.

- Bank wire transfers and PayPal international transfers have high fees and unfavorable exchange rates.

What is Venmo: Core Feature Analysis

Image Source: pexels

To understand what Venmo is, the best way is to learn about its three core features. These features together form its convenient, socialized payment ecosystem, making it play an important role in daily life in the United States.

Transfers Between Friends

The foundation of Venmo is its peer-to-peer (P2P) payment function. Users can easily transfer money to friends, family, or roommates without dealing with cash or complex bank information. The biggest feature of this function is its social attribute. Each transfer can be accompanied by notes and emojis, and these dynamics will appear in friends’ feeds (can be set to private), like a payment version of social media.

According to transaction data analysis, Venmo’s most common payment scenarios include:

- Food and Beverages: Splitting lunch, dinner, or coffee costs.

- Household Expenses: Paying rent, utilities, or internet fees.

- Transportation: Splitting gas or Uber fares.

- Entertainment Activities: Buying movie tickets or party supplies.

Merchant QR Code Payments

In addition to personal transfers, Venmo is increasingly accepted by merchants. Users can make commercial payments in the following ways:

- Venmo QR Code: At checkout, users just need to scan the QR code provided by the merchant to complete payment. Many well-known retailers, such as CVS, Lululemon, Foot Locker, and Uber Eats, support this payment method.

- Venmo Credit and Debit Cards: Venmo offers physical cards, expanding its usage range. Especially the Venmo credit card, which provides automatic cashback: 3% cashback on the highest spending category each month, 2% on the second highest, and 1% on all other spending, with no annual fee.

Fund Management and Withdrawal

Money received by users is stored in their Venmo balance. There are mainly two ways to withdraw funds from the balance:

- Standard Withdrawal (Standard Transfer): This is a free option. Funds are transferred to the user’s bound US bank account via the ACH network, usually taking 1-3 business days to arrive.

- Instant Withdrawal (Instant Transfer): If users need funds to arrive immediately, they can choose this service.

Instant withdrawal incurs a certain fee. Venmo charges 1.75% of the transfer amount as a service fee, with a minimum of $0.25 and a maximum of $25.

These features together explain what Venmo is: a localized US app that integrates social interaction, payments, and basic fund management.

Three Key Limitations of Using Venmo

Although Venmo is very convenient within the United States, it is not an all-powerful payment tool. To fully understand what Venmo is and why it cannot be used for international remittances, users must understand its three key limitations. These limitations define its service boundaries and explain why it cannot meet cross-border payment needs.

Geographic Restrictions: Limited to the US

Venmo’s primary limitation is its strict geographic nature. This service is completely designed around the US market, and users must meet a series of geography-related conditions to register and use it.

According to Venmo’s user agreement, its core requirements include:

- Located in the US: Users must actually reside within the United States.

- US Phone Number: Registration requires a valid US mobile number for verification.

- US Bank Account: Fund transfers in and out must be completed through a bound US bank account or eligible debit card.

This means that for tourists, temporary visitors, or users residing in mainland China and other countries/regions, even if they have friends in the US, they cannot register and use Venmo.

Currency Restrictions: USD Only

Venmo’s second core limitation is its single currency system. All transactions on the platform are settled in US dollars (USD), and it does not provide any form of currency exchange service.

This means users cannot send or receive any non-USD currency through Venmo. Even the cryptocurrency features provided within the platform have buy, sell, and hold values priced in USD. Since USD cannot be exchanged for RMB, euros, or other currencies, the function of remitting from the US to mainland China or other countries/regions fundamentally does not exist.

Transaction Limits and Account Verification

Venmo sets clear upper limits on users’ transaction amounts, and this limit is directly related to whether the account has completed identity verification.

For a newly registered account that has not completed identity verification, its weekly rolling total limit is only $299.99. This amount includes all personal transfers, merchant payments, and spending through the Venmo debit card. This amount is sufficient for paying for a meal or a cup of coffee but cannot meet larger payment needs.

To increase the limit, users must complete identity verification. This usually requires providing the following personal information:

- Legal name

- Home address

- Date of birth

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

After completing verification, the weekly rolling total limit can be significantly increased. However, for users needing to pay tuition, make investments, or handle large family expenses, even the verified limit may be insufficient.

Conclusion: Based on the three major limitations of geography, currency, and limits, Venmo is a pure domestic US payment tool. It cannot handle any form of international transfer, so users cannot use it to remit from the US to mainland China or any other country.

Reliable Alternatives for International Remittances

Image Source: unsplash

Since Venmo cannot be used for international remittances, what tools should users choose when needing to transfer money from the US to mainland China or other countries? Fortunately, there are many professional, reliable, and efficient alternatives on the market. These alternatives differ in fees, exchange rates, speed, and convenience, and users can choose based on their needs.

Professional Remittance Platforms

For most individual users, online professional remittance platforms are the best choice for balancing cost and efficiency. They are usually cheaper and more transparent than traditional banks.

- Wise (formerly TransferWise) Wise’s core advantage lies in its transparent fees and real exchange rates. Unlike many banks and remittance services, Wise uses the “mid-market rate,” which is the real exchange rate users search for on Google.

Traditional banks and some remittance services usually add a “markup” to the mid-market rate to profit, even if they advertise “zero service fees.” This markup is a hidden cost, meaning the receiver actually gets less money. Wise separates fees and exchange rates completely, allowing users to clearly know where every penny goes.

- Remitly Remitly is known for its flexible receipt methods and fast arrival times, especially suitable for remittances to mainland China. It supports direct transfers to the receiver’s Alipay and WeChat Pay accounts, greatly facilitating the receiver. Remitly usually offers two transfer options:

In addition, Remitly often offers promotions for new customers, such as fee waivers for the first remittance or better exchange rates within a certain amount. For transactions over $1,000, service fees may also be waived.Transfer Type Average Transfer Speed Economy 3-5 business days Express Within minutes - MoneyGram MoneyGram’s biggest advantage is its vast offline agent network worldwide. If the receiver does not have a bank account or finds electronic wallets inconvenient, this is an excellent choice.

MoneyGram has hundreds of thousands of agent locations in over 200 countries and regions, supporting cash pickup. Users can initiate remittances online, and the receiver can pick up cash at a nearby agent location within minutes. This flexibility is unmatched by pure online platforms.

Traditional Bank Wire Transfers

Conducting international wire transfers through banks is the most traditional method. It is safe and reliable, suitable for large transactions, but usually the most expensive and slowest choice.

To initiate an international wire transfer, users need to prepare detailed receiver information, which is much more complex than using a remittance app.

- Receiver Information: Name, address, and bank account number (for example, IBAN).

- Receiving Bank Information: Bank name, address, and SWIFT/BIC code.

SWIFT/BIC codeis a global bank identification code used to ensure funds are sent to the correct financial institution. It is different from the IBAN that identifies specific accounts.

Bank wire transfer fees mainly consist of two parts: high service fees and poor exchange rates. According to US bank data, the average service fee for a single international wire transfer is about $40-$50. For example, JPMorgan Chase Bank charges $40 for USD wire transfers sent overseas. In addition, the exchange rates provided by banks usually include higher markups, further increasing the total cost.

PayPal and Other Payment Apps

Some users may consider using PayPal for international transfers, but need to pay special attention to its complex fee structure. At the same time, be wary of apps like Zelle and Cash App that seem convenient, as they are also not suitable for international remittances.

- PayPal PayPal does support international remittances, but the total cost can be high. Its fees mainly include:

- Transaction Fee: International personal transfers charge 5%, capped at $4.99.

- Currency Conversion Fee: This is the largest hidden cost. PayPal embeds about 3% to 4% markup in its provided exchange rate.

- Zelle and Cash App These two apps are very popular in the US, but like Venmo, they are designed for domestic US transfers.

- Zelle: The service explicitly requires both sender and receiver to have US bank accounts and US mobile numbers. It cannot be used for remittances overseas.

- Cash App: Its international payment function is extremely limited, previously only supporting transfers between the US and UK, and its UK business stopped in 2024. Therefore, it cannot be used for remittances to mainland China.

Comparison Summary of Each Option

To help users make choices more intuitively, the table below summarizes the characteristics of several mainstream options for remitting from the US to mainland China.

| Option | Service Fee | Exchange Rate | Arrival Speed | Convenience |

|---|---|---|---|---|

| Wise | Low and transparent, charged proportionally | Excellent, uses mid-market rate | 1-2 business days | High, simple operation, fully online |

| Remitly | Economy mode low fee, Express mode slightly higher | Good, new users have promotions | Extremely fast (minutes) to several days | Extremely high, supports Alipay and WeChat receipt |

| Bank Wire Transfer | High, usually $40-$50 | Poor, includes high exchange rate markup | Slow, usually 3-5 business days | Low, requires filling complex information, cumbersome process |

| PayPal | Complex fee structure, includes high hidden costs | Poor, includes 3%-4% exchange rate markup | Faster, usually instant | Medium, requires both parties to have PayPal accounts |

In summary, what is Venmo? It is an excellent tool for handling within the United States splitting meal costs among friends, paying rent, and other small expenses. Over 60% of young users rely on it for daily expenses, making it a sharp tool for social payments.

However, users must recognize that due to strict geographic, currency, and financial compliance restrictions, Venmo absolutely cannot be used for international remittances to mainland China or any other overseas country.

In US life, Venmo is a good helper for daily payments. When it comes to cross-border remittances, users should decisively choose professional and transparent international remittance services like Wise or Remitly.

FAQ

Can I use Venmo without a US bank account?

No. Users must have a valid US bank account or eligible debit card to use Venmo. This is a mandatory requirement for registration and fund operations; the platform does not support binding non-US bank accounts.

Does using Venmo cost money?

Venmo’s core functions, such as transfers between friends and standard withdrawals, are free. But some advanced services incur fees.

For example, the Instant Transfer service charges 1.75% of the transfer amount, with a minimum fee of $0.25 and a maximum of $25.

Can Venmo transfers be revoked?

Users cannot unilaterally revoke payments already sent to an existing Venmo account. If a transfer is sent to the wrong person, the user needs to contact the receiver and request a refund. Therefore, be sure to carefully verify the receiver information before paying.

Is SSN required to register for Venmo?

New users do not need to provide a Social Security Number (SSN) immediately upon registration. But unverified accounts have a weekly limit of only $299.99. To increase the transaction limit, users must provide SSN or Individual Taxpayer Identification Number (ITIN) to complete identity verification.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.