- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

International Remittance via PayPal: A Secure and Convenient Cross-Border Payment Method

Image Source: unsplash

Yes, using PayPal for international money transfers is a safe and convenient method.

As of the end of 2023, 426 million users worldwide trust PayPal. You only need an email address or phone number to initiate a transfer to the recipient. Its multiple security measures and global network make it a reliable cross-border payment option for both individuals and businesses.

Key Points

- PayPal offers multiple security measures, such as encryption technology and two-factor authentication, to ensure the safety of your international money transfers.

- You only need the recipient’s email or phone number to easily initiate an international transfer via PayPal.

- Before transferring, verify your PayPal account and select the correct payment type (friends and family or goods and services).

- Using PayPal balance or a linked bank account for payments can help you save on transfer fees.

- PayPal supports transfers to over 200 countries and regions worldwide and supports more than 20 mainstream currencies.

Why Choose PayPal: Safety and Convenience

When conducting cross-border transactions, safety and convenience are the primary considerations. PayPal provides excellent solutions in both aspects, making your payment experience secure and efficient.

Multiple Security Measures

Your financial security is at the core of PayPal’s operations. It deploys multiple layers of protection to ensure every transaction is securely safeguarded.

- Advanced encryption technology: PayPal uses robust end-to-end encryption technology. Your sensitive information is encrypted before transmission, making it unreadable even if intercepted. All transactions are protected by Secure Sockets Layer (SSL) protocols, complying with the Payment Card Industry Data Security Standard (PCI-DSS).

- Two-Factor Authentication (2FA): You can enable an additional layer of security for your account. When activated, each login requires not only a password but also a dynamic verification code sent to your phone, significantly reducing the risk of account theft.

- 24/7 Fraud Monitoring: PayPal’s system monitors transactions around the clock to identify and block suspicious activities. Additionally, its buyer and seller protection policies provide dispute resolution for eligible transactions, offering greater assurance if issues arise.

PayPal’s security system is designed to provide a trustworthy payment environment, allowing you to focus on the transaction itself rather than worrying about its safety.

Exceptional Convenience

PayPal’s design philosophy is to simplify the payment process. You no longer need to memorize or request complex bank account details or international codes.

To initiate an international transfer, you only need the recipient’s email address or phone number. The entire process is highly intuitive, requiring just a few simple steps to complete the transfer. Whether you’re an individual or a business, this streamlined approach saves significant time and effort, making cross-border payments easier than ever.

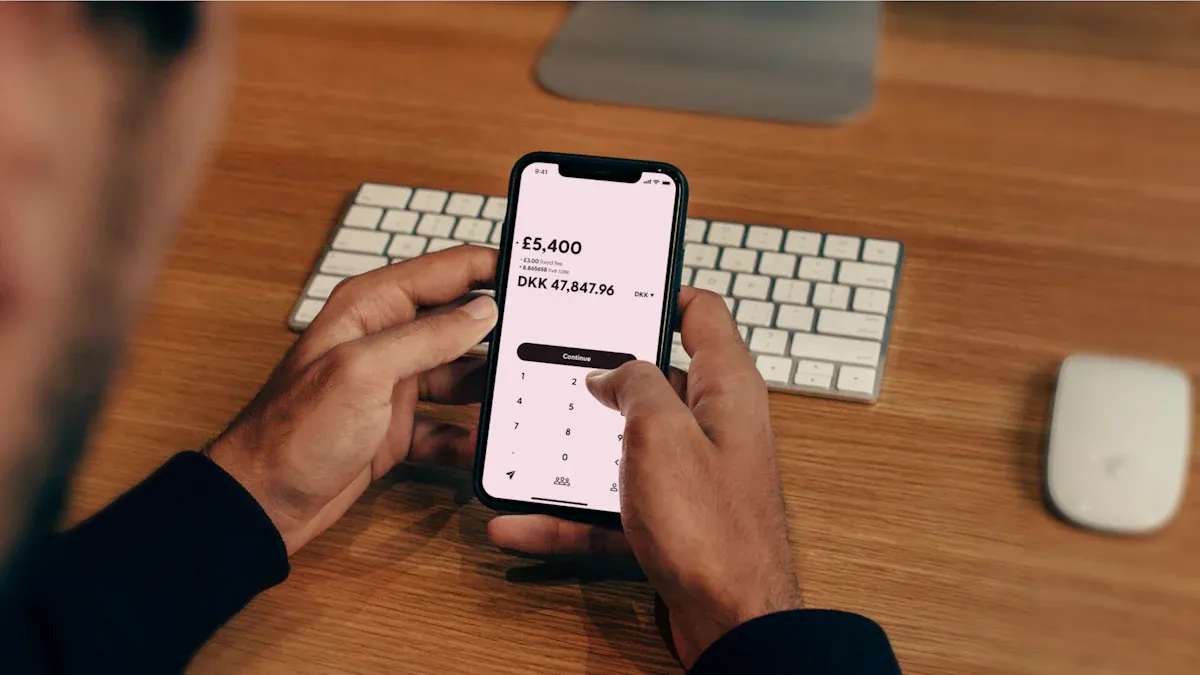

PayPal International Money Transfers: Step-by-Step Guide

Image Source: unsplash

Having understood PayPal’s safety and convenience, you may be ready to initiate your first cross-border payment. The process is very intuitive, but thorough preparation can make your experience even smoother. This guide will walk you through the entire process of preparing and successfully initiating an international money transfer.

Pre-Transfer Preparations

Before clicking the “Send” button, completing a few simple preparatory steps can ensure your funds reach their destination safely and quickly.

1. Verify Your Account to Increase Limits

By default, your PayPal account will have certain transfer limits. To conduct large transactions, you need to complete account verification. A verified account can have a single transaction limit of up to $60,000, though the specific amount may vary depending on the currency and destination country.

How to Verify Your PayPal Account? The verification process is straightforward. You can log into your account, find and click “View Limits” on the “Overview” page, and follow the instructions. It typically involves the following steps:

- Link a Payment Method: Link your bank account, credit card, or debit card (such as Visa or Mastercard) to PayPal. When linking a Hong Kong-licensed bank account, you’ll need to provide account details.

- Confirm Small Deposits: PayPal will deposit two small amounts into your bank account. Once received, log into PayPal and enter these amounts to complete verification.

- Provide Identity Proof: In some cases, PayPal may require identity documents (such as a passport or proof of address) to complete verification.

2. Prepare Recipient Information

Unlike traditional bank transfers, you don’t need to request lengthy bank details from the recipient. You only need one of the following:

- The recipient’s email address

- The recipient’s phone number

- The recipient’s PayPal username (

@username)

3. Choose the Correct Payment Type

This is a critical step. PayPal offers two main payment types: “Friends and Family” and “Goods and Services”. Choosing the wrong type may result in unnecessary fees or loss of transaction protection.

| Feature/Scenario | Friends and Family | Goods and Services |

|---|---|---|

| Purpose | Personal transfers like gifting or splitting bills. | Commercial transactions like purchasing goods or paying for services. |

| Fees | Sender pays a 5% cross-border fee (up to $4.99). | Recipient (seller) pays transaction fees; sender pays a 1.5% cross-border fee. |

| Protection | No buyer or seller protection. | Eligible buyer protection for issues like “item not received” or “not as described.” |

| Recommendation | Use only for trusted individuals. | Use for all commercial transactions to ensure shopping safety. |

Important Note: Never mark a commercial payment as a “Friends and Family” transfer to save on fees. This violates PayPal’s user agreement, leaves you without protection, and may lead to account restrictions.

Steps to Initiate a Transfer

Once all preparations are complete, initiating a transfer takes just a few minutes. The steps are essentially the same whether you use the PayPal website or mobile app.

- Log In and Select “Pay” Log into your PayPal account, find and click the “Send” or “Pay & Get Paid” button on the homepage or dashboard.

- Enter Recipient Information In the designated field, enter the recipient’s email address, phone number, or username you prepared.

- Enter Amount and Currency Enter the amount you wish to send and select the correct currency. The system will automatically display the current exchange rate and estimated amount received.

- Choose Payment Method and Type Select a funding source from your PayPal balance, linked bank account, or credit card. Then, carefully confirm whether the payment type is “Friends and Family” or “Goods and Services.”

- Review and Confirm Sending Finally, carefully review all details, including the recipient, amount, exchange rate, and fees. If everything is correct, click the “Send Payment Now” button.

After the transaction is complete, both you and the recipient will receive a confirmation email. If your payment status shows as “Pending,” it means the recipient has not yet accepted the funds, and you can still find the transaction in the “Activity” page and select “Cancel”. Once the funds are accepted, the transaction is completed instantly and cannot be reversed. At that point, the recipient can choose various methods to withdraw the funds, such as transferring to a bank account or using them for online purchases.

Fees, Exchange Rates, and Coverage

Image Source: unsplash

Understanding PayPal’s fee structure and global coverage can help you better plan your international transfers. While PayPal is highly convenient, costs vary depending on your payment method and whether currency conversion is involved.

Fee Structure and Costs

PayPal’s fees consist of three main components: cross-border transaction fees, funding source fees, and currency conversion fees.

1. Cross-Border Transaction Fees

These fees depend on the payment type you choose:

- Friends and Family Transfers: You pay 5% of the transaction amount as a fee, with a minimum of $0.99 and a maximum of $4.99.

- Goods and Services: The recipient (seller) pays the fees, typically a percentage of the transaction amount plus a fixed fee.

2. Funding Source Fees

Your payment method directly impacts the total cost.

| Funding Source | Additional Fees |

|---|---|

| PayPal Balance or Linked Bank Account | No additional fees |

| Credit or Debit Card | Additional 2.9% funding fee + a fixed fee |

Money-Saving Tip: To reduce costs, prioritize using your PayPal balance or a linked bank account for payments. While credit cards are convenient, they significantly increase fees.

3. Currency Conversion Fees

When your transaction involves different currencies, PayPal performs currency conversion. PayPal adds approximately a 4% markup to the base exchange rate as its currency conversion fee, meaning the exchange rate you see includes this cost.

Global Coverage

PayPal’s strength lies in its extensive global reach.

- Supported Countries: You can use PayPal to send money to users in over 200 countries and regions worldwide. Its services cover major economies and emerging markets across the Americas, Europe, Asia-Pacific, and Africa.

- Supported Currencies: PayPal supports over 20 mainstream currencies, including USD, EUR, GBP, JPY, and HKD.

Since the list of supported countries and regions is updated dynamically, it’s recommended to visit PayPal’s official “Global Services” page before transferring to check the latest support information and ensure the recipient’s location can receive funds.

With its robust security measures, simple operational process, and extensive global coverage, PayPal is an ideal tool for international money transfers. It strikes a perfect balance between strong security measures (such as 24/7 fraud monitoring) and exceptional convenience, providing a trustworthy cross-border payment solution.

Now, you can confidently start your first PayPal international money transfer based on your needs.

FAQ

To help you use PayPal more smoothly, we’ve compiled some common questions about international money transfers and provided answers.

How Long Does a Transfer Take?

Funds you send are typically deposited into the recipient’s PayPal account instantly. However, transferring funds from PayPal to their bank account may take a few business days, depending on the bank’s processing speed.

What If I Enter the Wrong Recipient Information?

If the recipient hasn’t accepted the funds, you can cancel the transaction immediately from the “Activity” page. Once the funds are accepted, the transaction cannot be reversed.

Therefore, always double-check the recipient’s email or phone number before clicking send.

Can I Send Money to Someone Without a PayPal Account?

Yes. You can still send money to their email or phone number. The recipient will receive a notification guiding them to register a free PayPal account to receive the funds. Once the account is set up, the funds will be deposited automatically.

Is There a Limit on PayPal International Transfers?

Yes. Unverified accounts have lower limits. After completing account verification (e.g., linking a bank account), your single transaction limit can be up to $60,000, though specific limits may vary by country and currency.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.