- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

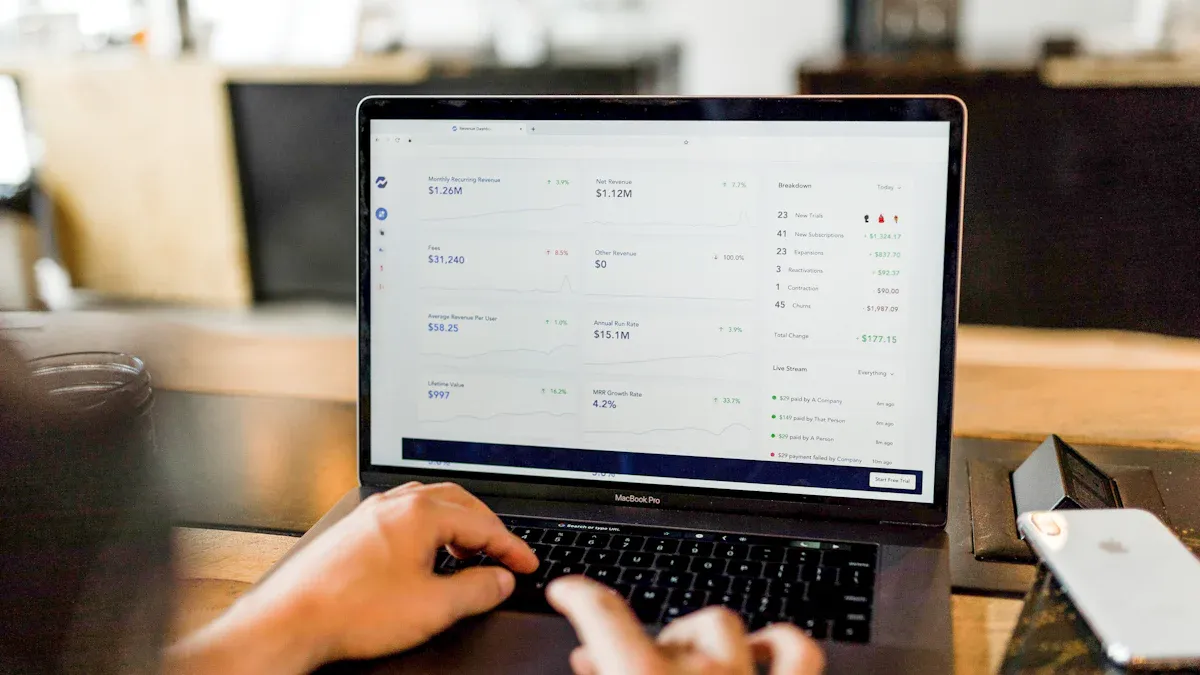

What is a Bank Routing Number? A Detailed Explanation of Its Uses and How to Obtain It

Image Source: unsplash

A bank routing number is a 9-digit code. You can think of it as the exclusive “address” for banks within the US. The core role of this number is to ensure funds are accurately delivered. For example, when setting up direct deposit to receive a paycheck, you need to provide it. According to data from the American Payroll Association, over 93% of US employees receive their salary this way. Please note that the routing number you use for electronic transfers or wire transfers may differ.

Key Takeaways

- A bank routing number is 9 digits; it identifies banks within the US.

- There are two types of routing numbers: ACH routing numbers for daily electronic payments, and wire transfer routing numbers for large urgent transfers.

- You can find the routing number by checking a check, logging into online banking, or contacting customer service.

- The routing number identifies the bank, while the bank account number identifies your personal account; both are very important.

- Routing numbers are only used for transactions within the US; international remittances require a SWIFT code.

What Is a Bank Routing Number?

Image Source: pexels

Simply put, a bank routing number is a code consisting of 9 digits. It is like the unique ID number for every financial institution within the US, ensuring your funds can be accurately directed to the correct bank.

9-Digit Institution Identifier

This 9-digit number is assigned by the American Bankers Association (ABA). Its main function is to identify specific federally or state-chartered banks. You can use this number to precisely locate any one of thousands of financial institutions. To understand its importance, consider the following data:

- As of the end of 2023, there were over 9,200 federally insured depository institutions in the US.

- This includes about 4,600 commercial banks.

- And about 4,600 credit unions.

In the face of such a vast financial system, a standardized identifier is essential.

Common Aliases: ABA and RTN

When handling financial matters, you may encounter several different names, but they usually refer to the same concept. Routing Number, ABA Number, or RTN (Routing Transit Number) are basically synonyms. Understanding this can help you avoid confusion when filling out forms.

The American Bankers Association has a clear explanation of the origin of this number:

The American Bankers Association (ABA) developed the routing transit number system in 1910. The original purpose was to facilitate the sorting, bundling, and mailing of paper checks, ensuring checks could be returned to the payer’s bank for deduction. This nine-digit code is printed at the bottom of the check.

Core Function: Ensuring Fund Flow

The most core function of this number is to act as a “traffic controller” in the financial system. When you set up direct deposit or conduct an electronic transfer, the payer’s system reads this number, just like a delivery person reads the postal code on a package. It first directs the funds to your designated bank. After the funds reach the bank, the bank then deposits the money into your account based on your personal account number. This process ensures every transaction is completed safely and efficiently.

Types of Routing Numbers

You might think a bank has only one routing number, but in some cases, banks provide different numbers for different types of transactions. The most common two types are ACH routing numbers and wire transfer routing numbers. Before making a transfer, you must confirm you are using the correct number that matches the transaction type.

ACH Routing Number

The ACH routing number is the one you use most often in daily electronic transactions. ACH stands for “Automated Clearing House,” a US financial network that processes batch electronic payments.

This number is mainly used in the following scenarios:

- Receiving direct deposits: Such as company-issued paychecks or government-issued benefits.

- Setting up automatic payments: Such as monthly automatic payments for utilities, credit card bills, or subscription services.

- Processing electronic transfers: Such as transferring money to friends via third-party apps.

ACH transfers are very suitable for routine, non-urgent fund transfers. Although the single-transaction limit for same-day ACH transactions is up to 1 million dollars, most banks set lower daily transfer limits for personal accounts, usually between 2,000 dollars and 25,000 dollars. Processing time generally takes 1 to 3 business days.

Wire Transfer Routing Number

When you need to make a large or urgent domestic transfer, you need to use the wire transfer routing number. Unlike ACH transfers, wire transfers are usually completed within a few hours or even minutes after submission, very fast.

Many banks, especially large financial institutions, designate a dedicated bank routing number for wire transfer transactions. This number may differ from the one on your check or used for ACH transactions.

Important Tip: Before initiating a wire transfer, be sure to log into your online banking or directly contact bank customer service to obtain the correct wire transfer routing number. Using the wrong number may cause the transfer to fail or be severely delayed.

In summary, for small, routine electronic payments, you should use the ACH routing number; for large, time-sensitive fund transfers, you need to confirm and use the dedicated wire transfer routing number.

Main Uses of Routing Numbers

The bank routing number is the cornerstone of the US financial system and plays a crucial role in your daily financial activities. From receiving salary to paying bills, understanding its specific uses can help you manage funds more efficiently.

Receiving Paychecks and Benefits

Setting up direct deposit is one of the most common uses of routing numbers. It allows your employer or government agency to deposit funds directly into your bank account, both safe and fast.

When you join a new company and set up direct deposit, you need to provide a series of information to your employer. Usually, you need to fill out a direct deposit form and attach the following details:

- Your full name and home address

- Bank name and address

- Account type (checking account or savings account)

- Your bank account number

- 9-digit bank routing number

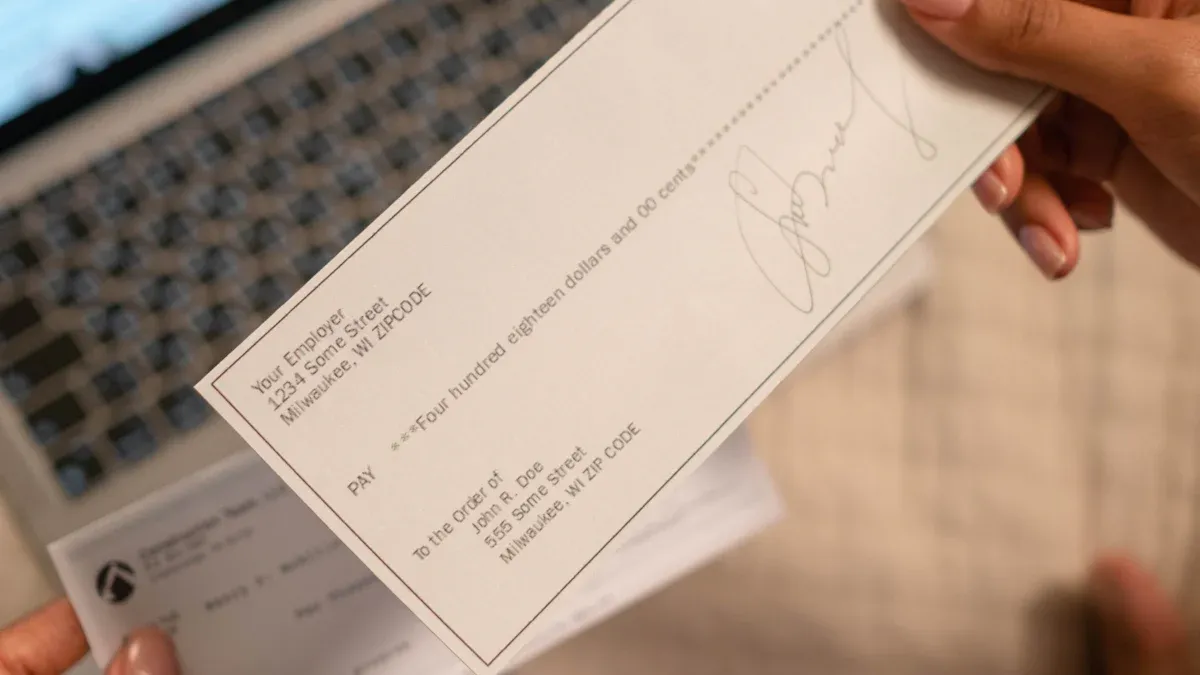

Practical Tip: To avoid handwriting errors, many employers recommend providing a voided check. The bottom of the check clearly prints the routing number and your account number, ensuring information accuracy.

In addition to paychecks, many government benefits are also issued via direct deposit. This includes:

- Social Security

- Supplemental Security Income (SSI)

- Veterans benefits

Setting Up Automatic Payments

Routing numbers are also key to setting up automatic payments. You can use it to authorize merchants to regularly deduct from your bank account to pay various bills. This method can help you avoid late fees and simplify your financial management.

Common automatic payment items include:

- Utilities and phone bills

- Credit card bills

- Car loans or mortgages

- Gym membership or childcare fees

When you authorize a merchant for pre-authorized electronic transfers, your rights are protected by federal regulation Regulation E. The regulation stipulates that banks must credit the funds to your account on the day they receive the transfer funds. At the same time, merchants must obtain your written authorization before deducting from your account and provide you with a copy of the authorization.

Processing Electronic Transfers (ACH)

When you use apps like Zelle®, Venmo, or PayPal to transfer money to friends, or transfer funds between accounts at different banks, you are actually conducting ACH electronic transfers. This process also requires the ACH routing number.

The steps to set up an ACH transfer are usually simple:

- Obtain recipient information: You need to know the recipient’s name, bank name, account type (checking or savings), account number, and routing number.

- Enter transfer details: Log into your online banking or mobile banking app, and enter the above information and transfer amount on the transfer page.

- Confirm and submit: Carefully check all information, then submit the transfer request. Funds usually arrive in the recipient’s account within 1-3 business days.

Initiating Domestic Wire Transfers

When you need to quickly transfer a large amount of funds, domestic wire transfer is the best choice. Unlike ACH transfers, wire transfers are usually completed within a few hours. As mentioned earlier, you may need to use a routing number specifically for wire transfers.

The cost of initiating a wire transfer is usually higher than ACH transfers. Different banks have different fee standards, but you can refer to the following market average data:

| Transfer Type | Average Fee |

|---|---|

| Domestic Incoming | About $15 |

| Domestic Outgoing | About $25 - $30 |

The chart below visually shows the domestic wire transfer fees of several major US banks:

Important Tip: Although some banks waive incoming fees for certain premium accounts, outgoing fees are common. Before initiating a wire transfer, be sure to confirm the exact fees and required routing number with your bank.

Ordering and Cashing Checks

Routing numbers were originally designed for processing paper checks. Today, they remain core elements for ordering new checks and cashing checks.

When you need to order new checks, you can operate in the following ways:

- Log into your online banking or mobile banking App, find the “Order Checks” option in account services.

- Directly contact bank customer service phone.

- Visit any bank branch to handle.

During the ordering process, the bank will use the routing number and account number associated with your account to print new checks.

In addition, modern checks include multiple advanced security technologies to prevent fraud, which work in conjunction with the MICR line where the routing number is located. These security features include:

- Microprinting: Tiny text that looks like a solid line to the naked eye but becomes visible when magnified.

- Thermosensitive ink: Special ink that changes color or disappears when rubbed with a finger.

- Chemical protection: If someone tries to alter the check with chemicals, the paper will show “VOID” or stains.

- Watermark: Patterns embedded in the paper visible only against light, cannot be copied.

These designs together ensure the security of your funds when using checks for payment.

How to Find Your Bank Routing Number

Image Source: unsplash

Getting your bank routing number is very simple. You have multiple reliable channels to look up this important 9-digit number. Below we have compiled the five most common and effective methods for you.

Check a Paper Check

If you have a personal checkbook, this is the quickest way to find the routing number.

- The bottom edge of the check contains the routing number and your account number.

- You will see three groups of numbers printed with special magnetic ink.

Location Guide: The routing number is usually the first group of numbers in the bottom left corner. It is always 9 digits. This rule applies to personal checks and business checks; the position of the number is uniform. Following it is generally your personal account number, and on the far right is the check number.

Log Into Online Banking

For those accustomed to digital operations, online banking or mobile banking App is the most convenient way to get information. Almost all banks clearly display this information in your account details.

The operation steps are usually as follows:

- Secure login: Open your bank’s mobile App or visit its official website, and log into your account.

- Select account: If you have multiple accounts, select the checking or savings account you want to query.

- Find details: After entering the account page, look for options like “Account Details,” “Show Details,” or “Routing & Account Numbers.”

- View numbers: After clicking, the system usually directly displays your full account number and corresponding routing number.

For example, Chase users can click the account in the App, then select “Account Details” to view. Bank of America’s online portal also provides similar functionality, convenient for you to look up anytime.

Review Bank Statements

Your bank statement may also contain the routing number, but this is not the most reliable method.

Some banks print the routing number on the statement, usually in the upper right corner or near your account number. However, many banks choose not to display the full routing number on statements for security reasons.

Suggestion: You can first check your latest statement. If you can’t find it, it is recommended to prioritize checking a check or logging into online banking, these two more direct methods.

Visit the Bank Website

If you don’t have a check on hand and can’t log into online banking temporarily, try visiting the bank’s official website. Many banks provide routing number information on their website’s “help center” or “frequently asked questions (FAQ)” pages.

This method is particularly useful for finding numbers for specific transactions. For example:

- Some banks (such as [Wells Fargo]) provide a tool that can be queried without logging in; you just need to select the state where the account was opened to find the corresponding ACH routing number.

- Banks usually publish a universal routing number for all domestic wire transfers.

Please note that what you find through the website is usually a universal number. If you need a number that exactly matches your personal account, logging into online banking is still the best choice.

Contact Bank Customer Service

When other methods are not feasible, directly contacting your bank is always the most reliable choice.

You can call the customer service phone on the back of your bank card. After verifying your identity, the customer service representative will accurately tell you the required bank routing number. Many large banks, such as [Citibank], provide 24/7 customer service, ensuring you can get help at any time.

Security Tip: Be sure to contact customer service through channels officially published by the bank to prevent scams. Do not contact the bank through phone numbers randomly found via search engines.

Routing Number vs. Bank Account Number

When handling financial transactions, you will encounter two crucial numbers: the routing number and the bank account number. Confusing them may lead to transfer failures or severe delays. You can imagine the routing number as the bank’s “address,” while the bank account number is your exclusive “house number” at that address. Both must work together to ensure funds are delivered accurately.

Function Comparison

The most fundamental difference between these two numbers is the objects they identify. The routing number points to the financial institution, while the account number points to your personal account within that institution.

The table below clearly shows their core differences:

| Feature | Routing Number | Bank Account Number |

|---|---|---|

| Main Function | Identifies the financial institution holding your account | Identifies your specific account within that financial institution |

| Uses | Electronic payments, direct deposits, ACH transfers, wire transfers | Electronic payments, direct deposits, ACH transfers, wire transfers |

Although their uses seem similar, entering either wrong can cause trouble. For example, if you use an ACH routing number for a transaction that requires a wire transfer routing number, the transfer may be rejected. Even if the transaction fails due to a number error, you may still need to pay fees, such as a $25 wire transfer outgoing fee.

Format Comparison

You can easily distinguish these two numbers by format and length.

- Routing Number: The format of this number is fixed. It always consists of 9 digits.

- Bank Account Number: The length of this number is variable. Depending on the bank, it usually consists of 8 to 17 digits.

When viewing your check, the first group of 9 digits at the bottom is the routing number, and the second group of numbers following it is your bank account number.

Uniqueness Comparison

The uniqueness of these two numbers also differs significantly, and understanding this is crucial.

The routing number identifies the bank institution, not the individual. This means customers with multiple accounts at the same bank (or the same regional branch) share the same routing number. For example, your checking account and savings account at the same bank will use the same routing number.

In contrast, your bank account number is completely unique. It is like your fingerprint, specifically used to identify your particular account at the bank, ensuring deposited funds belong only to you. Even at the same bank, no two accounts will have the same account number.

In summary, you can think of the bank routing number as the bank’s “address,” while the bank account number is your exclusive “house number.” When conducting any US financial transaction, accurately providing these two numbers is crucial. A simple input error or using an outdated number can lead to transaction delays or even failures. Be sure to confirm the correct ACH or wire transfer routing number based on the transaction type.

If you have any uncertainty, the safest method is to verify directly through the bank’s official channels.

FAQ

Do international remittances require a routing number?

No. Routing numbers are only used for financial transactions within the US. When you need to remit from other countries or regions to a US bank account, you need to use a SWIFT code.

- Routing Number: Used for domestic transfers in the US.

- SWIFT Code: Used for international wire transfers.

Can a bank routing number change?

Yes, it may change. If your bank is acquired or merged with another bank, the routing number may be updated. The bank will usually notify you in advance. Before making important transactions, it is best to verify again if the number is the latest version.

Do savings accounts have routing numbers?

Yes, savings accounts also have routing numbers. Usually, your checking account and savings account at the same bank share the same ACH routing number. You can confirm by logging into online banking or checking bank documents.

What to do if the routing number and account number are leaked?

These two numbers are printed on every check, so they are not highly confidential information. But if a leak occurs, you should take action immediately.

Recommended Actions: Closely monitor your account activity and check for any unauthorized transactions. If you find any suspicious activity, contact your bank immediately.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.