- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Do You Need to Know Before Sending Money to India via Remitly?

Image Source: unsplash

Are you looking for a safe and convenient platform for remittances to India? Remitly has successfully served millions of users worldwide since 2011 and is a trustworthy choice. Preparation is key to ensuring smooth transactions. This guide will help you understand the core information, making your Remitly remittance to India process smoother.

Mastering the necessary knowledge in advance can help you eliminate doubts and ensure every remittance is worry-free.

Core Points

- Remitly uses encryption technology and real-time monitoring to protect your funds.

- You need to prepare personal identification documents and accurate recipient information, including bank account number and IFSC code.

- Remittance fees depend on transfer speed and payment method; bank account payments are usually the cheapest.

- Remitly offers multiple receiving methods such as bank deposits, cash pickups, and mobile wallets.

- You can track the remittance status at any time and cancel the transfer before the funds are delivered.

Remitly’s Security

When making any international remittance, fund security is your primary concern. Remitly regards security as the cornerstone of its services, using multi-layered protection measures to ensure your funds and personal information are properly safeguarded. Understanding these security measures can make every remittance more reassuring.

Industry-Standard Encryption

Your personal data and transaction information are strictly confidential. Remitly uses bank-level encryption technology to protect your data. Specifically, the platform employs Transport Layer Security (TLS) protocol and AES-256 encryption standard. This means that throughout the entire process from entering information to completing the transaction, your sensitive data (such as identity information or bank details) is encrypted, preventing interception by unauthorized third parties.

Global Compliance Regulation

Remitly is a financial services company that operates legally worldwide and is subject to strict regulation. It holds remittance licenses in multiple countries and regions and complies with local laws and regulations. For example, in the United States and Canada, Remitly is regulated by multiple government agencies.

| Country/Region | Agency Name |

|---|---|

| United States (New York State) | New York State Department of Financial Services |

| United States (Massachusetts) | Massachusetts Division of Banks |

| Canada | Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) |

| Canada (Quebec) | Revenu Québec |

In India, Remitly’s operations also comply with local regulations and are supervised by the following agencies:

Real-Time Transaction Monitoring

To proactively prevent fraud, Remitly’s professional security team uses advanced machine learning algorithms to monitor every transaction in real time. This intelligent system operates 7x24 hours uninterrupted, analyzing transaction patterns, and immediately flags and takes action upon detecting suspicious activity or abnormal behavior, effectively protecting your funds from fraud threats.

User Identity Verification

Verifying your identity is a key step in securing your account. Remitly uses advanced verification processes such as multi-factor authentication to ensure only you can access your account and authorize transactions. This process may require additional identity information from you; although it adds a step, it greatly reduces the risk of account theft and unauthorized transactions.

Tip: Completing identity verification is not only a platform requirement but also an important safeguard for protecting your Remitly remittance to India transactions.

Documents and Information Required for Remittance

Preparing the correct documents and information is a key step to ensuring smooth remittance. Remitly needs to verify your identity to protect your account security and comply with global financial regulations. Preparing these materials in advance can make your Remitly remittance to India experience faster and smoother.

Sender Documents

When creating an account and initiating a remittance, you need to provide some personal documents. These documents are mainly used to verify your identity and address and are also the basis for increasing remittance limits.

First, you need a valid government-issued photo ID. This usually includes:

- Passport

- Driver’s license

- Other government-issued ID cards

Second, you may need to provide proof of address. Most institutions require an official document to confirm your residential address. Remitly accepts various documents as proof of address, such as:

- Bank statements

- Utility bills (such as water, electricity, gas bills)

- Credit card statements

- Lease agreements

Remitly sets different remittance limits based on your verification level. If you need to send larger amounts, the platform will require you to provide additional documents to increase your limit. For example, the initial limit for remittances from the US may be $25,000 USD, but with additional verification, a single transaction can transfer up to $100,000 USD.

Recipient Information

Providing accurate recipient information is crucial. Any minor error can cause remittance delays or even failure.

Key Tip: The recipient’s name must exactly match the name on their bank account and government ID. Be sure to carefully check every letter and avoid using nicknames or abbreviations.

When remitting to India, you need to prepare the following personal information for the recipient:

- Full Name: First and last name exactly as on the ID.

- Address: The recipient’s complete residential address in India.

- Contact Phone: A valid Indian mobile number for receiving notifications or contact when needed.

- Purpose of Remittance: Select a remittance reason from the dropdown menu, such as “family support” or “purchase of services”.

Bank Account Details

If you choose to deposit funds directly into the recipient’s bank account, accurate bank information is essential. Incorrect account information is one of the most common reasons for remittance failure.

Before initiating the transfer, confirm the following bank details with your recipient:

- Bank Name: The full name of the bank where the recipient’s account is located.

- Account Number: Ensure the account number is complete and correct.

- IFSC Code (Indian Financial System Code): This is an 11-character alphanumeric code used by the Indian banking system to identify specific branches, crucial for electronic fund transfers within India.

Operation Suggestion: After entering this numeric information, double-check with the recipient again. Spending an extra minute checking can save you hours or even days of processing time.

Fee and Exchange Rate Breakdown

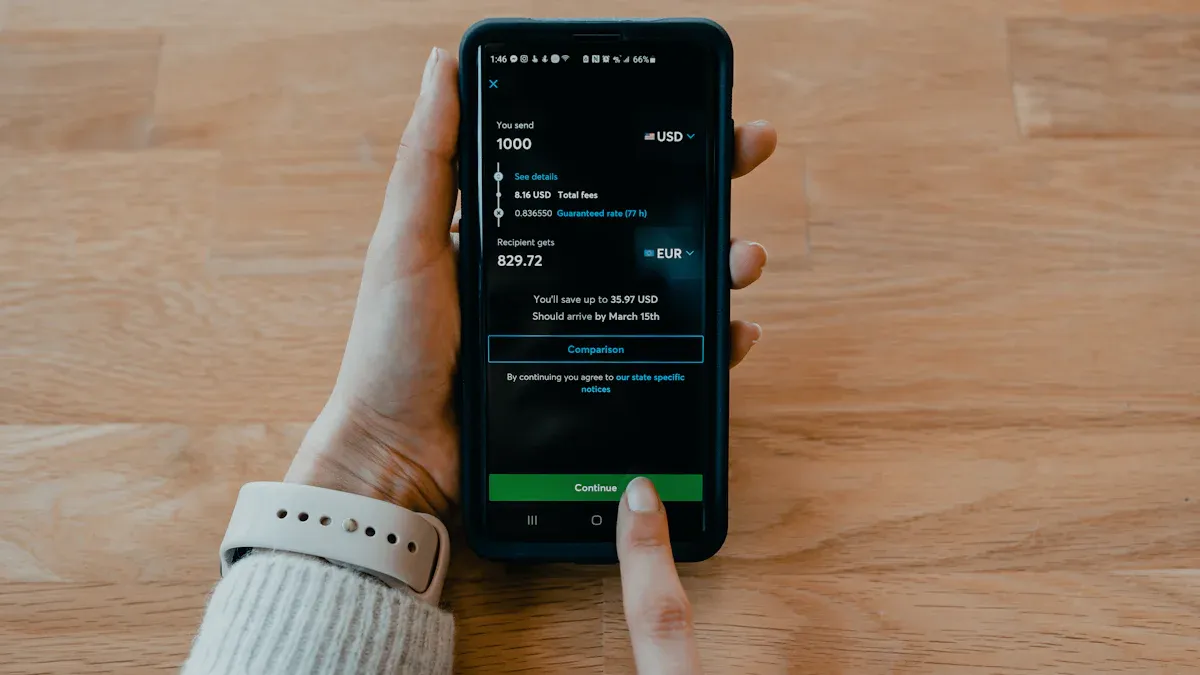

Image Source: pexels

When making international remittances, understanding the total cost is crucial. Remitly’s fee structure is clear and transparent, mainly consisting of two parts: service fees and exchange rates. Understanding how these two work together can help you choose the most cost-effective remittance solution, ensuring your recipient receives the maximum amount.

Fee Structure

Remitly’s service fees are not fixed; they vary based on your chosen transfer speed and payment method. This gives you flexibility to choose based on your needs (speed or cost).

Typically, you will see two transfer speed options:

- Express (Fast Remittance): Funds usually arrive within minutes. This option is the fastest but has relatively higher service fees.

- Economy (Economic Remittance): Funds take 3-5 business days to arrive. This option is slower but usually has lower service fees, possibly even zero.

Your payment method is another key factor affecting fees. Paying with a bank account is usually the most economical, while using a credit card incurs additional fees.

| Payment Method | Typical Fee Characteristics | Additional Notes |

|---|---|---|

| Bank Account | Lowest fees, especially with Economy service, fees may be $0 USD. | Most cost-effective choice, suitable for non-urgent arrivals. |

| Debit Card | Moderate fees, usually used for Express fast remittances. | Good balance between speed and cost. |

| Credit Card | Highest fees, usually incurs additional charges. | In addition to Remitly’s service fee, you need to pay about 3% credit card processing fee. |

Money-Saving Tip: If time is not urgent, choosing “Economy” speed and paying via bank account is the lowest-cost way for Remitly remittance to India.

Real-Time Exchange Rate Inquiry

Besides service fees, the exchange rate is the decisive factor in how many Indian Rupees (INR) the recipient ultimately receives. Remitly offers competitive exchange rates and locks them in at the time of your transaction, protecting you from exchange rate fluctuations.

Notably, Remitly offers special promotions for new customers.

- If you are sending money from the US to India for the first time, you can enjoy a promotional exchange rate.

- This promotion applies to the portion of your first remittance not exceeding $10,000 USD.

- If your remittance amount exceeds $10,000 USD, the excess will be calculated at the standard exchange rate at that time.

This new customer promotion can significantly increase the arrival amount of your first remittance, making it a very good benefit.

Using the Fee Calculator

To ensure you are fully aware of all costs before remitting, the Remitly platform provides a simple and easy-to-use fee calculator. This is an important tool you should use before initiating any transaction.

After entering the remittance amount, the calculator will immediately show you a clear breakdown, including:

- Service Fee (Transfer fee): Calculated based on your chosen speed and payment method.

- Current Exchange Rate (Exchange rate): The exchange rate locked for this transaction.

- Total Amount Recipient Gets: The exact Indian Rupee amount your recipient will receive after deducting all fees.

Operation Suggestion: Be sure to use the fee calculator before confirming the remittance. It can help you compare the total costs of different options (such as Express vs. Economy), ensuring you make the wisest decision and achieve “what you see is what you get”.

Receiving Methods in India

Remitly provides you with multiple flexible receiving methods, allowing you to choose the most convenient option based on the recipient’s specific situation in India. Understanding the characteristics of these methods can help you better complete the Remitly remittance to India process.

Bank Deposit

Bank deposit is one of the most common and secure receiving methods. You can deposit funds directly into the recipient’s bank account in India. This method requires no action from the recipient; funds arrive automatically.

Remitly has partnerships with multiple major banks in India. For example, when initiating a remittance from a bank account in Hong Kong, funds can be safely deposited into the recipient’s account at the State Bank of India (SBI). As a partner of SBI, Remitly deposits funds into accounts via electronic transfer systems such as NEFT, IMPS, or RTGS.

Important Tip: To ensure funds arrive smoothly, be sure to confirm the recipient’s bank account number and IFSC code are accurate again.

Cash Pickup

If your recipient does not have a bank account or prefers cash, cash pickup is an excellent choice. The recipient can pick up cash at designated locations with valid ID and the remittance reference number.

Remitly has an extensive cash pickup network in India, with partners including multiple well-known banks and financial institutions. Your recipient can pick up cash at branches of the following banks:

- State Bank of India (SBI)

- HDFC Bank

- ICICI Bank

- Axis Bank

- Punjab National Bank

This option provides great convenience for those living in areas with inconvenient banking services.

Mobile Wallet

For recipients familiar with digital payments, mobile wallets (such as UPI) are a fast and convenient receiving method. Funds can be directly transferred to the recipient’s mobile wallet account, usually completing within minutes.

To use this method, you need to provide the recipient’s UPI ID or mobile number linked to their mobile wallet. This modern receiving method is very suitable for small, urgent remittance needs, allowing the recipient to receive funds instantly and use them for online or offline spending.

Tracking Your Remitly Remittance to India

Image Source: pexels

After sending the remittance, you certainly want to know the latest status of the funds. Remitly provides clear, real-time tracking features, allowing you to monitor every step of the remittance progress at any time. This way, both you and the recipient can feel at ease.

How to Track Remittance

You can easily track your remittance through Remitly’s official website or mobile app. After logging into your account, you will see your recent transaction list on the homepage. Each transaction displays a current status to help you understand the stage of the funds.

To help you better understand these statuses, here is an explanation of common statuses and their meanings:

| Status | Meaning |

|---|---|

| In Transit | Your funds are being sent from Remitly to the receiving bank. |

| Under Review | The transaction is undergoing security review; this is a standard process to protect your funds. |

| Ready for Pickup | If you chose cash pickup, this means the funds are ready, and the recipient can go to the designated location to pick them up. |

| Delivered | Funds have been successfully deposited into the recipient’s account or picked up. |

| Canceled | The transaction has been canceled, and funds will be refunded to you according to the process. |

Tip: You can share the remittance reference number (Reference Number) with the recipient. They can also use this number to inquire about the remittance status with Remitly’s partners.

Viewing Remittance History

Remitly saves all your transaction records. If you need to review past Remitly remittance to India records, you can easily view them.

In your account, find the “Remittance History” or “Transfer History” section. This lists all your historical transactions, including remittance amount, recipient information, transaction date, and final status. This feature is very useful for personal accounting or checking past remittances.

Setting Transaction Notifications

To get updates immediately, Remitly allows you to customize transaction notifications. You can choose to receive reminders via email or SMS. This way, you don’t need to log in frequently to check and can stay informed of key remittance progress in time.

You can set your notification preferences by following these steps:

- Log in to your Remitly account.

- Go to the “Settings” page.

- Select “Notification Preferences”.

- Check the types of notifications you wish to receive, such as transaction status updates or promotional information.

By setting this up, you can ensure immediate notification when the remittance is successfully delivered, allowing you to inform your family or friends right away.

How to Cancel a Remittance

Sometimes plans change, and you may need to cancel a remittance already initiated. Remitly provides options to cancel transactions, but you need to understand the conditions and steps to ensure smooth operation.

Cancellation Conditions

Whether you can successfully cancel a Remitly remittance to India depends entirely on the remittance status. Remitly allows you to cancel transfers, but with a key prerequisite: funds have not yet been delivered to the recipient. If the transfer has been deposited into the recipient’s bank account or picked up in cash, the transaction can no longer be canceled.

The Key Is Timing: You must operate while the remittance is still in progress. It is recommended to log in to the Remitly app or website first to check the real-time status of the transaction before initiating cancellation.

Operation Steps

If you confirm the remittance is still in progress, you can cancel it by following these simple steps:

- Log in to Account: Open the Remitly mobile app or visit the official website and log in to your account.

- Select Transaction: On the homepage or in “Remittance History”, find the transaction you wish to cancel and click to enter the details page.

- Initiate Cancellation: On the transaction details page, you will see a “Cancel Transfer” option. Click it and follow the on-screen prompts to confirm your operation.

- Receive Confirmation: After completing the operation, you will receive a confirmation email informing you that the cancellation request has been successfully submitted.

Refund Process

Once you successfully cancel the remittance, Remitly will immediately start processing your refund. Funds will be returned to the account you originally used for payment.

Remitly promises that as long as funds have not been picked up or deposited, the platform will process the refund within three business days after your cancellation request. However, please note that the time for the refund to finally reach your bank account or credit card may also be affected by your bank’s processing speed.

What If Cancellation Is Not Possible

If your transaction status already shows “Delivered”, this means the funds have been successfully delivered, and you cannot cancel it through the Remitly platform.

In this case, the only solution is to contact your recipient directly. You need to explain the situation to them and ask them to return the funds to you through local methods.

In summary, Remitly provides you with a safe, flexible, and transparent remittance choice. It becomes a strong alternative to traditional bank wire transfers with the following advantages:

- Flexibility: Supports multiple receiving methods such as bank deposits, cash pickups, and mobile wallets multiple receiving methods.

- Transparency: Clear fee structure, exchange rates usually more favorable than traditional banks.

Before every Remitly remittance to India, be sure to carefully check all information, especially ensuring the recipient’s name exactly matches the ID. Using the fee calculator to estimate total costs ensures you are fully informed about the transaction.

Wishing every remittance of yours arrives smoothly and securely.

FAQ

When using Remitly to send money to India, you may encounter some specific issues. Here we have compiled some of the most common questions and their answers to help you find solutions quickly.

Does Remitly have limits for sending money to India?

Yes, Remitly has remittance limits. Your limit depends on your account verification level. For example, the initial limit may be $25,000 USD. You can apply to increase the limit by submitting additional documents to meet larger remittance needs.

What payment methods can I use for the remittance?

You have multiple payment options. Remitly supports payments using bank accounts, debit cards, or credit cards. Please note that choosing different payment methods may affect service fees and arrival speed. Paying with a bank account is usually the lowest cost.

What if I entered the recipient information incorrectly?

As long as the remittance is not completed, you have a chance to modify the information.

Please immediately log in to your Remitly account, find the transaction, and select the edit option to correct the recipient information. If the transaction is completed, you cannot modify it and need to contact the recipient directly.

Why did my remittance fail?

The most common reason for remittance failure is incorrect recipient information. This includes spelling errors in the name, or mistakes in the bank account number or IFSC code. Before initiating the remittance, be sure to carefully check all information accuracy with the recipient to avoid unnecessary delays.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.