- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How can one remit money from the United States to Nequi more efficiently and safely?

Image Source: unsplash

Do you want to transfer money from the USA to a Nequi account in Colombia?

Core Conclusion: The most efficient and secure way is to use professional international remittance platforms like Remitly or WorldRemit.

Nequi dominates the digital finance market in Colombia. It has over 24 million users, which is almost half of the country’s adult population. With such a large user base, mastering how to send money to a Nequi account becomes particularly important.

Key Points

- Using international remittance platforms is the best choice. Platforms like Remitly or WorldRemit are fast and secure for sending money to Nequi.

- When remitting, you only need the recipient’s name and phone number. No complex bank information is required.

- Remittance speed and fees depend on your payment method. Bank transfers have low fees but slow speed, while debit card payments are fast but have higher fees.

- Be sure to carefully verify recipient information before remitting. Once funds are sent, they usually cannot be revoked.

Which Remittance Method is the Best Choice?

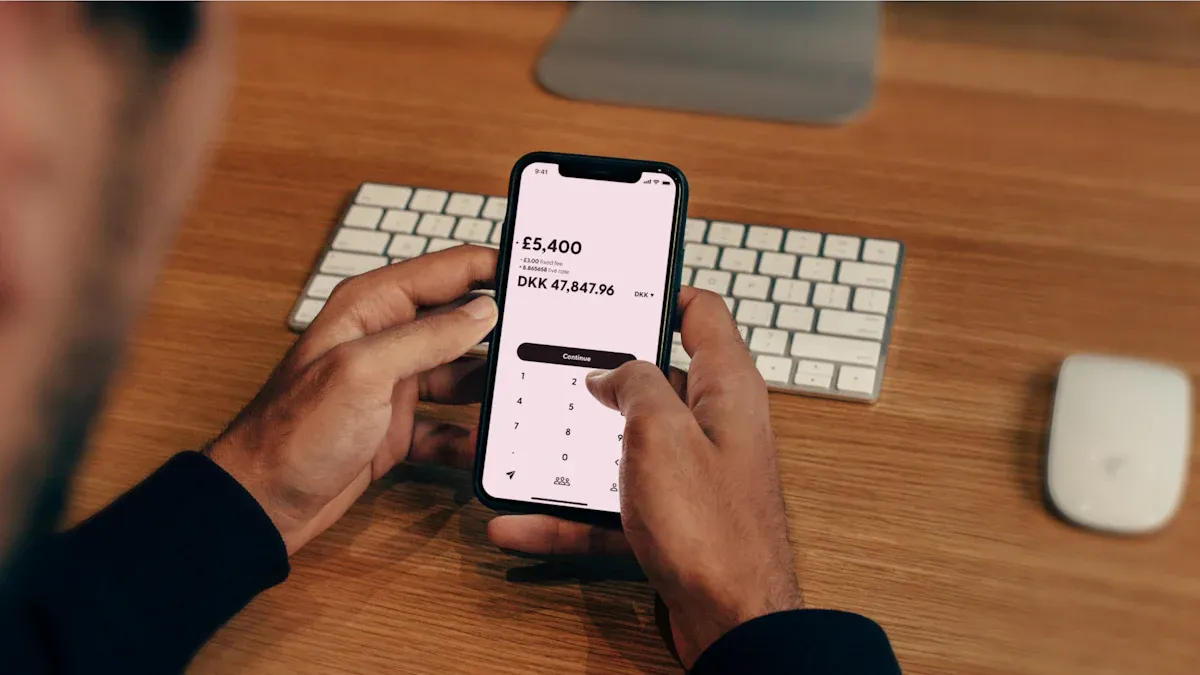

Image Source: unsplash

When you are ready to send money from the USA to a Nequi account in Colombia, you will face multiple options. Each method differs greatly in speed, fees, and operational convenience. To help you make an informed decision, let’s compare the mainstream remittance channels in detail.

Preferred: International Remittance Platforms

For most people, using professional international remittance platforms is the best solution for sending money to Nequi. Services like Remitly, WorldRemit, and Xoom (owned by PayPal) are specifically designed for international transfers and have the following core advantages:

- Fast Speed: Funds usually arrive in the recipient’s Nequi account within minutes or hours.

- Transparent Fees: You can clearly see the fees and final exchange rate before initiating the remittance.

- Simple Operation: The entire process can be completed on a mobile app or website without visiting a physical bank.

- Direct to Nequi: These platforms support direct transfers to Nequi mobile wallets, and the recipient does not need to provide complex bank information.

Exchange Rate Comparison: Where Are the Fees Hidden?

You need to note that different platforms have varying exchange rate strategies. Remitly and Xoom usually incorporate part of the fees into the exchange rate, meaning their rates may not be as attractive as the mid-market rate you see on Google.

The table below uses a $100 USD remittance as an example to show differences between platforms at a certain moment:

Remittance Service Recipient Receives (COP) Exchange Rate (1 USD = COP) Remitly 402,098.00 4021 WorldRemit 380,709.60 3807 Wise 365,951.09 3880 Note: The above data is for example purposes; actual exchange rates and fees change in real time. Although Wise has a better exchange rate, its arrival speed to Colombian bank accounts may be slower than platforms that go directly to Nequi.

Alternative: Traditional Bank Wire Transfer

Conducting an international wire transfer through your US bank account (such as Bank of America, Chase) is another option. This method is known for its high security because the entire process occurs within the traditional banking system.

However, its disadvantages are equally prominent:

- Slow Speed: An international wire transfer from the USA to Colombia usually takes 3 to 5 business days to arrive.

- High Fees: You need to pay multiple fees. In addition to the fixed fees charged by the bank, there are usually additional fees from intermediary banks, and the exchange rate provided by the bank also includes a high markup.

Taking US banks as an example, international wire transfer fees may be as follows:

| Wire Transfer Type | Fee |

|---|---|

| International Wire (Foreign Currency Payment) | $35 USD |

| International Wire (USD Payment) | $45 USD |

Core Disadvantage Summary

Bank wire transfer is like using a heavy truck to deliver a small package—although secure, it is costly and inefficient. For small-amount, high-frequency digital wallet remittances like Nequi, it is not an ideal choice.

Others: PayPal and Cryptocurrency

Finally, let’s look at two methods not primarily recommended: PayPal and cryptocurrency.

PayPal Although Xoom is part of PayPal and is very suitable for sending money to Nequi, direct transfers between PayPal accounts are very uneconomical. Its currency exchange rates are usually high, and the recipient needs to withdraw funds from the PayPal account to the bank, which is cumbersome and may incur additional fees.

Cryptocurrency In theory, you can complete cross-border transfers via cryptocurrency (such as Bitcoin, USDT). But for remittances to Colombia, this method carries huge legal and financial risks. When considering how to send money to Nequi, you should completely avoid this option.

Warning: Risks of Using Cryptocurrency in Colombia

- Ambiguous Legal Status: The Central Bank of Colombia has clearly stated that cryptocurrency is not legal tender in the country, and its use is not officially protected.

- Bank System Restrictions: The Colombian financial regulatory authority (SFC) prohibits regulated banks from providing services to cryptocurrency companies, making cashing out cryptocurrency extremely difficult and dangerous.

- Anti-Money Laundering Risks: Due to its anonymity, cryptocurrency transactions are easily used for illegal activities. The Colombian government is strengthening regulation of virtual asset service providers to combat money laundering and terrorist financing.

- High Fraud Incidence: Lack of clear regulation means that once you encounter fraud, it will be difficult to recover funds.

In summary, for your fund security and remittance efficiency, it is strongly recommended to stay away from using cryptocurrency for personal remittances.

How to Remit: Step-by-Step Operation Guide

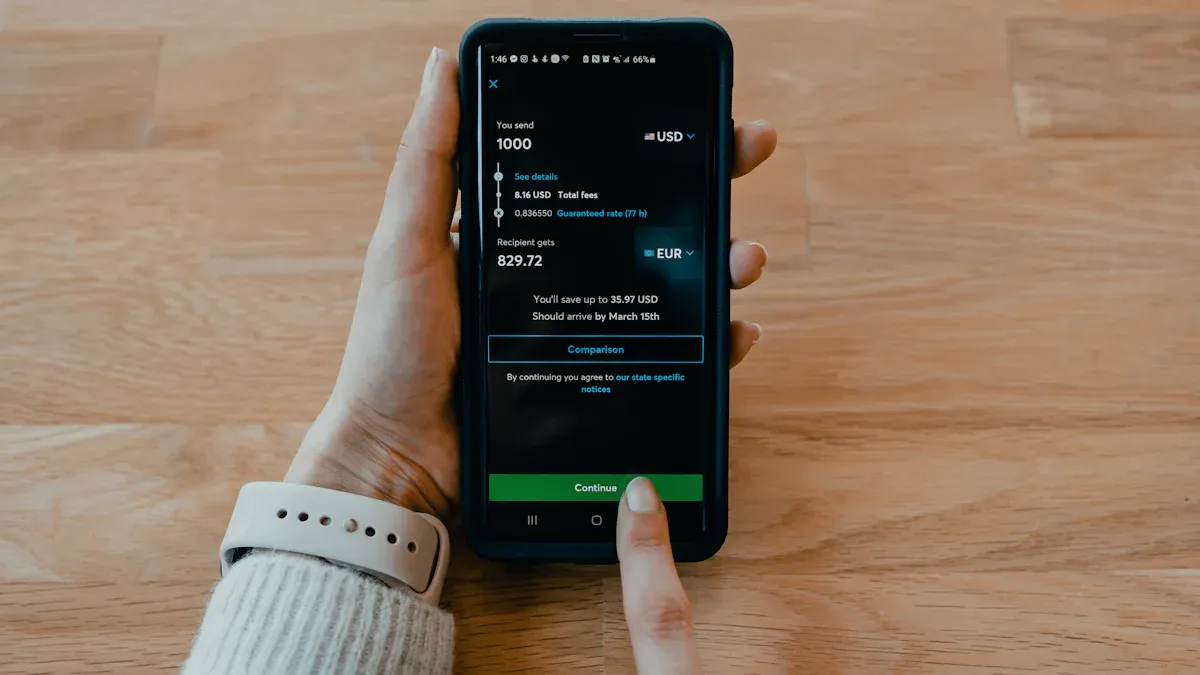

Image Source: unsplash

After selecting the best remittance platform, the actual operation is very simple. The entire process is as intuitive as online shopping. Below, we will break down how to remit step by step to help you get started easily.

Step One: Choose and Register a Platform

First, you need to create an account. This process usually takes only a few minutes.

- Choose a Service Provider: Based on our previous comparison, select your favorite platform from Remitly, WorldRemit, or Xoom.

- Download the App or Visit the Website: You can download their official app on your phone or visit their website directly on your computer.

- Create an Account: Click “Sign Up” or “Sign Up”, then follow the prompts to enter your email address and set a secure password.

Step Two: Complete Identity Verification

To ensure fund security and comply with anti-money laundering regulations, all legitimate remittance platforms require you to complete identity verification (KYC - Know Your Customer).

Professional Tip It is recommended to complete identity verification before initiating your first remittance. This avoids transfer delays due to review.

Usually, you need to provide clear photos or scans of the following documents:

- Proof of Identity: Such as your passport, driver’s license, or other photo ID issued by the US government.

- Proof of Address: Such as recent bank statements or utility bills with your name and residential address.

Step Three: Enter Remittance and Recipient Information

After verification is passed, you can officially start the remittance. You need to enter two key parts of information:

- Remittance Information: How many US dollars (USD) you plan to send from the USA. The platform will automatically calculate the Colombian pesos (COP) amount the recipient will receive and display the exchange rate and fees.

- Recipient Information: This is the most convenient step for sending to Nequi.

Unique Advantage of Nequi Remittance You do not need to ask the recipient for complex bank names, SWIFT/BIC codes, or bank account numbers. To send to Nequi, you usually only need two pieces of information:

- Recipient’s Full Name (exactly matching the name registered on their Nequi account)

- Recipient’s Phone Number (the Colombian phone number used when registering with Nequi)

Taking Xoom as an example, when selecting the receipt method, you simply choose “Mobile Wallet Receipt”, then select Nequi, and enter the other party’s phone number and name.

Step Four: Pay and Confirm the Transfer

The final step is to choose your payment method and confirm the transaction. Different payment methods directly affect arrival speed and total fees. This is the key point to weigh when considering how to remit.

Bank Account (ACH Transfer)

- Advantages: Fees are usually lower.

- Disadvantages: Arrival speed is slower, possibly taking 3-5 business days. This method usually corresponds to the platform’s “Economy” service.

Debit Card/Credit Card Payment

- Advantages: Extremely fast arrival; funds usually reach the recipient’s Nequi account within minutes. This corresponds to the platform’s “Express” service.

- Disadvantages: Higher fees. Using credit card payment may incur additional fees. For example, on some platforms, this fee may be 3% of the transfer amount.

To help you understand the differences more clearly, see the table comparison below:

| Payment Method | Fee Characteristics | Arrival Speed | Applicable Scenarios |

|---|---|---|---|

| Bank Transfer (Economy) | Lower fees | Slower (3-5 business days) | Remittances not sensitive to time, hoping to save fees |

| Debit/Credit Card (Express) | Higher fees, credit cards may have extra fees | Extremely fast (usually within minutes) | Urgent situations or hoping for quick fund arrival |

After selecting the payment method, carefully verify all information displayed on the screen: remittance amount, exchange rate, fees, recipient name, and phone number. After confirming no errors, click “Send” or “Confirm Transfer”, and your remittance journey is complete!

Fees, Limits, and Arrival Time Analysis

Understanding the fees, limits, and times in the remittance process can help you better plan your funds. This not only saves money but also ensures funds arrive on time. Below, we analyze these key factors in detail.

Remittance Fee Structure

The total cost of remittance is not just fixed fees. You need to pay attention to several parts, especially fees hidden in the exchange rate.

Fee Analysis International remittance platforms are usually more transparent than traditional banks. Bank wire transfers, in addition to high fees, may involve intermediary bank fees, with each intermediary potentially charging $15-50 in extra fees.

The table below clearly shows the main fee types you may encounter:

| Fee Type | Description |

|---|---|

| Fixed Processing Fee | The platform charges a fixed fee regardless of the remittance amount. |

| Percentage Fee | The fee is a percentage of your total remittance, usually appearing when using credit card payment. |

| Hidden Fee (Exchange Rate Markup) | The exchange rate provided by the platform may be less favorable than the mid-market rate. This difference is the platform’s hidden profit. |

Per-Transaction and Daily Limits

Remittance platforms and Nequi accounts themselves have certain limit regulations.

- Remittance Platform Limits: Limits vary by platform. For example, Remitly allows up to $100,000 per transfer from the USA, but specific amounts may require additional documents for verification.

- Nequi Receiving Limits: Nequi account receiving limits depend on the account type. Understanding the recipient’s account type is important.

Expected Arrival Time

Arrival speed mainly depends on your chosen payment method.

- Fast Arrival (Express): Using debit or credit card payment, funds usually arrive within minutes. This is the fastest method.

- Economy Arrival (Economy): Using bank account (ACH) payment, fees are lower, but funds need 3-5 business days to process and arrive.

When considering how to remit, you need to balance between these two.

Holiday Impact

Public holidays in the USA and Colombia may affect your remittance speed, especially when using bank account payment.

Holiday Delay Reminder The US ACH system pauses on federal holidays and weekends. If your remittance coincides with a holiday, processing time may be delayed by one to two business days. Although Colombia’s real-time payment system (such as Transfiya) supports 24/7 operation, bank-related processing may still be affected by its public holidays. Therefore, try to avoid holidays for urgent remittances.

Security Measures and Issue Handling

When sending your hard-earned money overseas, fund security is your top concern. Fortunately, both professional remittance platforms and Nequi itself have established multiple security defenses to protect every transaction.

Remittance Platform Security Measures

Legitimate international remittance platforms operate under strict regulation. In the USA, they act as Money Services Businesses and must comply with regulations from bodies like the Financial Crimes Enforcement Network (FinCEN). This means they operate within a legal framework, providing the first layer of protection for your funds.

On the technical level, these platforms use advanced encryption technology to protect your personal information and transaction data.

How is Data Protected? Platforms like Remitly use industry-standard 256-bit Secure Sockets Layer (SSL) and Transport Layer Security (TLS) protocols. Simply put, this is like building an encrypted private tunnel between you and the platform, ensuring all your information is secure during transmission and cannot be stolen.

Nequi’s Own Security Guarantees

Nequi is trustworthy primarily because it is affiliated with Bancolombia, one of Colombia’s largest and most mature banks. This strong background provides solid brand endorsement for Nequi’s security.

More importantly, Nequi collaborates with global payment networks like TerraPay to open secure international receipt channels.

- TerraPay provides a single, secure, and efficient payment network.

- It enables Nequi to seamlessly receive remittances from around the world.

- This cooperation ensures the entire payment experience is transparent and secure, achieving uninterrupted real-time global transactions.

It is with such technical support that funds you send from the USA can safely and quickly enter the recipient’s Nequi mobile wallet.

How to Handle Remittance Errors

Even in the most secure systems, occasional issues may arise due to input errors. If you discover an error in remittance information, the most critical point is: Act immediately.

Important Tip Since most remittances paid by debit card arrive within minutes, once funds reach the recipient’s account, the transaction is usually irreversible or uncancellable.

If you need to try canceling a transaction, follow these steps:

- Log in immediately to your remittance platform account (such as Xoom, Remitly).

- Find the transaction record and locate the remittance you wish to cancel.

- Check the cancel option. If the “Cancel” button is visible, it means funds have not been sent, and you can cancel immediately. If the button is invisible or grayed out, it means funds have arrived and cannot be withdrawn.

When completing the final step of how to remit, carefully verifying the recipient’s name and phone number is the best way to prevent errors.

The best solution for sending money from the USA to Nequi is to choose a reputable international remittance platform. It perfectly combines efficiency, security, and low cost. For example, Remitly has a 4.6-star customer satisfaction rating on Trustpilot, fully demonstrating that its service is trustworthy.

Now, you can confidently follow the steps in this article to complete your remittance.

Final Reminder: Before clicking send, be sure to verify the recipient’s name and phone number again to ensure everything is correct!

FAQ

Do I Need the Recipient’s Bank Account Number?

No. This is one of the biggest advantages of sending to Nequi. You usually only need to provide the full name registered by the recipient on Nequi and their Colombian phone number. The entire process is as simple as sending a message to a friend.

What If I Send Money to the Wrong Phone Number?

You must immediately contact the remittance platform’s customer service. If the funds have not been received, they may be able to cancel the transaction. But due to the fast remittance speed, once funds arrive, the transaction usually cannot be revoked. Therefore, carefully verify the number before sending.

Why is the Platform Exchange Rate Different from What I Searched Online?

What you search online is the mid-market exchange rate, which does not include any fees. Remittance platforms add a markup to this rate to profit. This markup is their hidden fee and part of the total cost.

Which Method is the Most Cost-Effective?

Usually, using bank account payment (Economy mode) has the lowest fees. Although slower (3-5 business days), if you are not in a hurry, this is the most economical choice. Using debit card payment (Express mode) is fast but has higher fees.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.