- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is MoneyGram Trustworthy? Details You Should Know Before Bank Transfers

Image Source: unsplash

Regarding whether MoneyGram is trustworthy, the answer is yes. It is a long-established remittance service that operates compliantly worldwide. However, you should understand that it is not suitable for all situations.

Core Trade-offs

- Advantages: Fast remittance speed; recipients can receive cash without a bank account.

- Disadvantages: Handling fees and exchange rates may not be the optimal choice.

Understanding these key details can help you determine if it truly meets your remittance needs.

Key Points

- MoneyGram is a trustworthy remittance service that complies with legal regulations worldwide.

- MoneyGram’s advantages are fast remittance speed and recipients can receive money without a bank account.

- MoneyGram’s disadvantages are that handling fees and exchange rates may be higher than bank wire transfers, making it unsuitable for large remittances.

- In emergency situations, MoneyGram is a good choice, but before remitting, carefully verify information and only send to people you know.

- Before remitting, please check fees and exchange rates on the MoneyGram official website and your bank to choose the most suitable method.

MoneyGram’s Security Assurance Mechanisms

When preparing to remit money, fund security is undoubtedly the primary consideration. MoneyGram has established a multi-layered security system to protect every transaction. Below, we detail how it works.

Global Compliance and Regulatory System

MoneyGram is a global company whose operations must strictly comply with laws and regulations worldwide. This means it is supervised by local financial regulatory authorities in every country. To prevent illegal activities such as money laundering and terrorist financing, MoneyGram requires all its agents and partners to adhere to strict guidelines.

These guidelines include:

- Complying with all applicable city, state, provincial, and national laws and regulations.

- Strictly implementing MoneyGram’s internal anti-fraud and anti-money laundering policies.

- Actively taking actions to ensure compliance standards are effectively implemented.

Additionally, any company wishing to become a MoneyGram business partner must pass a series of strict reviews, such as “Know Your Business” (KYB) background checks and sanctions list screening. This system ensures the reliability of its partner network from the source.

Data Encryption and Technical Protection

At the technical level, MoneyGram adopts industry-standard security measures to protect your personal information and transaction data. When you operate through its website or app, your data is encrypted to prevent theft during transmission.

At the same time, MoneyGram’s system monitors transactions in real time. It uses advanced fraud detection systems to continuously analyze abnormal patterns in transactions. Once suspicious activity is detected, the system immediately flags it for manual review, effectively intercepting potential fraud.

Regarding its network security certifications, public information shows the following:

| Certification Standard | MoneyGram Public Status |

|---|---|

| ISO 27001 | Not publicly verified |

| PCI DSS | Not publicly verified |

Although specific certification information is not publicly available, as a large financial service institution, it must follow payment industry data security standards to handle your sensitive information.

Is MoneyGram Trustworthy? Looking at the Security System

Overall, MoneyGram’s security system is the cornerstone of its reliability. It combines a strict global compliance framework with real-time technical monitoring to build a solid defense line. From the perspective of systems and processes, MoneyGram is trustworthy.

However, you need to understand that the security of any remittance service cannot be separated from the user’s own vigilance. The effectiveness of this security system also depends on you providing accurate information and complying with safe operation norms.

Transaction Information Confirmation and Anti-Scam Reminders

To ensure transaction accuracy and security, MoneyGram requires senders and recipients to provide detailed personal information for verification. Before remitting, please prepare the following information:

- Sender and Recipient Information:

- Legal full name (consistent with ID)

- Complete residential address (cannot be a PO box)

- Valid phone number

- Date of birth

- In regions like the US, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) may also be required

- Valid government-issued photo ID (such as passport, driver’s license)

Security Reminder: Always be vigilant against remittance scams! The convenience of remittance services can also be exploited by criminals. Absolutely do not remit to strangers. Common scams include: online shopping, fake prize notifications, impersonating relatives or friends in urgent need. Once funds are collected, they are difficult to recover. As long as you follow official procedures and only remit to people you know and trust, MoneyGram is trustworthy.

By carefully verifying information and staying vigilant, you can fully utilize MoneyGram’s security guarantees to complete a safe and fast international remittance.

Cost and Speed Comparison

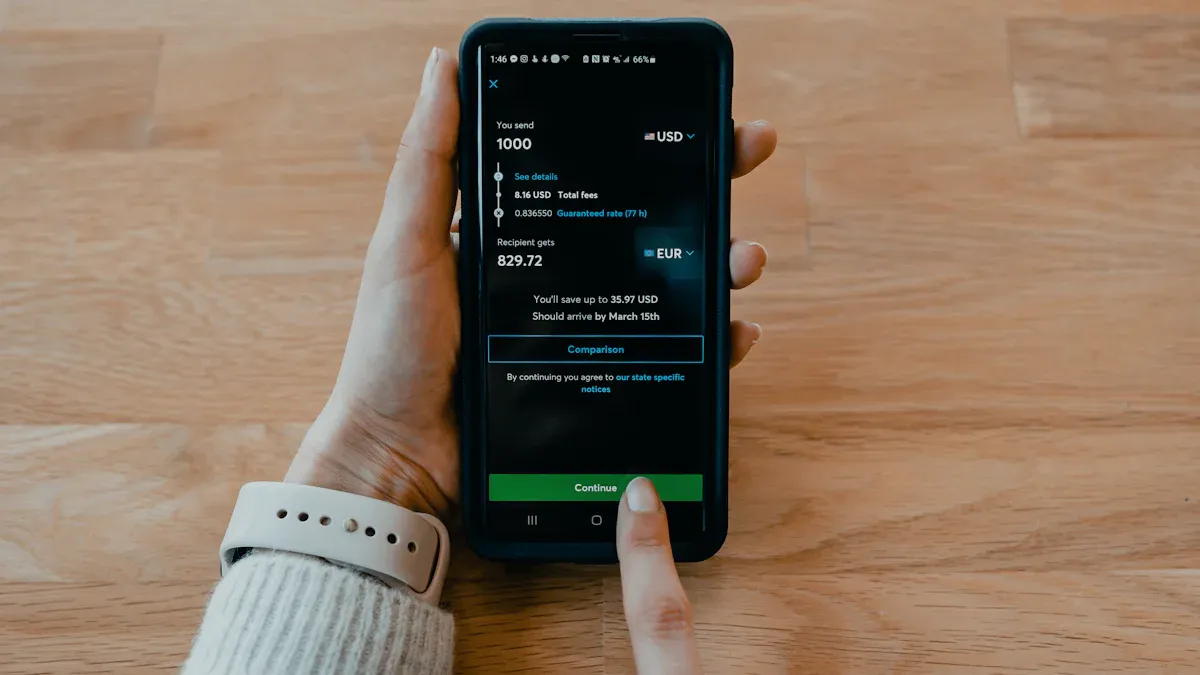

Image Source: unsplash

When choosing a remittance service, cost and speed are two decisive factors. MoneyGram and traditional bank wire transfers have their own advantages and disadvantages in these two aspects. You need to carefully weigh them to find the most suitable solution for yourself.

Fee Structure Analysis

The total cost of remittance is not just the surface handling fee. It consists of two parts:

- Transfer Handling Fee (Transfer Fee): This is the fee you pay directly for using the service. This fee varies based on your payment method, remittance amount, and destination country.

- Exchange Rate Margin: This is the difference between the exchange rate provided by the remittance service provider and the real-time mid-market rate. This part is a “hidden cost.” Although MoneyGram claims to offer “highly competitive exchange rates”, it still profits through the exchange rate margin. This margin can sometimes exceed 5%, so comparing exchange rates before remitting is crucial.

Fee Tip Do not just look at the handling fee! After entering the remittance amount on the MoneyGram official website or app, the system will display the final foreign currency amount the recipient can receive. You can reverse-calculate the actual exchange rate using this amount and compare it with the mid-market rate to understand the real remittance cost.

Remittance Speed Analysis

Speed is one of MoneyGram’s core advantages.

- MoneyGram: When choosing the “cash receipt” service, funds are usually ready in a few minutes, and the recipient can collect cash at any agent location with the reference number. Even for deposits into bank accounts, many transfers can be completed within a few hours.

- Bank Wire Transfer: International wire transfers through banks usually take 1 to 5 business days to arrive. This process involves multiple intermediary banks with longer processing flows.

If you pursue ultimate speed, especially in emergencies, MoneyGram is undoubtedly the better choice.

Influencing Factors: Payment Method and Region

The payment method and remittance region you choose will directly affect the final fees and arrival time.

- Payment Method: Usually, using a debit or credit card for online payment may have lower handling fees and faster processing. In contrast, going to an offline agent location to pay with cash may have higher fees.

- Receipt Method: Cash receipt is the fastest, almost instant. Choosing to deposit directly into the recipient’s bank account requires additional time, depending on the efficiency of the recipient’s bank.

- Destination: Remitting to different countries and regions has different fees and regulations. Some popular remittance corridors may have more favorable rates.

For example, sending $500 from the US to Europe, using a debit card for payment and having the recipient pick up cash, the handling fee may be $9.99. But for a domestic transfer in the US under the same conditions, the fee may be as high as $68.99. This shows that regional differences have a huge impact on costs.

Cost and Arrival Time Comparison

To give you a more intuitive feel, we take “sending $1,000 from the US to Mexico with the recipient picking up cash” as an example to compare the costs and speeds of different methods.

| Remittance Method | Estimated Handling Fee (USD) | Exchange Rate Features | Estimated Arrival Time |

|---|---|---|---|

| MoneyGram (Online, Debit Card Payment) | $1.99 - $4.99 | Includes provider profit, not optimal exchange rate | Within a few minutes |

| MoneyGram (Online, Credit Card Payment) | $0.99 - $32.99 (depending on receipt method) | Includes provider profit, not optimal exchange rate | Within a few minutes |

| MoneyGram (Offline, Cash Payment) | $9.99 or higher | Includes provider profit, usually worst exchange rate | Within a few minutes |

| Traditional Bank Wire Transfer (e.g., via licensed bank in Hong Kong) | $25 - $50 | Relatively transparent exchange rate, but still with margin | 1-5 business days |

Summary:

If your primary goal is speed and the recipient needs to get cash quickly, MoneyGram’s advantages are very obvious, even if the total cost may be slightly higher.

If you have no strict time requirements and care more about saving total costs, especially for larger remittance amounts, traditional bank wire transfers, although slow, may save you more money with better exchange rates.

Before making a decision, be sure to estimate on both MoneyGram and your bank’s official channels to get the most accurate fee and exchange rate information.

Remittance and Receipt Operation Guide

Image Source: unsplash

Understanding MoneyGram’s operation process can help you complete remittances more smoothly. Whether you choose online or offline, the entire process is very straightforward. Below is a detailed step-by-step guide.

Detailed Remittance Steps

You can choose online or offline methods based on your convenience.

Online Remittance (Website or App)

- Download the official MoneyGram app or visit its website.

- Log in to your personal account; if you don’t have one, register first.

- Enter the recipient’s information and the amount you wish to send.

- Choose your payment method, such as debit or credit card.

- Carefully check all information and complete the transaction after confirmation.

Offline Agent Location Remittance

- Use the official tool to find a MoneyGram agent location near you.

- Prepare your ID, recipient information, and remittance amount (including handling fee).

- Hand over all information and cash to the agent to complete the transfer.

- Keep the receipt safe and provide the 8-digit reference number to the recipient.

Required Information Checklist

To ensure a smooth transaction, you need to prepare the following information in advance. Incomplete information may cause delays or failures.

- Your Information: Your legal full name, address, and valid government-issued photo ID.

- Recipient Information: Recipient’s legal full name (must exactly match their ID).

- Bank Information: If choosing bank deposit, you also need the recipient’s bank name and account number.

About Valid IDs MoneyGram accepts various government-issued photo IDs. The most common include passport and driver’s license. Depending on the region, state ID, military ID, etc., may also be accepted. It is recommended to confirm acceptable ID types with the specific agent location in advance.

Receiving with Reference Number

The recipient’s cash pickup process is equally simple and fast.

The recipient needs to bring two things to a MoneyGram agent location:

- 8-Digit Reference Number: This is the key number you get from the receipt after remitting.

- Valid Photo ID: The name on the ID must exactly match the recipient name you filled in when remitting.

In some countries, if the recipient’s ID does not have address information, they may also need to provide proof of address, such as a recent utility bill.

Transaction Status Inquiry

After sending the remittance, you can track the fund status at any time to reassure yourself and the recipient.

To track the remittance, you usually need to provide the following information:

- Transaction reference number.

- Sender’s last name.

You can enter this information on the “Track Remittance” page on the MoneyGram official website to view progress. If you have a MoneyGram account, you can also log in directly and find the status of this remittance in your transaction history.

Advantages, Disadvantages, and Applicable Scenarios

Now that you understand MoneyGram’s security, costs, and operation processes, it is time to summarize its advantages and disadvantages to help you judge if it suits your specific situation.

Core Advantages Summary

MoneyGram’s greatest appeal lies in its speed and convenience.

- Lightning-Fast Arrival: In emergencies, its advantages are irreplaceable. Funds usually arrive within a few minutes.

- Extensive Network: Its physical network covers over 200 countries and regions worldwide with more than 350,000 agent locations. This means your recipient can likely find a pickup point nearby.

- No Bank Account Required: Recipients do not need a bank account; they can collect cash with the reference number and ID, which is especially important for recipients in areas with underdeveloped banking systems.

Main Disadvantages Analysis

Despite obvious advantages, you still need to note its several disadvantages.

- Higher Costs: Compared to bank wire transfers, MoneyGram’s handling fees and exchange rate margins usually result in higher total costs.

- Amount Limits: It is not suitable for large remittances. Online remittances usually have a limit of $10,000 per transaction. Although domestic US transfers can reach $15,000, this still limits its usage scenarios.

Best Applicable Scenarios

Based on its advantages, MoneyGram is your best choice in the following situations:

Emergency Fund Assistance

- Medical Emergency: Family needs to pay medical fees immediately.

- Travel Predicament: Lost wallet abroad or encountered an accident, urgently needing cash.

- Unexpected Bills: Need to pay sudden repair fees or bills immediately.

Additionally, when you need to remit to relatives or friends without bank accounts, MoneyGram’s cash receipt service is also an ideal solution.

Situations Not Recommended

In some cases, using MoneyGram may not be wise.

- Large Remittances: If you need to remit over $10,000, it is better to choose bank wire transfers or other services.

- Remitting to Strangers: This is the most important rule. Scammers prefer services like MoneyGram because once funds are collected, they cannot be recovered. Remember, no matter how touching the other party’s story is, absolutely do not remit to someone you have never met. As long as you follow this rule, MoneyGram is trustworthy.

Overall, in specific scenarios, MoneyGram is trustworthy; it is a fast remittance option. Your choice should be based on specific needs.

Decision Advice

- Pursuing Speed: If speed is your primary consideration or the recipient has no bank account, MoneyGram is the ideal choice.

- Saving Costs: If the remittance amount is large and time is not urgent, traditional bank wire transfers may save more costs.

Finally, before any remittance, you should verify all information through official channels to ensure transaction security.

FAQ

What if I fill in the remittance information wrong?

You must immediately contact MoneyGram customer service. If the funds have not been collected, they can help you modify or cancel the transaction. Please prepare your reference number to speed up processing.

Does MoneyGram have a remittance amount limit?

Yes, there are amount limits. Online remittances usually have a limit of $10,000 per transaction. Limits may vary by country and payment method. You can view specific prompts on the page during remittance.

What if the recipient never collects the remittance?

Remittances are usually valid for 90 days. If no one collects after this period, the transaction will be automatically canceled. You can contact customer service to apply for a refund. Please note that handling fees may not be refundable.

Can I use MoneyGram in mainland China?

Yes. MoneyGram has partner bank locations in mainland China, such as Bank of China. You can send or receive remittances through these locations. For specific supported services, it is recommended to consult the local partner bank.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.