- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Remit Money from El Salvador to the United States: Detailed Steps, Fees, and Recommended Services

Image Source: unsplash

Are you looking for the best way to remit money from El Salvador to the United States? There are multiple options available on the market, each differing in speed, fees, and security. Making the right choice can save you both time and money.

The goal of this guide is to help you make an informed trade-off among these key factors to find the service that best fits your personal needs.

Key Takeaways

- Before remitting, prepare identification and receiver information. Ensure the receiver’s name matches their ID exactly and verify bank account details.

- Online platforms offer fast remittances with low fees. Bank wire transfers are suitable for large amounts but are slow and expensive. Cash agent points are ideal for receivers without bank accounts.

- When comparing remittance services, don’t just look at service fees. Consider how much the receiver ultimately receives, which includes the exchange rate margin.

- Remitly and WorldRemit are popular online platforms. Western Union and MoneyGram are suitable for cash pickup. Bank wire transfers are best for large transactions.

- Remittance limits vary by provider. If a remittance is delayed, contact customer service. Once completed, remittances usually cannot be canceled.

Preparations Before Remittance

As the saying goes, preparation is half the battle. This is especially true for international remittances. To ensure a smooth process when sending money from El Salvador to the United States, you need to prepare some key documents and information in advance. This not only speeds up processing but also effectively avoids delays or extra costs due to errors.

Prepare Sender Documents

First, you need to prepare valid personal identification. This is a mandatory requirement for all legitimate remittance services to verify your identity and comply with anti-money laundering regulations.

- El Salvador ID (DUI)

- Valid Passport

Ensure your documents are within their validity period and clearly legible.

Obtain Receiver Information

Next, you need to accurately obtain the receiver’s personal information.

Important Tip: The receiver’s name must exactly match the name on their official US ID (such as a driver’s license or passport). Any spelling errors or inconsistencies may cause the remittance to be frozen or returned.

The information you need includes:

- The receiver’s full legal name

- The receiver’s detailed residential address in the United States

- The receiver’s contact phone number

Confirm Receiver Bank Account Details

If you choose to send funds directly to the receiver’s bank account, obtaining accurate bank information is crucial. A single digit error can cause the remittance to fail.

Ask the receiver to confirm the following bank account details:

- Bank Name: For example, Bank of America or Chase Bank.

- Account Number: The specific account the receiver uses to receive funds.

- ABA Routing Number: This is a nine-digit code used to identify US banking institutions. Each bank has its specific routing number to ensure funds are accurately delivered to the correct bank.

- Receiver Address Information: Including state and zip code.

With this information prepared, you can start comparing different remittance services and choose the plan that best suits you.

Main Methods for Sending Money from El Salvador to the United States

Image Source: unsplash

Once you have all documents ready, the next step is to choose the specific remittance method. There are multiple channels for sending money from El Salvador to the United States, each with unique advantages and disadvantages in speed, fees, and convenience. Understanding these differences will help you make the most informed decision.

Online Remittance Platforms

For users seeking speed and convenience, online remittance platforms are usually the best choice. You can complete the entire remittance process from home via a website or mobile app.

The biggest advantage of these platforms is their efficient operation. You simply register an account, enter receiver information and the remittance amount, then select a payment method. Paying with a debit card is typically the fastest way.

Transfer Speed Comparison:

- Debit or Credit Card Payment: Funds usually arrive within minutes, sometimes instantly.

- Bank Account Transfer: Most cases take 1 to 3 business days, with some providers offering same-day arrival.

Security is the top priority for these platforms. Legitimate online remittance services employ multiple technologies to protect your funds and personal information, such as:

- Data Encryption (SSL/TLS): Protects your information during operations from being stolen.

- Multi-Factor Authentication (MFA): Verifies your identity through multiple methods like password and phone verification code.

- Fraud Detection System: Uses intelligent algorithms to monitor suspicious transactions in real time and prevent fraud.

Bank Wire Transfer

Bank wire transfer is a very traditional and reliable remittance method. If you need to send large amounts or have extremely high security requirements, bank wire transfer is a trustworthy choice.

Nowadays, many banks (such as Banco Agrícola, Banco Cuscatlán) also offer online-initiated wire transfer services. This means you can transfer funds directly from your El Salvador bank account to the receiver’s US bank account via the bank’s official website.

However, you should note that bank wire transfers usually have two disadvantages:

- Slower Speed: An international wire transfer may take up to 4 business days to complete.

- Higher Fees: Banks typically charge higher service fees, and the exchange rate may not be as competitive as online platforms.

Cash Agent Points

If your receiver does not have a bank account or needs cash urgently, remitting through cash agent points is the best option. Western Union and MoneyGram are the two most well-known global providers.

The operation process is very simple:

- You go to any agent point in El Salvador.

- You pay the remittance amount and service fee in cash.

- You receive a Money Transfer Control Number (MTCN) or transaction reference number.

- You inform the receiver in the United States of this number.

When the receiver picks up the cash, they need to provide the following to the agent point:

- Valid photo ID (name must exactly match the remittance information)

- Transaction Reference Number (the MTCN you provided)

- Some basic information about the sender (such as name and country)

The main advantages of this method are fast speed (usually cash available within minutes) and no bank account required.

Cryptocurrency

With Bitcoin becoming legal tender in El Salvador, using cryptocurrency for remittances has become an emerging option. In theory, it can bypass traditional financial systems, potentially reducing costs.

However, this method is full of uncertainty and risk. First, the Central Reserve Bank of El Salvador clearly states that the risks of cryptocurrency transactions are entirely borne by the user, and its price is determined by the market. In the United States, the Financial Crimes Enforcement Network (FinCEN) also regulates cryptocurrency transactions.

Volatility is the biggest risk: The prices of cryptocurrencies like Bitcoin fluctuate dramatically. Research shows that severe Bitcoin price fluctuations may lead people to reduce remittances due to concerns about fund value depreciation. The $500 USD worth of Bitcoin you send today may only be worth $480 USD when the receiver exchanges it for dollars.

Therefore, although using cryptocurrency for remittances from El Salvador to the United States is technically feasible, its high risk and complex regulatory environment make it unsuitable for most ordinary users.

Recommended Popular Remittance Services

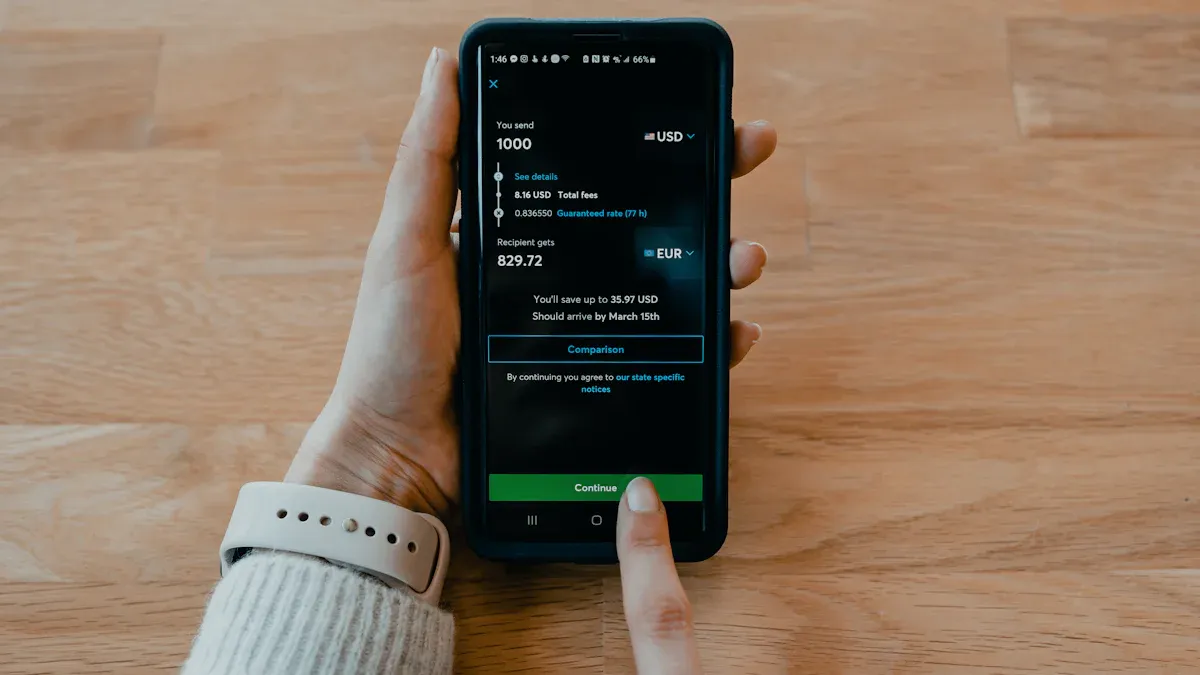

Image Source: pexels

Choosing the right service is key to successful remittance. Different services focus on fees, speed, and convenience differently. Below, we will review in detail several of the most popular services for sending money from El Salvador to the United States to help you make the best choice.

Remitly

Remitly is a very popular online remittance platform known for its flexible options and user-friendly mobile app. You can easily send funds to US bank accounts or designated cash pickup points through it.

Remitly typically offers two remittance speed options:

- Express (Fast): Pay with a debit card; funds usually arrive within minutes. This option has slightly higher fees.

- Economy: Pay with a bank account; funds take 3-5 business days to arrive but with lower fees.

New User Benefits: Remitly often offers promotional exchange rates or fee waivers for first-time users. Pay special attention when making your first remittance.

| Pros 👍 | Cons 👎 |

|---|---|

| Very convenient mobile app operation | Fast remittance fees are relatively high |

| Offers multiple receipt methods (bank deposit, cash pickup) | Exchange rates are competitive but not always the market best |

| Clear remittance status tracking | Daily or monthly remittance limits |

| Fast fund arrival (especially Express service) |

Best For: Users seeking speed and wanting to complete all operations via mobile phone.

WorldRemit

WorldRemit is a strong competitor to Remitly, also offering comprehensive online remittance services. Its extensive global network supports multiple receipt methods, making it a powerful choice.

After entering the remittance amount on the WorldRemit website or app, the system clearly lists all fees and the final arrival amount. This transparency allows you to easily compare total costs.

WorldRemit’s standout features:

- Diverse Receipt Options: In addition to bank deposits and cash pickup, some regions support mobile wallet receipts.

- Clear Fee Structure: All fees are explicitly displayed before you confirm the remittance.

- Wide Global Coverage: Extensive partner banks and cash pickup points in the United States.

| Pros 👍 | Cons 👎 |

|---|---|

| Very flexible receipt options | Fees vary significantly by receipt method |

| High transparency in fees and exchange rates | Mixed customer service experience reviews |

| User-friendly website and app interface | Some transactions may require additional identity verification, taking slightly longer |

| Frequent new user promotions |

Best For: Users needing to send to specific cash pickup points or valuing fee transparency.

Western Union and MoneyGram

Western Union and MoneyGram are the two giants in traditional cash remittance. Their biggest advantage is their vast global physical agent network. If your receiver needs cash urgently and has no bank account, these two services are irreplaceable.

Cost Reminder: Convenience comes at a price. Compared to online platforms, Western Union and MoneyGram usually have the highest total costs. Their fees include not only a higher service fee but, more importantly, their exchange rates are often far less competitive than online platforms. This means your receiver ultimately receives fewer dollars.

Core Advantages:

- Extremely Fast Speed: Cash is usually available for pickup within minutes.

- No Bank Account Required: No bank account needed for sender or receiver.

- Widespread Locations: Easy to find agent points in both El Salvador and the United States.

Best For: Receivers without bank accounts or users needing immediate cash in emergencies.

Local Bank Options

Conducting an international wire transfer through your local bank in El Salvador (such as Banco Agrícola, Banco Cuscatlán) is the most traditional and secure method. If you need to make large remittances, banks are a trustworthy choice.

Bank wire transfers move funds directly from your El Salvador bank account to the receiver’s US bank account. This process is strictly regulated by financial laws, offering extremely high security.

However, you need to pay for this security in time and money.

- Fees: Banks typically charge a high fixed service fee (for example, $25 to $50 USD), and the exchange rate includes a larger profit margin. Sometimes intermediary bank fees may further increase total costs.

- Speed: An international wire transfer usually takes 3 to 5 business days to complete.

Best For: Transactions of huge amounts (for example, over $10,000 USD) where fund security is the top priority. For small or medium amounts, bank wire transfers are not cost-effective.

How to Calculate Total Costs and Choose

When comparing different remittance services, it’s easy to be attracted by ads for “low service fees” or “zero fees.” However, the total cost of remittance goes far beyond the surface fees. To make the wisest choice, you need to understand the full composition of fees and learn how to compare practically.

Understanding Total Remittance Fees

The total cost of remittance consists of several parts, some obvious and some hidden.

Remittance providers may add a margin to the exchange rate to profit. This means the rate you get is not as good as the real market value. These hidden fees can significantly increase your total remittance cost.

The complete fees usually include the following three parts:

- Transfer Fee: This is the fee you pay directly when initiating the remittance, usually a fixed amount or percentage-based.

- Exchange Rate Margin: This is the most important “hidden fee.” There is a difference between the exchange rate provided by the provider (consumer rate) and the real interbank rate (mid-market rate). This difference is the provider’s profit and part of your cost.

- Potential Receiver Fees: In some cases, the receiver’s US bank may also charge a fee for receiving an international remittance.

How to Practically Compare

The simplest way to calculate total cost is to focus on “how much the receiver ultimately receives.” This number already accounts for all fees and exchange rate losses.

You can easily compare by following these steps:

- Choose two to three services you are interested in, such as Remitly, WorldRemit, or Xe.

- On each service’s website or app, enter the exact same remittance amount (for example, you plan to send $500 USD).

- View the “receiver gets” dollar amount displayed by each service.

Let’s look at a simple example:

| Provider | Remittance Amount | Service Fee | Exchange Rate Margin (Estimate) | Receiver Actually Gets |

|---|---|---|---|---|

| Service A | $500 USD | $3.99 USD | $5 USD | $491.01 USD |

| Service B | $500 USD | $0 USD | $12 USD | $488.00 USD |

In this example, although Service B claims “zero fees,” due to its larger exchange rate margin, the receiver ultimately gets less money. Therefore, Service A is the more economical choice. Using online comparison tools like Wise or Xe can help you view different providers’ final arrival amounts in real time.

In summary, online platforms are the ideal choice for most people. Those needing cash can choose Western Union, while large remittances should consider banks.

Your core needs determine the best solution:

- Pursuing Speed: Choose online platforms’ fast services.

- Lowest Fees: Prioritize comparing final arrival amounts.

- Highest Security: Large transactions can rely on bank wire transfers.

Finally, before each remittance from El Salvador to the United States, spend a few minutes comparing different services to maximize fund efficiency.

FAQ

How much can I remit at one time?

Remittance limits vary by provider.

Online platforms (like Remitly) usually have daily and monthly limits, with lower limits for new users. Bank wire transfers have the highest limits. You need to directly inquire with your chosen provider for specific amounts.

What if my remittance is delayed?

First, you should use the tracking number provided by the provider to check the remittance status. If the status remains unchanged for a long time, immediately contact the provider’s customer support. They can help investigate the cause of the delay.

Can I cancel after initiating the remittance?

This depends on the remittance processing stage.

- If the receiver has not yet picked up the cash or the funds have not been deposited into the bank account, you can usually cancel.

- Once the transaction is complete, you cannot cancel.

Contact your remittance provider as soon as possible to apply for cancellation.

Do I need a US bank account to remit?

No. You can initiate the remittance using a bank account, debit card, or cash in El Salvador. The receiver in the United States does not necessarily need a bank account; they can pick up cash at agent points of services like Western Union.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.